Form W-2 Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form W-2?

Form W-2 is a crucial tax document issued by employers to their employees. It summarizes the employee's annual income earned from the employer and the federal income taxes, Social Security, and Medicare taxes withheld from their paychecks throughout the year.

The employer electronically submits a copy of the W-2 to the IRS and also provides a copy to the employee for their tax filing purposes.

Who can file Form W-2?

Responsibility for filing Form W-2 falls solely on the employer's shoulders.

Employers use W-2 forms to report two key things:

- Employee income and taxes withheld: This includes details like total wages earned, federal income taxes deducted, and Social Security and Medicare taxes (FICA) withheld.

- Social Security contributions: The W-2 helps the Social Security Administration (SSA) track employee's earnings and contributions, ultimately determining their future Social Security benefits.

Every employee who received salary, wages, or any other form of compensation from their employer throughout the year will get a W-2 form. This is mandatory for full-time, part-time, and even temporary workers. However, Form W-2 is not applicable to independent contractors and self-employed individuals.

When is the Form W-2 due date?

Employers must file Form W-2 with the SSA by January 31st of the following year. For the 2024 tax year, the deadline to report employee income and taxes is January 31st, 2025.

E-file today and avoid the deadline rush!

Skip the last-minute scramble and e-file your W-2s now

Remember, January 31st is also the deadline to provide copies of Form W-2 to your employees. This ensures they have the necessary tax documentation for accurate reporting on their tax returns.

Form W-2 penalty

If you miss filing Form W-2 for your employees within the deadline, you will start incurring penalties. Below is the breakdown of Form W-2 penalties:

| Days late | Penalty per return | Maximum penalty per year | Maximum penalty for small businesses per year |

|---|---|---|---|

| Within 30 days | $60 | $630,500 | $220,500 |

| 31 days late through August 1 | $120 | $1,891,500 | $630,500 |

| After August 1 or not filed | $310 | $3,783,000 | $1,261,000 |

| Intentional disregard | $630 | - | - |

Don't risk penalties!

Be proactive! E-file your W-2 forms ahead of the deadline.

Form W-2 Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form W-2.

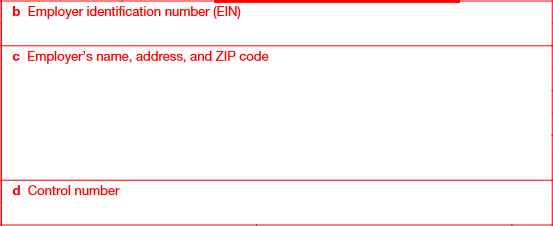

Employer information

- Box b: Enter the business EIN

- Box c: Enter the Employer's name, address, and ZIP code

- Box d: Enter the control number. It's a unique number, used by many employers to internally track and organize their W-2 forms. It's not required by the IRS

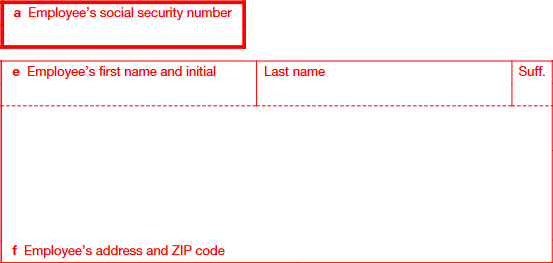

Employee information

- Box a: Enter the employee's SSN

- Box e: Enter the employee's first name and initial, last name, and suffix in the respective fields

- Box f: Enter the employee's address and zip code

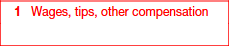

Box 1: Wages, tips, other compensation

Box 1 should include the total wages, tips, bonuses, prizes, and other taxable compensation paid to the employee during the year. DO NOT include pre-tax deductions like 401(k) contributions. Key things to include:

- Total wages, bonuses, prizes, and awards

- Noncash fringe benefits

- Reported tips

- Reimbursed employee business expenses

- Insurance premiums for 2% S-corp shareholders

- Employee contributions to HSAs and MSAs

- Group-term life insurance over $50,000

- Non-job related educational assistance

- Employer-paid social security and Medicare taxes

- Roth 401(k) contributions

- Nonqualified deferred compensation distributions

- Amounts includible under section 457(f)

- Split-dollar life insurance payments Insurance premiums for 2% S-corp shareholders

- HSA contributions if taxable to employee

- 409A deferred comp no longer subject to risk of forfeiture

- Nonqualified moving expenses and reimbursements

- Payments to employees on active military duty

- Other taxable compensation like scholarships

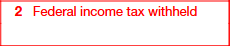

Box 2: Federal income tax withheld

Report the total federal income tax withheld from the employee's wages for the year. This includes:

- Federal income tax withholding

- 20% excise tax withheld on excess golden parachute payments.

Box 3: Social security wages

Report total wages subject to social security tax, not including social security tips. Generally include:

- Wages paid before deductions

- Noncash payments

- Reimbursed employee expenses

- Elective deferrals to retirement plans

- Designated Roth contributions

- Deferrals under section 457(f) and nonqualified plans

- Signing bonuses

- Group-term life insurance over $50K

- Accident/health insurance for 2% S-corp shareholders

- Contributions to MSAs and HSAs

- SIMPLE contributions

- Adoption benefits

Do not include social security tips reported in Box 7. The total of Boxes 3 and 7 cannot exceed the social security wage base ($168,600 in 2024).

If you paid the employee share of social security tax, report the gross amount.

Box 4: Social security tax withheld

Report the total social security tax withheld from the employee's wages and tips.

- This includes employee social security tax only, not the employer share

- The maximum amount in 2024 is $10,453.20 ($168,600 x 6.2%)

- Only include social security tax on 2024 wages and tips

- Report gross wages in Box 3 if you paid the employee share.

Box 5: Medicare wages and tips

Report total Medicare wages and tips. This includes:

- All wages and tips subject to social security tax (boxes 3 and 7)

- There is no wage base limit for Medicare tax

- Enter tips that employees reported even if you couldn't collect Medicare tax on them

If you paid the employee Medicare tax, report the gross amount of wages.

For government employers with employees who pay only Medicare tax, enter Medicare wages in box 5

Box 6: Medicare tax withheld

Report the total Medicare tax withheld from the employee's wages and tips.

- Include only the employee's share of Medicare tax, not the employer's share

- Include any Additional Medicare Tax withheld

- Only include Medicare tax for 2024 wages and tips

- Do not include any Medicare tax paid by the employer. Report the gross wages in Box 5 if you paid the employee's share.

Box 7: Social security tips

Report tips that the employee reported to you, even if you didn't collect social security tax on them.

- Include all tips the employee reported

- The total of boxes 3 and 7 cannot exceed $168,600 (the 2024 social security wage base)

- Also report these tips in box 1 along with wages

- Include tips from box 7 in the Medicare wages reported in box 5 share.

Box 8: Allocated tips

Report allocated tips for employees at large food/beverage establishments.

- Only includes tips allocated by the employer, not reported directly by the employee

- Do not include allocated tips in boxes 1, 3, 5 or 7

- Allocated tips are reported on Form 8027

Box 10: Dependent care benefits

Report total dependent care benefits provided to the employee under a dependent care assistance program (section 129).

This include:

- Fair market value of employer-sponsored daycare

- Amounts paid or reimbursed for dependent care under a section 125 cafeteria plan

- Value of in-kind benefits provided by the employer

- Amounts paid directly to a daycare facility

- Report all amounts paid, including those above the $5,000 exclusion.

Also include any dependent care benefits over the exclusion limit in boxes 1, 3, and 5 as wages.

Box 11: Nonqualified plans

Report distributions to the employee from a nonqualified deferred compensation plan or nongovernmental section 457(b) plan.

- This helps the SSA determine if any part of box 1, 3, or 5 was earned in a prior year.

- Also report these distributions in box 1.

- Only make one entry in box 11

- Do not report governmental 457(b) plan distributions here. Use Form 1099-R instead.

- Report deferrals that are no longer subject to risk of forfeiture in boxes 3 and 5, not box 11.

- Do not report current year deferrals or deferrals already in boxes 3/5.

Box 12: Codes

Report codes and amounts for all applicable items listed below. The codes do not correspond to boxes 12a–12d on Form W-2.

- Use box 12 to report any items A through HH

- Do not report section 414(h)(2) govt plan contributions here — use box 14 instead

- Also use box 14 for other information like union dues, uniform payments, etc.

Codes for Box 12:

| Code | Description |

|---|---|

| A | Uncollected social security tax on tips |

| B | Uncollected Medicare tax on tips |

| C | Taxable cost of group-term life insurance over $50,000 |

| D | Elective deferrals to 401(k) plan |

| E | Elective deferrals under 409A nonqualified plan |

| F | Elective deferrals to 408(k)(6) SARSEP plan |

| G | Elective deferrals and employer contributions to 457(b) plan |

| H | Elective deferrals to 501(c)(18)(D) tax-exempt plan |

| J | Nontaxable sick pay |

| K | 20% excise tax on excess golden parachute payments |

| L | Substantiated employee business expense reimbursements |

| M | Uncollected social security tax on taxable cost of group-term life insurance over $50,000 |

| N | Uncollected Medicare tax on taxable cost of group-term life insurance over $50,000 |

| P | Excludable moving expense reimbursements paid directly to employee |

| Q | Nontaxable combat pay |

| R | Employer contributions to Archer MSA |

| S | Employee salary reduction contributions to 409A nonqualified plan |

| T | Adoption benefits |

| V | Income from exercise of nonstatutory stock option(s) |

| W | Employer contributions to Health Savings Account |

| Y | Deferrals under section 409A nonqualified plan |

| Z | Income under section 409A on a nonqualified deferred compensation plan |

| AA | Designated Roth contributions under 401(k) plan |

| BB | Designated Roth contributions under 403(b) plan |

| DD | Cost of employer-sponsored health coverage |

| EE | Designated Roth contributions under governmental 457(b) plan |

| FF | Permitted benefits under a qualified small employer health reimbursement arrangement |

| GG | Income from qualified equity grants under section 83(i) |

| HH | Aggregate deferrals under section 83(i) elections as of the close of the calendar year |

Box 13: Checkboxes

Check all boxes that apply:

Statutory employee:

- Check this if the worker is a statutory employee (not a common-law employee)

- Applies to certain drivers, insurance agents, home workers, traveling salespeople

- Statutory employees have social security/Medicare tax but no income tax withholding

Retirement plan:

- Check this if the employee was covered by a retirement plan such as:

- 401(k), 403(b), SEP, or SIMPLE plans

- Governmental plans

- Section 501(c)(18) trusts

- Generally applies if employee was eligible to participate or had contributions

- Do not check for nonqualified or 457(b) plans

Third-party sick pay:

- Check this only if reporting sick pay paid by a third party

- Applies if you are the third party payer or the employer reporting third party sick pay

Box 14: Other

Other information:

- Report 100% of annual lease value of vehicle included in employee's income

- Use this box to report any other information to the employee, such as:

- State disability insurance tax withheld

- Union dues

- Uniform payments

- Health insurance premiums deducted

- Nontaxable income

- Educational assistance

- Minister's housing allowance

- Pension plan contributions:

- Nonelective employer contributions

- Voluntary after-tax employee contributions

- Required employee contributions

- Employer matching contributions

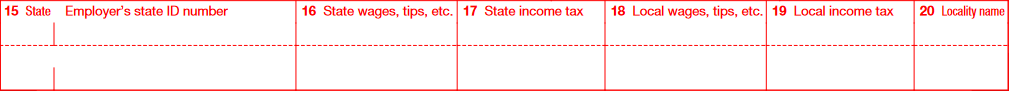

Boxes 15 through 20: State and local income tax information

Used to report state and local income tax information

- Enter two-letter state abbreviation in box 15

- Enter state employer ID number assigned by the state in box 16

- Report state wages in box 16

- Report state income tax withheld in box 17

- Can report info for up to 2 states and 2 localities

- Keep each state/locality separated by the broken line

- For more than 2 states/localities, use a second Form W-2

How to file Form W-2?

You have two options: efficient e-filing or traditional paper filing.

Form W-2 E-filing (recommended)

The IRS recommends e-filing your W-2s for a faster and simpler experience. Plus, you'll get instant notifications when they're processed.

Choosing an IRS-authorized e-file provider like TaxZerone makes it even easier. With just a few clicks, you can fill out your W-2s, review and submit, and share recipient copies.

It's that quick and easy! Choose e-filing for a smooth and efficient W-2 filing experience.

Paper filing

If you choose to paper-file Form W-2, here are the steps you need to follow:

- Download and print Form W-2 from the IRS website.

- Fill out recipient details (name, address, SSN, compensation) and your business info.

- Mail the completed form to the SSA.

- Don't forget! Mail a copy to each recipient by January 31st.

Important notes for paper filing:

- Mail early! Allow several weeks for forms to arrive on time.

- Always send a copy to each recipient for their tax reporting.

- Paper filing involves printing, mailing, and tracking forms. E-filing is faster, cheaper, and simpler!

Where to send Form W-2 - Mailing address

Send Form W-2 and W-3 to the address below:

| By U. S. Postal Service | Social Security Administration Direct Operations Center Wilkes-Barre, PA 18769-0001 |

| By Private Delivery Service (FedEx, UPS, etc.) | Social Security Administration Direct Operations Center Attn: W-2 Process 1150 E. Mountain Drive Wilkes-Barre, PA 18702-7997 |

How to e-file Form W-2?

E-filing your Form W-2 takes just 3 steps! To make it even faster, gather all the necessary information (like employee details and compensation amounts) before you start. That way, you can zip through the filing process in no time.

Information required to file Form W-2:

- Employer information, such as name, address, and EIN.

- Employee information, such as name, address, and SSN.

- Wages paid and taxes withheld

Once you have this information ready, you can follow the steps below to e-file Form W-2 using TaxZerone.

- Step 1: Fill out Form W-2

- Step 2: Review & transmit the return

- Step 3: Send the recipient copy

E-file Form W-2 with TaxZerone

When you choose to e-file Form W-2 with TaxZerone, you can:

- IRS form validations: catch any errors before you submit.

- Bulk upload: Upload multiple returns and finish in a flash.

- Share recipient copies: Email recipient copies instantly

- Secure access: Share recipient copies in a secure portal—ZeroneVault—where employees can download them anytime, anywhere.

- Top value: Enjoy the industry's best price, starting at just $0.59 per form.

Get these benefits by e-filing your

Form W-2 with TaxZerone

Effortless, efficient, and affordable e-filing awaits you.