E-file IRS Form 941 Online for the 2025 Tax Year

TaxZerone helps you e-file your 2025 quarterly payroll taxes with auto-calculations and zero stress.

File Form 941 online with the IRS at the lowest price.

At TaxZerone, we make payroll compliance quick, simple, and affordable for small to large businesses

$6.99

Transparent pricing with no hidden fees

How to File IRS Form 941 for the 2025 Tax Year?

Follow these steps to complete your quarterly payroll tax filing with confidence and accuracy.

Enter or Upload your Data

Enter your payroll data manually or import it in bulk with our Excel template.

Pay any due amount and sign

Select your preferred payment method to settle the balance due, e-sign the return, and review the form information to ensure its accuracy.

Transmit the return to the IRS

Securely submit your Form 941 to the IRS and receive a notification once your return is accepted.

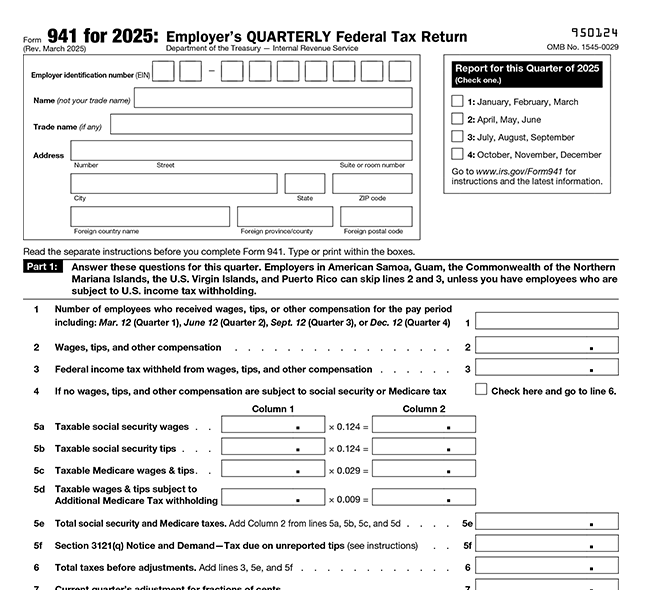

Information Required to File 941 Online

- Employer Details:

- - Name, EIN, and Address

- Employment Details:

- - Employee Count

- - Employee Wages

- Taxes and Deposits:

- - Federal Income Taxes

- - Medicare and Social Security Taxes

- - Form 941 Worksheets

- - Deposit Made to the IRS

- - Tax Liability for the Quarter

- Signing Form 941:

- - Signing Authority Information

- - Online Signature PIN or Form 8453-EMP

Deadline to file Form 941 for 2025 Tax Year

This quarterly form is due on the last day of the month following the conclusion of the quarter.

If the 941 due date falls on a federal holiday, the filing deadline will be the next business day.

Why Choose TaxZerone?

Powerful Features Designed to Simplify Your Payroll Tax Filing

IRS-authorized

Authorized by the IRS to securely process your tax filings with full compliance and trusted accuracy.

Easy Zero Filing

No payments this time? Just select 'No Taxes to Report' and let TaxZerone make filing your zero-return effortless.

Bulk Upload

Save time with our bulk upload option—import multiple records and file them all at once.

Smart Calculations

Automatically calculate your taxes accurately as you enter data, making filing faster and error-free.

Authorize/Sign your Return

Quickly sign your return using Form 8453-EMP or an online PIN.

(You can request your 94x PIN for FREE.)

Lowest price

Get the lowest prices for payroll tax filing while enjoying both accurate filing and expert support.

Supports Schedule B & Form 8974

Supports 941 Schedule B for semiweekly deposits and Form 8974 to easily claim the Employee Retention Credit.

Expert Support

Get real help from real people—expert assistance is always available when you need guidance, in both English and Spanish.

Why Businesses Trust TaxZerone

See why small businesses trust TaxZerone for smooth, simple, and reliable tax filing.

- Bill Martin

-Tonya Sheffield

-Samella Horsley

Ready to simplify your quarterly payroll tax filing?

E-file your quarterly payroll tax form with the IRS using TaxZerone and get stay tax

Related Resources

Form 941 Instructions

Read the TaxZerone’s step-by-step Instructions for form 941 and file accurately.

Form 941 Due Date

Check the Form 941 due date and file it before the deadline with TaxZerone

Form 941 Mailing Address

Know the mailing address of form 941 and send it to the IRS based on your location

Recent Blogs

Form 941 Guide for Employers: Quarterly Federal Tax Return Explained

Form 941: Step-by-Step Guide for the 2025 Tax Year

Frequently Asked Questions

1. What is Form 941 used for?

Form 941, the Employer’s Quarterly Federal Tax Return, is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Employers must also report their share of Social Security and Medicare taxes, along with wages, tips, and other compensation paid to employees.

Have fewer employees? You may be eligible to file Form 944 annually instead.

2. When are Form 941 due?

- 1st Quarter (Jan-Mar) Due by April 30

- 2nd Quarter (Apr-Jun): Due by July 31

- 3rd Quarter (Jul-Sep): Due by October 31

- 4th Quarter (Oct-Dec): Due by January 31 of the following year

3. Who files Form 941?

- Pay wages subject to federal income tax withholding.

- Withhold Social Security and Medicare taxes from employee paychecks.

- Pay the employer's portion of Social Security and Medicare taxes.

4. What are the penalties for not filing Form 941 on time?

| No. of days your deposit is late | Amount of the penalty |

|---|---|

| 1-5 calendar days | 2% of your unpaid deposit |

| 6-15 calendar days | 5% of your unpaid deposit |

| More than 15 calendar days | 10% of the unpaid deposit |

| More than 10 calendar days after the date of your first notice or letter or The day you get a notice or letter for immediate payment | 15% of your unpaid deposit |

Learn more about Form 941 penalties for not filing or not paying the taxes.

5. Who is required to file Form 941 Schedule B?

- Reported more than $50,000 in employment taxes in the lookback period.

- Accumulated $100,000 or more in tax liability on any given day in the current or prior calendar year.