E-file IRS Forms For FREE with TaxZerone

File your IRS forms online for free with TaxZerone. Our hassle-free e-filing service makes tax filing easy and efficient. As a trusted IRS-authorized e-file service provider, TaxZerone ensures a smooth and secure filing process.

Key Benefits:

- Free e-filing for IRS forms

- Trusted IRS-authorized provider

- Hassle-free and secure process

- Simplified tax filing journey

Free E-Filing Service For a Seamless Experience

Yes, you read that right—filing IRS forms with TaxZerone won't cost you a penny! Enjoy our free e-filing service and experience a seamless, hassle-free process. TaxZerone is your trusted partner for easy and efficient tax filing.

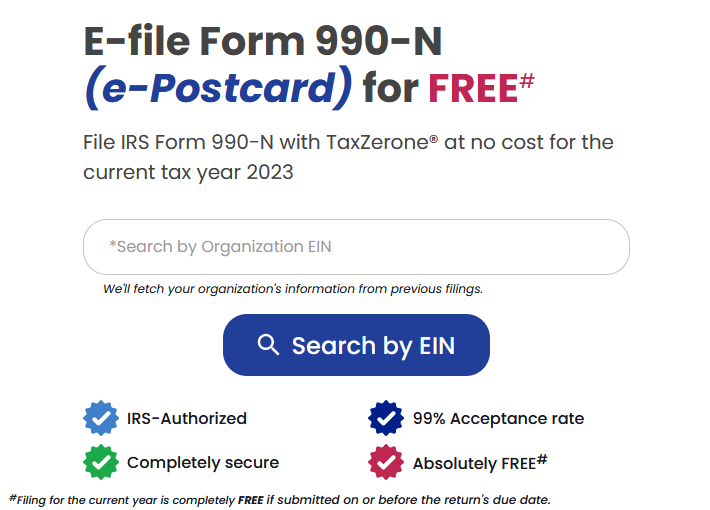

Form 990-N (e-Postcard) E-filing

Simplify your non-profit organization's tax filing process with TaxZerone’s free e-filing service for Form 990-N. Our platform streamlines your tax obligations, allowing you to focus on your mission.

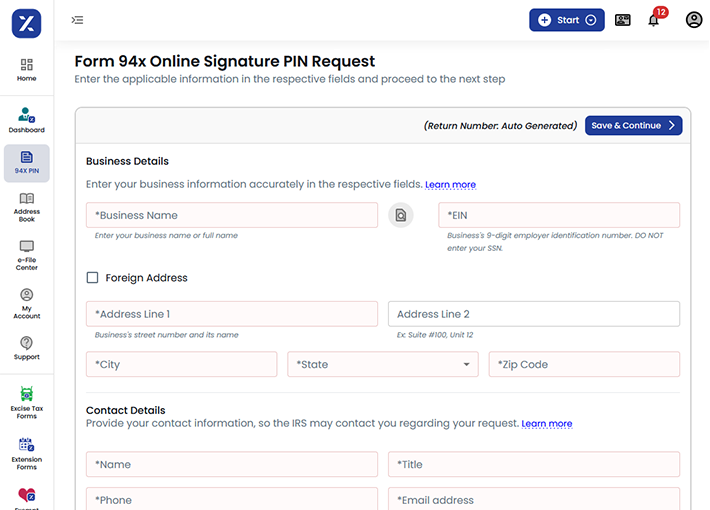

Form 94x PIN Request

Secure your PIN for 94x forms for free with TaxZerone. Our service prioritizes your security and convenience. Register online for 94x online signature PIN and file 94x forms effortlessly.

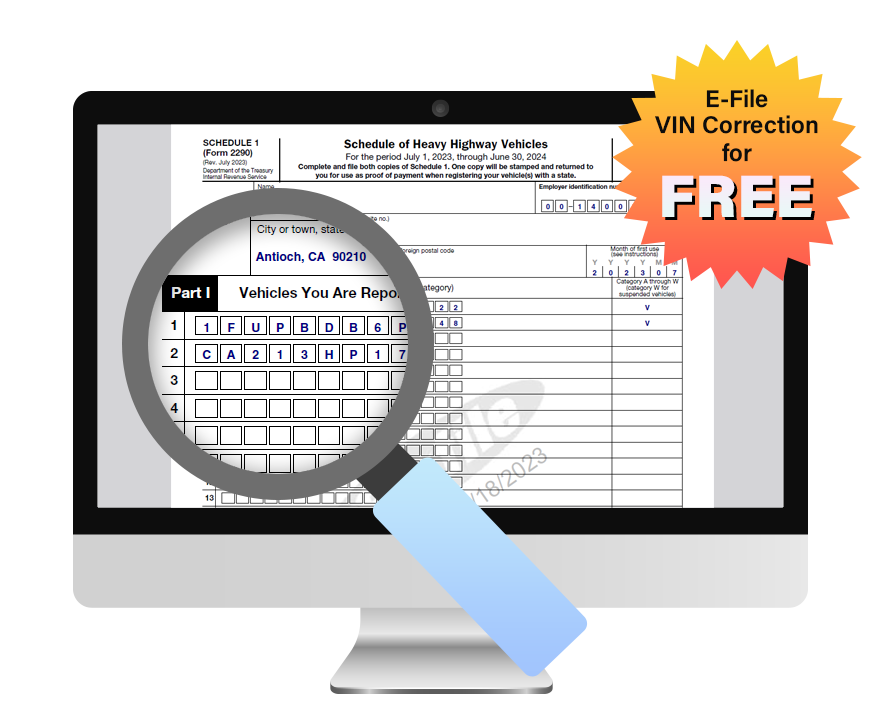

Form 2290 VIN Correction

Effortlessly correct errors in your vehicle identification number (VIN) on Form 2290 for free with TaxZerone’s user-friendly platform. No matter where you originally filed your Form 2290, TaxZerone makes the correction process simple and hassle-free.

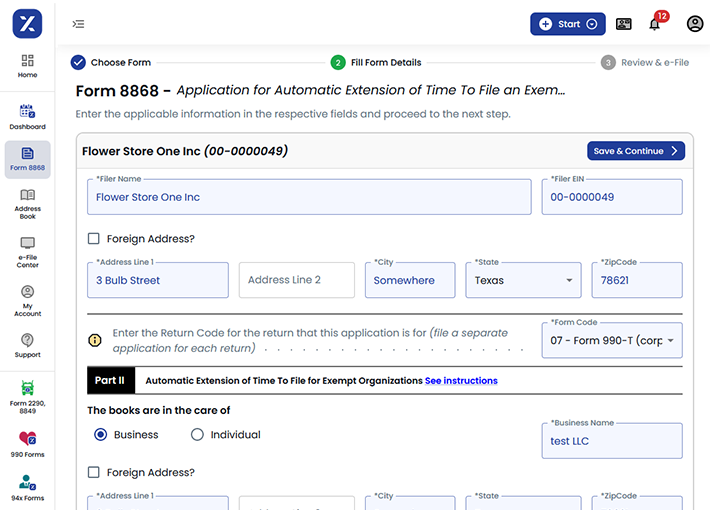

Free Extension (8868) for

Exempt Organizations

File Form 990 with TaxZerone and receive a free extension filing for Form 990 (Form 8868). Ensure compliance and meet deadlines without any additional cost. Choose TaxZerone for hassle-free, cost-effective tax solutions.

Request the W-9 Form Online

for FREE

Simplify your Form W-9 management with TaxZerone! Effortlessly request, store, and organize the W-9 form from contractors and vendors—completely FREE. Save time, reduce errors, and ensure your compliance is always up to date!

Benefits of E-filing IRS Forms with TaxZerone

Discover why you should choose TaxZerone to e-file your IRS forms, absolutely free.

Absolutely FREE

TaxZerone's e-filing service is entirely free, allowing you to manage your taxes without breaking the bank.

IRS-Authorized

As an authorized e-file service provider, TaxZerone complies with IRS regulations, ensuring accuracy and compliance.

Intuitive Interface

E-filing tax forms has never been easier. Our user-friendly platform simplifies the process and saves you time.

Start IRS Form Filing for Free Now

Take the first step towards stress-free tax filing with TaxZerone.

Begin your journey today.

It's free, easy, and secure.

Frequently Asked Questions

1. Is TaxZerone's e-filing service really free?

2. Are there any limitations to the free e-filing service?

3. Can I e-file multiple forms with TaxZerone's free service?

4. Can I file Form 990-N for FREE with TaxZerone?

5. Can I file a VIN correction for FREE with TaxZerone?

6. Is there a fee to file Form 8868 with TaxZerone?

No, TaxZerone allows you to file Form 8868 for FREE when you prepay for your applicable Form 990 e-filing. This cost-effective solution helps your organization stay compliant without incurring additional expenses.

7. Does TaxZerone provide a Form 94x PIN without any cost?

Yes, you can file a FREE IRS Form 94x PIN request using TaxZerone! Simply register on our platform, apply, and obtain a Form 94x PIN online, allowing you to e-file your 94x forms effortlessly.

8. Can I request Form W-9 for FREE with TaxZerone?

Yes, TaxZerone allows you to request Form W-9 for FREE! Our platform provides a fast and efficient way to request, manage, and store W-9 forms from your contractors and vendors without any charges.