E-file Form 7004 for Tax Year 2024

File Form 7004 online in just 3 simple steps and get an extension of up to 6 months.

E-File Before the Deadline to Avoid Penalties

Takes 3 steps and less than 5 minutes

File Form 7004 online for as low as just $14.99

Enjoy the simplest and most affordable way to e-file your form 7004. TaxZerone offers the best price in the industry. Save money and time with our user-friendly platform and transparent pricing options.

Start Saving Today!

3 Simple Steps to File IRS Form 7004 &

Secure a 6-Month Tax Extension

Follow these steps below to e-file Form 7004 online with the IRS.

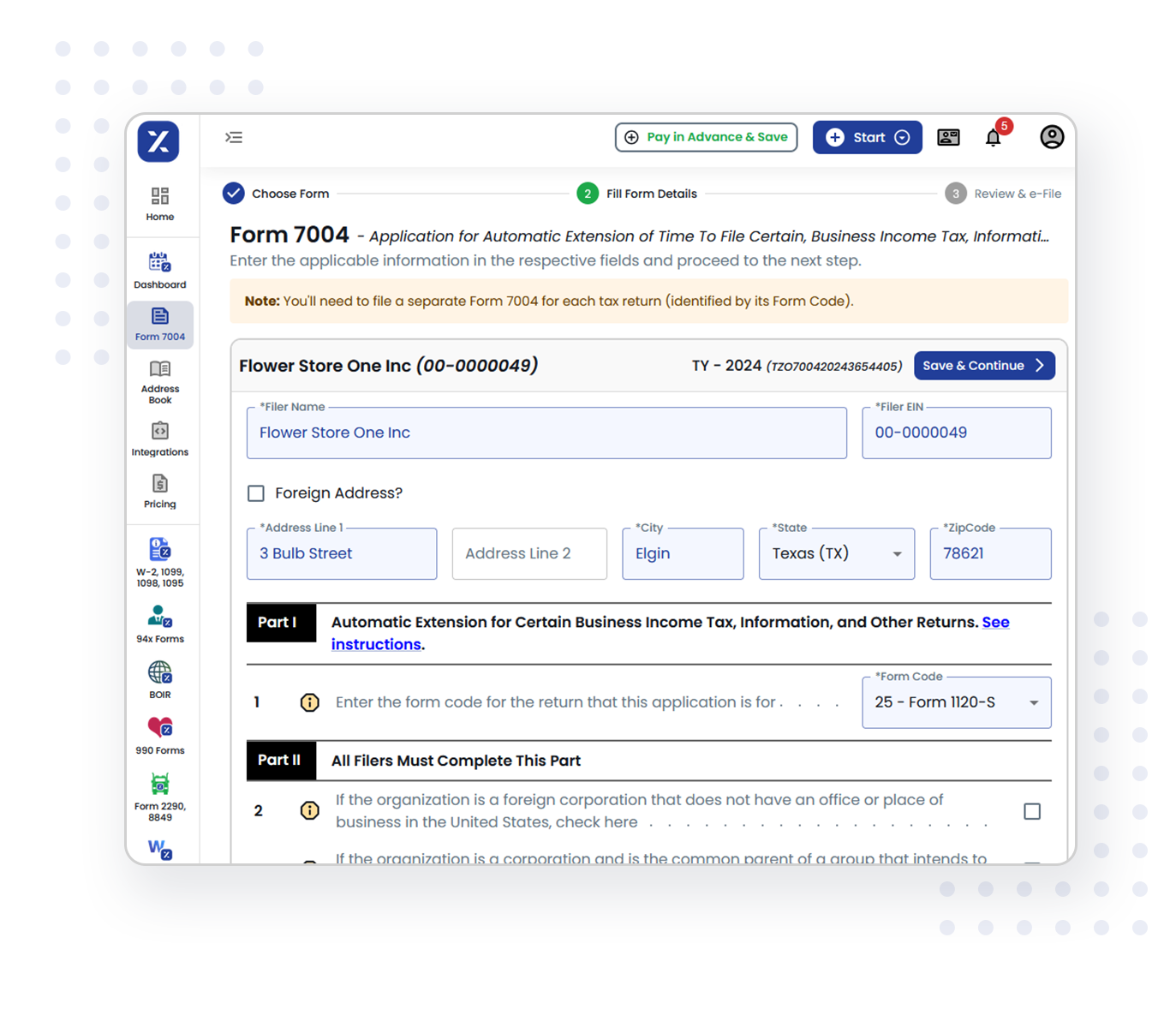

Enter business information

Provide your business details (such as name, EIN, and address), and choose the applicable tax return form (e.g., 1120, 1065, 1041) for which you are requesting an extension.

Enter Tax Information

Provide the tentative total tax liability, total taxes paid, and applicable credits. TaxZerone will automatically calculate the balance due.

Transmit the return to the IRS

Securely review & transmit your extension request through TaxZerone and receive an email notification from the IRS in minutes.

These steps look really simple, right? E-file Form 7004 now with TaxZerone.

You are just 3 steps away from getting an extension.

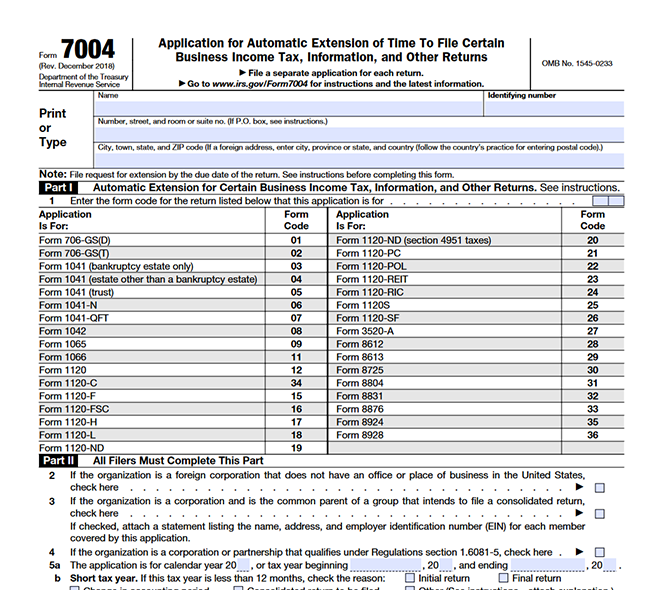

What is IRS 7004 Tax Form?

Understand how this simple form 7004 grants you a valuable 6-month extension for specific business tax returns.

What it is:

An official IRS form used to request an extension for filing various business tax forms.

What it offers:

A 6-month extension beyond the original due date, granting you valuable breathing room to gather records and complete your return accurately.

What forms does it apply to:

A range of business tax forms, including income tax returns (Forms 1120, 1120S, etc.), partnership returns (Form 1065), estate and trust returns (Form 1041), and certain information returns.

How to file:

You can file Form 7004 electronically (recommended) or by mail.

When to file:

Form 7004 must be filed by the original due date of the return you're seeking an extension for.

Avoid Penalties & Stay on Track for TY 2024

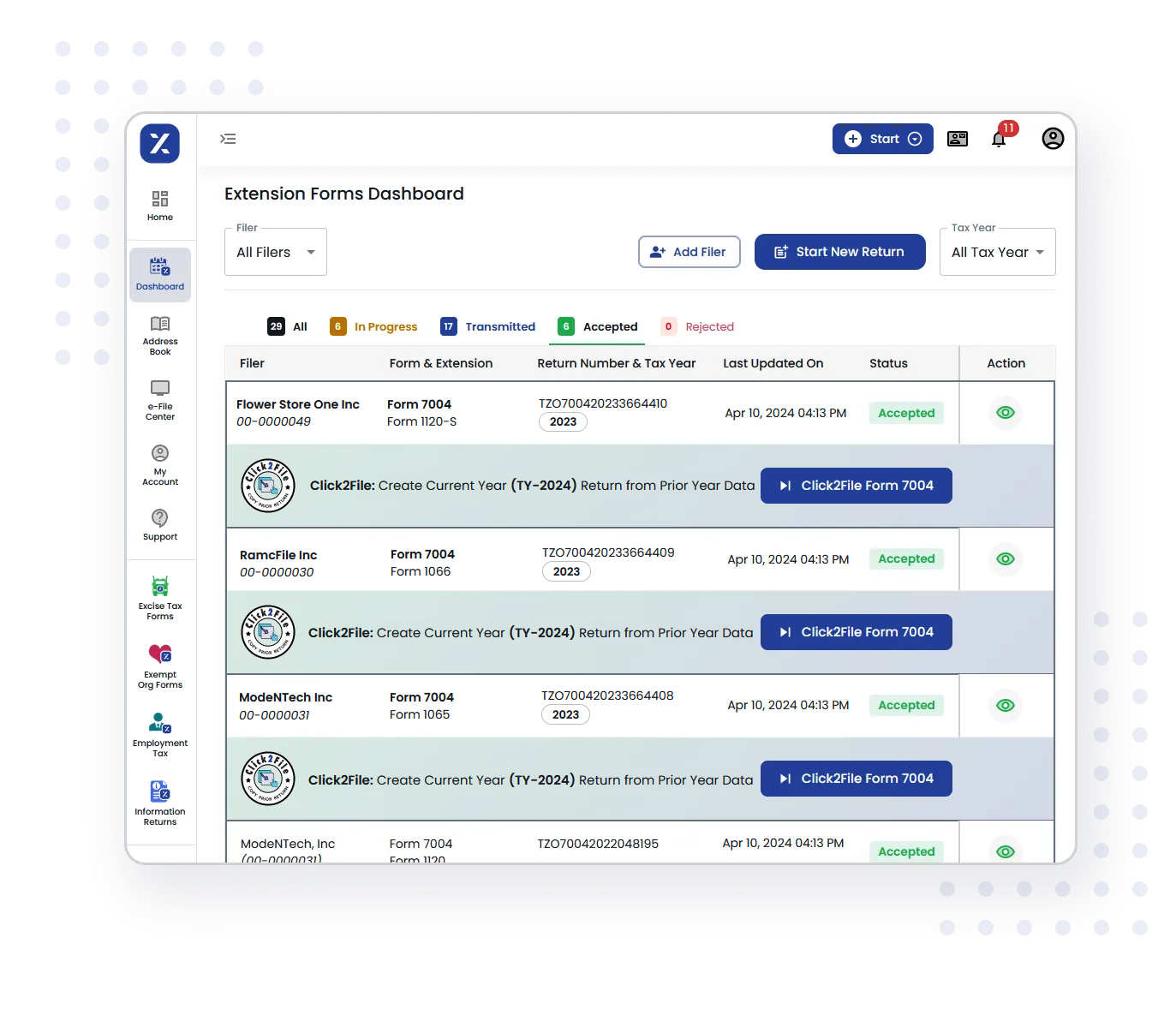

Click2File: Create Current Year Return from Prior Year Data

Tax Season Simplified:

Pre-Populate Your Current Return with Click2File!

Click2File takes the hassle out of tax preparation by automatically transferring relevant data from your previous return to your current one.

How it Works

Login and Select:

Simply access your TaxZerone account and choose Click2File Form 7004.

Review and Customize:

Click2File automatically populates your current return with relevant details. Review and adjust anything to reflect your current financial situation.

File with Ease:

Once everything is perfect, submit your return electronically. Click2File makes filing a breeze!

Experience the convenience of Click2File

How TaxZerone simplifies filing Form 7004 online?

Simplify Your Form 7004 Filing with TaxZerone's Easy and Powerful Features

Form-based filing

You fill out the form just as you complete a physical form, but instead of a pen you type out the required information.

Guided filing

Our step-by-step instructions will guide you along the way to complete your extension filing without any hassles.

Smart validations

We'll validate your return based on IRS rules and alert you if there are any errors, thereby reducing the chances of rejection.

Quick and secure e-filing

File Form 7004 online with TaxZerone in just 5 minutes and transmit your return to the IRS securely. It's that simple.

Instant return updates

Receive notifications on your return status as soon as the IRS processes it. Also, check the status from your TaxZerone account.

Free retransmission of rejected returns

Rest assured, if the IRS happens to reject your Form 7004 for any reason, you have the flexibility to make corrections and resubmit it to the IRS, all at no additional cost. Your peace of mind is our priority.

IRS-authorized

File your Business Tax Extension Form 7004 with an IRS-authorized e-file service provider and rest assured that your return will be accepted by the IRS, leaving you worry-free.

Timely Reminders

Stay on top of your tax obligations with our Timely Reminders feature. Receive proactive notifications to ensure you never miss a deadline when filing tax forms.

Dedicated Customer Support

Our team of Form 7004 experts is always here to answer your questions and guide you through the filing process.

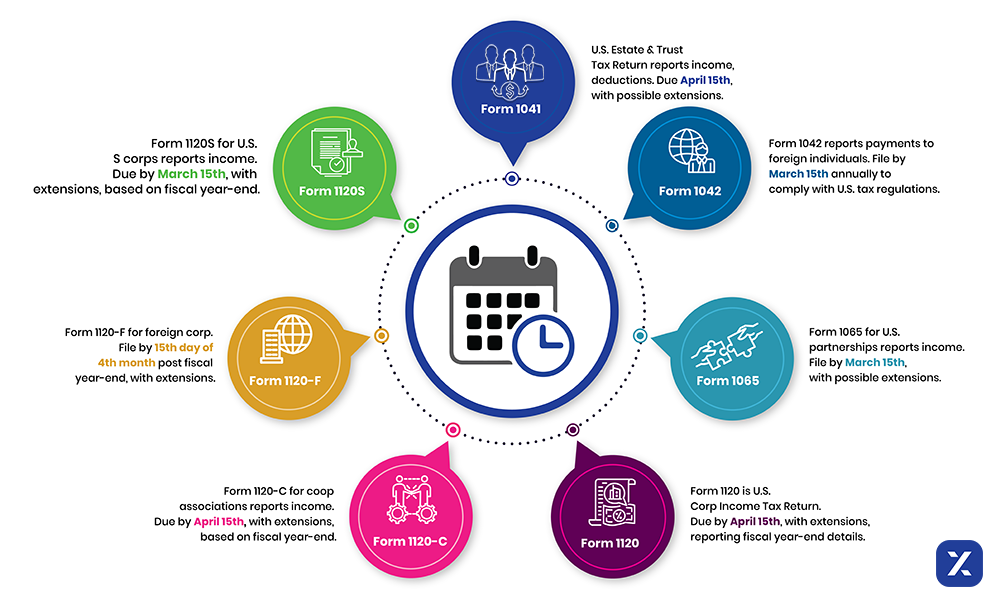

Form 7004 Due Dates

The Golden Rule: File Form 7004 on or before the original due date of the return you're seeking an extension for.

Beat the Deadline

Real Businesses, Real Feedback:

What People Say About TaxZerone's Easy e-Filing Solution

John - Small Business Owner

Emily - Startup Founder

Sarah - Tax Professional

Maria - Business Owner

David - Tax Professional

File your Business Tax Extension Anytime, Anywhere with Our Mobile App!

A mobile app from TaxZerone for e-filing Form 7004, lets you manage tax extensions on the go. Submit quickly, get secure access, and receive deadline reminders

Download Our App Now and Get Ready to File Your Tax Extension

Don't wait until the last minute - file your extension effortlessly with TaxZerone!

Learn How to File Form 7004 Through Videos

Get the Forms You Need: Form 7004 PDFs

Download the official forms and instructions directly from the IRS website

- Form 7004 (Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns) Download Form 7004 PDF

- Instructions for Form 7004 Download Instructions PDF for Form 7004

Ready to experience the ease of e-filing Form 7004?

E-filing is more than just a trend, it's a smarter way to file. So, switch to e-file and embrace the future!

Take the first step to discover the simplicity of e-filing.

Recent Blogs

FAQs on Form 7004

1. What is Form 7004?

2. When is the deadline to file Form 7004?

- March 15 – For S corporations (Form 1120-S) & partnerships (Form 1065)

- April 15 – For C corporations (Form 1120) and certain other business returns

Filing by these dates grants an automatic extension, typically six months, to file your return.

3. Who can file Form 7004?

Most business entities can file Form 7004, except for sole proprietors. Below businesses can use Form 7004 to get an extension to file business income tax:

- C-corps (Form 1120)

- S-corps (Form 1120S)

- Partnerships (Form 1065)

- Multiple-member LLCs as corporations and partnerships

- Trust, Estates and Others (Form 1041)

4. Can I file Form 7004 electronically?

Yes, you can definitely file Form 7004 electronically! In fact, the IRS encourages electronic filing for Form 7004 as it is faster, more accurate, and more convenient than filing on paper.

5. What is the difference between Form 7004 and 4868?

| Form 7004 | Form 4868 |

|---|---|

| Used by businesses, including partnerships, multi-member LLCs, C corporations, and S corporations, to request an automatic extension of time to file certain business income tax, information, and other returns. | Used by individuals (including sole proprietors and single-member LLCs) and resident aliens to request an automatic extension of time to file their U.S. individual income tax return. |

| Examples of returns covered by Form 7004 include Form 1120 (Corporate Income Tax Return), Form 1065 (Partnership Return of Income), and Form 1041 (U.S. Income Tax Return for Estates and Trusts). | Covers Form 1040 (U.S. Individual Income Tax Return), Form 1040NR (U.S. Nonresident Alien Income Tax Return), and Form 1040NR-EZ (U.S. Nonresident Alien Income Tax Return for Certain Business Income). |

| Deadline to file: Typically due on March 15th for partnerships and S corporations, and April 15th for C-Corps, trusts and multi-member LLCs | Deadline to file: Typically due on April 15th |

6. Does the IRS provide proof of an extension?

The IRS doesn't typically send a separate confirmation notice as proof of your Form 7004 extension being successfully filed.

If you e-filed your Form 7004 through an authorized IRS e-file provider, you should receive an immediate confirmation email with a reference number as proof of successful submission. This email serves as your confirmation document.