Form 945 Instructions

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

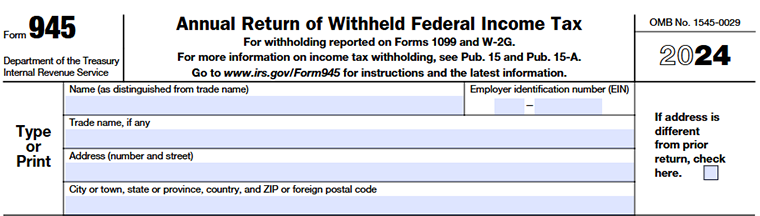

IRS Form 945 is an Annual Return of Withheld Federal Income Tax form. Businesses need to file this form to report the nonpayroll payments made by the employer during the tax year and the tax withheld from these nonpayroll payments.

Who must file Form 945?

Businesses withholding taxes from the nonpayroll payment should file form 945 to the Internal Revenue Service. You may need to file Form 945-A if you are a semiweekly depositor of the taxes.

Important dates

The deadline for filing Form 945 is January 31st of every year. If the deadline falls on a weekend or holiday, it is extended to the following working day. If you paid the full taxes for the year on time, you can file the return by February 10, 2025, for the tax year 2024.

Filing methods supported by Form 945

- E-Filing: The IRS recommends Employers file form 945, Annual Return of Withheld Federal Income Tax to file using the Electronic filing method.

- Paper filing: The Employer can file form 945 using the paper filing method by completing the form and mailing it to the respective address based on the state from where you are filing.

TaxZerone recommends E-filing of Form 945 for easy filing and faster processing of your employment forms

Important information required in Form 945

To file Form 945, below is the information typically required:

- Business information such as Name, EIN, and Address

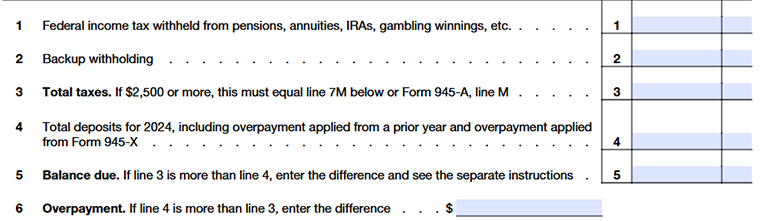

- Federal income tax withheld

- Backup withholding

- Total taxes

- Total deposits

- Balance due

- Overpayment

Step-by-step instructions to file form 945

Step 1: Enter the employer details

- Name: Provide the legal Business name

- Employer identification number (EIN): Enter the Unique EIN number for your Business

- Address: Fill in your Business address, street name, city or Town name, State or Province name, and Zipcode

Step 2: Enter tax withheld

Line 1: Enter the total amount of tax withheld from pensions, annuities, IRAs, Military retirement, Gambling winnings, Indian gaming profits, etc., during the tax year.

Line 2: Enter the backup withholding amount for a full year.

Line 3: Add the amount that you entered on Line 1 and Line 2. Now, on Line 3, enter the total amount.

Line 4: Enter the total deposit amount for 2024, including overpayments from Form 945-X and overpayments from a previous year.

Line 5: There is a balance due if Line 3 exceeds Line 4.

Line 6: There is an Overpayment if Line 4 exceeds Line 3.

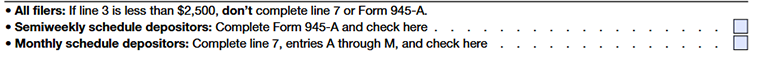

Step 3: Select the Depositor Category

- Select the first check box, if you are a semi-weekly depositor and enter details in

form 945-A - Select the second check box, if you are a monthly scheduled depositor and enter

details in 7 - If your Line 3 is less than $2500, there is no need to fill up the Line 7 or Form 945-A.

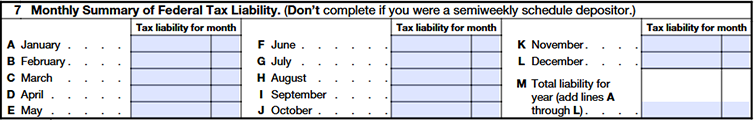

Step 4: Enter the details in line 7 if you are a monthly Depositor

- Enter the total tax withheld for the month of January(A),February(B), March(C), April(D), May(E), June(F), July(G), August(H), September(I), October(J), November(K), and December(L)

- (M) Add the amount you entered from Line 7(A) to 7(L). You can now put the total amount of taxes withheld for the year in Line (M). Verify that the total amounts on Lines 3 and 7 (M) are equal.

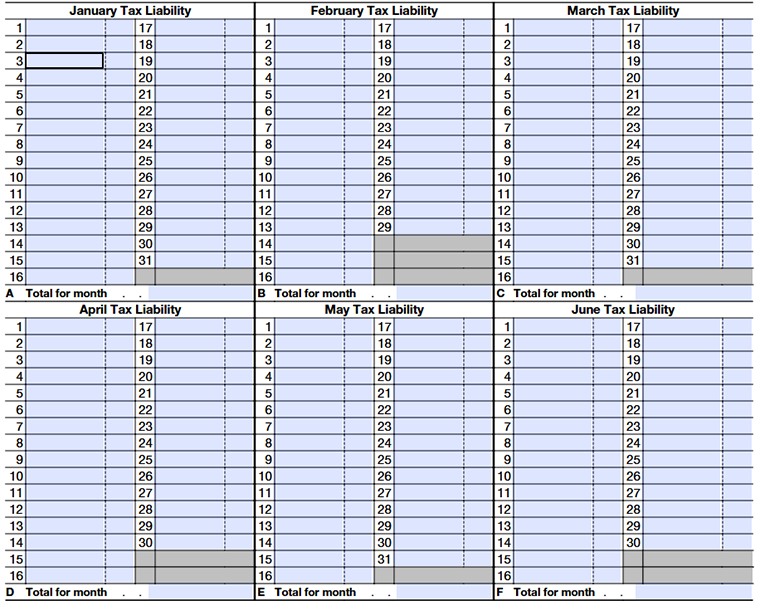

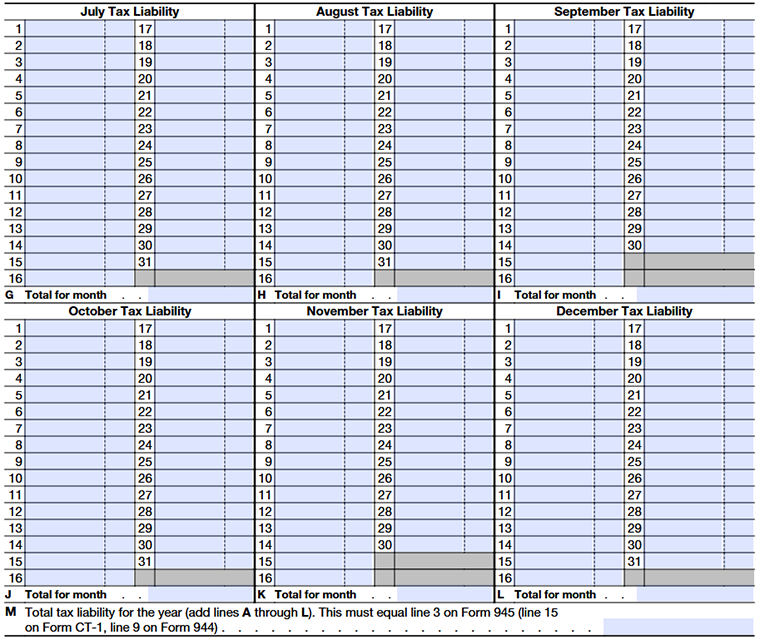

Step 5: Enter the details in form 945-A if you are a semi-weekly Depositor

- Enter the total tax withheld from the employee's wages for each day of the month from January to June.

- Enter the total tax withheld in each month in the respective fields

- Enter the total tax withheld from the employee's wages for each day of the month from July to December.

- Enter the total tax withheld in each month in the respective fields

- Add the taxes mentioned from line A to L and enter the total taxes in line M. The Tax amount should be equal to the taxes mentioned in M and should be equal to line 3 of Form 945

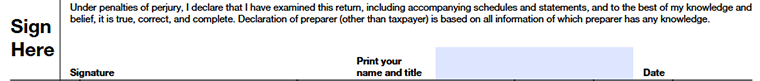

Step 6: Sign the form

- The authorized person to file the return should sign the form along with their name and title and mention the signing date.

For additional details, refer to the Instructions for Form 945

E file form 945 with Taxzerone

E-File Form 945 easily with Taxzerone for just $6.99 per return.

Start your Form 945 E-filing process with us in 3 simple steps.