File Form W-2 for Tax Year 2024 with Ease

Report employee wages and taxes with TaxZerone’s accurate and hassle-free e-filing solution for Form W-2.

Affordable Pricing

Start at just $2.49, with pricing as low as $0.59 per form for bulk filings.

For your return volume

Filing Requirements for Form W-2

Ensure a smooth filing process by gathering these details:

- Employer Information: Employer’s Name, EIN, and Address.

- Employee Information: Employee’s Name, SSN, and Address.

- Wage Information: Wages, tips, other compensation, and federal income tax withheld.

- State Tax Information: State ID Number, State Wages and State Income Tax

3 Simple Steps to Complete Your Form W-2 E-filing

Filing your Form W-2 with TaxZerone is fast, easy, and secure. Here's how you can do it:

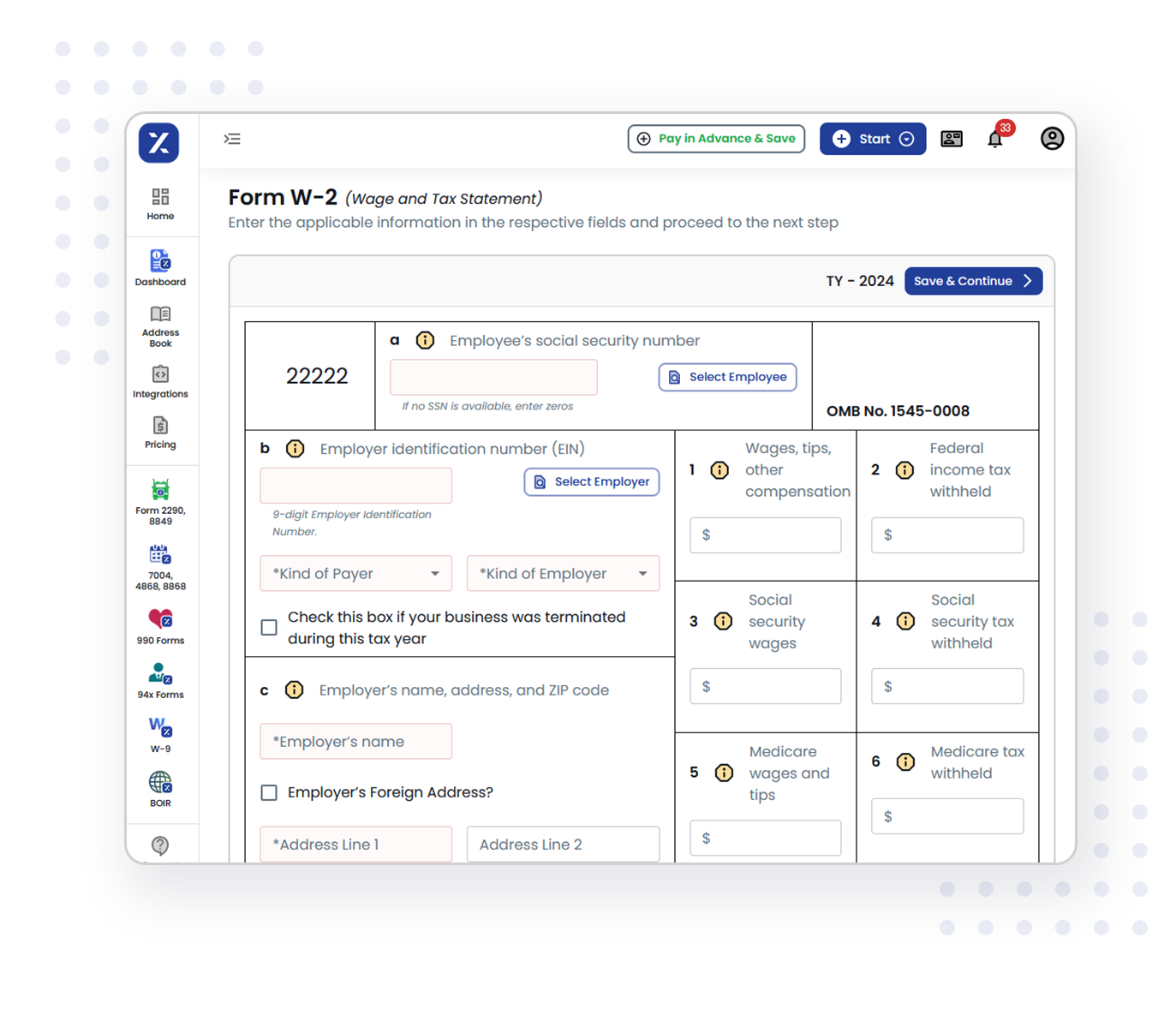

Enter Information for Form W-2

Fill in your business details (EIN), employee information (name, SSN, address), and wage details.

Review & Transmit

Verify the accuracy with TaxZerone’s SSA validations and securely e-file your Form W-2.

Send Employee Copies

Use ZeroneVault for secure electronic delivery or choose traditional postal mailing.

Takes only 3 steps

Why Choose TaxZerone for Form W-2 E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

SSA Form Validations

TaxZerone automatically validates your Form W-2 to ensure accuracy and compliance. Our system reduces the risk of errors or rejections by the SSA.

Supports bulk upload

Easily upload multiple forms at once, saving time and effort, whether you’re filing for a small team or a large workforce.

Share Employee Copies

Easily distribute employee copies securely through ZeroneVault for electronic delivery or choose traditional postal mail for physical copies.

Best price in the industry

TaxZerone offers competitive pricing tailored to your filing volume, ensuring affordability without compromising on quality.

Form-based filing

Easily input your data directly into our user-friendly platform, and we’ll handle the rest.

Guided filing

Receive step-by-step guidance, helpful prompts, and real-time assistance to confidently complete your form W-2 filing.

Important Deadlines for Filing Form W-2

Send Employee Copies

Deadline: January 31, 2025 Deliver employee copies securely through ZeroneVault or opt for traditional postal mail.

File with the SSA (e-file)

Deadline: January 31, 2025 Submit your Form W-2 electronically.

File with the SSA (paper)

Deadline: January 31, 2025 Mail your Form W-2 if filing on paper.

Save time and stress with TaxZerone. File your form W-2 on time and effortlessly.

Start Filing Now!E-file Form W-2 Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099 State Filing | Price Per Form |

|---|---|

| Per Form | $0.99 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

W-2 State Filing

Did you know that some states require separate filings for Form W-2 in addition to the federal filing?Ensure compliance with state-specific tax laws by filing in all required jurisdictions.

Schedule Filing: Plan Ahead and Stay On Track

Prepare your W-2 filings in advance, and let TaxZerone handle the submission on your chosen date.

Select Your Filing Date

Choose your preferred filing date, and we'll ensure your Form W-2 is submitted on time.

Ensure Accuracy

Employees have the opportunity to review their forms before submission to confirm all details are correct.

Prevent IRS Correction Forms

Scheduling your filing ahead of time helps reduce errors, minimizing the need for IRS correction forms down the line.

Share Employee Copies for Form W-2 with Ease

At TaxZerone, we make it simple to share Form W-2 copies with your employees securely and on time.Choose the method that works best for your business:

Secure Delivery via ZeroneVault

- Instant Access: Employees can securely access their W-2 forms online, eliminating the need for printing or mailing.

- Data Security: ZeroneVault ensures that sensitive employee data remains safe during electronic sharing.

- User-Friendly: Employees can download or print their forms at their convenience.

Traditional Postal Mailing

- Physical Copy: For those who prefer physical copies, TaxZerone offers postal mailing services for W-2 forms.

- Timely Delivery: Employee copies are mailed promptly to meet IRS deadlines, ensuring compliance.

- Convenience: You can focus on your business while we handle the mailing process for you.

Get Started with TaxZerone Today

File Form W-2 online effortlessly with TaxZerone.

- File accurately and stay compliant.

- Save time with our bulk upload feature.

- Enjoy the best pricing in the industry.

Frequently Asked Questions

1. What is Form W-2?

2. Who Needs to File Form W-2?

3. When is the Deadline to File Form W-2?

4. What Are the Penalties for Late Filing of Form W-2?

The IRS imposes penalties for late filing of Form W-2, based on how late the form is filed and whether the filer qualifies as a small business.

- Filed within 30 days of the deadline:

- $60 per form.

- Maximum penalty: $232,500 for small businesses or $664,500 for larger businesses.

- Filed more than 30 days late but before August 1:

- $130 per form.

- Maximum penalty: $664,500 for small businesses or $1,993,500 for larger businesses.

- Filed after August 1 or not filed at all:

- $330 per form.

- Maximum penalty: $1,329,000 for small businesses or $3,987,000 for larger businesses.