Attention Truckers! E-File Form 2290 Now to Stay Compliant for the 2025–26 Tax Year

Form 2290 for the 2025–26 Tax Season Is Now Open

File HVUT Form 2290 early with TaxZerone and receive your

IRS-stamped Schedule 1 in minutes.

File Form 2290 online for as low as just $19.99

TaxZerone offers the best price in the industry, offering multiple pricing plans based on the number of trucks. Make the e-filing process simple, hassle-free, and affordable.

Start Saving Today!

Get Schedule 1

in Minutes

E-file Form 2290 now to pay HVUT and get your IRS-stamped Schedule 1 within minutes.

FREE VIN Correction (Amendment)

Did you enter the wrong VIN on your HVUT form? No problem! Correct it for FREE with TaxZerone.

FREE Retransmission of rejected returns

If the IRS rejects your return for any reason, you can correct and resend it at no extra cost.

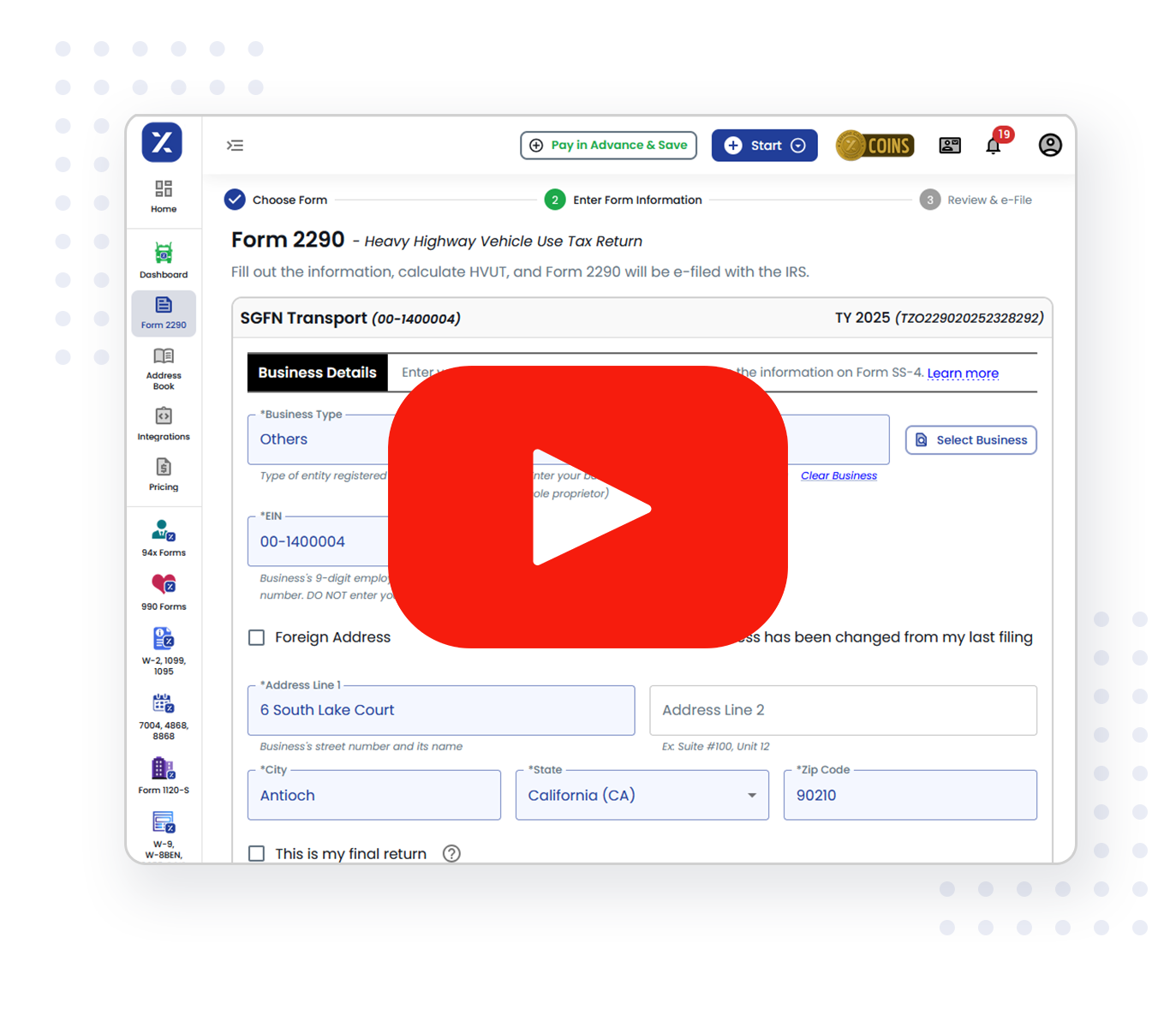

Get your IRS-stamped Schedule 1 in 3 simple steps

TaxZerone makes filing your 2290 tax form easy, so you can get back on the road quickly.

Enter form information

Enter the required information, such as name, EIN, VIN, taxable gross weight, and first used month (FUM).

Review and pay the tax due

Review your form information and pay the balance tax due using the EFW or EFTPS or Credit/Debit card option.

Transmit & get Schedule 1

Transmit your return to the IRS and get your stamped Schedule 1 as soon as you complete the filing.

Filing Form 2290 is a key compliance step in the trucking industry. Without a valid Schedule 1, you won’t be able to register or renew your vehicle tags. It's also required during audits and DOT inspections.

Get Schedule 1 immediately

What is Form 2290?

IRS Form 2290 is used to report and pay the Heavy Vehicle Use Tax (HVUT) for vehicles that weigh 55,000 pounds or more and operate on public highways in the U.S. This federal tax helps fund highway maintenance and infrastructure.

If you own a qualifying truck, you must file Form 2290 annually and receive a stamped Schedule 1 from the IRS. This Schedule 1 is required for vehicle registration, renewal, and compliance during roadside checks. Whether you’re an individual owner-operator or managing a fleet, timely and accurate filing ensures your trucks stay legally operational.

Simplify Your HVUT Filing with TaxZerone!

New to TaxZerone? Don't worry about manually entering Form 2290 info.

Try AutoMagic2290:

Form 2290 filing made effortlessly magical

Upload your prior-year Schedule 1, and like magic, our

super-smart system will automatically fill in your IRS 2290

info—all at an affordable price of just $19.99

No matter where you filed last year.

Get your new Schedule 1 copy for this year

Top reasons to choose TaxZerone for Form 2290 filing

Truckers get countless benefits with TaxZerone. However, here are the top benefits.

Easy e-filing

File your tax return easily and hassle-free. With our user-friendly interface, you can quickly enter your tax details and submit your return within minutes.

Guided filing

Our step-by-step irs form 2290 instructions will guide you to complete your return accurately. This minimizes rejection, ensuring that your tax return is filed the first time correctly.

Smart validations

We'll validate your returns for errors and discrepancies in your tax return. You can correct any errors before transmitting your return, reducing the chances of rejection.

Quick and secure e-filing

File the tax form 2290 online with TaxZerone in just 5 minutes and transmit your return to the IRS securely. It's that simple.

Instant Schedule 1

Get Schedule 1 as soon as you complete the filing process. No more waiting for the paper Schedule 1 to arrive in the mail.

Free retransmission of rejected returns

Even if the IRS rejects your Form 2290 due to any reason, you can correct and retransmit it to the IRS for free. No additional charges.

IRS-authorized

File HVUT tax Form with an IRS-authorized e-file service provider and stay worry-free that your return will be accepted by the IRS.

Supports bulk upload

Upload your information, file heavy vehicle use tax in bulk, and complete your filing swiftly and accurately.

FREE VIN correction

Reported your VIN incorrectly while filing HVUT tax form? File VIN correction for your return at zero cost.

AutoMagic2290

Upload your prior year Schedule 1, and TaxZerone will automatically populate the necessary information into your current filing. Review the pre-filled information, make any necessary adjustments, and file your return with the IRS.

Multiple Payment Options

Choose the method that suits you best, including Electronic Funds Withdrawal (EFW), Electronic Federal Tax Payment System (EFTPS) and Credit or Debit cards.

Dedicated Customer Support

Our team of tax experts is always here to answer your questions and guide you through the filing process.

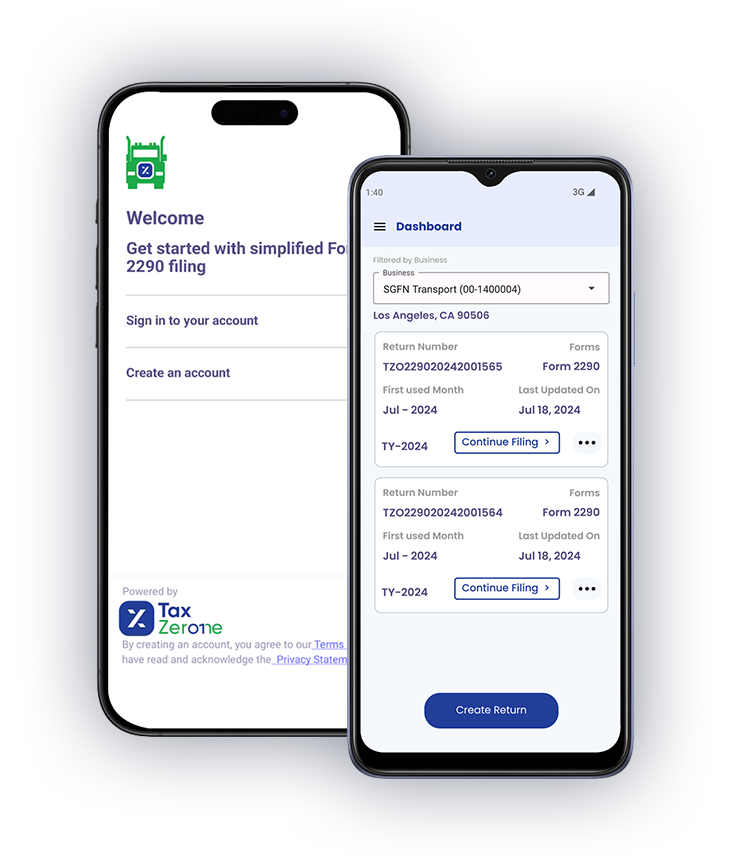

Get the TaxZerone 2290 App - Available on Android, iPhone, and iPad.

The TaxZerone mobile app gives you flexibility and control over your 2290 filings from anywhere.

- Complete and submit your return in minutes

- Instantly access your Schedule 1

- View past filings on your phone

- Get real-time updates on your return status

Download the app on Android or iOS and take your Form 2290 filing on the road- anytime, anywhere.

Haul in the high-speed express lane for HVUT filing!

Ready to file Form 2290 with TaxZerone?

Skip the paper forms and confusing instructions. Filing online with TaxZerone is:

Simple

Enter your information, click a button, and boom - you're done!

Fast

No waiting in line at the post office. Get your Schedule 1 instantly.

Accurate

Our IRS-authorized e-filing system ensure worry-free compliance.

Secure

We protect your data with high-level encryption and industry-leading security measures.

Effortless

No printing, mailing, or manual calculations. We handle everything.

Don't just file your HVUT - simplify it with TaxZerone. Click the button below and experience the difference.

E-File Now!Get Schedule 1 in minutes

Form 2290 - Tax Calculator

Take the Guesswork Out of HVUT

Filing your Heavy Vehicle Use Tax (HVUT) shouldn't be a mystery. Ditch the spreadsheets and calculations with TaxZerone's fast and accurate HVUT Tax Calculator.

Calculate Your HVUT NowGet started in just seconds!

Driving Success: Truckers share their experience with TaxZerone

Read the satisfied truckers' testimonials and see why TaxZerone is the trusted choice for stress-free e-filing.

Avoid These Common Filing Mistakes

Even small mistakes can lead to IRS rejections. Here are the most common errors and how to avoid them:

- EIN mismatch: Ensure the EIN on your form exactly matches what’s on IRS records.

- Incorrect VIN: Double-check every character of your Vehicle Identification Number.

- Wrong First Used Month: Select the correct month your vehicle first operated.

- Late Filing: Missing the deadline results in penalties and interest.

TaxZerone automatically checks for common errors to help you file accurately.

Get the Forms You Need: Form 2290 PDF

Download the official forms and instructions directly from the IRS website

- For HVUT Download Form 2290 PDF

- For Instructions Download Instructions for Form 2290 PDF

E-file Now and experience the future of compliance.

Faster, easier, and stress-free.

E-filing is more than just a trend, it's a smarter way to file. So, switch to e-file and embrace the future!

Take the first step to discover the simplicity of e-filing.

Frequently Asked Questions

1. What is IRS Form 2290?

2. When is the due date for IRS Form 2290?

3. Why should I file Form 2290 online?

4. Who should file Form 2290?

5. What is Form 2290 Schedule 1?

6. Who is exempt from Form 2290?

- Light Vehicles: Vehicles with a gross weight of less than 55,000 pounds.

- Agricultural Vehicles: Vehicles used exclusively for agricultural purposes and expected to travel less than 7,500 miles during the tax period.

- Qualified Exempt Vehicles: Some special-purpose vehicles, such as bloodmobiles, mobile libraries, and certain trucks used for tax-exempt purposes.

- Mileage Exemptions: Vehicles that are expected to be driven less than 5,000 miles during the tax period (or 7,500 miles for agricultural vehicles).

7. Is Form 2290 filed annually?

8. What is Form 2290 Category V?

9. What is the late filing penalty for Form 2290?

| Failure to file the Heavy Vehicle Used Tax (HVUT) return by the deadline. | Failure to file both the 2290 return and heavy vehicle taxes |

|---|---|

| 4.5% of the total tax amount due, and the penalty will increase monthly for up to five months. | 0.5% of your total tax amount. You will also face an additional interest charge of 0.54% per month. |

10. What is Form 2290 contact number? form 2290 irs phone number

- Toll-free: 866-699-4096

- Not toll-free: 859-320-3581

11. What is Form 2290 for farmers?

12. What are logging vehicles?

13. What is Form 2290 low mileage credit?

14. Where can I download Form 2290 pdf?

15. Where do I mail Form 2290 without payment?

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0031

However, the IRS recommends e-filing for quicker and secure processing.