E-File IRS Form 990-EZ with TaxZerone

E-file your IRS 990-EZ online and stay tax-exempt using TaxZerone.

Complete your 990-EZ with us and receive your IRS acceptance notification within a few hours. It's that simple!

Why Choose TaxZerone?

Check out the features that make TaxZerone an ideal choice for exempt organizations to e-file 990-EZ returns.

Get Instant Updates on Your Filing Status

Once your return is transmitted to the IRS, our system keeps you updated with the return status. No more waiting for your tax-exempt status!

IRS-authorized

File your 990-EZ return through TaxZerone, an e-file service provider authorized by the IRS, and be assured that the IRS will accept your return.

Guided Filing

Access step-by-step instructions to complete filing quickly. You can also access our help articles to understand Form 990-EZ Tax return better.

Secure E-filing

Advanced security measures to ensure your personal information is kept safe throughout the e-filing process. Your 990-EZ return will be submitted securely to the IRS.

Easy E-filing

Simple navigating and a user-friendly interface to e-file Form 990-EZ within minutes. Just answer a series of simple questions, and we'll cover the rest!

Accurate and Compliant

Our platform supports built-in IRS validation checks that minimize errors to ensure that your 990-EZ return is accurate and accepted by the IRS.

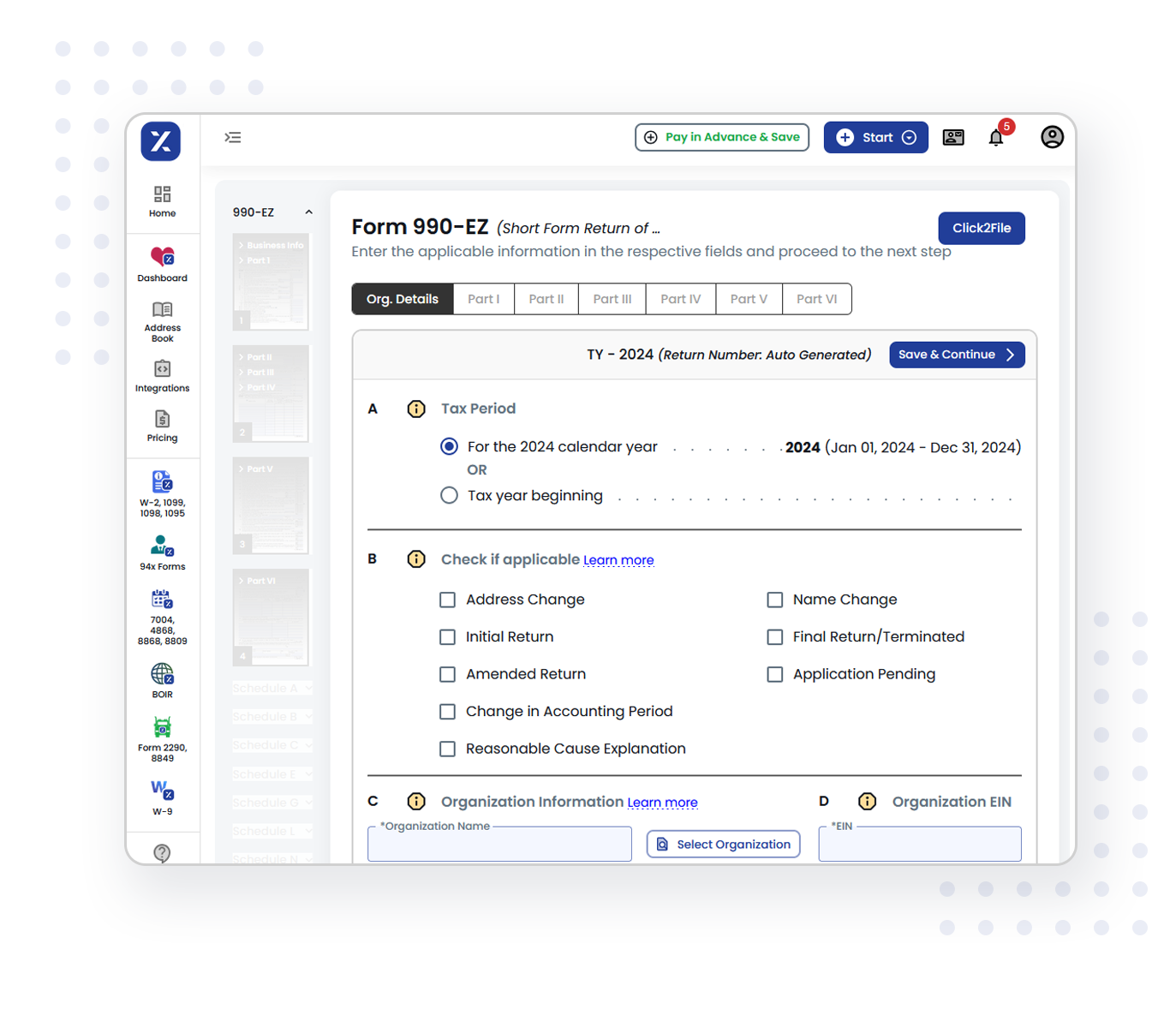

Form 990-EZ e-filing made easy with TaxZerone

Follow the steps below to file Form 990-EZ for your exempt organization.

Provide Organization Details

Choose the tax year for which you want to file a return, and provide your organization’s details.

Preview the return

Review the information provided in the return for accuracy before transmitting.

Transmit to the IRS

Transmit your 990-EZ return to the IRS and get the acceptance in just a few hours.

Stay tax compliant with the IRS

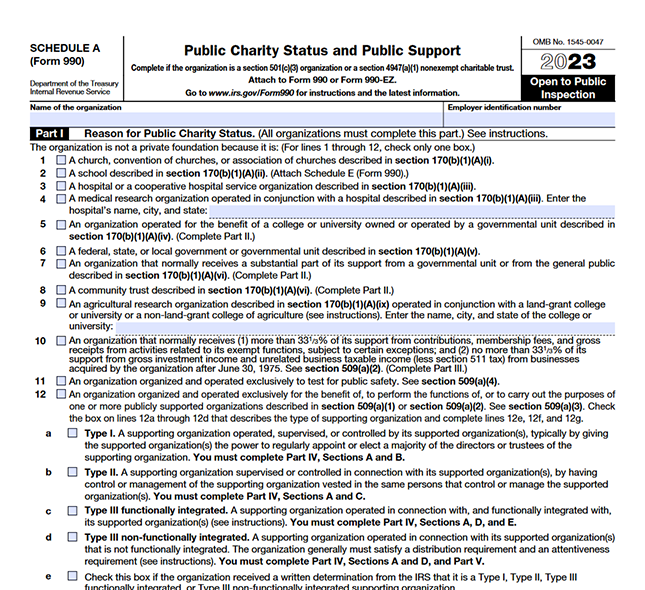

Schedules for Form 990-EZ

TaxZerone supports all the 990-EZ schedules for FREE!

These schedules will be auto-generated while you file your 990-EZ form with us.

- Schedule A - Public Charity Status and Public Support.

- Schedule B - Schedule of Contributors.

- Schedule C - Political Campaign and Lobbying Activities.

- Schedule E - Schools.

- Schedule G - Supplemental Information Regarding Fundraising or Gaming Activities.

- Schedule L - Transactions With Interested Persons.

- Schedule N - Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

- Schedule O - Supplemental Information to Form 990-EZ.