Easily e-file your IRS Form 1099-B for the 2023 tax year

TaxZerone simplifies the process of filing your 1099-B forms online and distributing recipient copies without any hassle.

Takes less than 5 minutes

Best price in the industry

Start for as low as $2.49, with rates decreasing to $0.59 per form for larger quantities.

For your return volume

3 Simple steps to complete your Form 1099-B e-filing

Filing information returns is effortless with TaxZerone

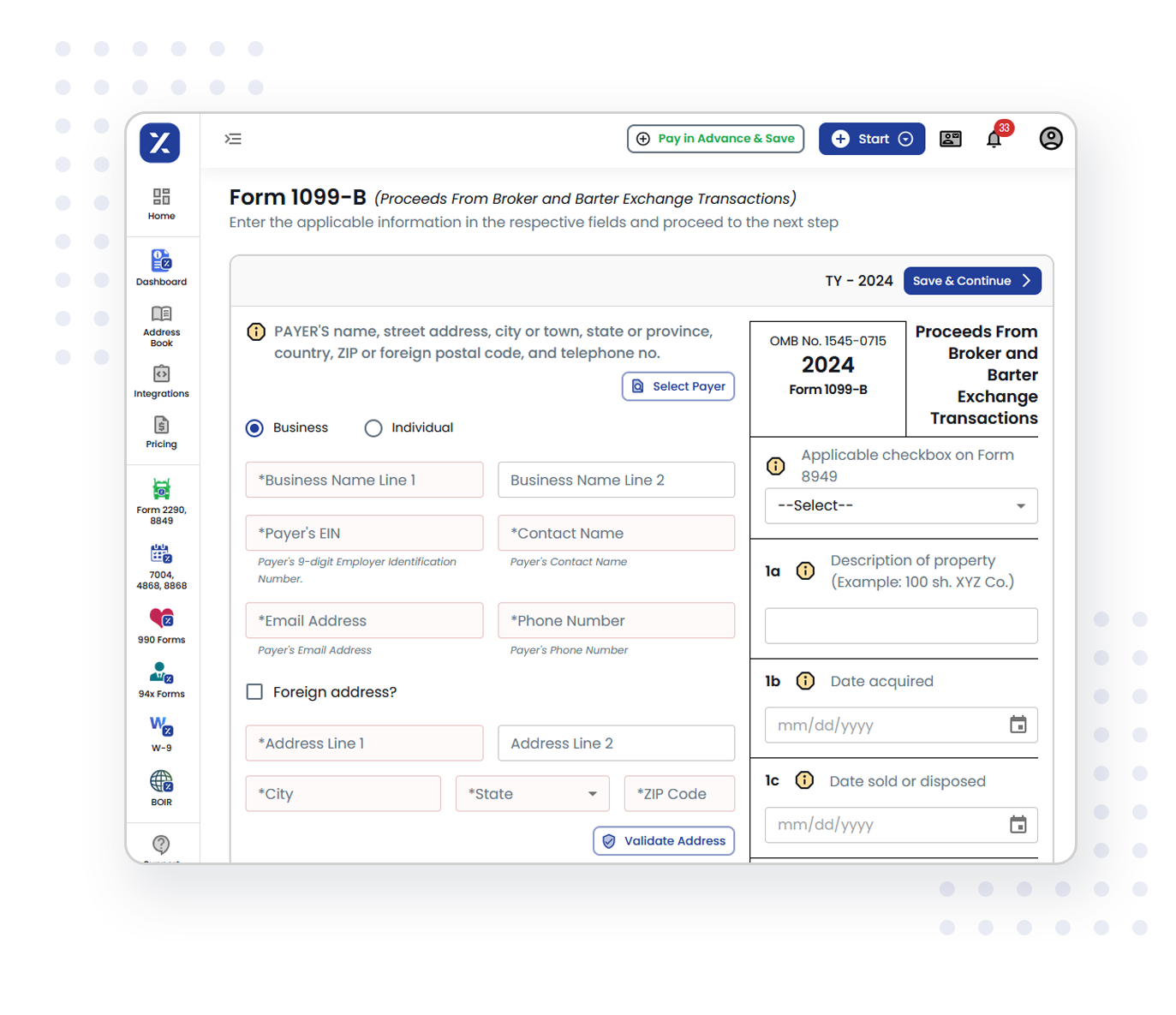

Fill out Form 1099-B

Fill out the required fields, including your and the recipient’s information, description of the property, date of sale, proceeds from the sale, etc.

Review & transmit the return

Review the return and make sure it’s accurate. Then, transmit it to the IRS.

Send the recipient copy

Share the recipient copy by email effortlessly.

Takes only 3 steps

Top reasons to choose TaxZerone for Form 1099-B e-filing

See how TaxZerone simplifies your information return filing.

Smart IRS validations

TaxZerone conducts real-time validation checks to ensure your 1099-B forms adhere to IRS standards, preventing costly errors and potential rejections.

Supports bulk upload

Effortlessly upload multiple form entries and eliminates the necessity for manual data input. Streamline your e-filing process, whether you have just a few forms or hundreds to process.

Email recipient copies

Easily send recipient copies via email to save time and resources and ensure recipients receive them promptly.

Competitive pricing

TaxZerone offers the most competitive rates based on your return volume. Stay IRS-compliant with reliable our e-filing service—all without breaking the bank.

Simplified form-based filing

Simplify your filing process by steering clear of complex interfaces, and complete your paperwork just as easily as filling out a physical form.

Assisted filing

Get step-by-step instructions to accurately complete your filing and ensure error-free submissions with assistance available at every stage of the process.

Choose TaxZerone for a seamless and efficientForm 1099-B e-filing experience

Say yes to an effortless and efficient e-filing experience. Say yes to TaxZerone.

Takes 3 steps and less than 5 minutes

Frequently Asked Questions

1. What is Form 1099-B?

2. Who needs to file Form 1099-B?

3. When is the deadline to file Form 1099-B?

- The deadline to share recipient copies: February 15, 2024

- The deadline to file Form 1099-B (if you’re paper filing): February 28, 2024

- The deadline to file Form 1099-B (if you’re e-filing): April 01, 2024

4. What information is required to e-file Form 1099-B?

- Business details

- Recipient details

- Interest income

- Early withdrawal penalty

- Amounts of bonds or treasury obligations

- Investment expenses