File Form 1099-SA for Tax Year 2024 with Ease

Report distributions from Health Savings Accounts (HSA), Archer MSA, or Medicare Advantage MSA with TaxZerone’s accurate and hassle-free e-filing solution for Form 1099-SA.

Affordable Pricing

Start at just $2.49, with prices as low as $0.59 per form for bulk filings.

For your return volume

Filing Requirements for Form 1099-SA

Let’s make your 1099-SA filing smooth! Here’s what you’ll need:

- Payer Information: Payer’s Name, TIN, and Address

- Recipient Information: Recipient’s Name, TIN, and Address

- Distribution Information: Total distributions from HSA/MSA and taxable amounts (if applicable)

3 Simple Steps to Complete Your Form 1099-SA E-filing

Filing your Form 1099-SA with TaxZerone is fast, easy, and secure.

Here’s how you can do it in just three simple steps:

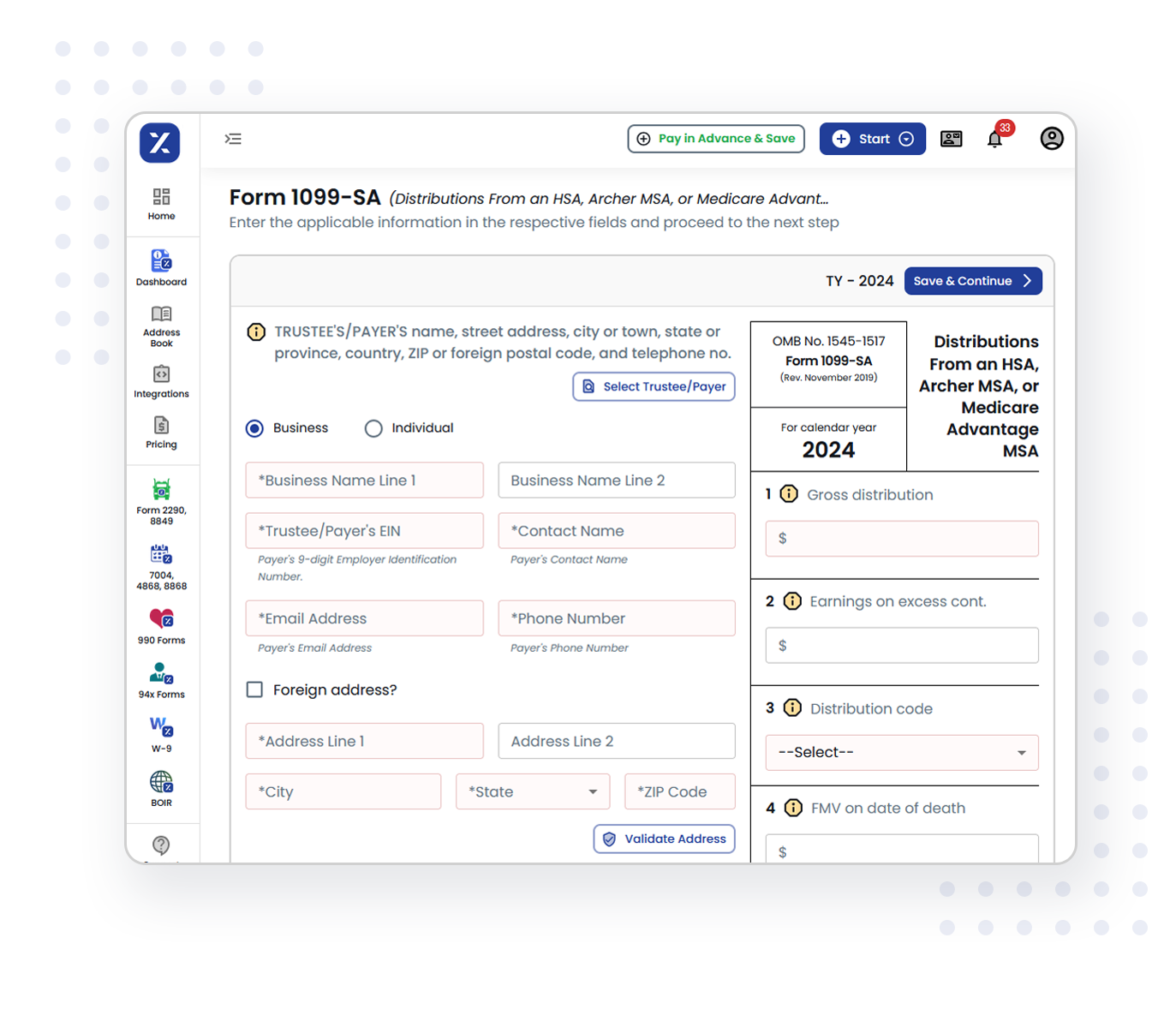

Enter Information for Form 1099-SA

Simply fill in your Business/Individual details (EIN/SSN), recipient's information (name, address, TIN), and distribution amounts.

Review & Transmit

Ensure accuracy with TaxZerone’s IRS validations, then securely e-file your Form 1099-SA to the IRS.

Send Recipient Copy

Securely deliver the recipient's copy via ZeroneVault, ensuring safe sharing, or choose postal mail for a physical copy.

Why Choose TaxZerone for Form 1099-SA E-filing?

TaxZerone is the trusted e-filing solution for businesses of all sizes. Here’s why:

IRS Form Validations

With TaxZerone, you can be confident that your Form 1099-SA submissions are accurate and compliant. Our system automatically checks for errors or missing information, reducing the risk of IRS rejections and penalties.

Supports Bulk Upload

Filing multiple 1099-SA forms is easy with TaxZerone’s bulk upload feature. Upload and file numerous forms in one go, saving you valuable time and effort.

Share Recipient Copies

Once your Form 1099-SA is filed, securely share copies with recipients through ZeroneVault for quick and safe electronic delivery. Alternatively, opt for postal mailing to provide physical copies, ensuring timely and secure delivery based on recipient preferences.

Best Price in the Industry

TaxZerone offers the most competitive pricing in the industry. Whether you’re filing one form or many, our e-filing services help you save time and money without compromising on quality.

Form-based Filing

Filing Form 1099-SA is quick and easy with TaxZerone’s user-friendly form-based interface. Fill in the required fields, and let us handle the rest.

Guided filing

Not sure about a specific field or requirement? Our guided filing process offers step-by-step instructions, helpful prompts, and real-time support, ensuring that you confidently complete your

Form 1099-SA filing.

Important Deadlines for Filing Form 1099-SA

Send Recipient Copies

Deadline: January 31, 2025 Deliver recipient copies on time through ZeroneVault for secure electronic sharing or opt for postal mail.

File with the IRS (e-file)

Deadline: March 31, 2025 Submit your Form 1099-SA electronically.

File with the IRS (paper)

Deadline: February 28, 2025 Mail your Form 1099-SA if filing on paper.

Save time and stress with TaxZerone. File your 1099-SA on time and effortlessly.

Start Filing Now!E-file Form 1099-SA Pricing Calculator

| No. of Forms | Price Per Form |

|---|---|

| 1 to 25 | $2.49 |

| 26 to 50 | $1.99 |

| 51 to 100 | $1.59 |

| 101 to 250 | $1.29 |

| 251 to 500 | $1.09 |

| 501 to 1000 | $0.79 |

| 1001 and above | $0.59 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Postal Mailing | Price Per Form |

|---|---|

| Per Form | $1.75 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

| W-2/1099/1095 Electronic Delivery | Price Per Form |

|---|---|

| Per Form | $0.50 |

Estimate Your Price

| Enter the number of to calculate your estimated cost | |

| Total Price: | $0.00 |

State Filing Not Required for Form 1099-SA

There are no state-specific tax filing requirements for Form 1099-SA. TaxZerone ensures your federal filing is complete and compliant, so you don’t need to worry about any additional state-level reporting.

Schedule Filing: Plan Ahead and Stay On Track

Want to ensure your filings are submitted on time without the stress? With Schedule Filing, you can prepare your Form 1099-SA filings in advance, and we’ll take care of the submission when the time comes

Choose Your Filing Date

Set your preferred filing date, and we’ll ensure your forms are submitted to the IRS promptly and accurately.

Ensure Accuracy

Recipients can review their 1099-SA forms before submission, allowing them to identify and correct any errors in advance.

Avoid the Need for IRS Correction Forms

Scheduling your filing provides an opportunity to validate all details beforehand, reducing errors and eliminating the hassle of filing IRS correction forms later.

Share Recipient Copies with Ease

TaxZerone makes it simple to deliver Form 1099-SA copies to your recipients securely and on time.

Choose the method that works best for your business:

Secure Delivery via ZeroneVault

- Share recipient copies electronically through ZeroneVault, a secure and easy-to-use platform.

- Recipients can access their forms instantly, eliminating the need for printing or mailing.

- ZeroneVault ensures top-notch data security, giving you peace of mind when sharing sensitive tax information.

Traditional Postal Mailing

- Prefer to send a physical copy? TaxZerone also offers postal mailing services.

- Recipient copies are delivered promptly, ensuring compliance with IRS deadlines.

- Save time and eliminate stress by allowing TaxZerone to manage the mailing process for you.

Get Started with TaxZerone Today

Filing Form 1099-SA online has never been easier. With TaxZerone, you can:

- File quickly and accurately.

- Stay compliant with IRS requirements.

- Save time with bulk upload.

- File at the best price in the industry.

Start your e-filing process today and complete your Form 1099-SA in just 3 simple steps!

Frequently Asked Questions

1. What is Form 1099-SA?

- Used to report distributions from HSAs, Archer MSAs, and Medicare Advantage MSAs.

- Includes details on the amount distributed and the purpose of the distribution.

- Essential for reporting on your tax return.

2. Who Needs to File Form 1099-SA?

- Trustees or custodians are responsible for filing the form.

- Form 1099-SA must be sent to both the IRS and the account holder.

- Helps ensure accurate tax reporting for the account holder.

3. When is the Deadline to File Form 1099-SA?

- January 31: Last day to send recipient copies.

- February 28: Last day for paper filing.

- March 31: Last day to file electronically.

4. What are the Penalties for Late Filing of Form 1099-SA?

- If filed within 30 days of the deadline: $60 per form, maximum penalty $664,500 per year ($232,500 for small businesses)

- If filed after 30 days but before August 1: $130 per form, maximum penalty $1,993,500 per year ($664,500 for small businesses)

- If filed after August 1 or not filed at all: $330 per form, maximum penalty $3,987,000 per year ($1,329,000 for small businesses)