E-File CA Form 199 for the 2024 Tax Year with TaxZerone

Simplify the e-filing process of CA Form 199 for the 2024 tax year.

Complete your CA Form 199 e-filing with TaxZerone and maintain your tax-exempt status. It’s that simple!

CA Form 199 e-filing made simple with TaxZerone

Follow the steps below to electronically file your CA Form 199

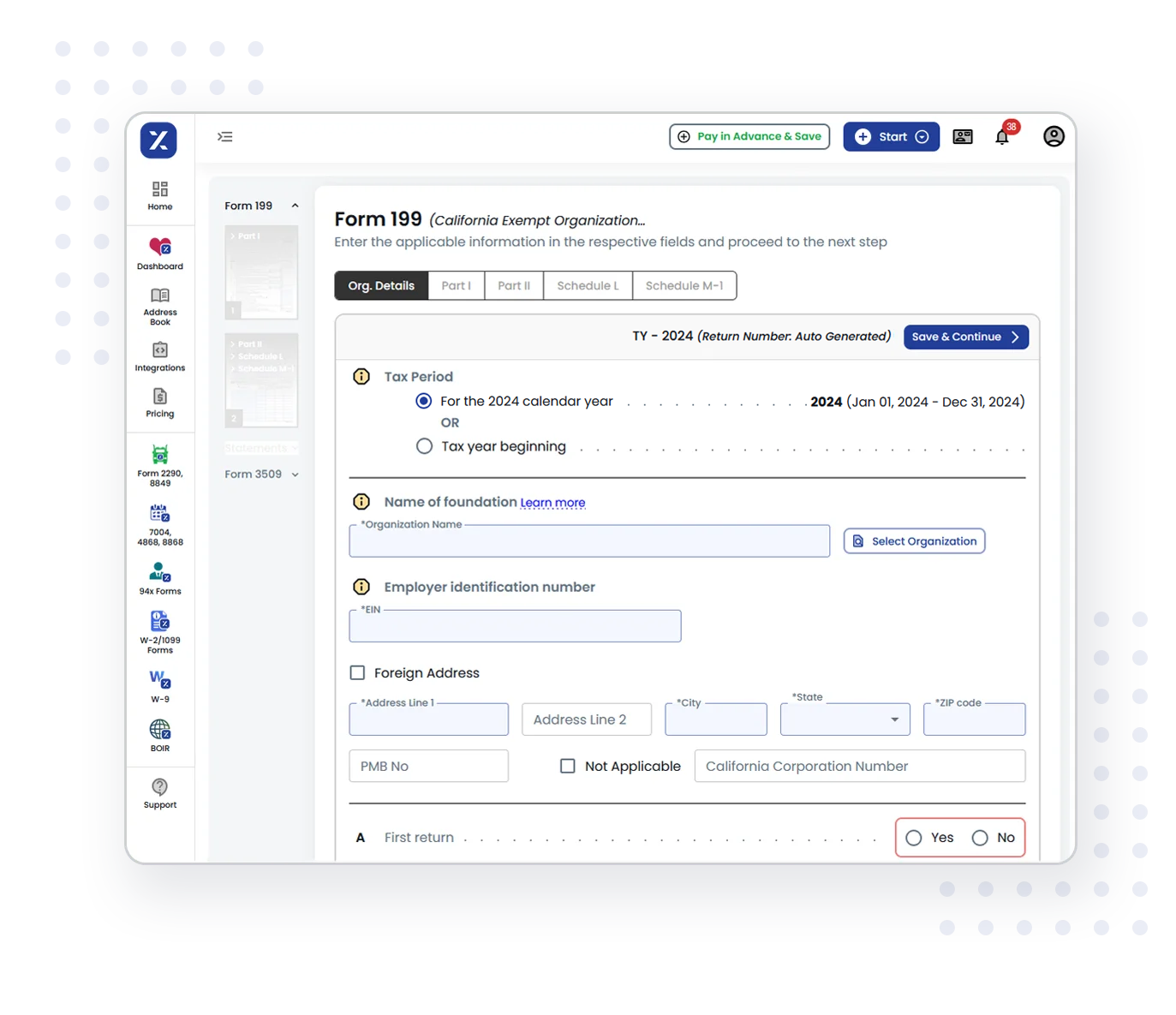

Provide Organization Details

Choose the tax year you want to file a return and provide your organization's details and other required information.

Preview the return

Review the information provided in the return for accuracy before transmitting.

Transmit to FTB

Once you have reviewed the form, you can transmit it to the FTB.

Stay tax-compliant with the FTB

California Form 199 online Tax Filing Guide

Filing California Form 199 is essential for maintaining your non-profit’s good standing with the state. Our guide breaks down each step, helping you meet California’s specific requirements with ease. We provide you with the information and resources you need for successful and timely filing.

California Franchise Tax Board Resources

For detailed instructions, eligibility criteria, and the latest updates, visit the California Franchise Tax Board’s Form 199 page.

Information Required to E-file CA Form 199 Online

Here is the list of major information that you’ll need to complete your CA Form 199 filing

- Organization’s Basic Information

- Organization’s Exempt Status

- Organization’s Activities

- Financial information such as revenues and expenses

- Filing fee details

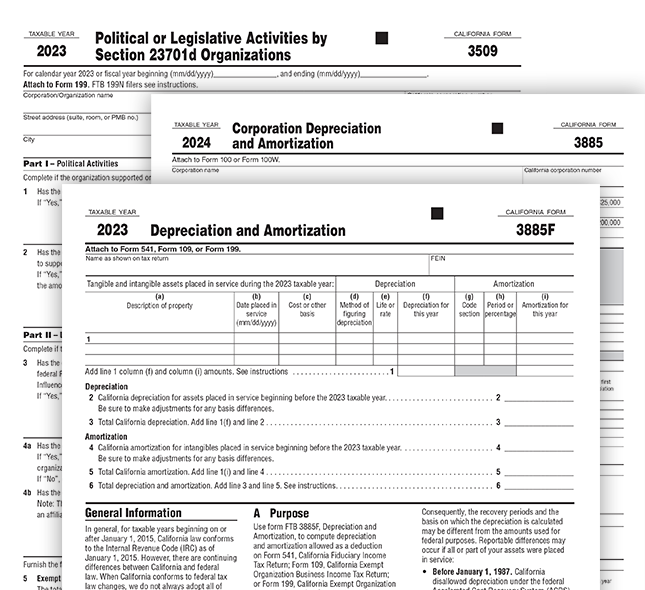

Supporting Forms of CA Form 199

TaxZerone currently supports the following California 199 sub-forms for FREE!

They will be auto-generated while you file your CA Form 199 with us.

- FTB 199 - Form 3509 - Political or Legislative Activities by Section 232701d Organizations

- FTB 199 - Form 3885 - Corporation Depreciation and Amortization

- FTB 199 - Form 3885F - Depreciation and Amortization

Get More Information on California Form 199 Instructions

Why Us?

Here's why TaxZerone is an ideal choice for exempt organizations to e-file their CA 199 returns

Seamless Status Tracking

Stay informed every step of the way. TaxZerone provides real-time updates on your filing status, ensuring you're always in the know about your tax-exempt status.

IRS-Authorized e-filing with TaxZerone

TaxZerone is an IRS-authorized e-filing provider, meaning your CA Form 199 will surely be accepted by the FTB.

Guided Filing with Expert Assistance

Get expert guidance for your Form 199 filing. Our step-by-step tutorials and helpful resources will make the process a smooth one. And if you need assistance, our support team is always ready to assist!

Unparalleled Security

We take your privacy seriously. TaxZerone employs robust security measures to safeguard your data and ensures that your Form 199 is transmitted securely to the FTB.

Effortless Navigation

With TaxZerone, completing your Form 199 return is a breeze. Our user-friendly interface guides you through the process step-by-step, making your entire e-filing process easy and simple!

Re-transmit Rejected Returns

If the FTB rejects your CA Form 199 for any errors, you can fix those errors and retransmit the return for FREE!

TaxZerone supports filing for multiple tax years, helping you efficiently manage past and current returns.

E-File NowSimplified e-filing process

Hear What Our Clients Say About Us

Stay Tax-Exempt Status with TaxZerone

It's time to simplify your e-filing process with TaxZerone!

E-file Form CA Form 199 and keep enjoying the benefits of your tax-exempt status

Frequently Asked Questions

1. What is CA Form 199, and who needs to file it?

CA Form 199 must be filed by the following organizations:

- Organizations granted tax-exempt status by the FTB.

- Nonexempt charitable trusts as described in IRC Section 4947(a)(1).

2. What is the deadline for filing CA Form 199?

CA Form 199 is typically due on the 15th day of the 5th month after the end of the organization’s fiscal year.

3. Can an organization request an extension for filing CA Form 199?

However, an organization that is not in good standing or suspended on the original due date of the return will not be given an extension of time to file.

4. Can I paper file CA Form 199?

If payment is included with the completed form, mail it to:

Franchise Tax Board

PO Box 942857

Sacramento, CA 94257-0501 .

If payment is not required with the completed form, mail it to:

Franchise Tax Board

PO Box 942857

Sacramento, CA 94257-0501 .