Form 1099 NEC Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-NEC?

IRS Form 1099-NEC is a tax return that businesses and individuals must file each year to report payments made to independent contractors or freelancers. This documents the income they received from you so it can be properly reported on their tax return.

Form 1099-NEC replaces the previous 1099-MISC form for reporting non-employee compensation.

Who can file Form 1099-NEC?

If you or your business paid $600 or more in non-employee compensation in a tax year, you are required to file Form 1099-NEC with the IRS and provide a copy to the contractor. This includes payments to contractors, freelancers, consultants, attorneys, etc.

Payments reported in Form 1099-NEC:

- Over $600 was paid for services by a non-employee: Report in Box 1.

- Legal fees of over $600 were paid to an attorney: Also, report in Box 1.

- Sales of products over $5,000 made on commission for resale: Use Form 1099-NEC or 1099-MISC.

- Withheld federal income tax under backup withholding rules: Report in Box 4.

Payments exempt from Form 1099-NEC:

The IRS states these payments should not be reported on Form 1099-NEC.

- Payments to corporations (except medical services)

- Payments for merchandise, telegrams, freight, storage, etc.

- Rent paid to real estate agents or property managers

- Wages, bonuses, and prizes paid to employees (use Form W-2)

- Military differential pay (use Form W-2)

- Business travel allowances (may go on Form W-2)

- Insurance premiums (use Form W-2 or 1099-R)

- Payments to tax-exempt organizations

- Payments to government entities

- Homeowner assistance funds

- Certain disability or survivor benefits

- Compensation for wrongful incarceration

When is the Form 1099-NEC due date?

The due date for filing Form 1099-NEC is January 31st of the year following the payment. For example, if you made payments in 2024, you must file Form 1099-NEC by January 31, 2025.

Avoid the last-minute 1099-NEC deadline stress!

E-file now for easy IRS compliance and peace of mind.

The due date to provide copies of Form 1099-NEC to recipients is also January 31. By providing recipient copies within the deadline, you can ensure the recipient has the tax documentation they need to accurately report the income on their tax return.

Form 1099-NEC penalty

If you fail to file Form 1099-NEC for your contractors within the deadline, the IRS will impose a penalty for each missed return. Below is the breakdown of Form 1099-NEC penalties:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $120 |

| After August 1 or not filed | $310 |

| Intentional disregard | $630 |

Don't risk penalties!

Be proactive! E-file your 1099-NEC forms ahead of the deadline.

Form 1099-NEC Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-NEC.

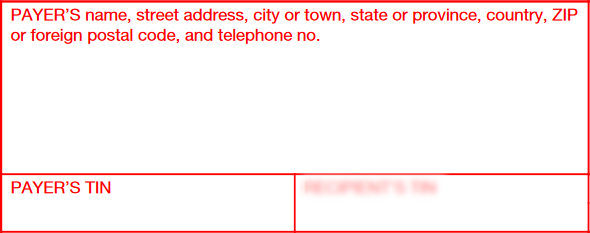

Payer details

- Enter your or your business name

- Enter your complete address

- Enter your TIN (SSN if you're an individual; EIN if you're a business)

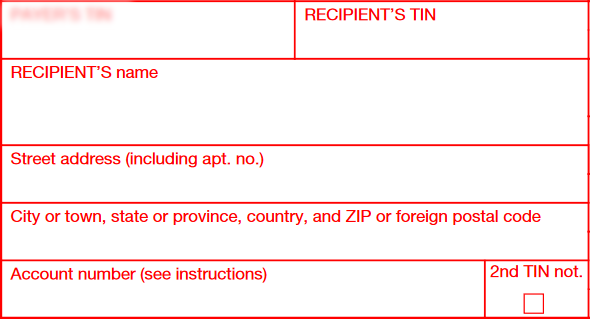

Recipient details

- Recipient's TIN: Enter the TIN (SSN for an individual; EIN for a business)

- Enter the recipient's name

- Enter the recipient's complete address, including street address, city or town, state or province, country, and ZIP or foreign postal code

- Account number: If you have multiple accounts set up for a single recipient to whom you will need to issue more than one Form 1099-NEC, you must include the applicable account number for that recipient on each form.

- 2nd TIN not: The IRS requires you to verify that you have the correct Taxpayer Identification Number (TIN) for individuals and businesses for whom you file 1099 forms.

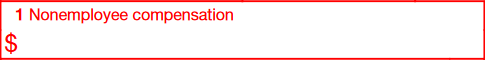

Box 1: Nonemployee compensation

Enter the nonemployee compensation of $600 or more paid in the tax year.

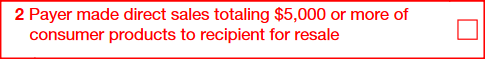

Box 2: Payer made direct sales totaling $5,000 or more

Check the box if your business sold $5,000 or more worth of consumer goods directly to an individual who will then resell the items. Do not enter a dollar amount — just check the box.

Box 4: Federal income tax withheld

Report any federal income tax that was withheld from payments made to a contractor or freelancer.

This is known as backup withholding. It applies when a payee has not provided you with their TIN.

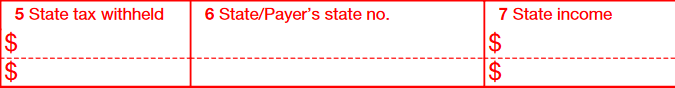

Boxes 5–7: State information

Boxes 5–7 are optional state-level reporting boxes. You do not need to complete these for the IRS.

- Box 5: Report any state income tax withheld from the payment

- Box 6: Enter the 2-letter state abbreviation and payer's ID number for that state

- Box 7: Enter the amount of compensation associated with that state

How to file Form 1099-NEC?

Form 1099-NEC can be filed electronically or by postal mail.

Form 1099-NEC electronic filing (E-filing)

E-filing Form 1099-NEC is recommended by the IRS as the process is quick and simple. Additionally, you will receive notifications as soon as the IRS processes your return.

To e-file Form 1099-NEC, you can choose an IRS-authorized e-file service provider like TaxZerone.

With TaxZerone, you can complete the e-filing process in just a few minutes and clicks. Simply fill out the form, review and transmit it to the IRS, and share the recipient copy.

Paper filing

If you choose to paper-file Form 1099-NEC, here are the steps you need to follow:

- Download and print Form 1099-NEC from the IRS website.

- Fill out the recipient's name, address, TIN, and compensation amount in the required boxes. Include your business name, address, and TIN as well.

- Mail the completed paper form to the IRS at the address provided in the 1099 instructions.

- Mail a copy of the 1099-NEC to the recipient by January 31st.

Important notes for paper filing:

- Mail forms several weeks before the deadline to ensure they arrive on time.

- You must also send a copy of the 1099-NEC to the recipient for their tax reporting.

- Paper filing requires printing, mailing, and tracking forms for proof of compliance. Alternatively, you can file 1099-NEC forms electronically for faster processing and delivery.

Where to send Form 1099-NEC - Mailing address

The mailing address for Form 1099-NEC varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-NEC:

| If your business operates in or your legal residence is… | Mail Form 1099-NEC to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Internal Revenue Service Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury Internal Revenue Service Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to e-file Form 1099-NEC?

You can complete Form 1099-NEC filing in 3 simple steps. But, before you begin the e-filing process, make sure you have all the required information ready, so you can complete filing swiftly.

Information required to file Form 1099-NEC:

- Payer information, such as name, address, and TIN.

- Recipient information, such as name, address, and TIN.

- Nonemployee compensation

- Federal income tax withheld, if any

Once you have this information ready, you can follow the steps below to e-file Form 1099-NEC using TaxZerone.

- Step 1: Fill out Form 1099-NEC

- Step 2: Review & transmit the return

- Step 3: Send the recipient copy

E-file Form 1099-NEC with TaxZerone

When you choose to e-file Form 1099-NEC with TaxZerone, you can:

- Get IRS form validations to check your returns for accuracy

- Bulk upload return records and complete a large volume of returns in one go.

- Email recipient copies by email

- Share recipient copies in a secure portal—ZeroneVault—where recipients can access their return copies at any time anywhere

- Complete filing at the best price in the industry—as low as $0.59 per form

Get these benefits by e-filing your

Form 1099-NEC with TaxZerone

Effortless, efficient, and affordable e-filing awaits you.