E-file IRS Form 990-PF for the 2024 Tax Year

- Easily report the financials of your private foundation with TaxZerone.

- TaxZerone supports all additional Schedules for FREE!

- We support tax years 2024, 2023, and 2022.

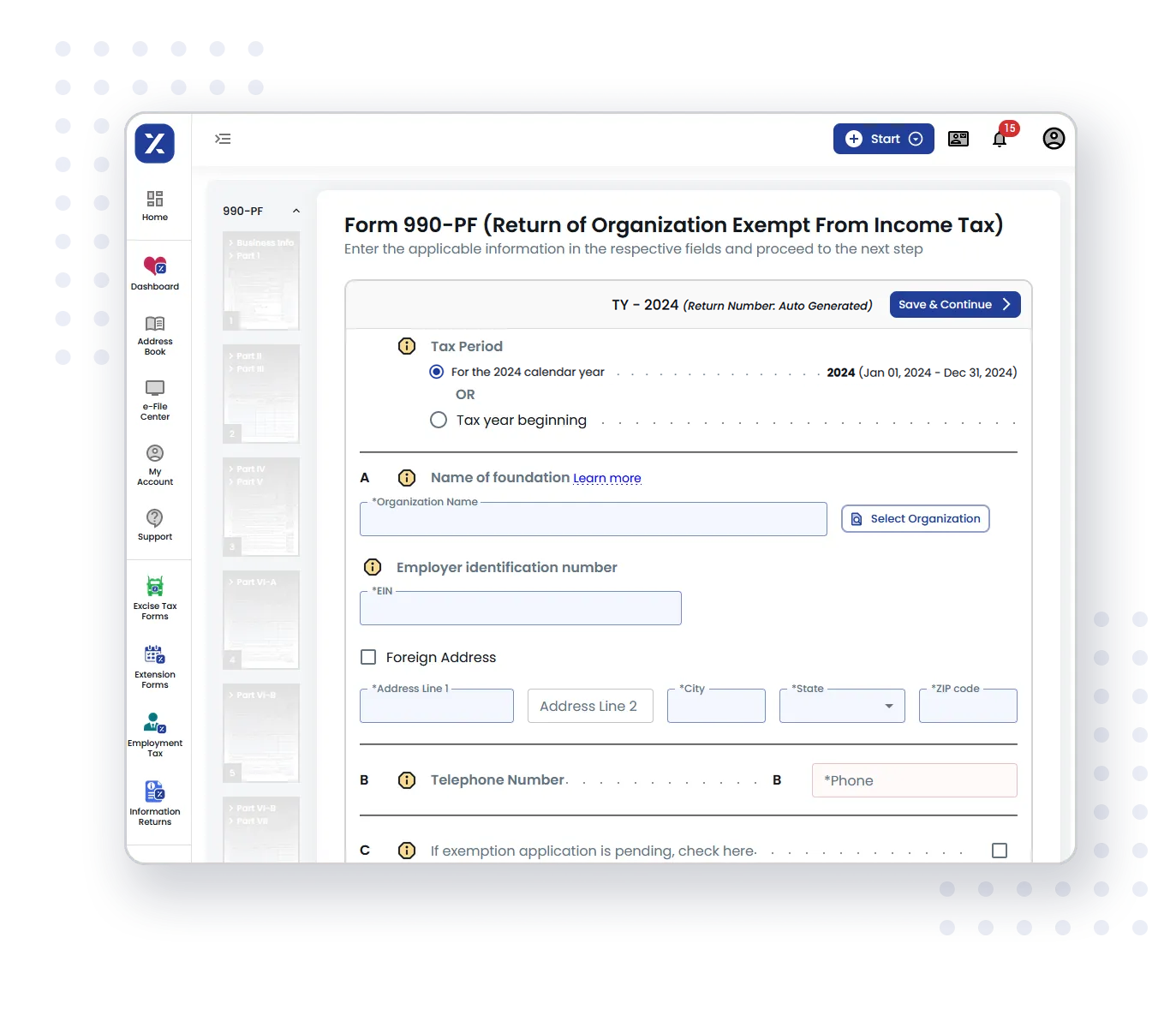

E-file Form 990-PF with TaxZerone in 3 simple steps!

Follow the steps below to file Form 990-PF for your private foundation.

Provide foundation details

Choose the tax year you want to file a return and provide your foundation’s details.

Preview the return

Review the information provided in the return for accuracy before transmitting.

Transmit to the IRS

Transmit your 990-PF return to the IRS and get the acceptance in just a few hours.

Stay tax compliant with the IRS

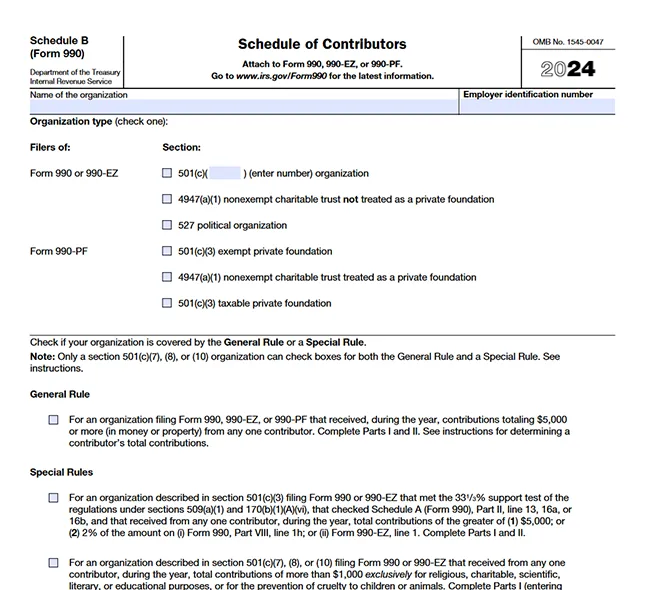

Schedules for Form 990-PF

TaxZerone supports the following 990-PF schedule for FREE!

This will be auto-generated while you file your 990-PF form with us.

- Schedule B - Schedule of Contributors.

- Form 2220, Underpayment of Estimated Tax by Corporations

Get More Information on Form 990 PF Instructions

Why TaxZerone?

Discover why TaxZerone stands out as the preferred option for private foundations to electronically file their 990-PF returns.

Get Instant Status Updates

Get real-time instant updates on your return's progress once it's transmitted to the IRS through TaxZerone. No more waiting – our system keeps you informed throughout the process.

Guaranteed IRS Acceptance

File your 990-PF return confidently with TaxZerone, an IRS-authorized e-file service provider, and rest assured the IRS will accept your 990-PF return!

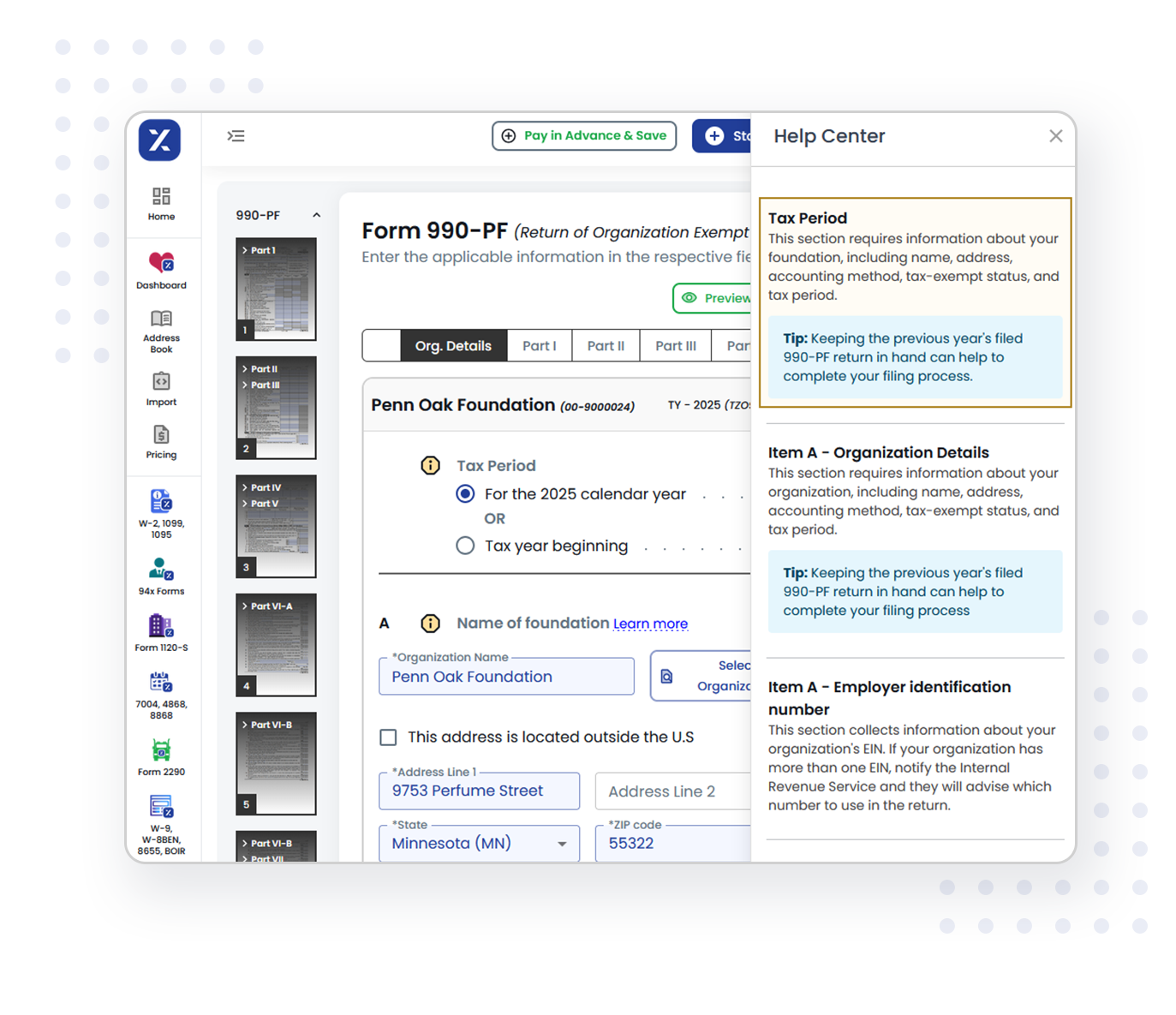

Get Clear Guidance and Support

Access step-by-step instructions and helpful articles to navigate your 990-PF confidently. Our intuitive interface and easy navigation will simplify your e-filing process.

Pay Securely with PayPal

Complete your filing with confidence using PayPal. It's fast, secure, and offers added payment flexibility—no need to enter card details directly.

Click2File for Effortless Filing

With Click2File, we automatically transfer relevant data from your previous return to your current one, making filing even easier and faster.

Free Retransmission

If the IRS rejects your 990-T due to any errors, you can correct the issues and retransmit the return without any additional fee.

Data Security. Our Priority

We follow Advanced security measures safeguarding your personal information throughout the e-filing process, ensuring your 990-PF return is submitted securely to the IRS.

Simplified E-filing

Our intuitive platform and simple question-and-answer format make it a breeze to complete your 990-PF e-filing. No tax expertise is required, just a few clicks, and we'll handle the rest!

Accuracy Guaranteed: Built-in IRS Validation

Minimize errors and maximize success with our built-in IRS validation checks. We'll ensure your 990-PF return is accurate and compliant, reducing the chances of rejections and delays.

TaxZerone supports filing for multiple tax years, helping you efficiently manage past and current returns.

E-File Form 990-PFSimplified e-filing process

Hear What Our Clients Say About Us

IRS Form 990-PF Filing Guide

- Gather Essential Information

Collect records on income, expenses, assets, grants, and contributions made during the tax year. - Complete Part I - Revenue and Expenses

List revenue sources, such as contributions and investment income, and break down expenses. - Fill Out Part II - Balance Sheets

Record assets, liabilities, and net assets at both the start and end of the tax year. - Document Charitable Activities and Distributions (Part IX)

Include details on grants and donations, ensuring compliance with distribution requirements. - Calculate Excise Tax on Investment Income (Part VI)

Accurately calculate and report excise taxes on net investment income to avoid penalties. - File Form 990-PF by the Deadline

Form 990-PF is due on the 15th day of the 5th month after the foundation’s fiscal year-end. E-filing is recommended for a quicker processing experience.

Secure Your Tax-Exempt Status with TaxZerone

File Fast, Stay Compliant. E-file your Form 990-PF with TaxZerone effortlessly and stay compliant for years.

Frequently Asked Questions - Form 990-PF

1. What Is IRS Form 990-PF?

2. What information does Form 990-PF collect?

3. Who is required to file Form 990-PF?

4. Can a private foundation lose its tax-exempt status if it fails to comply with Form 990-PF filing requirements?

5. When is the deadline to file Form 990-PF?

6. What should be attached along with Form 990-PF?

7. Can we extend the deadline of Form 990-PF?

8. How to correct the errors in previously filed Form 990-PF?

- If you used TaxZerone to file the original return:

- Go to Exempt Organization Forms dashboard.

- Choose Form 990-PF.

- Clicking on “Amend Return” will automatically transfer all field values from the original return to the amended one.

- You must provide a reason for the amendment, correct any errors, and submit the amended return to the IRS.

- In case you filed your original Form 990-PF with another service provider, easily make amendments using TaxZerone.

Related Resources

Form 990-PF Instructions

Read the Instructions for Form 990-PF to file accurately with TaxZerone

Form 990-PF Due Date

Know more about the Due Date of Form 990-PF and file your form on time.

Form 990 Schedule B

Learn more about Form 990

Schedule B and file easily.