E-file IRS Form 4868 today and get a 6-month extension

Need more time to file your Form 1040, personal income tax? File Form 4868 online with TaxZerone, an IRS-authorized provider, and avoid penalties.

Takes 3 steps and less than 5 minutes

Why should you e-file Form 4868 with TaxZerone?

TaxZerone simplifies the online filing of Form 4868 with its top-notch features

Form-based filing

Fill out Form 4868 just like you complete a physical form in no time. To be precise, less than 5 minutes.

Guided filing

Get answers to your questions while you fill out the form and complete filing easily.

Instant form updates

Receive form updates right in your inbox as soon as the IRS processes your return. Stay worry-free.

IRS form validations

Resolve alerts based on IRS rules while you complete the form and e-file your returns error-free.

Transmit rejected forms for free

Re-transmit your rejected returns for free after updating your form, irrespective of the reason.

Quick and secure

E-file Form 4868 with the IRS quickly and securely. Also, make payments securely.

Get an extension of up to 6 months by completing just 3 simple steps

If you have the required information, you can get your extension form filed in less than 5 minutes. Follow the steps below to e-file Form 4868.

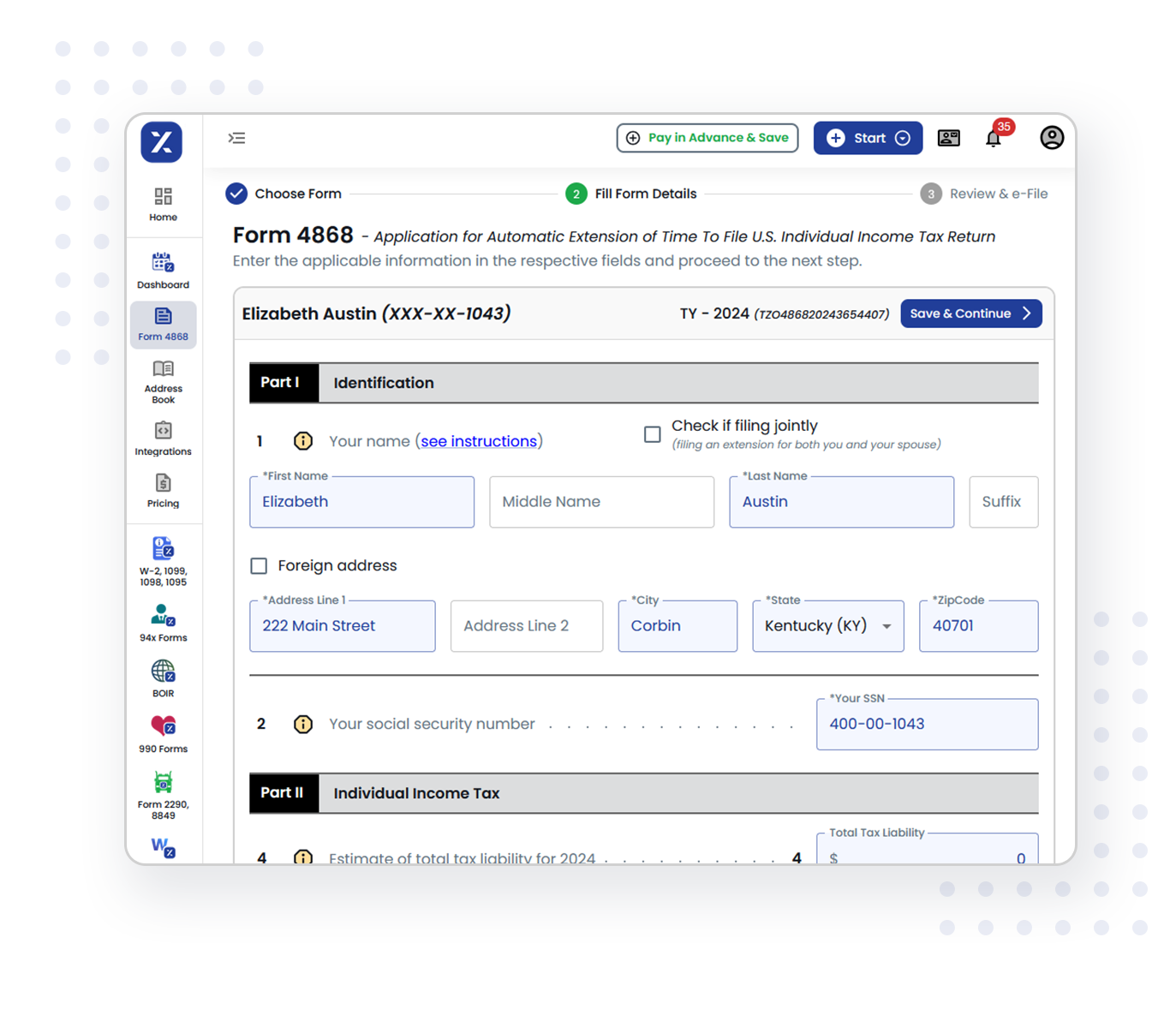

Enter form information

Select the tax year and enter personal information such as name, address, and SSN. Calculate the balance due by providing tax liability and payments made.

Preview the return

Review whether the information entered is correct and make changes if required. Provide bank account information if you have a balance due.

Transmit the return to the IRS

Securely transmit your return to the IRS and wait for an email notification from us on the status of your return.

Complete these steps with TaxZerone, get an extension to file 1040 returns, and avoid penalties.

You are just 3 steps away from getting an extension.

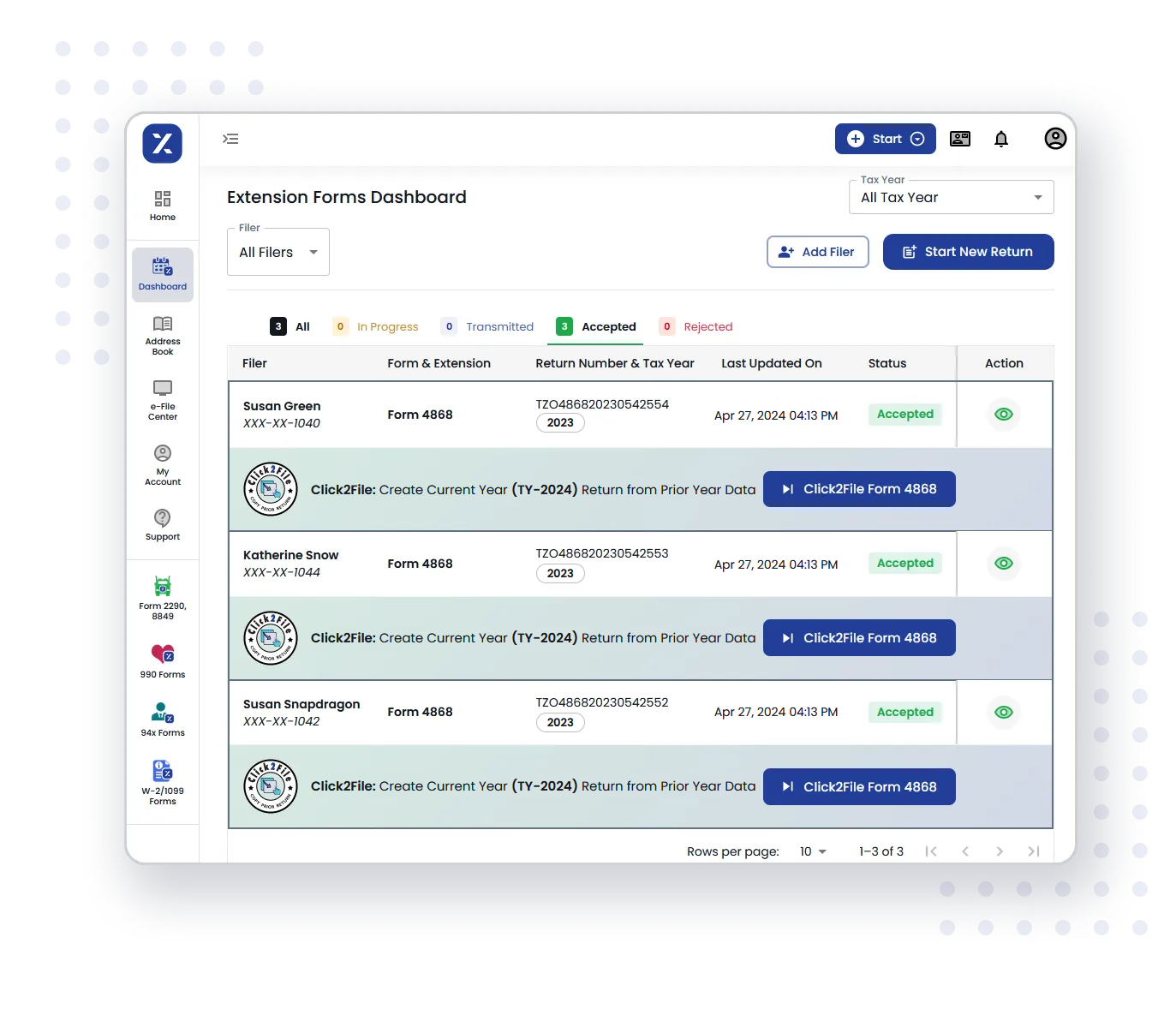

Click2File: Create Current Year Return from Prior Year Data

Tax Season Simplified:

Pre-Populate Your Current Return with Click2File!

Click2File takes the hassle out of tax preparation by automatically transferring relevant data from your previous return to your current one.

How it Works

Login and Select:

Simply access your TaxZerone account and choose Click2File Form 4868.

Review and Customize:

Click2File automatically populates your current return with relevant details. Review and adjust anything to reflect your current financial situation.

File with Ease:

Once everything is perfect, submit your return electronically. Click2File makes filing a breeze!

Experience the convenience of Click2File

File Your Personal Tax Extension Anytime, Anywhere with Our Mobile App!

The mobile app from TaxZerone for e-filing Form 4868 allows you to manage your personal tax extensions on the go. Submit quickly, gain secure access, and receive helpful deadline reminders.

Download Our App Now and Get Ready to File Your Tax Extension

Learn How to File Form 4868 Through Videos

Have personal information, 2024 tax liability, and tax payments made ready?

You can e-file Form 4868 with the IRS in the next 5 minutes.

Simple. Secure. Accurate.

FAQs on Form 4868

1. What is a 4868 tax form?

2. When is the deadline to file Form 4868?

For the 2024 tax year, you will need to e-file Form 4868 by April 15, 2025. Make sure to file the extension form using TaxZerone within the due date to avoid penalties.

Filing Form 4868 will extend the filing deadline to October 15, 2025.

3. Who can file Form 4868?

4. What information do I need to file Form 4868?

To file Form 4868 online, you will need to have the following information:

- Personal information such as Name, Address, and SSN

- Total tax liability for 2024

- Tax payments made in 2024