Meet Vermont's 2024 W-2 Filing Requirements

Stay informed about Vermont’s W-2 filing requirements and deadlines, and conveniently e-file your W-2 forms with speed and precision

As low as $0.99 per W-2 state filing form

Key Vermont W-2 Form Information

| State Tax | Form | Filing Requirement | Filing Method |

|---|---|---|---|

| Yes, Wages are taxable | Form W-2 Wage and Tax Statement | Yes, the W-2 form should be filled out for withheld tax | Electronic /Paper We recommend electronic filing. |

| Form WHT-434 Annual Withholding Reconciliation | Yes, Form WHT-434 to reconcile the total tax Withheld | Electronic /Paper We recommend electronic filing. |

Who Needs to File W-2 Forms in Vermont?

All employers who withhold Vermont state tax from employees are required to file Form W-2 for the 2024 tax year. Regardless of company size or the number of employees, employers must file Form W-2 if Vermont state taxes are withheld

What Must Be Filed?

- Form W-2: Wage and Tax Statement for each employee.

- Form WHT-434: Annual Withholding Reconciliation form for Vermont

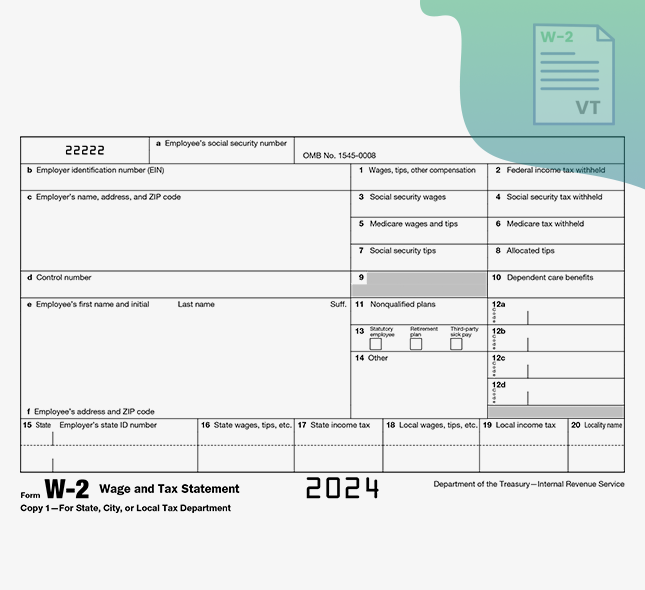

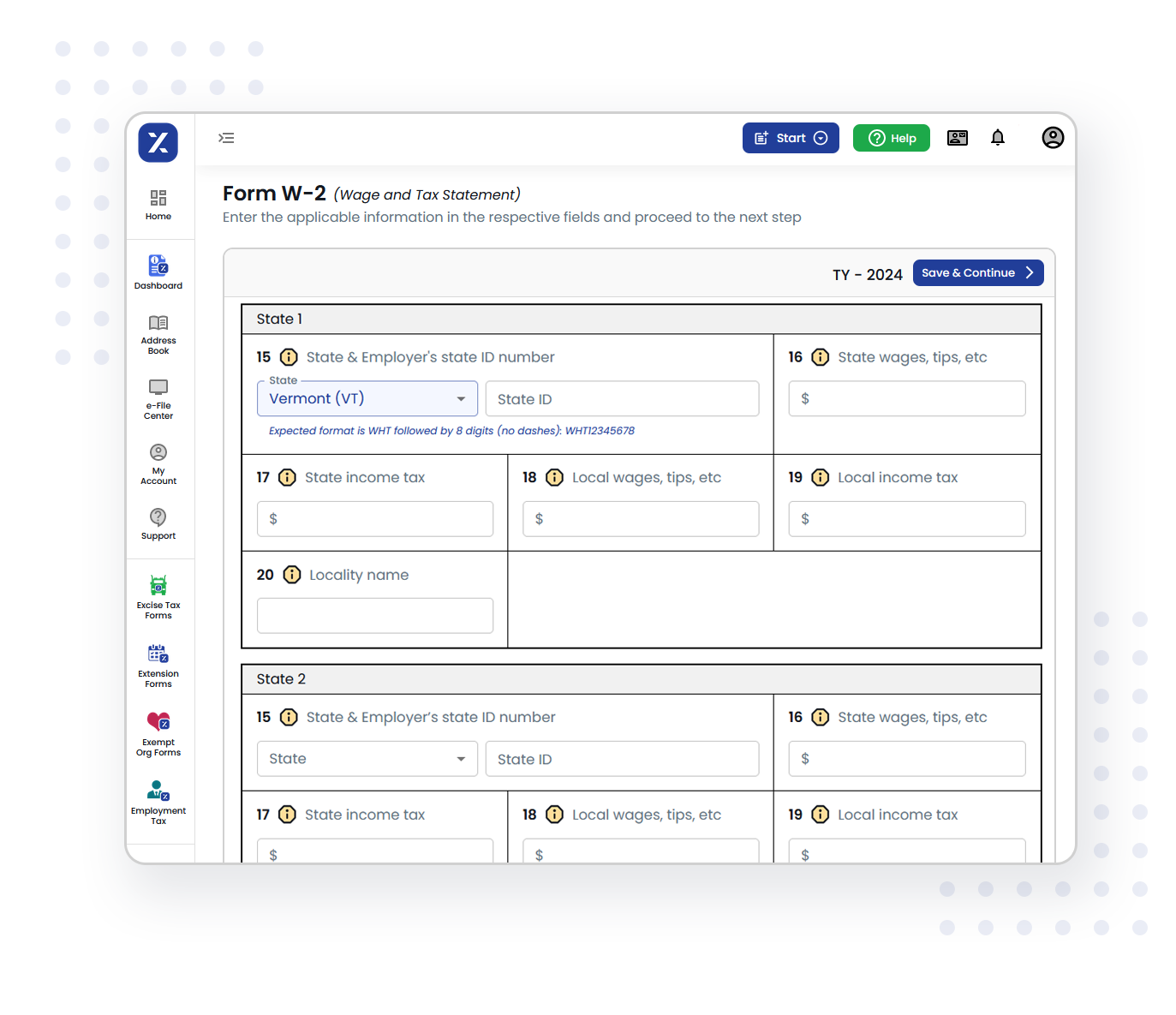

Important W-2 Form Fields for Vermont Filings

Ensure the following key fields on the W-2 form are correctly filled:

Employer’s state ID number

In Box 15, enter the state name and the employer's Vermont state ID number. This is mandatory if Vermont state income tax has been withheld from the employee's wages.

State wages, tips, etc.

Enter the total wages, tips, or other compensation subject to Vermont state income tax in Box 16.

State income tax

In Box 17, enter the amount of Vermont state income tax withheld from the employee's wages.

TaxZerone makes filing Vermont W-2 forms a breeze complete it fast and effortlessly in just a few steps!

File Vermont W-2 FormFiling Methods for Vermont W-2 Forms

Electronic Filing

All employers filing 25 or more information returns must electronically file Form W-2 in the state of Vermont. This requirement applies to all employers, regardless of company size. Information returns include both Forms W-2 and 1099.

Simply enter or upload your employees' data, review it, and submit it. Once transmitted, we handle all the details.

Paper Filing

Employers filing fewer than 25 information returns can submit their W-2 forms via paper filing. However, if the total count of information returns, including Forms W-2 and 1099, reaches 25 or more, paper filing is not permitted for W-2 forms.

Mailing Address:

Vermont Department of Taxes,

PO Box 1881,

Montpelier, VT 05601-1881

Recommendation: Skip the hassle of paper filing! Choose TaxZerone for lightning-fast e-filing, unmatched accuracy, and an effortless experience.

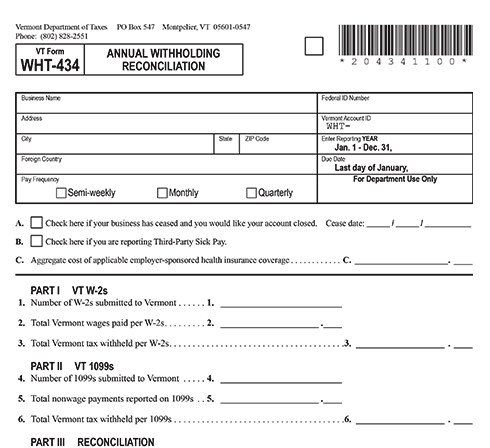

Vermont Form WHT-434:

W-2 Reconciliation

All employers filing Form W-2 in Vermont are required to submit Form WHT-434 along with it. This additional form ensures that the total tax withheld from employees is accurately reconciled. Form WHT-434 must be filed to verify and match withholding amounts. Both forms are necessary for complete tax reporting in Vermont.

File your W-2 forms with TaxZerone.

TaxZerone will seamlessly manage your Form WHT-434 filing too!

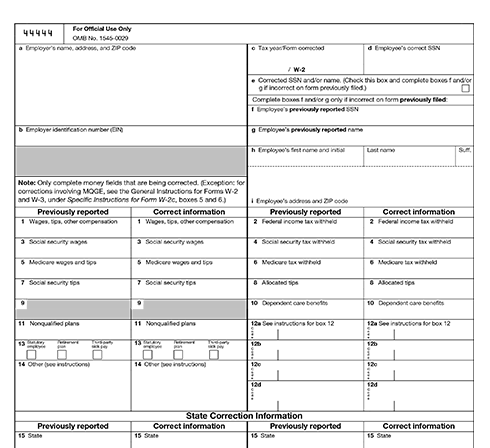

W-2c Corrections for Vermont Filings

Employers must file W-2 form amendments electronically by logging into myVTax. If opting for paper filing, corrected W-2 forms should be sent to the Vermont Department of Taxes with "Amended " written on top, along with Form WHT-434.

Mailing Address:

Vermont Department of Taxes,

PO Box 1881,

Montpelier, VT 05601-1881

Filing Deadline for Vermont W-2 Forms

- Form W-2 (Wage and Tax Statement)

- Form WHT-434 (Reconciliation Form)

Why Choose TaxZerone for Your Vermont W-2 Filing Needs?

When it comes to e-filing W-2 forms, TaxZerone stands out as your go-to solution. Our platform is designed to make the filing process easy, accurate, and timely. Experience the following benefits:

Quick & Easy

Complete your W-2 filings in just three simple steps, taking less than five minutes!

Affordable Pricing

Each form costs only $0.99 for w2 state filings with absolutely no hidden fees.

Bulk Upload Feature

Save valuable time by uploading multiple forms in one go.

Dedicated Support Team

Have questions? Our expert team is available to help you navigate any filing challenges.

Ready to simplify your Vermont W-2 filing process?

Sign up with TaxZerone today and file Vermont state W-2 state forms for just $0.99 each .

Frequently Asked Questions

1. Does Vermont have a W-2 filing requirement?

2. What information is required on Vermont Form W-2?

3. Can W-2 forms be filed electronically with Vermont?

4. What is Form WHT-434?

Form WHT-434 is the Annual Reconciliation of Vermont Income Tax Withheld. It is used to report the total amount of Vermont state income tax withheld from all employee’s wages.