Effortlessly e-file your IRS Form 1099-K for the 2023 tax year

Simplify the process of filing your 1099-K forms online and distributing recipient copies with TaxZerone.

Takes less than 5 minutes

Industry-leading pricing

Start filing for as low as $2.49 per form, with rates dropping to only $0.59 per form for larger quantities.

For your return volume

E-file your Form 1099-K effortlessly in just 3 simple steps

With TaxZerone, streamline the information return filing process.

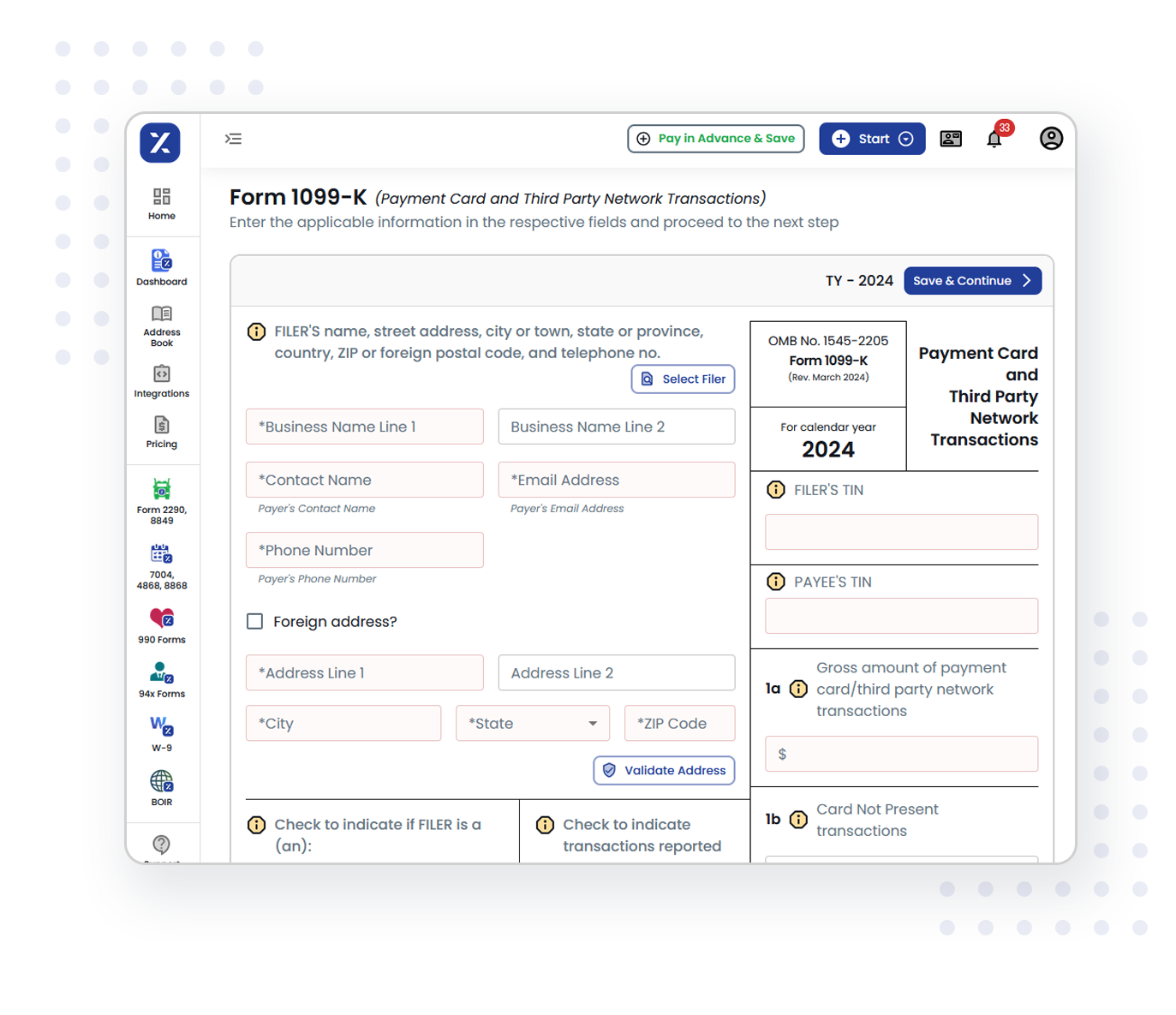

Fill out Form 1099-K

Enter all necessary details, including your and the recipient's information, gross amount of payment card and third-party network transactions, number of transactions, and total transactions for each month.

Review & transmit the return

Review the form and ensure the entered information is accurate. Then, transmit the return to the IRS.

Send the recipient copy

Share the recipient copy via email in no time.

Takes only 3 steps

Why choose TaxZerone for your Form 1099-K e-filing needs?

Explore how TaxZerone simplifies and streamlines your information return filing process.

Smart IRS validations

TaxZerone conducts real-time validation checks to ensure your 1099-K forms meet IRS standards. Steer clear costly errors and potential rejections in no time.

Bulk upload support

Effortlessly upload multiple form entries and eliminate the need for manual data input. Streamline your e-filing process, whether you're managing just a few forms or hundreds.

Email recipient copies

Effortlessly email recipient copies and save time and resources. Ensure prompt delivery without any hassle.

Competitive pricing

TaxZerone provides competitive rates tailored to your return volume. Be IRS compliant with our dependable e-filing service, at affordable prices.

Simplified form-based filing

Make filing easier by avoiding complicated interfaces. Finish your paperwork as effortlessly as filling out a paper form.

Guided filing

Receive clear, step-by-step instructions to accurately complete your filing. Ensure error-free submissions with assistance available at every stage of the process.

Choose TaxZerone for a seamless and efficientForm 1099-K e-filing experience

Enjoy effortless and streamlined e-filing with TaxZerone

Takes 3 steps and less than 5 minutes

Frequently Asked Questions

1. What is Form 1099-K?

- Credit, debit, or stored value cards, such as gift cards (payment cards)

- Payment apps or online marketplaces, which are also known as third-party settlement organizations

2. Who needs to file Form 1099-K?

3. When is the deadline to file Form 1099-K?

- The deadline to share recipient copies: January 31, 2024

- The deadline to file Form 1099-K (if you’re paper filing): February 28, 2024

- The deadline to file Form 1099-K (if you’re e-filing): April 01, 2024

4. What information is required to e-file Form 1099-K?

- Business details

- Recipient details

- Indication of whether you're a payment settlement entity (PSE) or electronic payment facilitator (EPF)/other third-party

- Gross amount of payment card/third party network transactions

- Card Not Present transactions

- Number of payment transactions

- Total reportable transactions for each month

- Federal and state income tax withheld if any