E-File Form 2290 Amendment due to Exceeded Mileage

Did your suspended vehicle exceed the mileage limit?

Stay tax compliant and avoid penalties by filing Form 2290 amendments with TaxZerone.

Get the updated Schedule 1 copy in minutes

E-file 2290 Amendments due to exceeded mileage

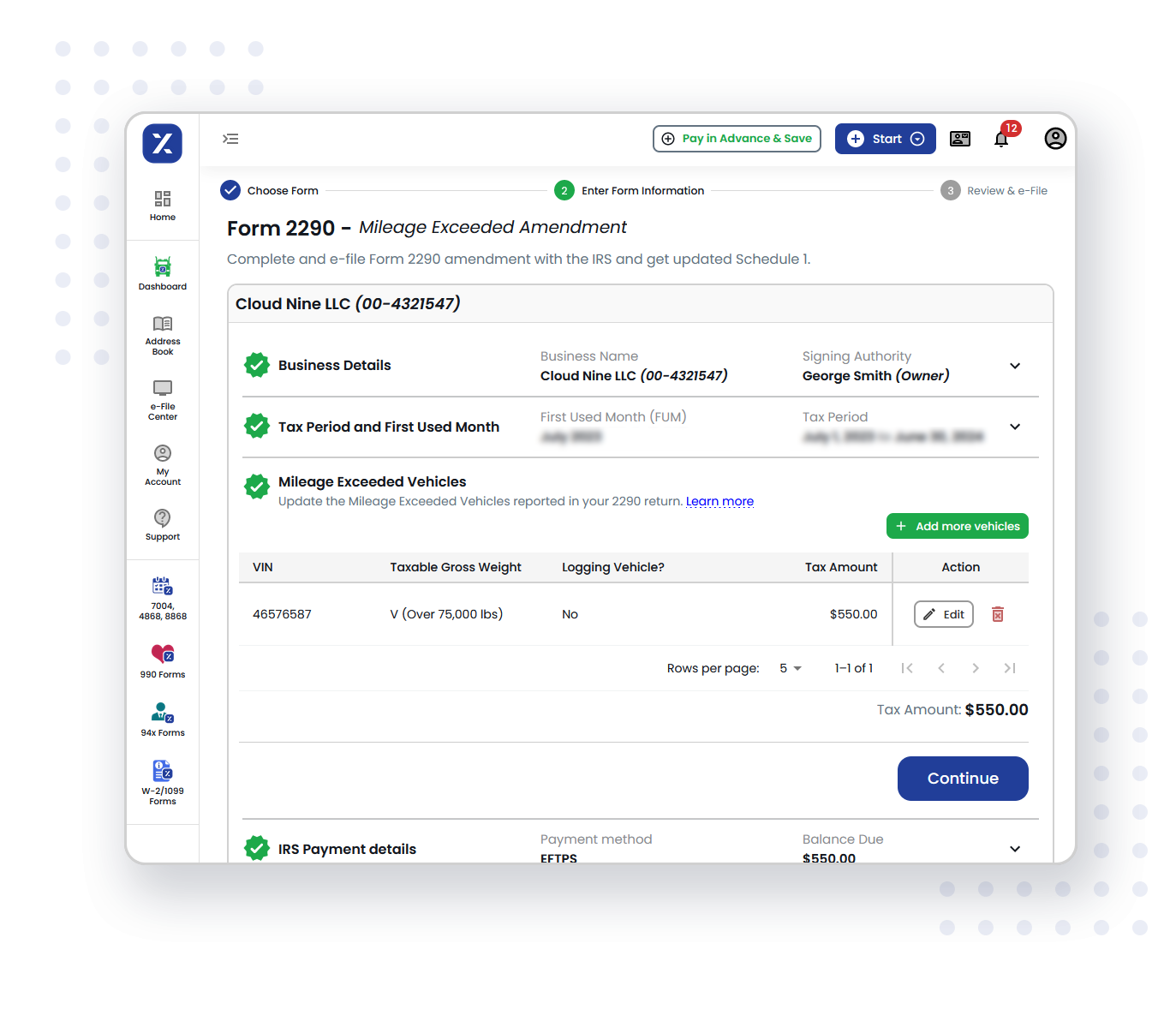

Follow the steps below to file the 2290 amendment return and get the updated Schedule 1 copy.

Enter form information

Fill out the required fields, including the business and vehicle information.

Preview the return

Review the form information for accuracy before transmitting.

Transmit to the IRS

Transmit the 2290 amendment return and get updated Schedule 1.

Get the updated Schedule 1 copy in minutes

Simplified e-filing service for Form 2290 amendments

Check out how TaxZerone simplifies Form 2290 amendments due to exceeded mileage limit.

Get Updated Schedule 1 Instantly

Receive the updated Schedule 1 in your inbox as soon as the IRS accepts your return. Say goodbye to waiting for your updated Schedule 1 copy.

IRS-authorized

File amendment for your 2290 return through an e-file service provider authorized by the IRS, ensuring that your return will be accepted by the IRS.

Guided Filing

Access our helpful resources within the application while filing your return and confidently complete the amendment filing. The entire process takes less than 5 minutes.

Secure E-filing

With TaxZerone, your data remains secure and confidential throughout the filing process. Rest assured that your sensitive information is well protected.

Easy E-filing

Our platform is designed with intuitive navigation, allowing you to navigate through the amendment filing process effortlessly. No prior tax knowledge is required.

Accurate and Compliant

Our built-in validation checks minimize errors and ensure your amendments meet all IRS requirements. You can file your tax return with accuracy.

Try TaxZerone for Form 2290 amendments and experience all these benefits.

E-File Form 2290 Amendment NowTaxZerone: Preferred E-file Service Provider,

for Form 2290 Amendments

In addition to the Form 2290 amendment due to exceeded mileage limit, TaxZerone also supports the following:

- ★ VIN correction

(Absolutely FREE) - ★ Taxable Gross Vehicle Weight Increase

Get the updated Schedule 1 copy in minutes and hit the road

It's time to simplify your tax filing process with TaxZerone! E-file Form 2290 amendments due to exceeded mileage limit.

Get the updated Schedule 1 copy in minutes

FAQs

1. What is an exceeded mileage amendment?

2. When should I file Form 2290 amendment for exceeded mileage?

3. Why should I file Form 2290 amendment?

- Taxable gross weight increase

- Exceeded mileage limit

- Incorrect VIN reported