E-File BOI Report with Our Trusted Online Platform

Quickly and securely complete your BOI Form and ensure compliance with the latest BOI Reporting 2024 requirements. Simplify your FinCEN BOI Report filing and avoid penalties.

Affordable Filing for Your FinCEN BOI Report

Get your BOI Report for just $39.99 Per EIN. Ensure timely submission of your Beneficial Ownership Information Reporting without any hassles.

Why Choose TaxZerone For Form Beneficial Ownership Information Report (BOIR)

Comprehensive BOI Reporting Solution

Supports all types of BOI reports, including Initial, Correction, Update, and Newly Exempt Entity reports.

Prioritizing Security

Our advanced security protocols safeguard your personal information throughout the BOIR filing process, ensuring your data remains protected and providing you with peace of mind.

Invite Beneficial Owners

Invite beneficial owners to securely provide their information via a secure portal.

Best Price in the Industry

Benefit from our competitive pricing with no hidden fees, providing you with the most cost-effective solution for your BOI filing needs.

Easy E-Filing

Make FinCEN BOI reporting simple with our easy-to-use e-filing system. It's quick and hassle-free.

Guided Filing

Our guided filing feature provides clear instructions and helpful tips at each step, making it easy to complete your BOI report accurately and efficiently.

Common Errors in BOI Reporting

Avoid These Mistakes in Your BOI Filing

Filing your FinCEN BOI Report incorrectly could result in costly delays or penalties. Here are common errors we help you avoid:

- Missing Beneficial Owners: All owners must be listed in the BOI Report Form.

- Filing Late: Ensure compliance with BOI Reporting 2024 deadlines.

- Incorrect Details: Accurate submission of entity and ownership data is key.

Complete Your Beneficial Ownership Information

Report with Ease

Ensure compliance and avoid penalties by reporting accurate information about your business's owners and controllers by the federal deadline. Our service simplifies the process, helping you meet all requirements efficiently and on time

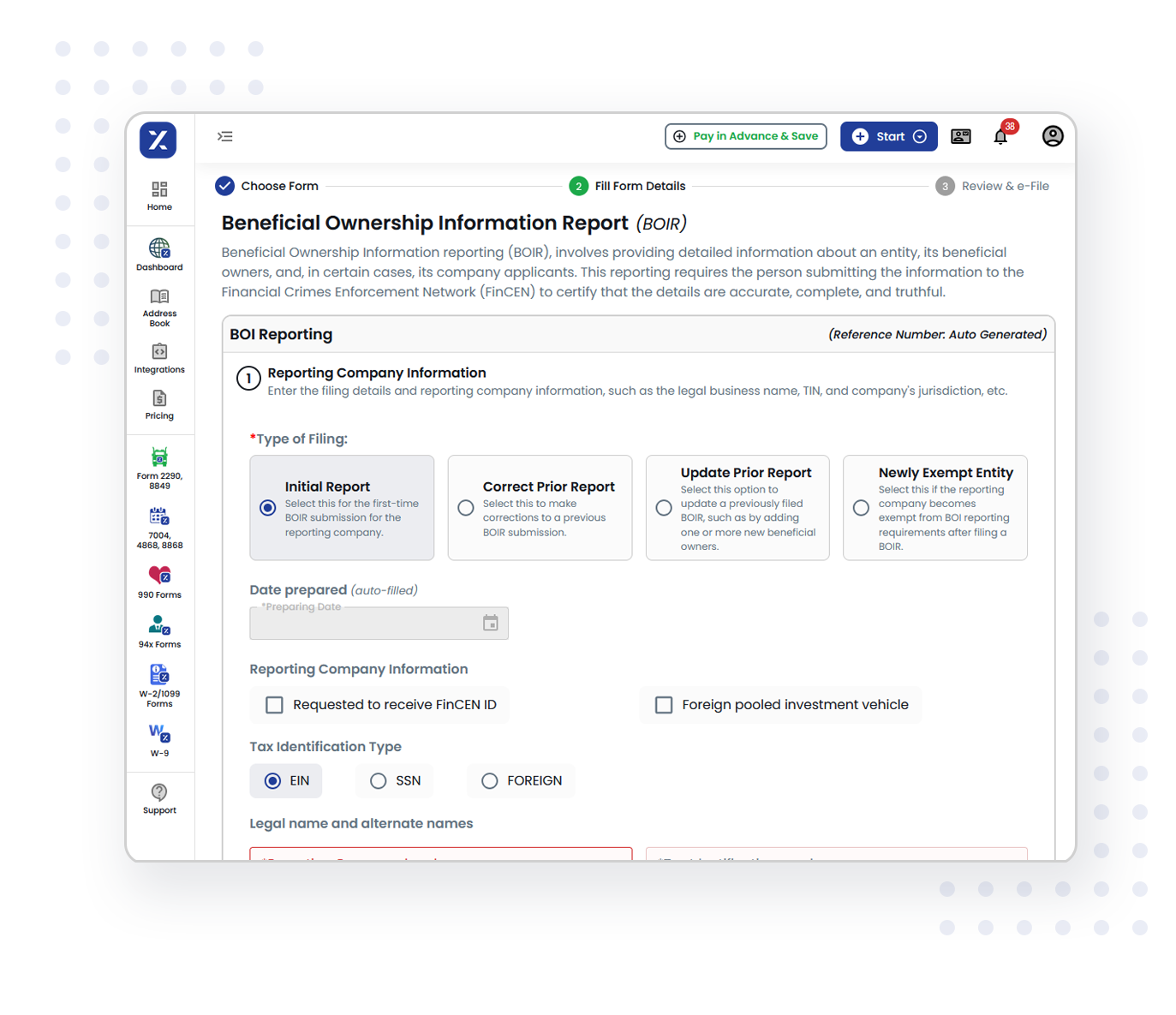

Steps to File Your FinCEN BOI report Online

Types of Filing: Select the appropriate type of filing for your business

Company Information: Enter essential details about your company

Company Applicant Information: Provide information about the individual submitting the report

Beneficial Owner Information: Accurately report details of those who own or control the business

Submit the BOI Report: Review and submit your report to meet the federal deadline

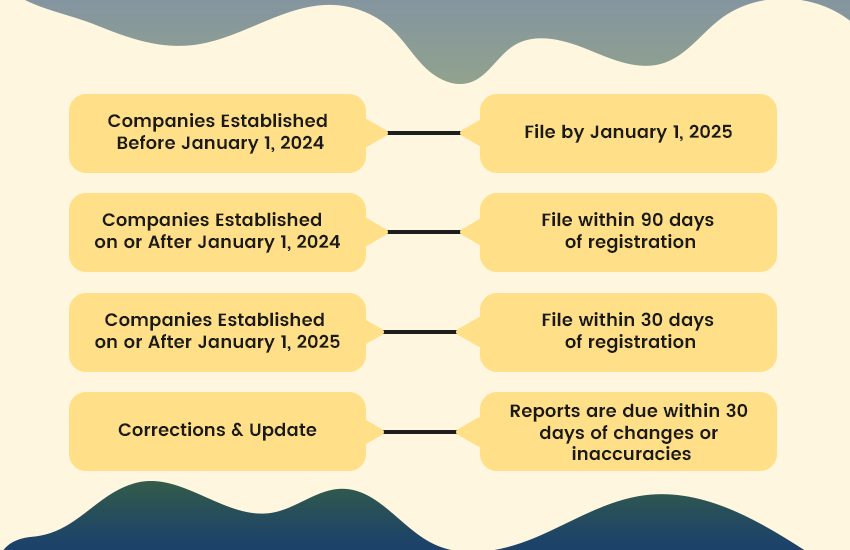

Beneficial Ownership Information Report (BOIR) Filing Deadlines

The deadline for filing a FinCEN BOI Report depends on when your company was established or registered.

What is beneficial ownership information reporting?

Beneficial Ownership Information Reporting is a key requirement under the Corporate Transparency Act. This rule, which took effect on January 1, 2024, requires companies to file information about their beneficial owners—the individuals who directly or indirectly own or control the company.

To comply, companies must report this data to the Financial Crimes Enforcement Network (FinCEN). This new regulation aims to increase transparency and combat financial crimes.

Meeting this requirement is crucial because failure to file can result in severe consequences, including criminal charges, hefty fines, and even imprisonment. Many companies have important deadlines this year, so it's essential to understand and follow these new rules to avoid these serious penalties

What's the Corporate Transparency Act?

The Corporate Transparency Act (CTA), enacted in January 2021, requires U.S. businesses to report their beneficial owners—those who own 25% or more of a company or exert substantial control. Certain entities like publicly traded companies and large operating companies are exempt. The reported information includes the owner's name, address, date of birth, and ID number. This measure aims to enhance transparency and combat financial crimes by making it harder for individuals to use anonymous shell companies

Who is a beneficial owner?

Beneficial owners are individuals who either directly or indirectly:

- Own or control at least 25% of your company’s ownership interests

- Exercise significant control over your business

Common examples of beneficial owners include:

Key Decision-Makers: Individuals who play a crucial role in making major decisions for the company

Senior Officers: High-ranking executives such as the president, CEO, CFO, general counsel, or COO

Authority Figures: Those with the power to appoint or remove key officers or a majority of directors within the company

Identifying these individuals is essential for ensuring transparency and compliance with financial regulations