IRS Form 940 Due Date

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

Form 940 is an annual tax form used by U.S. employers to report the Federal Unemployment Tax (FUTA) to the Internal Revenue Service (IRS). This form is essential for reporting wages paid to employees subject to FUTA taxes and for claiming any credits for state unemployment taxes paid.

Table of Contents

Federal Unemployment Tax Act (FUTA)

The Federal Unemployment Tax Act (FUTA) establishes payroll taxes that employers must pay to fund state unemployment insurance programs. These funds provide benefits to employees who have lost their jobs.

Employers must file Form 940 and pay FUTA taxes if they:

- Paid $1,500 or more in wages during any calendar quarter in the current or preceding year.

- Had at least one employee working for any part of a day in 20 or more different weeks in the current or preceding year.

Exceptions:

- Household Employees: Exempt if paid less than $1,000 in cash wages in any quarter. If wages exceed $1,000, FUTA taxes must be paid.

- Farm Workers: Exempt if paid less than $20,000 in cash wages in any quarter or had fewer than 10 employees in 20 different weeks. If wages exceed $20,000 or employees exceed 10, FUTA taxes must be paid.

FUTA Tax Rates

FUTA tax rates may change annually. For 2024, the rate was 6.0% on the first $7,000 of each employee's annual wages. Employers may receive a credit of up to 5.4% for timely state unemployment tax payments, reducing the effective FUTA rate to 0.6% if all state taxes are paid on time and the state is not subject to credit reduction.

FUTA Credit Reduction

Some states with outstanding federal loans may have their FUTA tax credits reduced, leading to a higher tax rate.

Credit Reduction States for 2024:

- California: 0.9%

- New York: 0.9%

- U.S. Virgin Islands: 4.2%

Employers in multiple states, including credit reduction states, must complete Schedule A (Multi-State Employer and Credit Reduction Information) when filing Form 940.

Form 940 Deadline

The deadline to file Form 940 with the IRS is January 31st each year. If FUTA taxes are deposited on time, the filing deadline extends to February 10th.

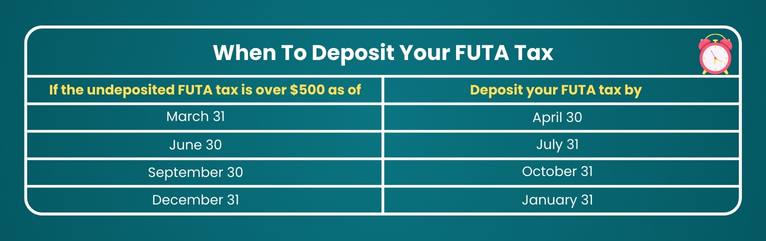

Quarterly deposits are required for FUTA tax liabilities over $500. Liabilities under $500 can be carried over to the next quarter.

Information Required to File Form 940

To file Form 940, employers need the following information:

- Employer Identification Number (EIN), company name, and address.

- Return type: Amended, Successor Employer, No Employee Payments, or Final Return.

- Total payments to employees.

- Adjustments for state exclusions.

- FUTA tax liability, deposits, balance due, or overpayment.

- Authorized signature.

Refer to the IRS Form 940 Instructions for detailed guidance.

Filing Methods for IRS Form 940

Electronic Filing:

The IRS provides a list of authorized e-file providers for Form 940. Electronic filing is recommended for faster and more secure processing.

Paper Filing:

Employers can mail Form 940 to the IRS. The mailing address depends on the employer's state and whether a payment is included.

Amending Form 940:

Employers can amend Form 940 for the current and previous years by filing an amended return either electronically or on paper.

Steps to Amend Form 940:

- Select Form 940 (paper or electronic).

- Check the "Amend return" box.

- Update to the correct amounts or other information if necessary.

- Provide a reason for the amendment.

- Submit the amended form to the appropriate address (for paper filing) or electronically to the IRS.

Attach Schedule R if amendments apply to an aggregate Form 940.

Importance of Filing Form 940

- Legal Obligation: Employers must file Form 940 to avoid IRS penalties and interest.

- Support System: FUTA taxes fund unemployment benefits for eligible workers.

- Responsible Business Practice: Timely and accurate filing demonstrates compliance and helps avoid audits.

- Tax Credits: Some states offer credits that reduce the federal FUTA tax liability.

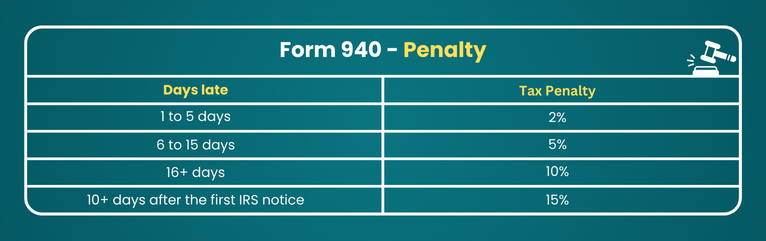

Penalties for Late Submission

Penalties for not submitting Form 940 by the deadline vary based on the violation's nature, business size, amount owed, and payment delay. Penalties increase with the length of the delay.