E-file IRS Form 1099-MISC for the 2023 tax year

Easily file your 1099-MISC forms online and send recipient copies using TaxZerone.

Takes less than 5 minutes

Competitive pricing

Get started for $2.49, with pricing as low as $0.59 per form for higher volumes.

For your return volume

3 Simple steps to complete your Form 1099-MISC e-filing

Filing information returns is effortless with TaxZerone

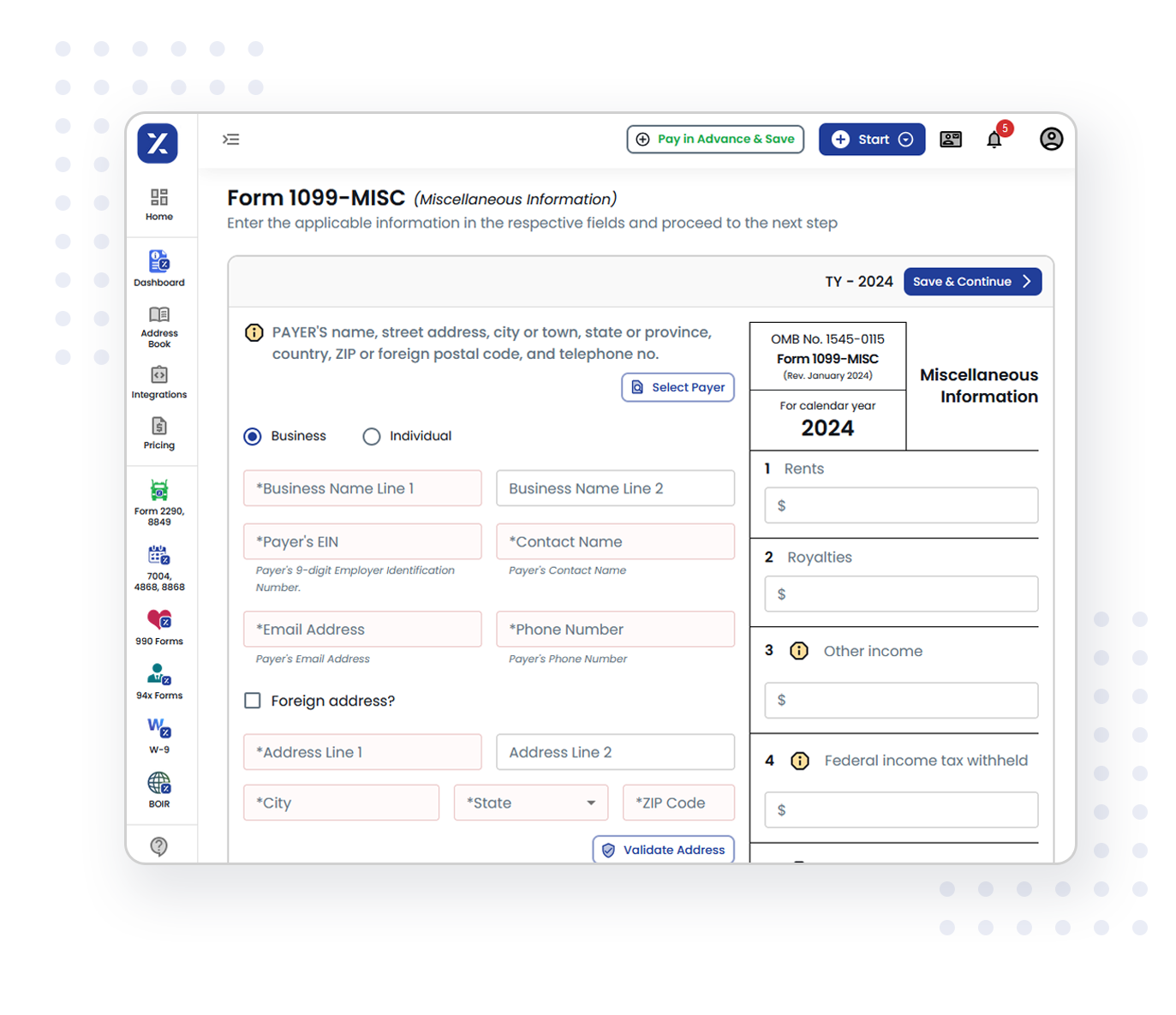

Fill out Form 1099-MISC

Fill out the required fields, including your and recipient’s information.

Review & transmit the return

Review the return for accuracy and transmit it to the IRS.

Send the recipient copy

Share the recipient copy with the contractor by email.

Takes only 3 steps

Top reasons to choose TaxZerone for Form 1099-MISC e-filing

Check out how TaxZerone simplifies your information return filing.

IRS form validations

Equipped with real-time validation checks. Be assured that your

1099-MISC forms will meet IRS requirements and avoid costly errors.

Supports bulk upload

Easily upload form information in bulk. Do away with manual data entry and streamline e-filing, whether you have a few forms or hundreds.

Email recipient copies

Offers the convenience of sending recipient copies electronically, saving you time and resources while ensuring recipients receive their forms promptly.

Best price in the industry

TaxZerone offers the best price based on your return volume. Be compliant with reliable e-filing services without breaking the bank.

Form-based filing

Simplified e-filing process with form-based filing. No need to navigate confusing interfaces.

Guided filing

Get step-by-step instructions to ensure you complete your filing accurately, with no room for error. Help’s available every step of the way.

Stay compliant with the IRS by e-filingForm 1099-MISC with TaxZerone

Say yes to an effortless and efficient e-filing experience.

Takes 3 steps and less than 5 minutes

Frequently Asked Questions

1. What is Form 1099-MISC?

2. Who needs to file Form 1099-MISC?

- A minimum of $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- A minimum of $600 in rent, prizes, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish, cash paid from a notional principal contract to an individual, partnership, or estate, payments to an attorney, and any fishing boat proceeds.

- A minimum of $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

3. When is the deadline to file Form 1099-MISC?

4. What information is required to e-file Form 1099-MISC?

- Business details

- Recipient details

- Payments made

- Federal income tax withheld