File Form 1099-R for Tax Year 2024 with Ease

Report retirement distributions accurately and effortlessly with TaxZerone’s secure and hassle-free e-filing solution for Form 1099-R.

Affordable Pricing

Start at just $2.49, with prices as low as $0.59 per form for bulk filings.

For your return volume

Filing Requirements for Form 1099-R

Simplify your 1099-R filing with ease! Here's what you'll need:

- Payer Information: Payer’s Name, TIN, and Address

- Recipient Information: Recipient’s Name, TIN, and Address

- Payment Information: Retirement Distribution Amount, Federal Tax Withheld (if applicable)

- State Tax Information: Payer’s State Name, State Number, State Distribution, and State Tax Withheld.

3 Simple Steps to Complete Your Form 1099-R E-filing

Filing your Form 1099-R with TaxZerone is fast, easy, and secure. Here’s how you can do it in just three simple steps:

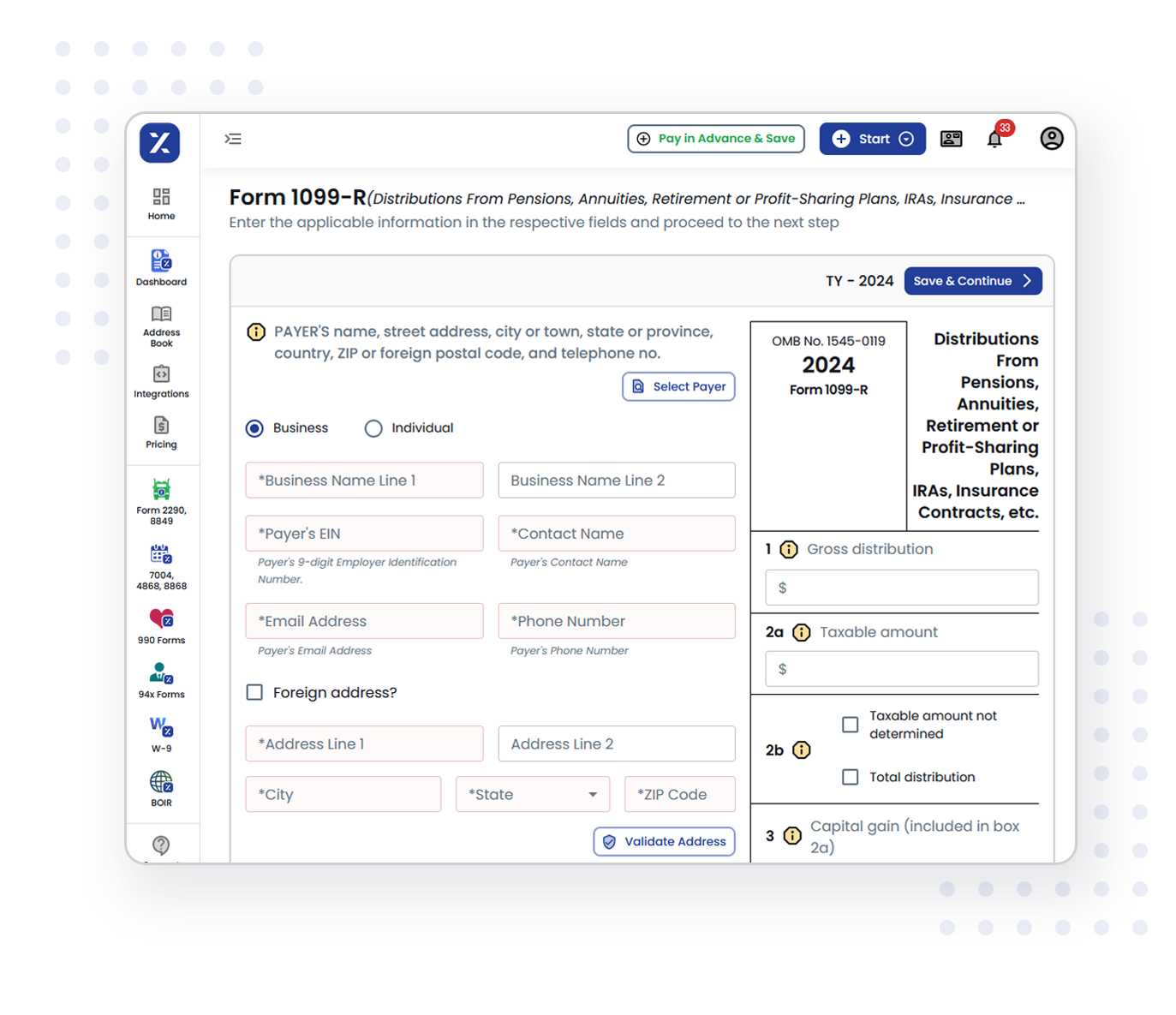

Enter Information for Form 1099-R

Fill in your business/ individual details (EIN/SSN), recipient's information (name, address, TIN), and the retirement distribution amount.

Review & transmit

Ensure accuracy with TaxZerone’s IRS validations, then securely e-file your Form 1099-R to the IRS.

Send Recipient Copy

Securely deliver the recipient's copy via ZeroneVault, ensuring safe sharing or opt for postal mail.

Why Choose TaxZerone for Form 1099-R E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

IRS Form Validations

Ensure accuracy with automatic IRS form validations for Form 1099-R submissions, minimizing the risk of errors and penalties.

Supports Bulk Upload

Streamline your filing process with bulk upload for Form 1099-R, allowing you to file multiple forms efficiently, whether it’s a handful or hundreds.

Share Recipient Copies

Deliver recipient copies securely and on time via ZeroneVault, eliminating the hassle of managing physical forms. Alternatively, you can opt for postal mailing to ensure timely delivery of recipient copies.

Competitive pricing

Enjoy affordable pricing tailored to your filing volume, helping you save time and reduce costs.

Simplified Form-based Filing

Easily complete your Form 1099-R directly on our platform by filling out the required fields—we'll handle the rest.

Guided Filing Assistance

Receive clear instructions and real-time guidance throughout the filing process to ensure your Form 1099-R is accurate and compliant.

Important Deadlines for Filing Form 1099-R

Send Recipient Copies

Deadline: January 31, 2025 Deliver recipient copies on time through ZeroneVault for secure electronic sharing or opt for postal mail.

File with the IRS (e-file)

Deadline: March 31, 2025 Submit your Form 1099-R electronically.

File with the IRS (paper)

Deadline: February 28, 2025 Mail your Form 1099-R if filing on paper.

Save time and stress with TaxZerone. File your 1099-R on time and effortlessly.

Start Filing Now!E-file Form 1099-R Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099 State Filing | Price Per Form |

|---|---|

| Per Form | $0.99 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

1099-R State Filing

Did you know that some states require separate filings for Form 1099-R in addition to the federal filing? Ensure compliance with state-specific tax laws by filing in all required jurisdictions.

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Dist. of Columbia

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

New Jersey

New Mexico

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

Utah

Vermont

Virginia

West Virginia

Wisconsin

Schedule Filing: Plan Ahead and Stay On Track

Want to ensure your filings are submitted on time without the stress? With Schedule Filing, you can prepare your Form 1099-R filings in advance, and we’ll take care of the submission when the time comes.

Choose Your Filing Date

Set your preferred filing date, and we’ll ensure your forms are submitted to the IRS promptly and accurately.

Ensure Accuracy

Recipients can review their 1099-R forms before submission, allowing them to identify and correct any errors in advance.

Avoid the Need for IRS Correction Forms

Scheduling your filing provides an opportunity to validate all details beforehand, reducing errors and eliminating the hassle of filing IRS correction forms later.

Share Recipient Copies with Ease

TaxZerone makes it simple to deliver Form 1099-R copies to your recipients securely and on time. Choose the method that works best for your business:

Electronic Sharing via ZeroneVault

Deliver recipient copies securely through ZeroneVault, auser-friendly platform.

- Recipients can access their forms instantly, bypassing the need for printing or mailing.

- Rest easy with ZeroneVault’s advanced data protection for secure sharing of sensitive tax information.

Reliable Postal Mailing

Prefer physical copies? TaxZerone’s postal service ensures timely delivery of recipient forms.

- Meet IRS deadlines effortlessly with prompt and professional mailing services.

- Save time and reduce effort by allowing TaxZerone to handle the mailing process.

Get Started with TaxZerone Today

Filing Form 1099-R online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Save time with bulk upload.

- File at the best price in the industry.

Start your e-filing process today and complete your Form 1099-R in just 3 simple steps!

Frequently Asked Questions

1. What is Form 1099-R?

2. Who Needs to File Form 1099-R?

3. When is the deadline to file Form 1099-R?

4. What are the Penalties for Late Filing of Form 1099-R?

- Filed within 30 days of the deadline: $60 per form, with a maximum penalty of $664,500 per year ($232,500 for small businesses).

- Filed after 30 days but before August 1, 2025: $130 per form, with a maximum penalty of $1,993,500 per year ($664,500 for small businesses).

- Filed after August 1, 2025, or not filed at all: $330 per form, with a maximum penalty of $3,987,000 per year ($1,329,000 for small businesses).