E-File IRS Form 990-Schedules Easily for the 2024 Tax Year with TaxZerone

TaxZerone handles all Form 990 and 990-EZ schedules for the 2024 tax year. Complete your form and all required schedules electronically.

Form 990 & 990-EZ Schedules: A Complete List

Find the specific schedule(s) you need to file your tax return.

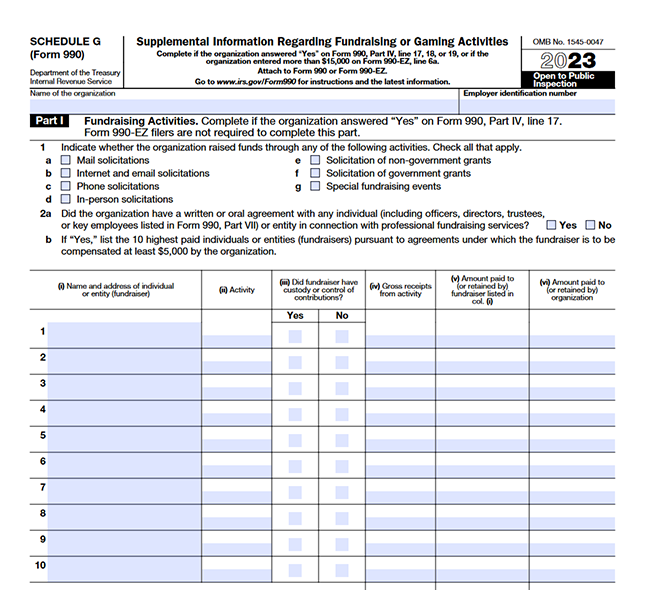

Supplemental Information Regarding Fundraising or Gaming Activities.

(Applicable to Forms 990 or 990-EZ)

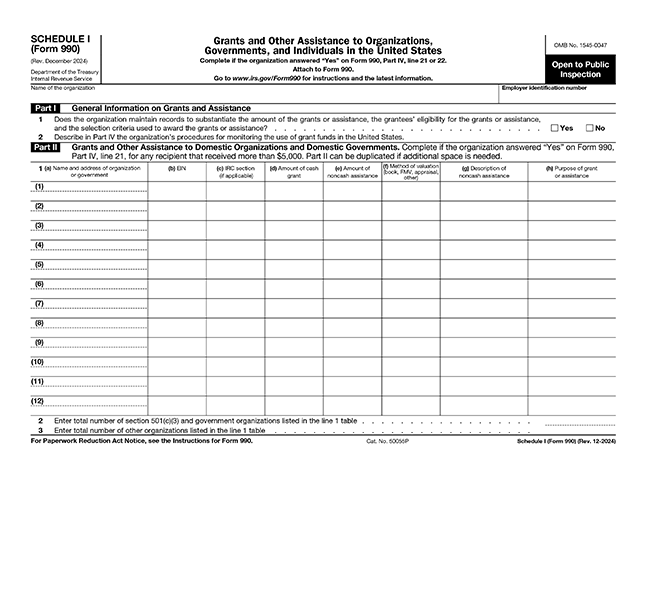

Grants and Other Assistance to Organizations, Governments, and Individuals in the United States.

(Applicable to Forms 990)

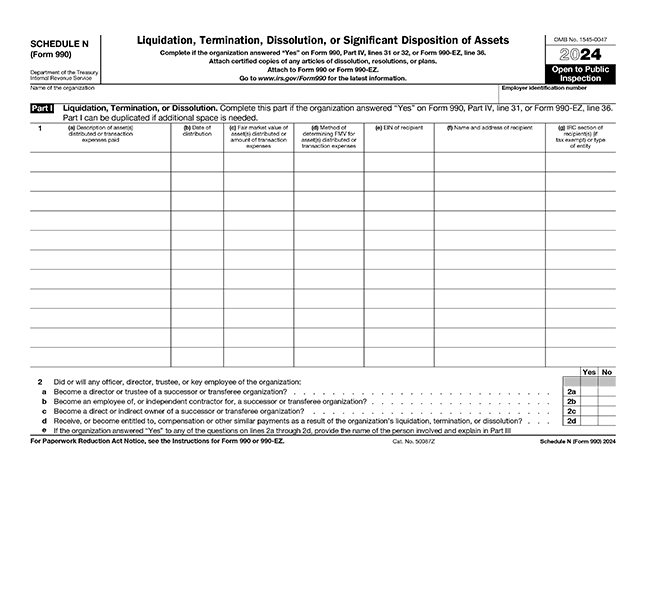

Liquidation, Termination, Dissolution, or Significant Disposition of Assets.

(Applicable to Forms 990 and 990-EZ)

Simplify Your Nonprofit Tax Filing with TaxZerone

Don't let complex schedules slow you down. Streamline your Form 990 or 990-EZ

filing with TaxZerone's comprehensive schedule support.

Frequently Asked Questions

1. Which Form 990/990-EZ Schedules Do I Need?

The specific schedules you need depend on your organization's activities and financial situation. However, some common schedules include:

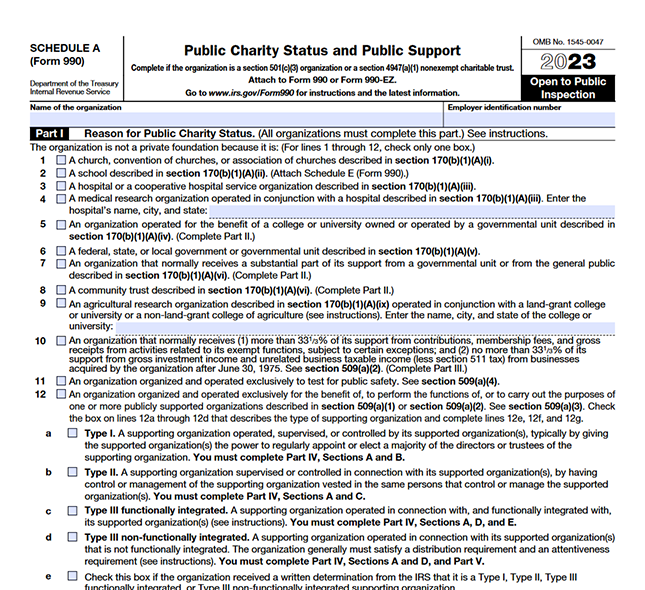

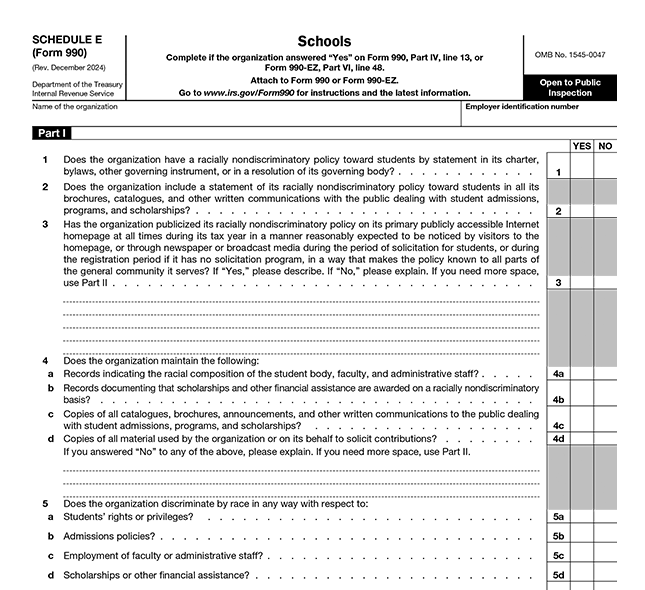

- Schedule A (Forms 990 and 990EZ): Public Charity Status and Public Support.

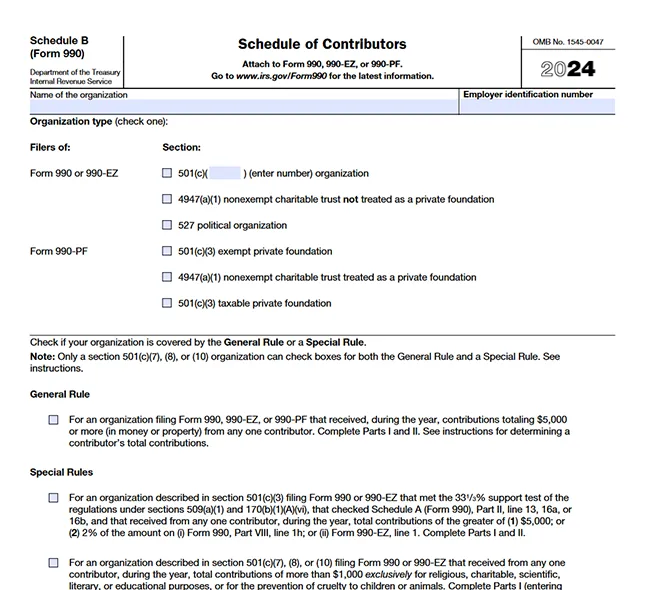

- Schedule B (Forms 990, 990 EZ, and 990PF): Schedule of Contributors

- Schedule G (Forms 990 or 990EZ): Supplemental Information Regarding Fundraising or Gaming Activities

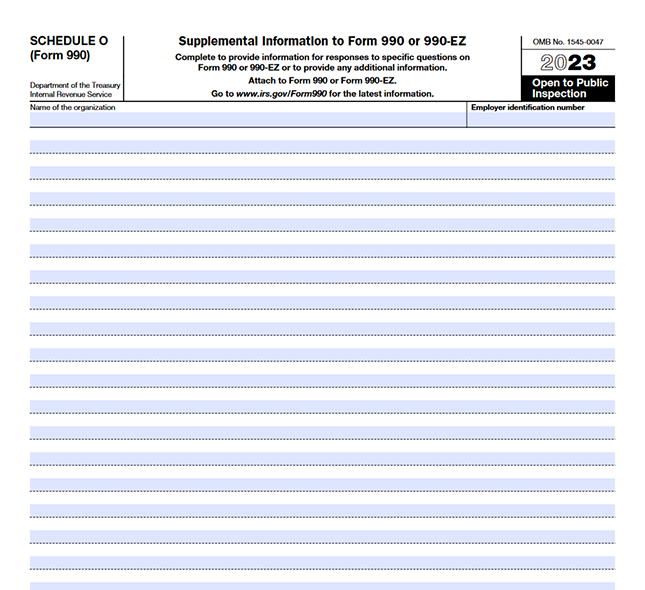

- Schedule O (Forms 990 and 990EZ): Supplemental Information to Form 990 or 990EZ

2. Is There a Deadline for Filing Schedules with My Form 990/990-EZ?

Yes, the deadline for filing your Form 990/990-EZ, including all applicable schedules, is the same as the deadline for your tax return. This is typically the 15th day of the fifth month (May 15th) following your organization's fiscal year-end. However, extensions can be obtained by filing Form 8868.

3. What Happens if I Miss a Schedule or Make a Mistake?

If you accidentally omit a required schedule or make an error, it's important to file an amended return as soon as possible. TaxZerone can guide you through the amendment process.

4. Can I file electronically with all the schedules attached?

Yes! TaxZerone allows you to e-file your Form 990 or 990-EZ with all the completed schedules electronically.

5. Can TaxZerone help me e-file my Form 990/990-EZ with schedules?

Absolutely! TaxZerone offers secure and convenient e-filing for your Form 990/990-EZ, including all associated schedules. This eliminates the need for paper filing and ensures faster processing by the IRS.