Filing Form 2290 using the Mobile App

File your Form 2290 anywhere, anytime with TaxZerone Mobile App!

Employment Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Tired of dealing with paper forms or sitting at a computer to file your IRS Form 2290? With the TaxZerone Mobile App, truckers and fleet owners can now e-file their Heavy Vehicle Use Tax (HVUT) form right from their phone—anytime, anywhere.

This page will take you through how to file Form 2290 using a mobile app, why it’s a smarter way to file, and what to keep in mind when choosing the best e-filing app for life on the road.

Table of Contents

Why file Form 2290 using a Mobile App?

Filing Form 2290 through a mobile app provides convenience, speed, and flexibility, especially for truckers and business owners who are often on the road. Mobile apps allow you to complete and submit your tax return from anywhere, at any time, and receive immediate proof of filing.

Need to File Form 2290 for Your Heavy Vehicle?

Start filing with the TaxZerone Mobile App today and complete your HVUT Form 2290 and get your Stamped schedule 1 instantly!

Benefits of Electronic Filing Over Paper Filing

Paper filing is slow, prone to errors, and can delay your 2290 Schedule 1. E-filing through TaxZerone is:

- Faster: Get your IRS-stamped Schedule 1 within minutes.

- More Accurate: Smart error checks reduce rejections.

- More Convenient: File 24/7 without visiting an IRS office.

- Trackable: Know the status of your return in real time.

- Eco-Friendly: No printing, no mailing, no paper waste.

Step-by-step: Filling Form 2290 via Mobile App

Using the TaxZerone Mobile App is quick and easy. Simply follow the steps below to complete your filing.

Step 1: Download and Install the TaxZerone App

Download the app from the Apple App Store (iOS) or Google Play Store (Android).

Step 2: Create or log in to Your Account

Register with your business information, including your Employer Identification Number (EIN). Make sure you have an Employer Identification Number (EIN).

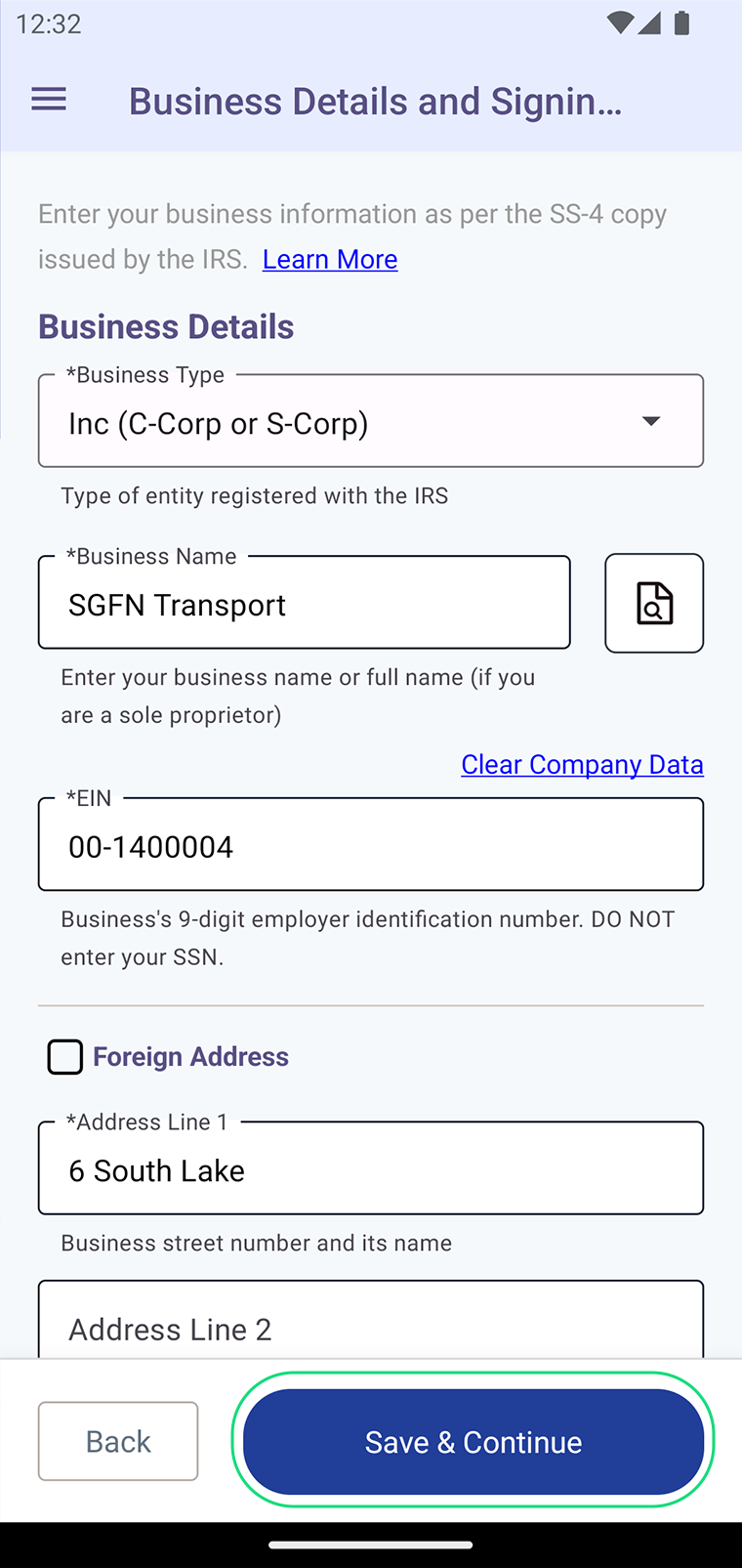

Step 3: Enter your business details

Enter the Business details including name, EIN, address, and contact information. Ensure all information is accurate and matches official records.

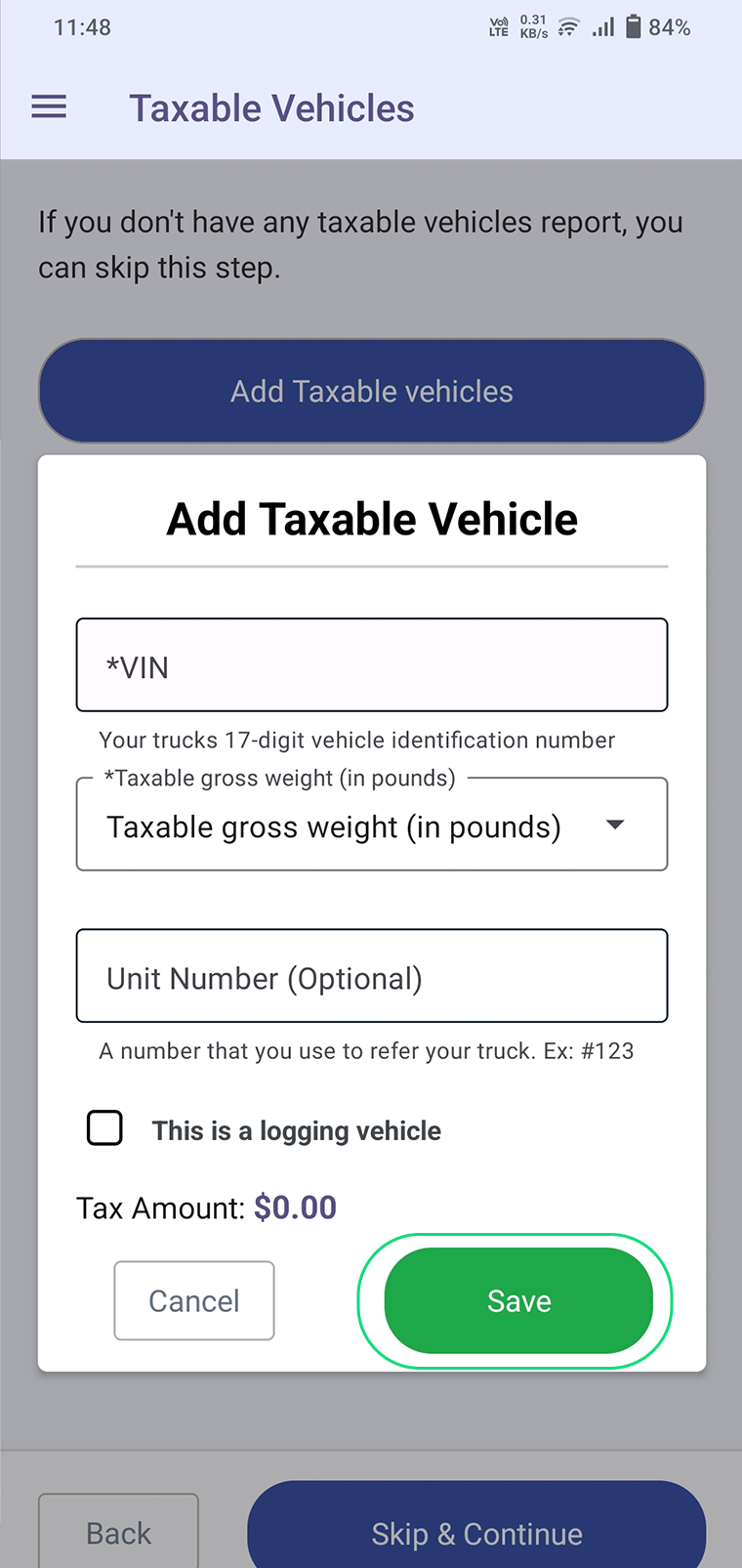

Step 4: Enter the Vehicle Details

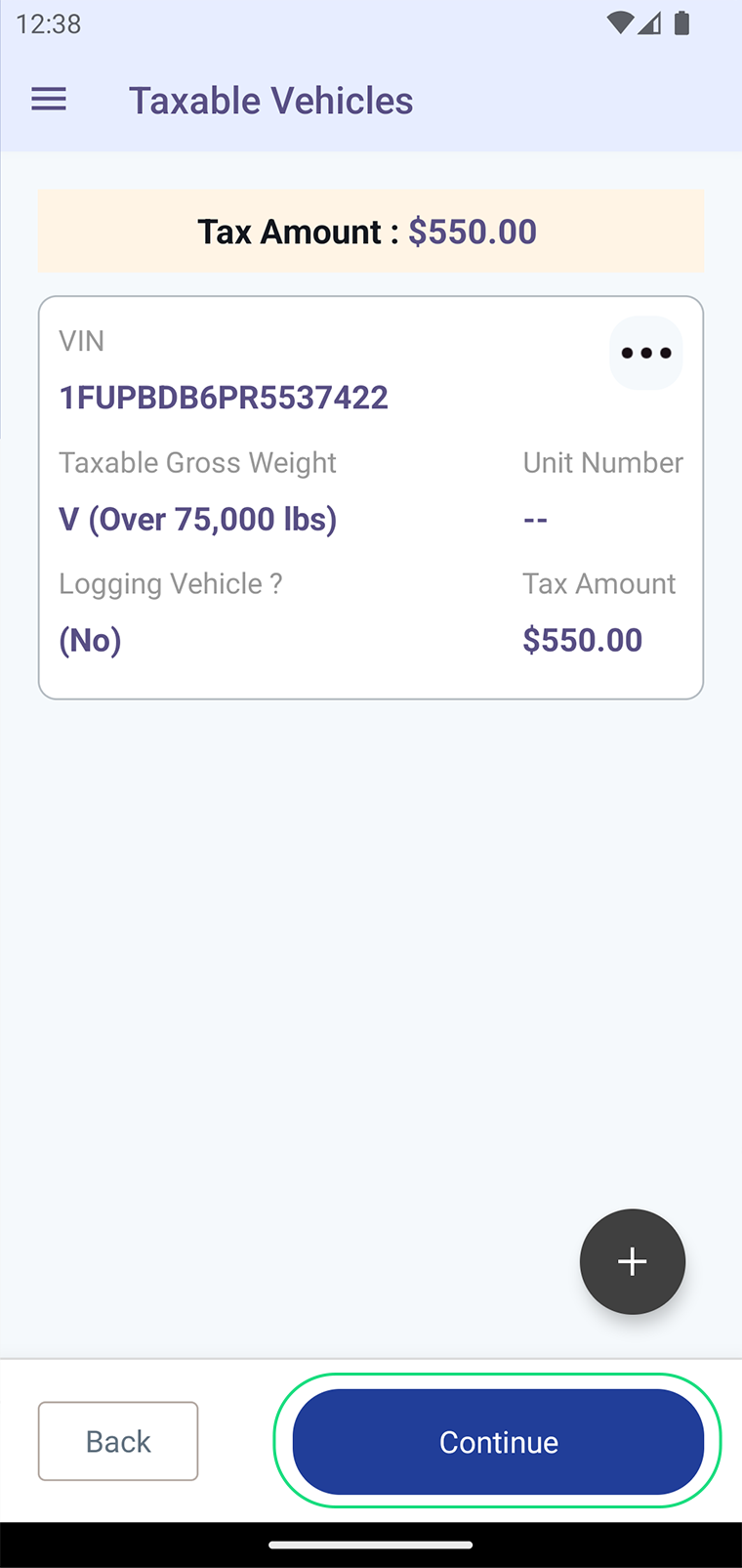

- Provide vehicle information such as Vehicle Identification Number (VIN), taxable gross weight.

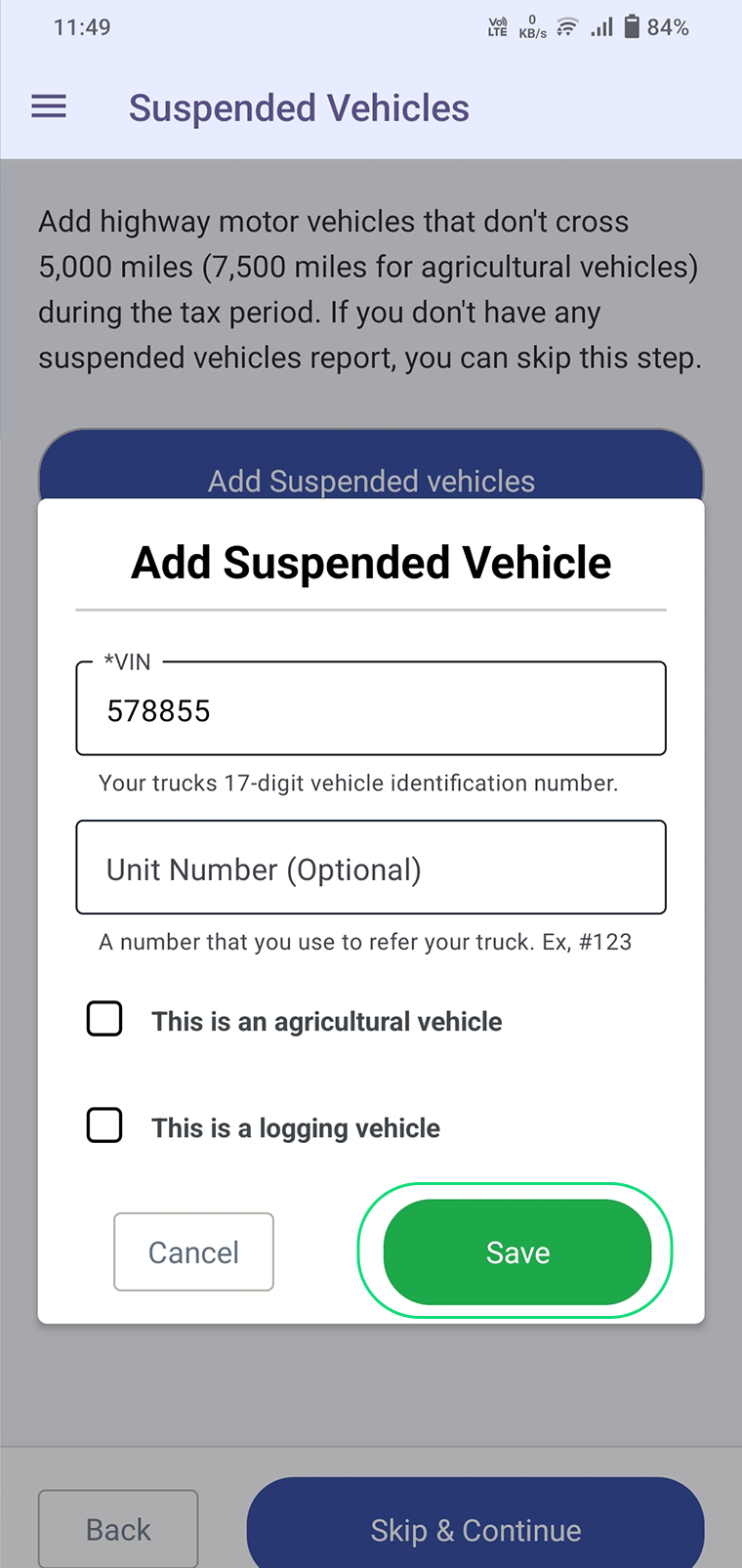

- Enter the Suspended Vehicle

If your vehicle qualifies as suspended (driven less than 5,000 miles, or 7,500 for agricultural use), enter its details here. Or otherwise, you can skip this step.

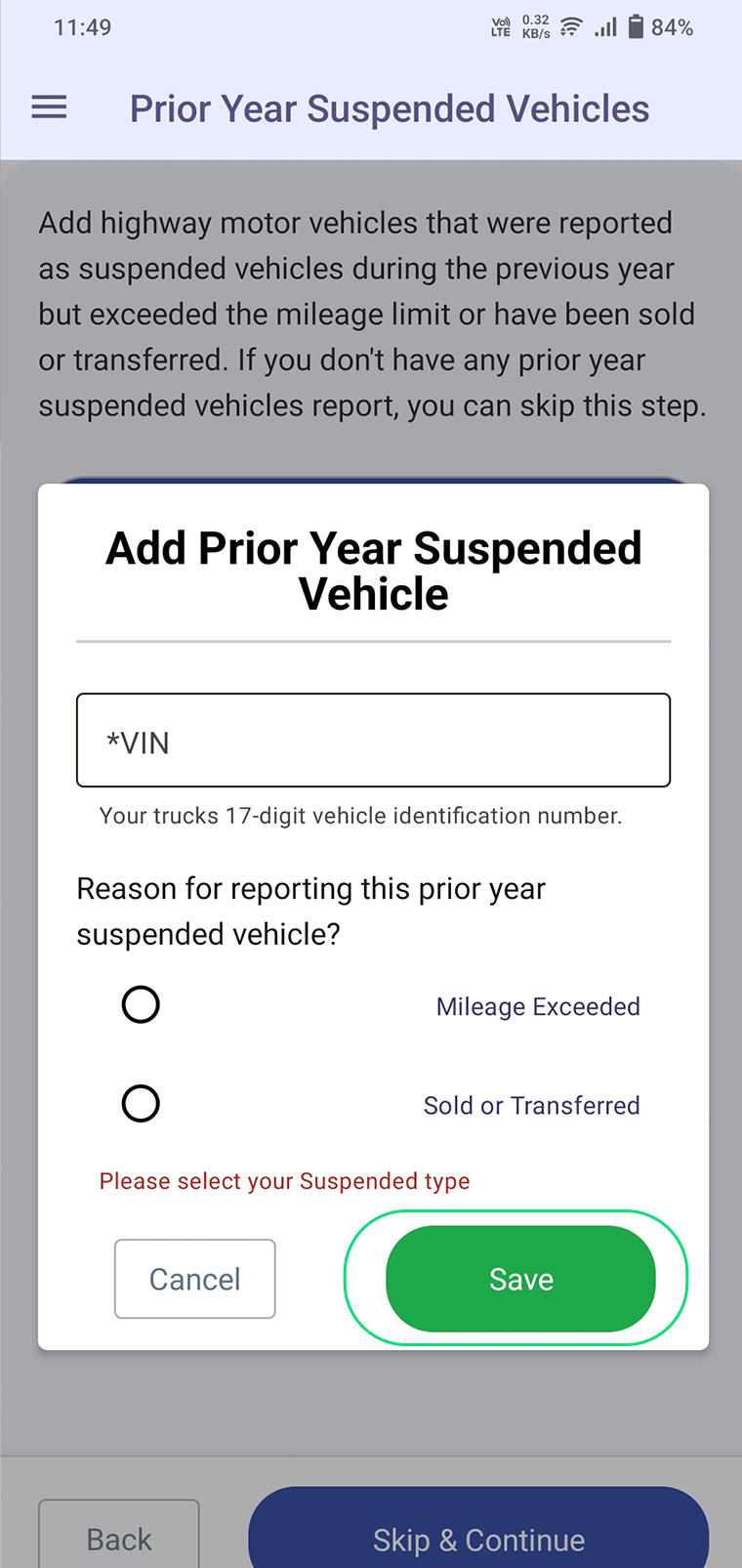

- Enter the Prior year suspended vehicle

If your vehicle was reported as suspended on last year’s Form 2290, enter its details here. If not, you can skip this step.

Step 5: Calculate and Review Your Tax

The app will automatically calculate the amount of HVUT you owe based on your vehicle’s weight.

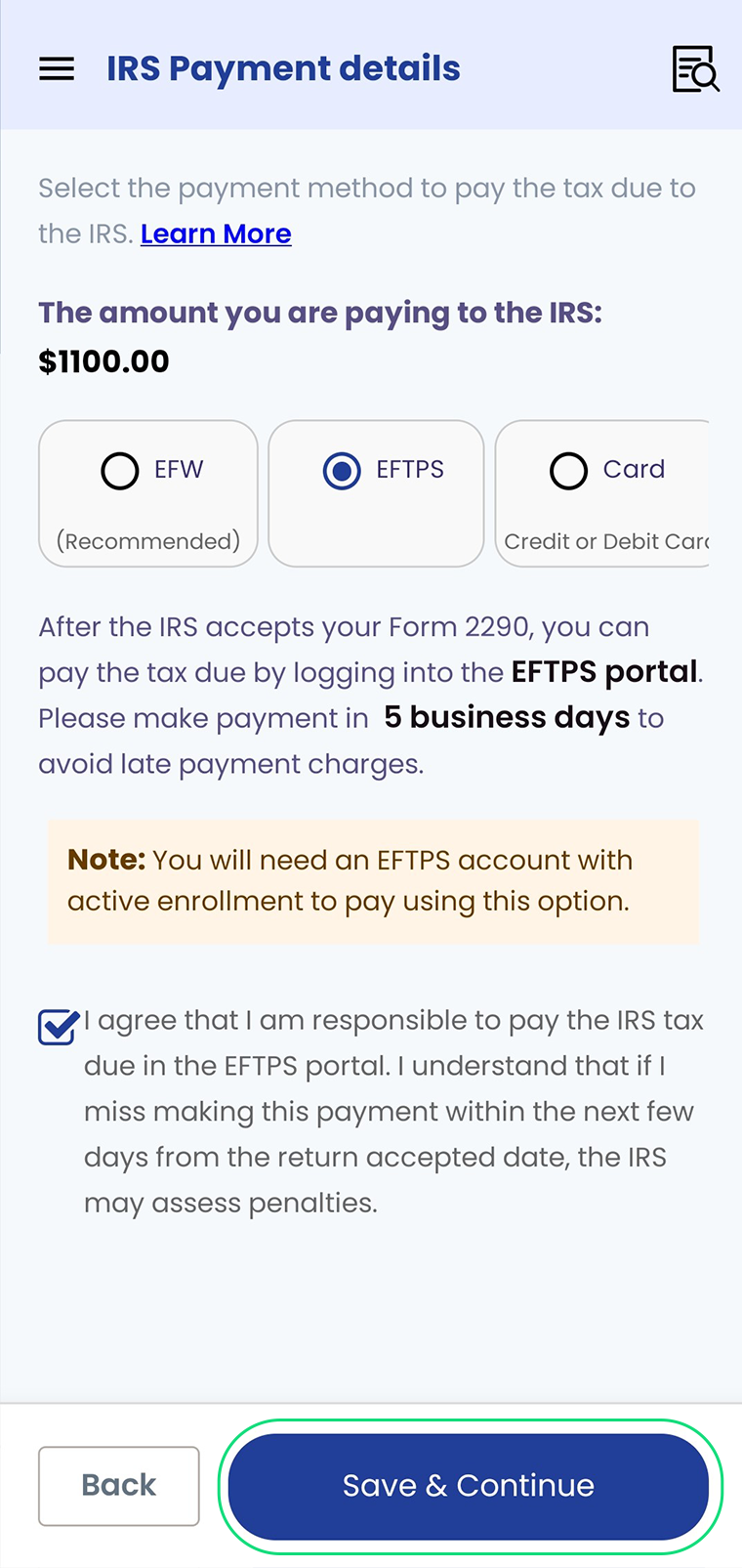

Step 6: Choose Payment Method

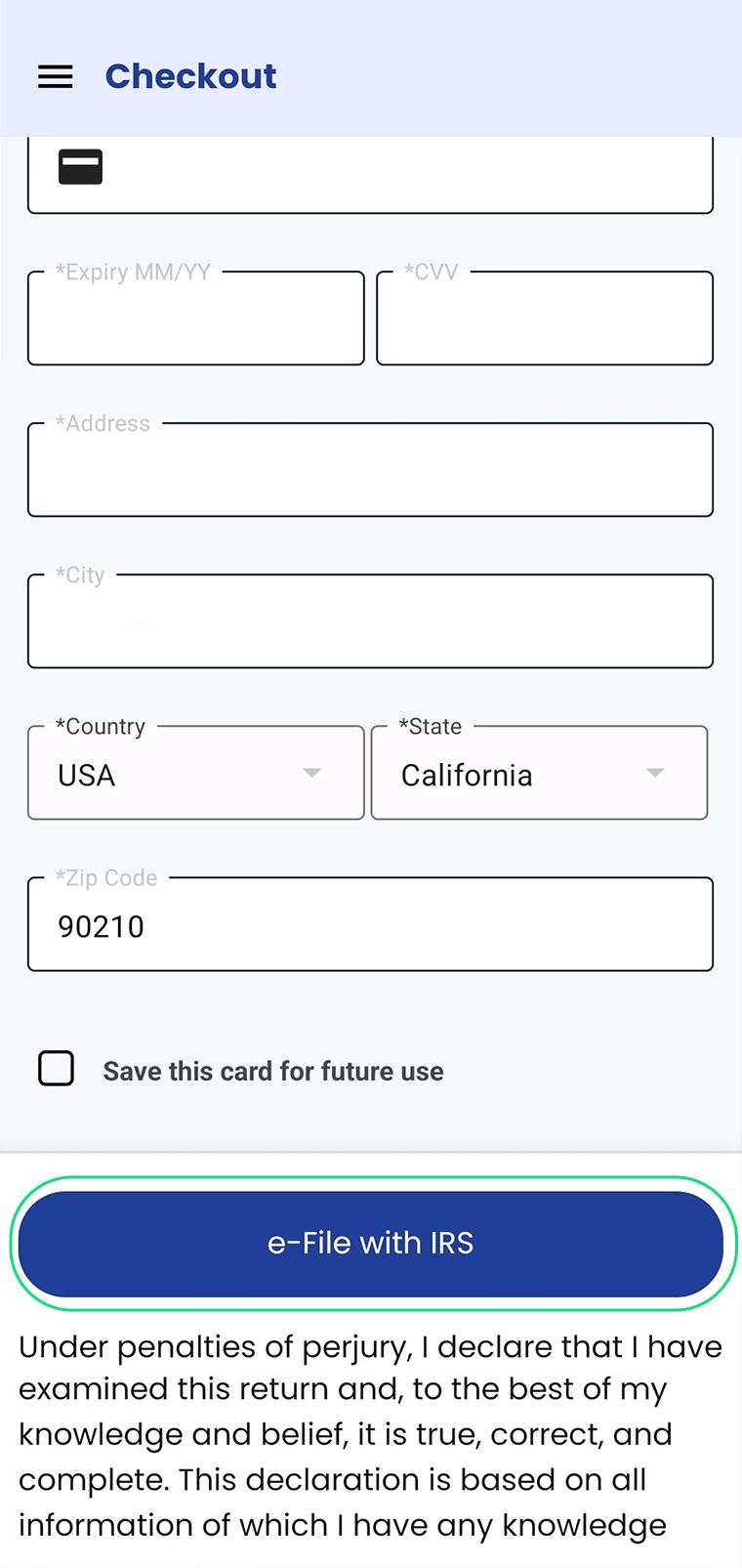

Select a payment option such as EFTPS, EFW, or credit/debit card.

Step 7: Submit Your Form 2290

Review your information and submit the form directly to the IRS through the app.

👉Need help to file Form 2290? Refer to the Form 2290 instructions for step-by-step guidance on completing and submitting your return.

Common Mistakes to Avoid When Filing Form 2290 via Mobile

While mobile filing is fast and convenient, here are some common errors to watch out for:

- ❌ Entering the wrong VIN – One incorrect character can lead to rejections.

- ❌ Choosing the wrong weight category – This affects your tax amount.

- ❌ Missing the first-used month – Filing late for that month leads to penalties.

- ❌ Not submitting for suspended vehicles – You must still file even if no tax is due.

- ❌ Using an incorrect EIN – Your EIN must be valid and at least 14 days old.

Important:

If you need to file a VIN correction or an amended return, such as updating the vehicle’s weight or reporting mileage over the suspension limit, please visit TaxZerone website for further instructions and easy filings.

🎥 For help, watch our step-by-step videos here: [Watch Tutorial Videos]

Ready to File Your Form 2290 the Easy Way?

Download the TaxZerone Mobile App and file your Form 2290 in just a few taps—fast, secure,

and IRS-authorized and get your stamped Schedule 1 instantly.