Form 1099-B Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-B?

IRS Form 1099-B, Proceeds from Broker and Barter Exchange Transactions, is a tax document used to report the sale or exchange of securities or investment properties by brokers and barter exchanges. It details the proceeds from these transactions, including the sale date, cost basis, and any resulting gain or loss.

Who needs to file Form 1099-B?

Brokers and barter exchanges are required to file Form 1099-B. Specifically:

- Brokers: Any broker who sells stocks, bonds, commodities, or other financial instruments on behalf of a customer must file Form 1099-B to report the proceeds from these sales to both the IRS and the customer.

- Barter exchanges: Organizations that facilitate the exchange of goods or services between members must file Form 1099-B to report the fair market value of goods or services exchanged.

When is the Form 1099-B due date?

Payers must be aware of two important deadlines related to Form 1099-B:

Filing deadline with the IRS

The deadline for payers to submit Form 1099-B to the IRS depends on the filing method:

- Electronic filing deadline: March 31, 2025

If you are e-filing Form 1099-B with the IRS, the deadline is March 31st of the year following the tax year for which the form is being issued.

If the deadline falls on a federal holiday or weekend, the form is due on the next business day. - Paper filing deadline: February 28, 2025

If you are filing Form 1099-B with the IRS using traditional paper methods, the deadline is February 28th of the year following the tax year for which the form is issued.

Avoid the stress of last-minute 1099-B deadlines.

E-file with TaxZerone now for hassle-free IRS compliance and peace of mind.

Recipient copies deadline: February 15, 2025

Payers must provide recipients with copies of Form 1099-B by February 15th of the year following the tax year for which the form is issued. This ensures recipients have the necessary information to accurately file their tax returns on time.

Failure to meet these deadlines or providing inaccurate information on Form 1099-B may result in IRS penalties. Payers should take appropriate measures to ensure the timely and accurate filing and distribution of Form 1099-B to avoid potential penalties.

Form 1099-B penalty

If you miss filing Form 1099-B within the deadline, the IRS will impose a penalty. Here are the Form 1099-B penalty rates:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $330 |

| Intentional disregard | $660 |

Why risk penalties?

E-file your 1099-B forms ahead of the deadline with TaxZerone.

Form 1099-B Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-B.

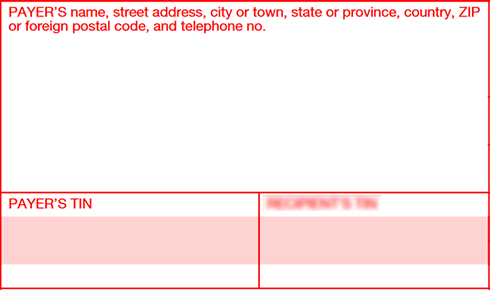

Payer details

Enter your name or business name, complete address, and TIN (SSN if you're an individual; EIN if you're a business)

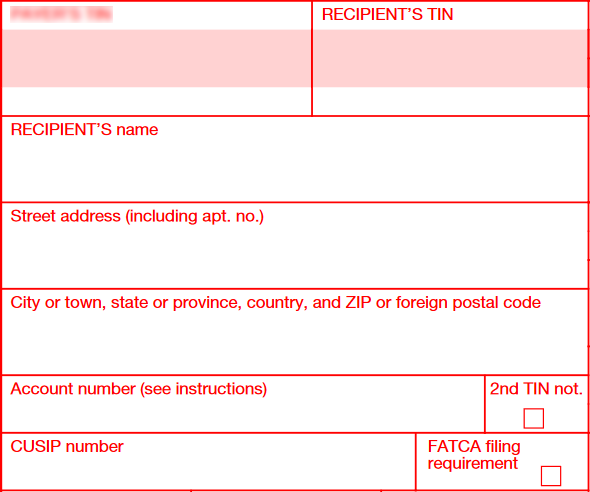

Recipient details

Enter the recipient’s name, complete address, and TIN (SSN for an individual; EIN for a business).

- Account number: You must provide the account number in these two situations:

- You have multiple accounts for the same recipient, and you are filing more than one Form 1099-B for that recipient.

- You checked the "FATCA filing requirement" box.

- 2nd TIN not: If the IRS has notified you two times within the last 3 years that the payee provided an incorrect TIN, you can enter an "X" in this box. By doing so, the IRS will stop sending you further notices about this account's TIN.

CUSIP Number

For transactional reporting by brokers, enter the CUSIP (Committee on Uniform Security Identification Procedures) number of the security or other applicable identifying number.

FATCA Filing Requirement Checkbox

Check this box if you are a

- Foreign Financial Institution (FFI) reporting payments to a U.S. account pursuant to an election described in Regulations section 1.1471-4(d)(5)(i)(A).

- U.S. payer that is reporting on Form 1099-B as part of satisfying your requirement to report with respect to a U.S. account for chapter 4 purposes as described in Regulations section 1.1471-4(d)(2)(iii)(A).

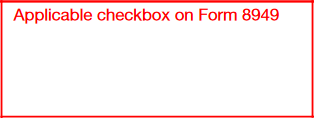

Applicable Checkbox on Form 8949

Use this box to enter a one-letter code to assist the recipient in properly reporting the transaction on Form 8949 and/or Schedule D (Form 1040).

- Code A : Short-term transaction for which cost basis is reported to the IRS. Recipient reports on Schedule D line 1a or Form 8949 Box A 1 > Schedule D line 1b.

- Code B : Short-term transaction for which cost basis is not reported to the IRS. Recipient reports on Form 8949 Box B > Schedule D line 2.

- Code D : Long-term transaction for which cost basis is reported to the IRS. Recipient reports on Schedule D line 8a or Form 8949 Box D > Schedule D line 8b.

- Code E : Long-term transaction for which cost basis is not reported to the IRS. Recipient reports on Form 8949 Box E > Schedule D line 9.

- Code X : Use when holding period is unknown, so cannot determine if Box B or E should be checked on Form 8949.

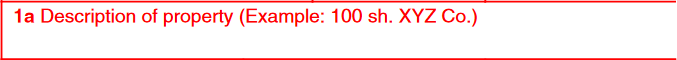

Box 1a: Description of Property

For stocks and debt instruments:

- Enter the issuer's name

- Enter the number of shares/units exchanged

- For stocks, also enter the class (e.g. preferred, common) abbreviated as P, C, or O (for others)

For non-Section 1256 options or securities futures contracts:

- Enter the name of the underlying asset

- Enter the number of shares/units covered by the contract

For bartering transactions:

- Describe the service or property provided

For regulated futures contracts and forward contracts:

- Enter "RFC" or other appropriate brief description

Box 1b: Date Acquired

Enter the date you acquired the securities that were sold.

However, leave this box blank if:

- The securities sold were acquired on multiple different dates

- You checked Box 5 (indicating the securities were non-covered) and chose not to complete Box 1b

Box 1c: Date Sold or Disposed

- For broker transactions, enter the trade date of the sale or exchange.

- For barter exchanges, enter the date that cash, property, credit, or scrip is actually or constructively received.

Box 1d: Proceeds

Enter the total gross cash proceeds received from all dispositions (including short sales) of securities, commodities, options, securities futures contracts, or forward contracts.

Show any losses, such as from closing a written option or forward contract, as a negative amount by enclosing it in parentheses.

You must reduce the proceeds by any commissions and transfer taxes related to the sale.

For securities sold due to the exercise of an option:

- Pre-2014 options: You may, but are not required to, adjust for option premiums if consistent with your books. Check the box in Box 6 accordingly.

- Post-2013 options: See Regulations section 1.6045-1(m) for treatment of premiums.

If selling identical stock via a single trade order on the same day, you can average the proceeds per share, unless the customer notifies intent to use actual proceeds per share by Jan 15th of the following year.

DO NOT include any accrued qualified stated interest on bonds sold. Report that interest on Form 1099-INT instead.

Box 1e: Cost or Other Basis

Enter the adjusted cost basis of any securities sold, unless:

- The security is non-covered (meaning you checked Box 5)

- If you checked Box 5 indicating the securities are non-covered and you are not reporting basis, leave Box 1e blank

Only enter "-0-" in Box 1e if the securities actually had a zero cost-basis.

Box 1f: Accrued Market Discount

Enter the amount of accrued market discount.

Box 1g: Wash sale loss disallowed

Report any losses that were disallowed due to the wash sale rule. The wash sale rule applies when you sell a security at a loss and purchase the same or substantially identical security within 30 days before or after the sale.

You must report disallowed losses if both the sale and purchase transactions occurred in the same account and involved covered securities with the same CUSIP number.

Box 2: Type of Gain or Loss

Indicate whether the gain or loss is short-term or long-term, and whether any portion of the gain or loss is ordinary income or loss. To make this determination, follow these steps:

- Consider any information reported on a transfer statement or Form 8937.

- Apply the rules for stock acquired from a decedent or as a gift.

- If a customer acquired securities that caused a loss from a sale of other securities to be disallowed under the wash sale rule (reported in box 5 of a 2013 or earlier Form 1099-B, or box 1g of a 2014 or 2015 Form 1099-B), use the rules in section 1223(3) to determine the holding period of the acquired securities.

- For short sales, report whether any gain or loss on the closing of the short sale is short-term or long-term based on the acquisition date of the security delivered to close the short sale. Apply the rule in section 1233(d), if applicable.

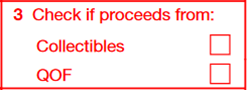

Box 3: Check if Proceeds Are From Collectibles or From a QOF

- Check the "Collectibles" box if the proceeds you are reporting in box 1d are from a transaction involving collectibles.

- Check the "QOF" box if you are reporting a disposition of an interest in a QOF.

Box 4: Federal Income Tax Withheld

Report any federal income tax withheld from payments reported.

Box 5. Check if a Noncovered Security

Check the box if you’re reporting the sale of a noncovered security.

DO NOT check this box if reporting the sale of a covered security.

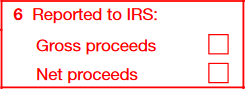

Box 6: Reported to IRS

Box 6 relates to how the broker reports the sale proceeds to the IRS.

- Gross Proceeds checkbox:

- Check this box if you're reporting the gross proceeds from the sale.

- Gross proceeds typically include the total amount received from the sale before any deductions.

- Net Proceeds checkbox:

- Check this box if you're reporting the net proceeds from the sale.

- Net proceeds are the amount after subtracting commissions and option premiums from the gross proceeds.

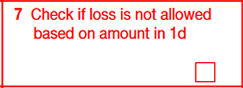

Box 7: Checked if Loss Not Allowed Based on Amount in Box 1d

Box 7 is used to indicate a specific situation where a loss cannot be claimed by the taxpayer. This box is checked when a loss cannot be claimed based on the amount reported in Box 1d (Proceeds).

Check this box if the proceeds (Box 1d) are:

- From a reportable change in control or capital structure

- Received from a corporation and cannot be treated as a loss by the taxpayer

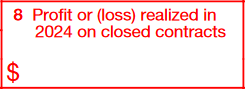

Box 8: Profit or (Loss) Realized in 2024 on Closed Contracts

Enter the profit or (loss) realized by the customer on closed regulated futures, foreign currency, or Section 1256 option contracts in 2024.

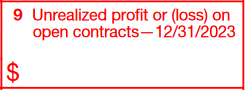

Box 9: Unrealized Profit or (Loss) on Open Contracts—12/31/2023

Enter the unrealized profit or (loss) on open regulated futures, foreign currency, or Section 1256 option contracts at the end of 2023.

DO NOT include amounts related to contracts that were open on December 31, 2023, and were transferred to another broker during 2025.

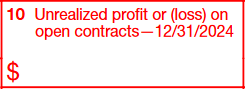

Box 10. Unrealized Profit or (Loss) on Open Contracts—12/31/2024

Enter the unrealized profit or (loss) on open regulated futures, foreign currency, or Section 1256 option contracts at the end of 2024.

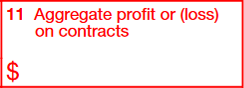

Box 11: Aggregate Profit or (Loss) on Contracts

Enter the aggregate profit or (loss) for the year from regulated futures, foreign currency, or Section 1256 option contracts.

Use boxes 8–10 to calculate the aggregate profit or (loss).

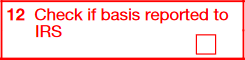

Box 12: Check if Basis Reported to IRS

Check this box if:

- You are not checking box 5, or

- You are checking box 5 but are reporting basis to the IRS in box 1e anyway

Box 13: Bartering

- Cash received

- The fair market value of any property or services received

- The fair market value of any trade credits or scrip credited to the member's or client's account

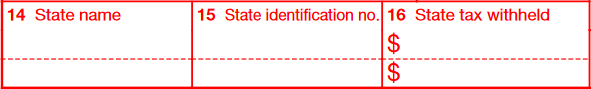

Box 14–16: State information

Box 14: Enter the 2-letter state abbreviation for the state

Box 15: Enter the state identification number

Box 16: Report any state income tax withheld from the payment

How to File Form 1099-B

You can file Form 1099-B, either electronically or by mail.

Electronic Filing (E-filing)

E-filing is the IRS-recommended method for its efficiency, accuracy, and prompt processing notifications.

To e-file Form 1099-B, you can choose an IRS-authorized e-file service provider, such as TaxZerone.

TaxZerone streamlines the e-filing process and allows you to complete it within minutes. Here's how it works:

- Enter the required information, including:

- Payer's name, address, and Tax Identification Number (TIN)

- Recipient's name, address, and TIN

- Transaction details (date of sale, proceeds, cost basis, etc.)

- Review all entered information for accuracy.

- Transmit the form electronically to the IRS.

- Provide a copy to the recipient.

Paper filing

While less efficient, paper filing remains an option for those who prefer it.

Steps for paper filing:

- Download Form 1099-B from the official IRS website.

- Print the form.

- Complete all required fields using black ink.

- Make a copy for your records.

- Mail the original form to the IRS address specified in the Form 1099 General Instructions. The mailing address varies based on your state.

- Send a copy to the recipient by February 15th of the year following the reportable transaction.

Important considerations for paper filing

- Mail forms several weeks before the deadline to ensure timely arrival.

- Use certified mail for proof of timely filing.

- Ensure all copies are legible.

As an alternative, you can choose to file Form 1099-B electronically for faster processing and delivery, reducing the risk of delays or lost forms.

Where to send Form 1099-B - Mailing address

If you prefer paper filing, the mailing address for Form 1099-B varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-B:

| If your business operates in or your legal residence is… | Mail Form 1099-B to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to E-File Form 1099-B with TaxZerone

Before you start e-filing Form 1099-B, ensure you have all the necessary information to facilitate a smooth and efficient filing experience. Here's what you need to gather:

Required information for filing Form 1099-B:

- Taxpayer information:

- Name, address, and taxpayer identification number (TIN) of the recipient

- Name, address, and TIN of the payer (broker)

- Transaction details:

- Description of the property sold

- Date acquired

- Date sold or disposed

- Sales price

- Cost or other basis

- Amount of gain or loss

- Additional information:

- Whether the basis was reported to the IRS

- Whether the gain or loss was short-term or long-term

- Any federal income tax withheld

- CUSIP number (for securities): A unique identifier for most financial instruments

Steps to e-file Form 1099-B using TaxZerone:

Step 1: Complete Form 1099-B

Open Form 1099-B and fill out the necessary fields with the information you have gathered, including payer details, recipient details, transaction details, and any federal income tax withheld.

Step 2: Review and transmit the return

Carefully review all the entered information to ensure accuracy. Once verified, transmit the completed Form 1099-B to the IRS electronically through TaxZerone's secure platform.

Step 3: Provide the recipient copy

After successfully transmitting the form to the IRS, send a copy of the completed Form 1099-B to the recipient. This ensures they can accurately report the income on their tax return.

Benefits of E-Filing Form 1099-B with TaxZerone

E-filing Form 1099-B with TaxZerone offers several advantages that streamline the filing process and ensure compliance with IRS requirements:

- IRS Form Validations: TaxZerone's system checks your returns for errors or missing information to ensure accuracy before submission.

- Email Recipient Copies: Conveniently send recipient copies of Form 1099-B via email and eliminate manual mailing.

- Secure Portal Access (ZeroneVault): Recipients can access their return copies anytime, anywhere through the secure ZeroneVault portal.

- Competitive Pricing: TaxZerone offers industry-leading pricing, with rates starting as low as $0.59 per form, making it affordable for businesses of all sizes.

By using TaxZerone's e-filing solution, you can streamline your Form 1099-B filing. Save time, reduce errors, and provide a better experience for your recipients.