Form 1099 MISC Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

What is IRS Form 1099-MISC?

Form 1099-MISC is an annual tax return that businesses and individuals must file with the IRS. It reports payments made during the year to independent contractors or others who are not employees. The form is used to report various types of miscellaneous income paid to an individual or business, such as:

- Rent payments

- Royalties

- Prizes and awards

- Payments to attorneys

- Payments for services to unincorporated businesses

The main purpose of Form 1099-MISC is to inform recipients of the income and the IRS of the payment so that taxes can be assessed appropriately. With Form 1099-MISC, the IRS can ensure that recipients claim the income on their tax returns and pay any taxes owed.

Who can file Form 1099-MISC?

Businesses or individuals who made certain payments over specified thresholds to independent contractors must file Form 1099-MISC. You must file Form 1099-MISC if you paid at least:

- $10 or more in royalties or substitute payments in lieu of dividends or tax-exempt interest

- $600 in

- Rent payments

- Prizes or awards

- Other income payments

- Cash paid from a notional principal contract to an individual, partnership, or estate

- Fishing boat proceeds

- Medical and health care payments

- Crop insurance proceeds

- Fees paid to an attorney

- Deferrals to nonqualified deferred compensation plans

- Section 409A deferred compensation.

Payments exempt from Form 1099-MISC:

You are generally not required to report the following payments on Form 1099-MISC, even if they are taxable income to the recipient:

- Payments to a corporation (except certain payments to attorneys and medical service providers)

- Payments for merchandise, freight, storage, etc.

- Rent payments to real estate agents or property managers (but agents must issue 1099s to property owners)

- Wages paid to employees (report on Form W-2 instead)

- Certain military differential wage payments (report on Form W-2)

- Business travel allowances paid to employees

- Cost of current life insurance protection (report on Form W-2 or Form 1099-R)

- Payments to tax-exempt organizations like charities, governments, HSAs, etc.

- Homeowner assistance from HFA Hardest Hit Fund

- Certain disability or death benefits for public safety officers

- Compensation for wrongful incarceration

When is the Form 1099-MISC due date?

The due date for filing Form 1099-MISC is March 31st of the year following the payment. For example, if you made payments in 2024, you must file Form 1099-MISC by March 31, 2025.

Avoid the last-minute 1099-MISC deadline stress!

E-file now for easy IRS compliance and peace of mind.

In addition to filing Form 1099-MISC with the IRS, payers must also provide copies of the form to recipients by January 31, 2025. Furnishing the 1099-MISC to recipients by this deadline gives them the information they need to properly report the income on their own tax returns.

Form 1099-MISC penalty

The IRS imposes penalties for failing to file Form 1099-MISC by the deadline or failing to furnish copies to recipients on time. The penalties are as follows:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $120 |

| After August 1 or not filed | $310 |

| Intentional disregard | $630 |

Don't risk penalties!

Be proactive! E-file your 1099-MISC forms ahead of the deadline.

Form 1099-MISC Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-MISC.

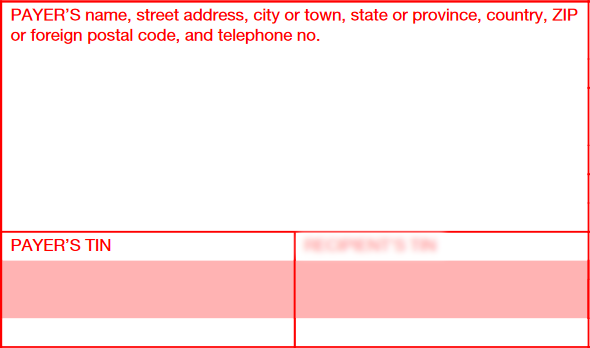

Payer details

- Enter your or your business name

- Enter your complete address

- Enter your TIN (SSN if you're an individual; EIN if you're a business)

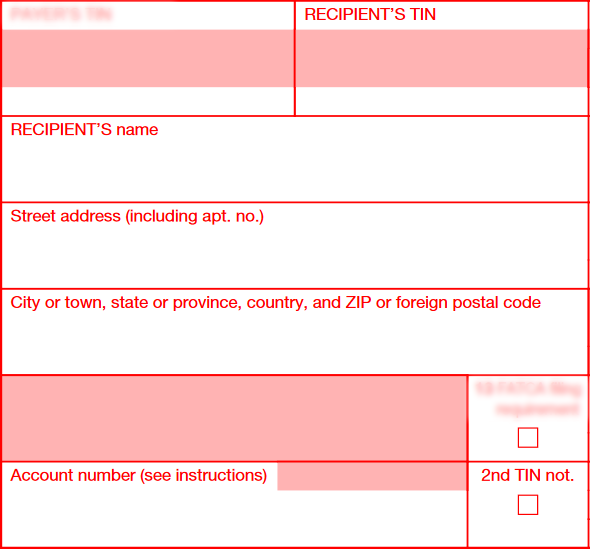

Recipient details

- Recipient’s TIN: Enter the TIN (SSN for an individual; EIN for a business)

- Enter the recipient’s name

- Enter the recipient’s complete address, including street address, city or town, state or province, country, and ZIP or foreign postal code

- Account number: If you have multiple accounts set up for a single recipient to whom you will need to issue more than one Form 1099-MISC, you must include the applicable account number for that recipient on each form.

- 2nd TIN not: The IRS requires you to verify that you have the correct Taxpayer Identification Number (TIN) for individuals and businesses for whom you file 1099 forms.

Box 1: Rents

Report rent payments of $600 or more in box 1, including:

- Office space rentals. But don't report rents paid to real estate agents or property managers. Agents must report rents to property owners on their own 1099-MISC forms.

- Machine and equipment rentals. If the rental includes the machine and an operator, prorate the rent between the machine (box 1) and the operator's fee (Form 1099-NEC).

- Land rentals, such as farmers paying for grazing rights.

Box 2: Royalties

Report royalty payments of $10 or more in box 2. This includes royalties for:

- Oil, gas, and mineral rights: Report the gross amount before taxes or other reductions.

- Intangible property, such as patents, copyrights, trademarks, and trade names.

- Literary works: Report royalties paid by a publisher to an author or their literary agent. The agent must report the gross amount paid to the author.

DO NOT include the following royalty types in box 2:

- Surface royalties (report in box 1 instead).

- Working interest royalties (report on Form 1099-NEC).

- Timber royalties under pay-as-cut contracts (report on Form 1099-S).

Box 3: Other income

Report any other income of $600 or more that doesn't fit into other boxes, such as:

- Prizes and awards not for services provided. Report the fair market value of prizes won on game shows.

- Sweepstakes winnings not involving a wager. Report gambling winnings on Form W-2G.

- Any other miscellaneous income over $600.

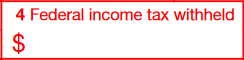

Box 4: Federal income tax withheld

Report any federal income tax withheld from payments reported in boxes 1, 2, 3, 5, 6, 8, 9, and 10. Withholding is required if recipients have not provided their TIN.

Also, report income tax withheld from payments to members of Native American tribes for gaming activities.

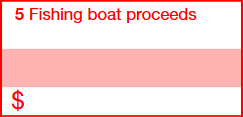

Box 5: Fishing boat proceeds

If you operate a fishing boat, report crew members' share of proceeds from the catch in box 5. Specifically:

- For boats with fewer than 10 crew members, report each individual's share of the proceeds or fair market value of an in-kind distribution.

- Also, report up to $100 per trip paid to crew members for additional duties like mate, engineer, or cook.

DO NOT include wages reported on Form W-2.

Box 6: Medical and health care payments

Report payments of $600 or more to medical service providers, including:

- Doctors, dentists, chiropractors, etc.

- Hospitals, clinics, nursing homes, etc.

- Other providers of health care services

- Health and accident insurers

Payments include fees for services, injections, drugs, dentures, etc. Report total amounts paid, not just charges for services.

Payments to incorporated medical providers must be reported. However, payments to pharmacies for prescription drugs do not need to be reported.

Do not report payments made to tax-exempt hospitals, government-owned hospitals, or government health care providers.

Box 7: Payer made direct sales totaling $5,000 or more

Check the box if you paid a person $5,000 or more in commissions for selling consumer products on a buy-sell, deposit-commission, or other commission basis for resale anywhere other than a permanent retail establishment.

Do not enter a dollar amount — just check the box if this type of payment over $5,000 was made.

You can report these direct sales commissions either in box 7 of Form 1099-MISC or box 2 of Form 1099-NEC.

Box 8: Substitute payments in lieu of dividends or interest

Report aggregate substitute payments of $10 or more received on behalf of a customer for:

- Dividends

- Tax-exempt interest accrued while their securities were loaned

These payments are made to a broker when a customer's securities are loaned out. File Form 1099-MISC and furnish a copy to the customer for whom you received the payment.

Substitute payments are made on behalf of individuals, trusts, partnerships, companies, etc. They are not made on behalf of tax-exempt organizations, governments, or foreign governments.

Box 9: Crop insurance proceeds

Report crop insurance proceeds of $600 or more paid to farmers, unless the farmer elected to capitalize the expenses under IRS section 278, 263A, or 447.

In those cases, the insurance proceeds can be excluded.

Box 10: Gross proceeds paid to an attorney

Report gross proceeds of $600 or more paid to an attorney for legal services, regardless of whether the attorney performed services for you or another party.

Box 11: Fish purchased for resale

If you purchase fish for resale, report total cash payments of $600 or more paid to any person engaged in the trade or business of catching fish.

“Fish” includes all aquatic life. “Cash” means coin, currency, cashier's checks, etc. Not personal checks.

You must keep records of each payment, but only report the total annual amount on 1099-MISC.

Box 12: Section 409A deferrals

You are not required to complete this box.

If you choose to report Section 409A deferrals, enter the total amount of at least $600 deferred during the year under nonqualified deferred compensation (NQDC) plans for nonemployee recipients.

The deferrals include earnings on current and prior year deferrals. See IRS Notice 2008-115 for more information.

Box 13: FATCA filing requirement checkbox

- Check this box if you're a U.S. payer reporting on Form(s) 1099, including payments on Form 1099-MISC, to fulfill your obligation for a U.S. account under chapter 4 of the Internal Revenue Code (Regulations section 1.1471-4(d)(2)(iii)(A)).

- Also, check if you're an FFI reporting payments to a U.S. account based on an election in Regulations section 1.1471-4(d)(5)(i)(A).

- Check if you're an FFI making the election in Regulations section 1.1471-4(d)(5)(i)(A) and reporting a U.S. account for chapter 4 purposes, with either no reportable payments on Form 1099 or payments below the reporting threshold for any applicable Form 1099.

Box 14: Excess golden parachute payments

Enter any amount above the average annual compensation (base amount) for the last 5 tax years as excess golden parachute payments. See Q/A-38 to Q/A-44 in Regulations section 1.280G-1 for guidance on calculating the excess.

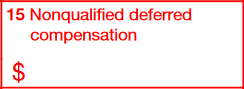

Box 15: Nonqualified deferred compensation

Enter amounts deferred (including earnings) that must be included in income under section 409A due to plan non-compliance.

Exclude correctly reported amounts on prior-year Forms 1099-MISC, corrected Forms 1099-MISC, Form W-2, or Form W-2c. Also, exclude amounts with substantial risk of forfeiture under section 409A.

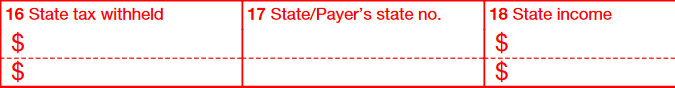

Boxes 16–18: State Information

For payers in the Combined Federal/State Filing Program or submitting paper copies, these optional boxes are for reporting payments to two states.

- Box 16: Report any state income tax withheld from the payment

- Box 17: Enter the 2-letter state abbreviation and payer's ID number for that state

- Box 18: Enter the amount of compensation associated with that state

How to file Form 1099-MISC?

You can file Form 1099-MISC either electronically or on paper, but electronic filing is recommended by the IRS.

Form 1099-MISC electronic filing (E-filing)

E-filing is a fast, simple way to file Form 1099-MISC. You can use an IRS-authorized service like TaxZerone to electronically submit your forms. The benefits of e-filing include:

- Quick process: It only takes a few minutes to complete and file the forms online.

- Instant IRS notifications: You receive a confirmation when the IRS processes your returns.

- Furnish recipient copies easily: You can electronically deliver copies to recipients with the help of an e-file service provider.

Paper filing

If you choose to paper-file Form 1099-MISC, here are the steps you need to follow:

- Download and print blank Form 1099-MISC from IRS.gov.

- Manually complete the forms with recipient and business information.

- Mail the forms to the IRS address listed in the instructions.

- Mail copies to recipients by January 31.

Important notes for paper filing:

- Mail forms several weeks early to ensure timely delivery.

- You must also furnish paper copies to recipients.

- Printing, mailing, and tracking forms takes more time, effort, and cost than e-filing. Alternatively, you can e-file 1099-MISC forms for faster processing and less cost.

Where to send Form 1099-MISC - Mailing address

The mailing address for Form 1099-MISC depends on your business location. Below is a table that summarizes the mailing address for Form 1099-MISC:

| If your business operates in or your legal residence is… | Mail Form 1099-MISC to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301. |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury, Internal Revenue Service Center, P.O. Box 219256, Kansas City, MO 64121-9256. |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201 |

| Outside the United States | Department of the Treasury, Internal Revenue Service Center, Austin, TX 73301. |

How to e-file Form 1099-MISC?

You can complete Form 1099-MISC filing in 3 simple steps. E-filing your 1099-MISCs is an easy process if you're prepared with the necessary information.

Information required to file Form 1099-MISC:

- Payer information, such as name, address, and TIN.

- Recipient information, such as name, address, and TIN.

- Miscellaneous payments made

- Federal income tax withheld, if any

Once you have this information ready, you can e-file your 1099-MISCs in just 3 steps using TaxZerone:

- Step 1: Fill out Form 1099-MISC

- Step 2: Review & transmit the return

- Step 3: Send the recipient copy

E-file Form 1099-MISC with TaxZerone

TaxZerone offers several advantages for e-filing your Form 1099-MISC:

- IRS form validation: TaxZerone checks your returns for errors before filing.

- Bulk uploading: Easily file high volumes by batch uploading recipient data.

- Email delivery: Send recipient copies digitally via email.

- ZeroneVault: Share copies through ZeroneVault, a secure online access portal, for anytime, anywhere access.

- Low cost: Complete filing at the best price in the industry—as low as $0.59 per form.

Get these benefits by e-filing your

Form 1099-MISC with TaxZerone

Effortless, efficient, and affordable e-filing awaits you.