E-File IRS Form 990 for the 2024 Tax Year

- Quickly file your nonprofit’s annual financial report with TaxZerone.

- TaxZerone supports all additional Schedules for FREE!

- We support tax years 2024, 2023, and 2022.

E-file Form 990 with TaxZerone in 3 simple steps!

Follow the steps below to file IRS Tax Form 990 for your exempt organization.

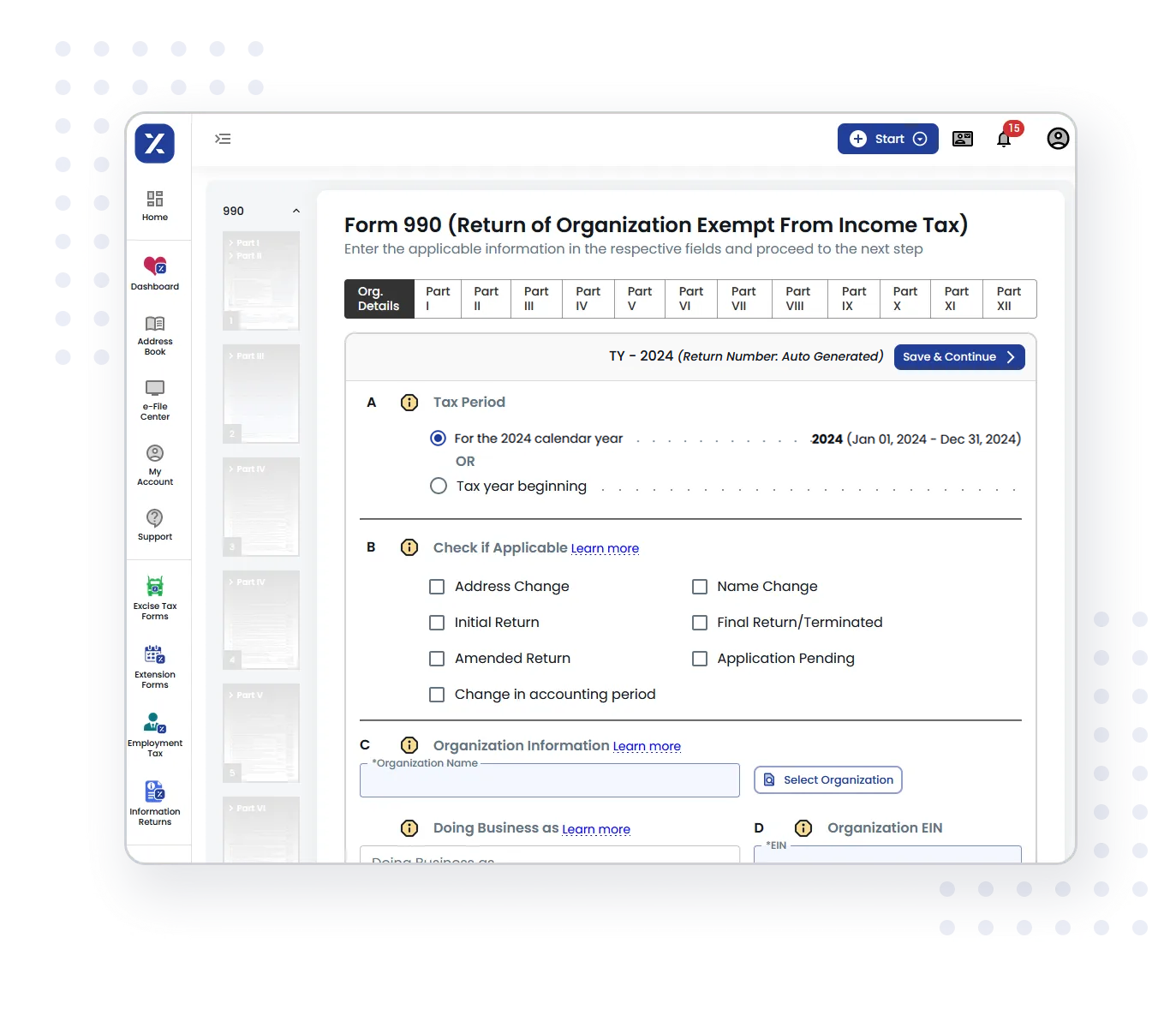

Provide Organization Details

Choose the tax year you want to file a return and provide your organization’s details.

Preview the return

Review the information provided in the return for accuracy before transmitting.

Transmit to the IRS

Have the 990 return accepted within hours of transmitting it to the IRS.

Stay tax compliant with the IRS

Schedules for Form 990

TaxZerone currently supports the following 990 schedules for FREE!

These schedules will be auto-generated while you file your 990 form with us.

- Schedule A - Public Charity Status and Public Support.

- Schedule B - Schedule of Contributors.

- Schedule C - Political Campaign and Lobbying Activities.

- Schedule D - Supplemental Financial Statements.

- Schedule E - Schools.

- Schedule F - Statement of Activities Outside the United States.

- Schedule G - Supplemental Information Regarding Fundraising or Gaming Activities.

- Schedule H - Hospitals.

- Schedule I - Grants and Other Assistance to Organizations, Governments, and Individuals in the United States.

- Schedule J - Compensation Information.

- Schedule K - Supplemental Information on Tax-Exempt Bonds.

- Schedule L - Transactions With Interested Persons.

- Schedule M - Noncash Contributions.

- Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

- Schedule O - Supplemental Information to Form 990

- Schedule R - Related Organizations and Unrelated Partnerships

Get More Information on Form 990 Instructions

Why TaxZerone?

Explore the distinct features that position TaxZerone as the preferred choice for exempt organizations filing 990 tax form.

Streamlined IRS Status Updates

Receive real-time updates on your tax-exempt status after transmitting your return through TaxZerone. No more waiting – our system keeps you informed throughout the process.

IRS-Authorized E-Filing Software

File your 990 return confidently with TaxZerone, an IRS-authorized e-file service provider, and be assured that the IRS will accept your return.

User-Friendly Filing Experience

Access to step-by-step instructions and helpful articles for quick and easy ways to complete your Form 990 return. Our intuitive interface and easy navigation simplify the e-filing process.

Pay Securely with PayPal

Complete your filing with confidence using PayPal. It's fast, secure, and offers added payment flexibility—no need to enter card details directly.

Click2File for Effortless Filing

With Click2File, we automatically transfer relevant data from your previous return to your current one, making filing even easier and faster.

Free Retransmission

If the IRS rejects your 990-T due to any errors, you can correct the issues and retransmit the return without any additional fee.

Security at the Forefront

Advanced security measures ensure the safety of your personal information during the e-filing process. Your 990 return is submitted securely to the IRS, giving you peace of mind.

Easy E-filing

Navigate effortlessly through a user-friendly interface to complete your entire 990 e-filing process within minutes. Simply respond to a set of straightforward questions, and we'll handle the rest!

Accurate and Compliant

Leverage our platform's built-in IRS validation checks, minimizing errors and enhancing the accuracy of your 990 return. Reduce the risk of IRS rejections with our thorough validation process.

TaxZerone supports filing for multiple tax years, helping you efficiently manage past and current returns.

E-File Your Form 990Simplified e-filing process

501(c)(3) Exemption Requirements

To qualify for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, an organization must be established and operate solely for tax-exempt purposes, with no part of its income benefiting any private individual.

Stay Organized with Our Filing Checklist

Our checklist covers each step for an .organized filing:

- Determine Eligibility – Confirm your organization qualifies for 501(c)(3) status.

- Gather Financial Statements – Have your financials ready for review.

- Develop Your Bylaws – Ensure governance documents are complete.

- Submit to IRS – We handle the submission to fast-track your approval.

Hear What Our Clients Say About Us

Secure Your Tax-Exempt Status with TaxZerone

E-file your Form 990 effortlessly with TaxZerone and stay compliant for years. It’s fast, reliable, and stress-free

Frequently Asked Questions

1. What is the purpose of filing Form 990?

2. Who is required to file Form 990?

3. When is the deadline to file Form 990?

4. What should be attached along with Form 990?

5. How does Form 990 differ from Form 990-EZ?

| Form 990 | Form 990-EZ |

|---|---|

| Filed by large organizations with gross receipts ≥ $200,000 or total assets ≥ $500,000 during a tax year | Filed by mid-size organizations with gross receipts < $200,000 and total assets < $500,000 during a tax year |

| It is a long and more detailed form | It is a short form of Form 990 |

6. How to extend the deadline of Form 990?

7. How to correct errors in previously filed Form 990?

- If you used TaxZerone to file the original return:

- Go to Exempt Organization Forms dashboard.

- Choose Form 990.

- Clicking on “Amend Return” will automatically transfer all field values from the original return to the amended one.

- You must provide a reason for the amendment, correct any errors, and submit the amended return to the IRS.

- In case you filed your original Form 990 with another service provider, easily make amendments using TaxZerone.

Related Resources

Form 990 Instructions

Read the Instructions for Form 990 to file accurately with TaxZerone

Form 990 Due Date

Know more about the Due Date of Form 990 and file your form on time.

Form 990 Schedules

Learn more about Form 990 Schedules and file easily.