E-File Form 8849 to Claim for Refund of Excise Taxes

Claiming your 2290 excise tax credits has never been easier. Choose TaxZerone for a hassle-free way of Form 8849 e-filing.

Complete filing in less than 5 minutes

Recover your hard-earned money by filing

Form 8849 with TaxZerone

We understand that different circumstances can lead to tax refunds. Our platform supports the following claim options through Form 8849.

Sold/Destroyed/Stolen Vehicles

Claim a refund of excise taxes paid if you have sold, destroyed, or had a vehicle stolen in a tax year.

Low Mileage Vehicles

Request refund for taxable vehicles that were driven less than the 5,000-mile (7,500 miles for agricultural vehicles) limit in a tax year.

Overpayment of Tax

Made an overpayment of tax, either by mistake or due to a change in circumstances? Claim a refund for the excess amount.

You are just 3 steps away from getting your excise tax refunds

TaxZerone offers a simplified 8849 tax filing process to claim refunds accurately and effortlessly.

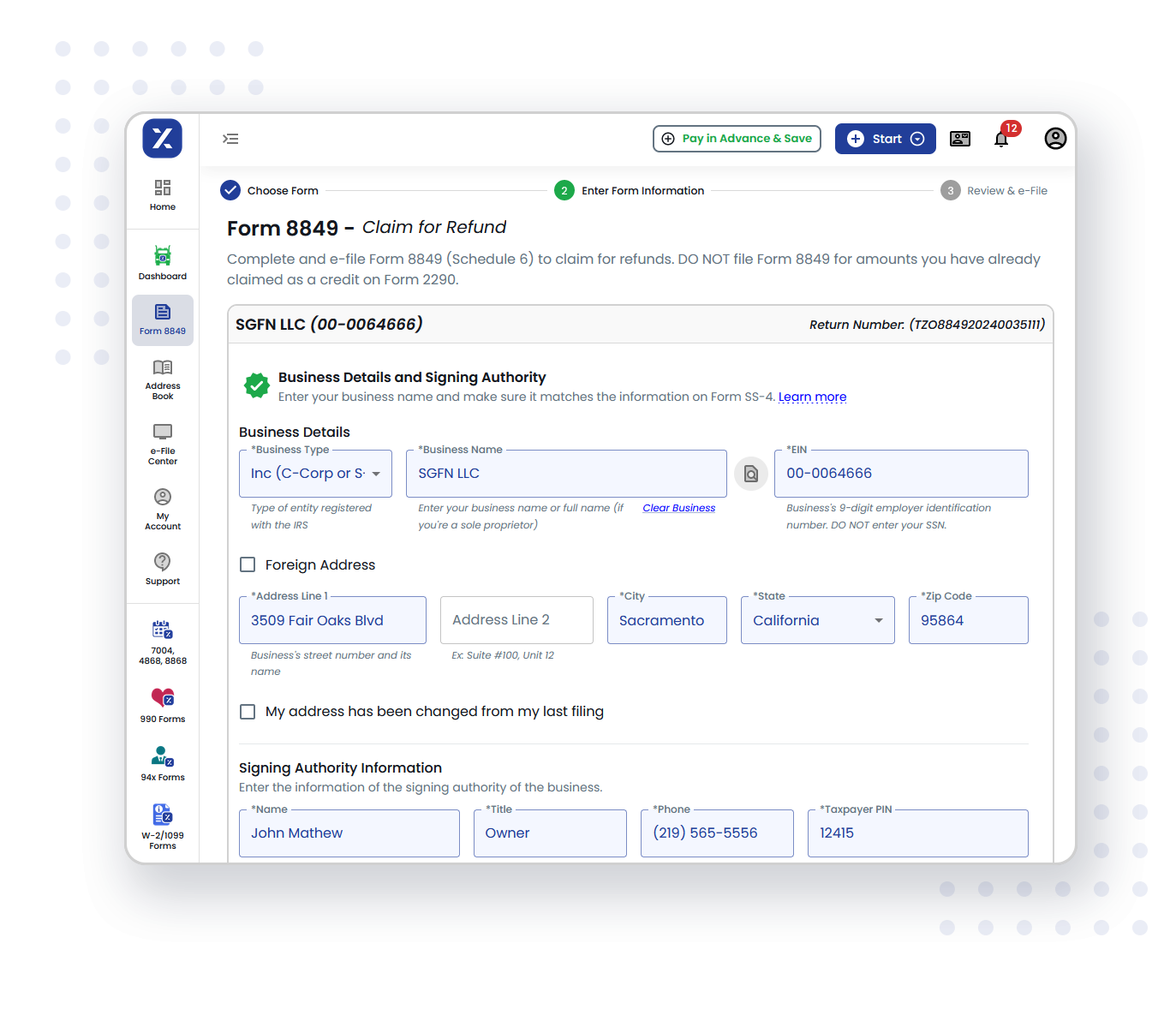

Enter form information

Enter all the necessary information required for your Form 8849 claim, from vehicle details to tax payment records.

Review Form 8849

Once you have entered all the information, take a moment to verify the details provided to ensure everything is accurate and up to date.

Transmit to the IRS

Securely transmit your completed Form 8849 to the IRS for processing and get the refund claimed.

Let's recover the refund amount that rightfully belongs to you. Take the first step now.

Complete filing in less than 5 minutes

Benefits that set TaxZerone apart from the rest

When it comes to e-filing your Form 8849, TaxZerone stands out for several compelling reasons.

IRS Authorized

Authorized by the IRS, giving you the confidence that your e-filed Form 8849 is in compliance with their regulations. We adhere to strict standards to ensure the accuracy of your claim.

Easy Filing

Our user-friendly interface and intuitive design make the entire e-filing process straightforward and accessible, even for those unfamiliar with tax forms.

Guided Filing

Never worry about missing important details or making errors. Our platform walks you through each section of the form, prompting you to enter the required information accurately.

Secure Filing

Our platform employs robust security measures to ensure that your personal and financial data remains safe throughout the e-filing process. We use advanced encryption technology to safeguard your information.

Smart Validations

Our system automatically validates the information you enter on the form. It checks for errors, inconsistencies, and missing data, alerting you to any issues before you submit your claim.

Automatic Credit Calculations

When you input the necessary information, our system automatically calculates the credits and refunds you are eligible to receive. This ensures accuracy and saves you time and effort in manual calculations.

Ready to file Form 8849 Schedule 6 to claim refunds?

Take control of your tax claim process today! Claim your tax refunds with ease and efficiency.

Get started now by clicking the button below.

Complete filing in less than 5 minutes