Revised IRS Form 941 for 2024

As a business owner, one of your quarterly responsibilities is completing Federal Form 941. To be compliant and avoid IRS penalties, you must file Form 941 every quarter without fail.

The IRS has updated Form 941 for the 2024 tax year. There are some modifications to Form 941 that employers should be aware of before filing it.

Here we provide thorough information regarding the IRS Form 941 amendments for the 2024 tax year.

- The Social Security and Medicare tax limits have been revised.

- The draft guidelines provide for the withdrawal of COVID-19 credits.

- These changes could be effective across all four quarters of 2024.

The following topics are covered:

What are the changes to Form 941 for 2024?

There are some major changes to Form 941 for 2024. The following changes are expected for the 2024 tax year:

- The Social Security wage base limit has increased from $160,200 to $168,600.

- In 2024, household workers earning $2,700 or more must pay Social Security and Medicare taxes.

- Election workers who get $2,300 or more in cash or similar pay will be liable to Social Security and Medicare taxes in 2024.

- Businesses can no longer claim COVID-19 credits for qualifying sick and family leave wages on Federal Form 941.

Certain lines have been removed from Form 941 for 2024:

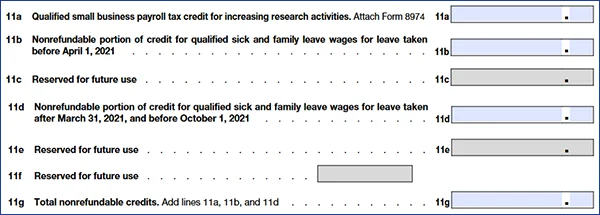

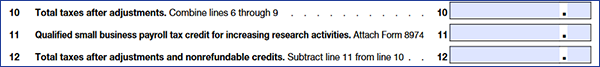

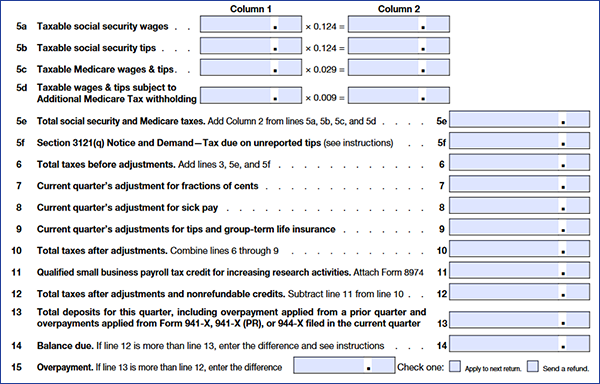

- In Part 1, Lines 11a to 11g have been removed. Instead, Line 11 will have the information regarding Form 8974 (Payroll tax credit for Qualified small businesses for increasing research activities). Refer to the image attached below.

- Form 941, 2023

- Revised Form 941, 2024

- Lines 13a- 13i have also been removed. Instead, line 13 will contain information regarding the sum of deposits for the particular quarter which includes overpayment applied from a prior quarter and overpayments applied from Form 941-X, Form 941-X (PR), Form 944-X, or Form 944-X (SP) filed in the current quarter.

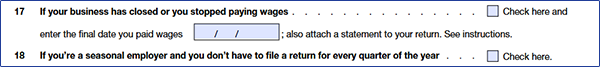

- In Part 3, Lines 19 - 28 have been removed.

When are the Form 941 deadlines for the 2024 tax year?

Form 941 is required to be filed every quarter while the business is in operation. The 2024 Form 941 due dates are listed in the table below:

| Reporting Period | Deadline |

|---|---|

| January - March | April 30, 2024 |

| April - June | July 31, 2024 |

| July - September | October 31, 2024 |

| October - December | January 31, 2025 |

TaxZerone, an IRS-authorized e-file provider, offers a straightforward Form 941 filing solution at the low cost of$6.99 per form.

E-File NowHow do I file Form 941 online for the 2024 tax year with TaxZerone?

E-filing Form 941 with TaxZerone is simple and accurate. TaxZerone updates the filing process every quarter to include the most recent IRS revisions.

TaxZerone makes filing easier by automatically calculating taxes, checking for errors using IRS business rules, and providing built-in worksheets, 941 Schedule B, and Form 8974.

Follow the simple steps outlined below to complete and submit your forms to the IRS in minutes!

Step 1: Sign in to create a free TaxZerone account!

Step 2: Choose 'Form 941' and enter the details.

Step 3: Review and Transmit to the IRS

Form 941 has undergone substantial modifications for the 2024 tax year, including reduced Social Security and Medicare tax limits and the elimination of COVID-19 credits. Employers must meet quarterly filing requirements. Using an IRS-authorized platform, such as TaxZerone, simplifies the process while maintaining accuracy and compliance.

Ready to get started with Form 941 e-filing?

TaxZerone has incorporated all the IRS changes in Form 941 for the 2024 tax year.

Click the button below and start your filing process with TaxZerone.

Takes 3 simple steps