File Form 1099-NEC for Tax Year 2024 with Ease

Report non-employee compensation with TaxZerone’s accurate and hassle-free e-filing solution for Form 1099-NEC.

Takes less than 5 minutes

Affordable Pricing

Start at just $2.49, with prices as low as $0.59 per form for bulk filings

For your return volume

Filing Requirements for Form 1099-NEC

Let's make your 1099-NEC filing a breeze! Here's what you'll need:

- Payer Information: Payer’s Name, TIN and Address

- Recipient Information: Recipient’s Name, TIN and Address

- Payment Information: Non-employee compensation and Federal Tax Withheld (if applicable)

- State Tax Information: Payer’s State Name, State ID Number, State Income and Tax Withheld

3 Simple steps to complete your Form 1099-NEC E-filing

Filing your Form 1099-NEC with TaxZerone is fast, easy, and secure.

Here's how you can do it in just three simple steps:

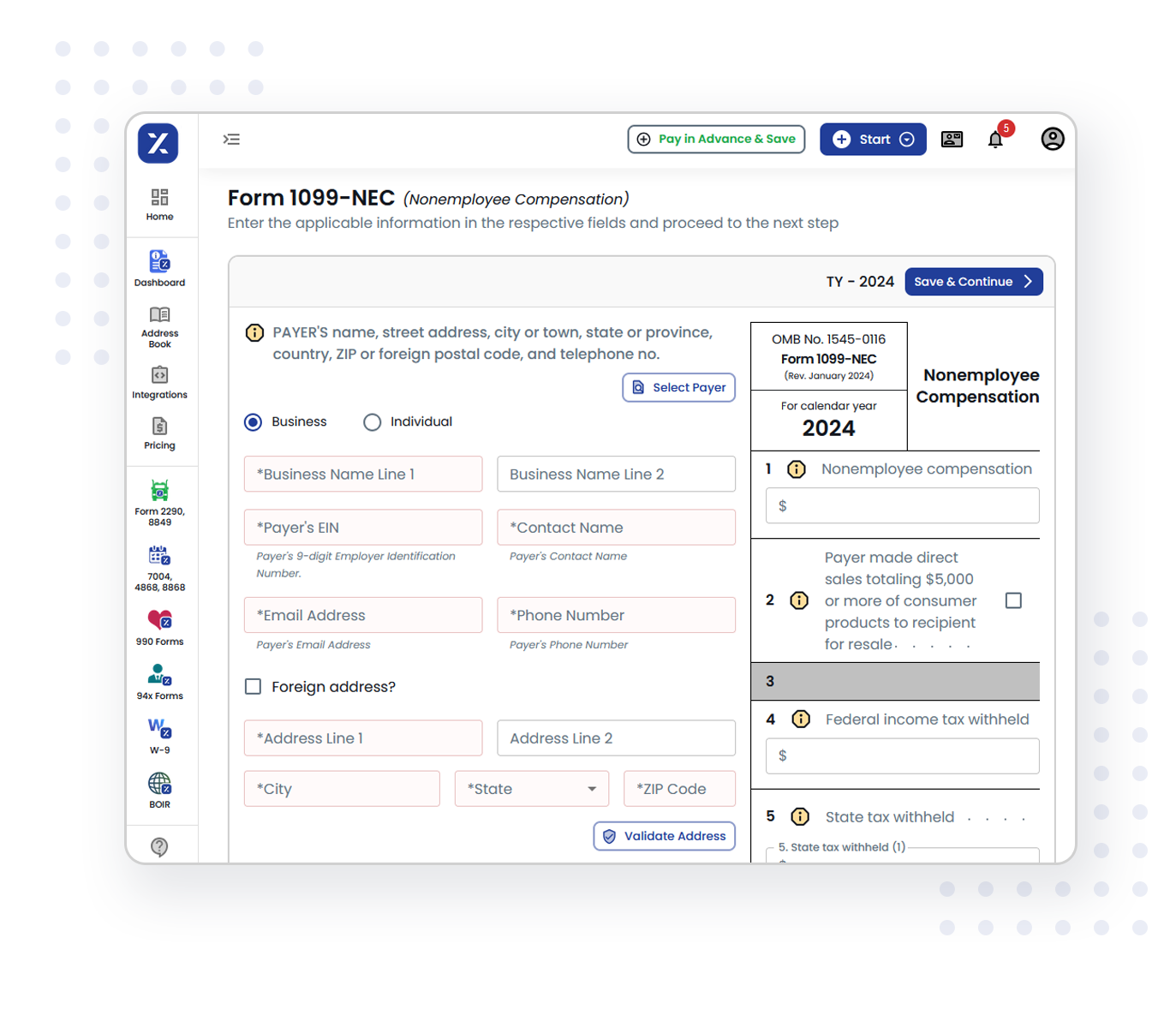

Enter Information for Form 1099-NEC

Simply fill in your business/individual details (EIN/SSN), recipient's information (name, address, TIN), and the non-employee compensation paid.

Review & Transmit

Ensure accuracy with TaxZerone's IRS validations, then securely e-file your Form 1099-NEC to the IRS.

Send Recipient Copy

Securely deliver the recipient's copy via ZeroneVault, ensuring safe sharing or opt for postal mail.

Why choose TaxZerone for Form 1099-NEC E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here's why:

IRS form validations

TaxZerone performs automatic IRS form validations to ensure your Form 1099-NEC submissions are accurate and compliant. Our system checks for errors or missing information, reducing the risk of rejections and penalties from the IRS.

Supports bulk upload

If you have multiple 1099-NEC forms to file, TaxZerone offers a bulk upload option. You can upload and file multiple forms in one go, saving you time and effort. Whether you have a handful of contractors or hundreds, we’ve got you covered.

Share Recipient Copies

Once your Form 1099-NEC is filed, you can effortlessly share a copy with the recipient, ensuring timely delivery. Whether you prefer secure electronic delivery through ZeroneVault or traditional postal mailing, we've got you covered. Say goodbye to the hassle of printing and handling physical copies, as we ensure efficient and reliable delivery to recipients.

Best price in the industry

We offer the best prices in the industry based on your filing volume. TaxZerone’s e-filing services are designed to save you both time and money. Whether you’re filing a single form or many, we offer affordable pricing without compromising on quality.

Form-based filing

Filing your Form 1099-NEC is easy with TaxZerone’s form-based interface. Simply fill out the necessary fields directly in our platform, and we’ll handle the rest.

Guided filing

Not sure about a particular field or requirement? No problem! Our guided filing process provides clear instructions, helpful prompts, and real-time assistance to make sure you complete your Form 1099-NEC filing with confidence.

Important Deadlines for Filing Form 1099-NEC

Send Recipient Copies

Deadline: January 31, 2025 Deliver recipient copies on time through ZeroneVault for secure electronic sharing or opt for postal mail.

File with the IRS (e-file)

Deadline: January 31, 2025 Submit your Form 1099-NEC electronically

File with the IRS (paper)

Deadline: January 31, 2025 Mail your Form 1099-NEC if filing on paper.

Save time and stress with TaxZerone. File your 1099-NEC on time and effortlessly.

Start Filing Now!E-file Form 1099-NEC Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099 State Filing | Price Per Form |

|---|---|

| Per Form | $0.99 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

Form 1099-NEC State Filing

Did you know that some states require separate filings for Form 1099-NEC in addition to the federal filing?Ensure compliance with state-specific tax laws by filing in all required jurisdictions.

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Dist. of Columbia

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

New Jersey

New Mexico

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

Utah

Vermont

Virginia

West Virginia

Wisconsin

Schedule Filing: Plan Ahead and Stay On Track

Want to ensure your filings are submitted on time without the stress? With Schedule Filing, you can prepare your Form 1099-NEC filings in advance, and we’ll take care of the submission when the time comes.

Choose Your Filing Date

Set your preferred filing date, and we’ll ensure your forms are submitted to the IRS promptly and accurately.

Ensure Accuracy

Recipients can review their 1099-NEC forms before submission, allowing them to identify and correct any errors in advance.

Avoid the Need for IRS Correction Forms

Scheduling your filing provides an opportunity to validate all details beforehand, reducing errors and eliminating the hassle of filing IRS correction forms later.

Share Recipient Copies with Ease

TaxZerone makes it simple to deliver Form 1099-NEC copies to your recipients securely and on time.Choose the method that works best for your business:

Secure Delivery via ZeroneVault

- Share recipient copies electronically through ZeroneVault, a secure and user-friendly platform.

- Recipients can access their forms instantly, without the need for printing or mailing.

- ZeroneVault ensures data security, giving you peace of mind when sharing sensitive tax information.

Traditional Postal Mailing

- Prefer a physical copy? TaxZerone also offers postal mailing services.

- Recipient copies are delivered promptly, ensuring compliance with IRS deadlines.

- Save your time and enjoy a hassle-free experience by letting TaxZerone handle the mailing process for you.

Get Started with TaxZerone Today

Filing Form 1099-NEC online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Save time with bulk upload.

- File at the best price in the industry.

Start your e-filing process today and complete your Form 1099-NEC in just 3 simple steps!

Frequently Asked Questions

1. What is Form 1099-NEC?

2. Who Needs to File Form 1099-NEC?

If you have paid $600 or more to independent contractors, freelancers, and other self-employed individuals for their service, you are required to file Form 1099-NEC. This applies whether you are an individual, a corporation, or an LLC.

Common examples of those who need to file include:

- Small business owners

- Corporations hiring freelancers or contractors

- Individuals hiring independent contractors

- Nonprofit organizations paying independent service providers

3. What is the difference between Form 1099-NEC and Form 1099-MISC?

4. When is the deadline to file Form 1099-NEC?

The deadline to file Form 1099-NEC is January 31st of the year following the tax year being reported. This deadline applies to both sending the form to recipients and filing it with the IRS, regardless of whether you file electronically or by paper. If January 31st falls on a weekend or holiday, the deadline is extended to the next business day.

The deadline to file Form 1099-NEC for the tax year 2024 is Friday, January 31, 2025.

5. What Are the Penalties for Late Filing of Form 1099-NEC?

For the 2024 tax year, the penalties for late filing of Form 1099-NEC are as follows:

- Filed within 30 days of the deadline (Form 1099-NEC deadline January 31, 2025):

- $60 per form

- Maximum penalty per year: $664,500 for large businesses, $232,500 for small businesses

- Filed more than 30 days after the deadline but before August 1, 2025:

- $130 per form

- Maximum penalty per year: $1,993,500 for large businesses, $664,500 for small businesses

- Filed after August 1, 2025, or not filed at all:

- $330 per form

- Maximum penalty per year: $3,987,000 for large businesses, $1,329,000 for small businesses

It's important to note that these are just the penalties for late filing. Additional penalties may apply for other errors, such as failing to provide a correct payee statement or intentionally disregarding the requirement to provide a correct 1099-NEC form.

To avoid penalties, it's crucial to file your 1099-NEC forms on time. You can do this by either mailing them to the IRS or filing them electronically. Electronic filing is generally faster and more accurate, and it can help you avoid penalties.

6. What Are the Key Changes for the 2024 Tax Year Regarding Form 1099-NEC?

For the 2024 tax year, there are a few key changes regarding Form 1099-NEC:

1. Mandatory Electronic Filing Threshold Lowered:

- Businesses that file 10 or more Form 1099s are now required to file them electronically. This is a significant change from previous years, where the threshold was higher.

2. Continuous Use Form:

- The IRS has moved Form 1099-NEC to a continuous use basis. This means that there won't be a new version of the form each year. Instead, the same form will be used for multiple tax years.