Form 8974 Instructions

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

This form 8974, which can be used on Forms 941, 943, or 944, tells you how much of a qualified small business payroll tax credit you can get for increasing research activities.

Who Needs to file Form 8974?

You must file Form 8974 and attach it to Form 941, 943, or 944 if you elected on your income tax return to claim the qualified small business payroll tax credit for increasing research activities against your payroll taxes. This payroll tax credit must be elected on an original, timely filed income tax return (including extensions) using Form 6765. If you haven’t filed an income tax return making the election to claim the payroll tax credit on Form 6765, you cannot file Form 8974 or claim the qualified small business payroll tax credit for increasing research activities on Form 941, 943, or 944.

Form 8974 Instructions - Step-by-Step Guide

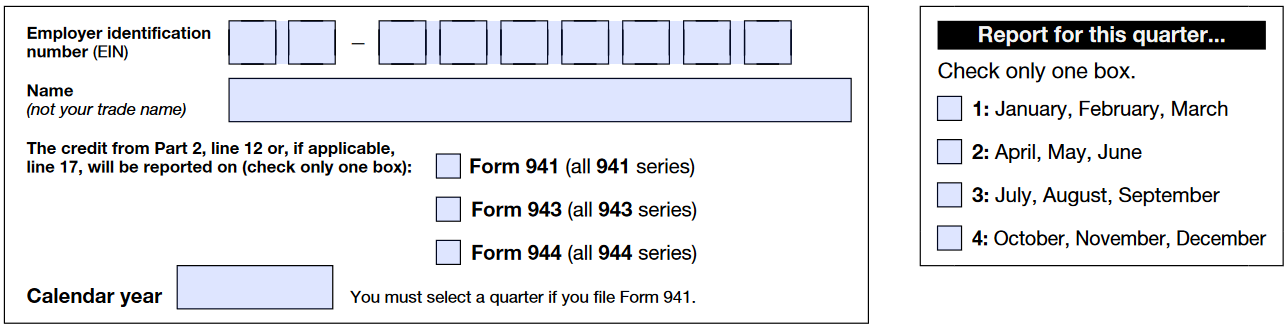

Business Information

- Enter Employer Identification Number (EIN): Input your EIN and business name as shown on Form 941, 943, or 944.

- Form Selection: Check the applicable form box.

- Schedule R: If filing Schedule R with Form 941 or 943, include the client's or customer's EIN.

Calendar Year and Quarter

- Calendar Year: Enter the year as on Form 941, 943, or 944.

- Quarter: Select the appropriate quarter on Form 941.

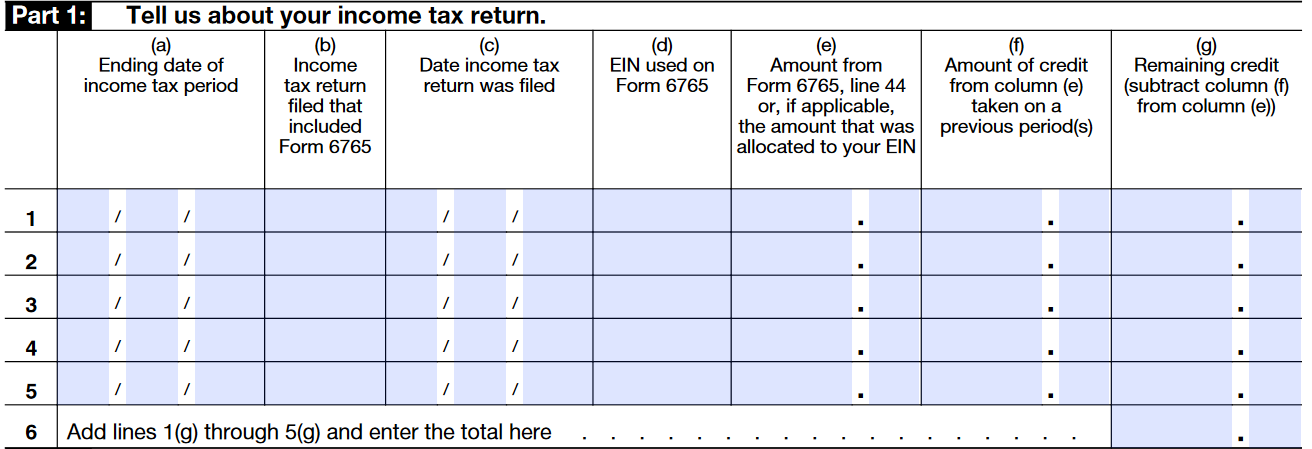

Part 1: Income Tax Return Details

Lines 1–5

- Column (a): Income tax period ending date (MM/DD/YYYY).

- Column (b): Type of income tax return filed that included Form 6765.

- Column (c): Date the return was filed (MM/DD/YYYY).

- Column (d): If the EIN on Form 6765 is different from the EIN on Form 8974, enter the EIN from Form 6765.

- Column (e): Credit amount from Form 6765, line 44 (up to $250,000 per year before 2023; $500,000 after).

- Column (f): Amount of credit previously taken.

- Column (g): Remaining credit (subtract column (f) from column (e)). Sum all amounts in column (g) and enter on line 6, column (g).

Carryforward and Additional Years

- Carryforward: If credit is unused in the first quarter, carry forward the amount to future quarters or years.

- Additional Years: For additional years, use extra rows with the earliest year on line 1. The total may exceed $500,000 if carrying forward unused credits from multiple years.

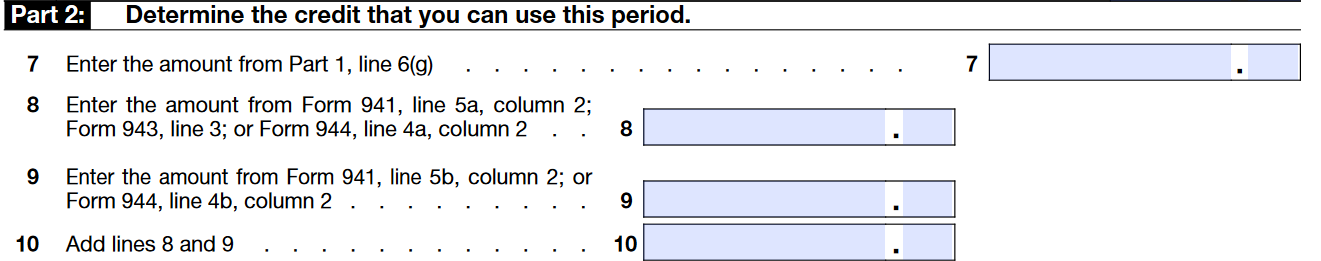

Part 2: Determine Usable Credit This Period

Lines 7–10

- Line 7: Remaining credit from Part 1, line 6, column (g).

- Line 8: Social Security tax amount from Form 941, line 5A, column 2.

- Line 9: Additional social security tax from Form 941, line 5B, column 2.

- Line 10: Total of lines 8 and 9.

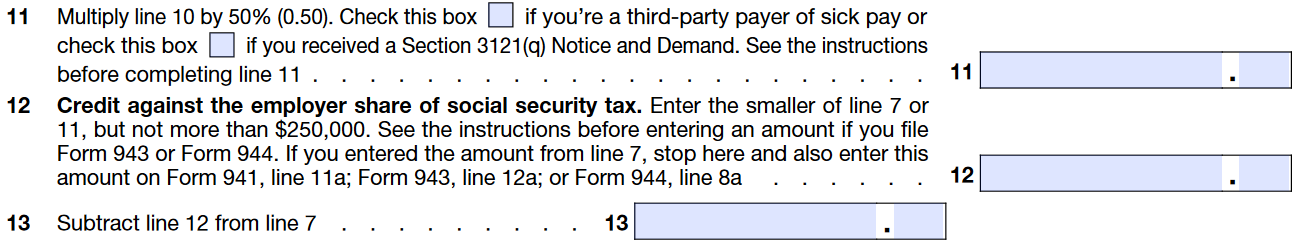

Lines 11–13

- Line 11: Multiply line 10 by 50% (limit credit to employer’s share of social security tax).

- Line 12: Smaller value of line 7 or line 11 (up to $250,000).

- Line 13: Subtract line 12 from line 7.

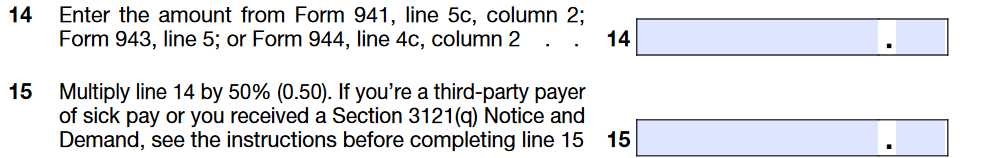

Lines 14–15

- Line 14: Medicare tax amount from Form 941, line 5C, column 2.

- Line 15: Multiply line 10 by 50% (limit credit to employer's share of Medicare tax).

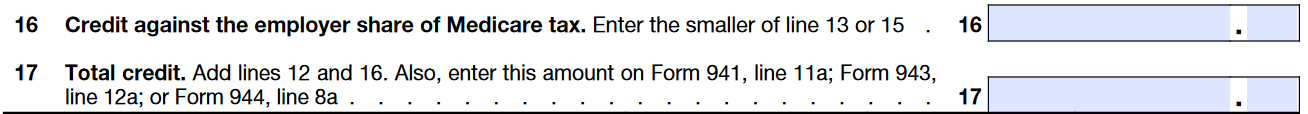

Lines 16–17

- Line 16: Smaller value of line 13 or line 15 (up to $250,000).

- Line 17: Add lines 12 and 16. Enter the total on Form 941, line 11 (or Form 943, line 12, or Form 944, line 8).

Important Updates to the 2023 Form 8974

- Form 8974 has been updated following the Inflation Reduction Act of 2022, which doubled the available credit from $250,000 to $500,000.

- The employer share of social security tax credit is now reduced to $250,000, with any remaining credit applied to Medicare taxes.

- New lines 13-17 have been added for the 2023 tax year.

Claiming the R&D Payroll Tax Credit

The following steps must be taken by qualified small businesses to claim the Research and Development (R&D) Payroll Tax Credit:

- Choose the Credit on Form 6765: Choosing the R&D payroll tax credit is the first thing you need to do. You file Form 6765 with your income tax return. With this choice, small businesses can use the credit for payroll taxes instead of income taxes.

- File Form 8974: Once you've chosen the credit, you must complete Form 8974 and attach it to your payroll tax forms (Forms 941, 943, or 944) to figure out and claim the credit against the employer's share of Social Security taxes.

- Send with Payroll Forms: You send Form 8974 with your quarterly or yearly payroll tax forms, like Form 941. With this credit, you can pay up to $250,000 less in payroll taxes each year.

E-file Form 941 and Attach Form 8974 with TaxZerone

Steps to Complete IRS Form 941 & Form 8974 Easily Using TaxZerone:

- Select the tax year and quarter.

- Enter the details for Form 941.

- Enter the qualified small business payroll tax credit on Form 941, Line 11.

- Enter the Form 8974 information and ensure that Line 17 matches Form 941, Line 11.

- Review and submit Form 941 to the IRS.

Start using TaxZerone today for fast, efficient,

and accurate Form 941 filing.

Experience hassle-free e-filing with our user-friendly platform, ensuring compliance

and peace of mind every step of the way.