Form 8582 Passive Activity Loss Limitations

Report your passive losses quickly and accurately!

Form 8582 is used to calculate how much of a trust’s passive activity losses - such as rental real estate or royalty losses - can be deducted for the current tax year. Because the IRS limits passive loss deductions, the form helps separate the losses that are allowable now from the suspended losses that must be carried forward.

When e-filing Form 5227 filers report allowable rental real estate losses on Schedule E (Form 1040), Part I, Line 22. This amount may include rental losses from prior years that become deductible after applying the passive activity loss limitations. Form 8582 is completed only when necessary to calculate the allowable loss. Line 28 is used solely to disclose certain prior-year unallowed losses that are not reported on Form 8582 and does not allow a deduction. Royalty losses should not be reported on Line 22.

Table of Contents

What is Form 8582 Attachment?

Form 8582 is an IRS form used to determine how much of a trust’s passive activity losses - such as rental real estate or royalty losses - can be deducted in the current tax year. It also tracks carried forward passive losses from prior years, helping show which losses are allowed now and which must remain suspended for future use.

Understanding Passive Activity Losses (PAL)

Passive activity loss limitations happen when the expenses from a rental or other passive activity are greater than the income it earns. The IRS does not allow trusts to deduct all passive losses at once, so the trust must use 8582 form to determine the allowable portion for the year.

Who must Attach Form 8582?

Any Form 5227 filer who reports rental income, royalty income, or other passive activity losses and shows a net loss must attach 8582 form. This includes split-interest trusts with rental properties, passive investments, or suspended losses from prior years.

How Form 8582 Relates to Schedule E (Form 1040)

If you e-file Form 5227, any allowable rental real estate loss for the year is reported on Schedule E (Form 1040), Part I, Line 22. This can include rental losses carried forward from prior years once they are allowed under the passive activity loss rules. Form 8582 is only completed when it’s needed to figure out how much of the loss you can claim. Line 28 is used to show certain prior-year losses for disclosure only and does not affect your deduction. Royalty losses are not entered on Line 22.

How to File Form 8582 Attachment with TaxZerone

TaxZerone allows you to upload Form 8582 as an attachment when you file Form 5227. The system makes sure the attachment is included, providing the IRS with a complete and accurate picture of your passive income, allowable losses, and any losses that were suspended.

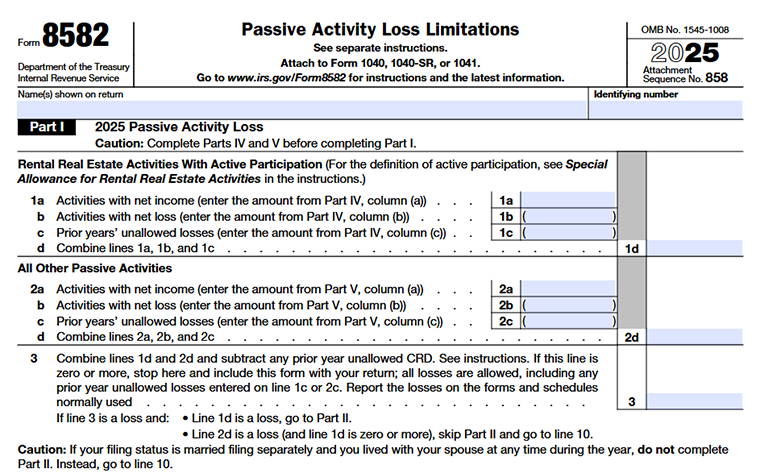

Part I: 2025 Passive Activity Loss

Part I is where you'll combine net income and net losses from all passive activities to see if a Passive Activity Loss (PAL) applies for 2025. Before filling out Part I, you'll need to calculate the necessary amounts using Parts IV and V.

- Part IV is for rental real estate activities where you actively participate.

- Part V applies to all other passive activities.

Rental Real Estate Activities with Active Participation

Line 1a: Enter total net income from activities shown in Part IV, column (a).

Line 1b: Enter total net losses from Part IV, column (b).

Line 1c: Enter prior years’ unallowed losses from Part IV, column (c).

Line 1d: Combine the amounts from lines 1a, 1b, and 1c to determine the total.

All other passive activities (from Part V)

Line 2a: Enter total activities with net income from Part V, column (a).

Line 2b: Enter total activities with net loss from Part V, column (b).

Line 2c: Enter prior year unallowed losses from Part V, column (c).

Line 2d: Combine amounts from lines 2a, 2b, and 2c.

Line 3: Overall passive gain or loss

Combine lines 1d and 2d, then subtract any prior year unallowed Commercial Revitalization Deduction (CRD). Enter the final amount on line 3.

- If the result is zero or more, stop here. Attach this form to your return - all passive losses are allowed, including prior-year unallowed losses reported on lines 1c or 2c. Report the losses on the applicable forms and schedules as usual.

- If loss:

- If line 1d is a loss, continue to Part II.

- If line 2d is a loss (and line 1d is zero or positive), skip Part II and go directly to line 10.

If you have a prior year unallowed CRD from rental real estate activities, treat it as a negative amount. Combine it with lines 1d and 2d, enter the total on line 3, and write “CRD”with the negative amount on the dotted line.

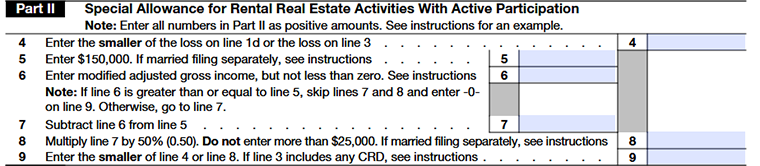

Part II: Special Allowance for Rental Real Estate Activities with Active Participation

Line 4: Enter the smaller loss

On line 4 of Part II, enter the smaller of:

- The loss on Part I, line 1d, or

- The loss on line 3.

Example:

- Part I, line 1d, shows a loss of $3,000.

- Line 2d shows a gain of $100.

- The combined loss on line 3 is $2,900.

Since $2,900 is smaller than $3,000, you enter $2,900 as a positive number on Part II, line 4.

Line 5: Special Income Limit for Married Filing Separately

If you file as Married Filing Separately and live apart from your spouse for the entire year, enter $75,000 on line 5 instead of $150,000.

Line 6: Modified adjusted gross income (MAGI)

Enter your Modified adjusted gross income (MAGI), then remove the following amounts if they are included:

- Passive activity losses

- Rental real estate losses allowed to real estate professionals

- Taxable Social Security or Tier 1 railroad retirement benefits

- Deductible traditional IRA and section 501(c)(18) pension contributions

- The deductible part of self-employment tax

- Excluded interest from EE and I U.S. savings bonds used for education

- Employer-provided adoption assistance exclusions

- Student loan interest deduction

- FDII and GILTI deductions

Then add back:

- Portfolio income and related expenses

- Any income treated as nonpassive (such as gains from PTPs or recharacterized passive income)

- Any overall loss from a fully disposed passive activity

Enter the final amount on line 6. If the result is less than zero, enter 0.

Example:

If your AGI is $92,000 and includes $5,500 of taxable Social Security benefits, enter $86,500 on line 6.

Line 7: Income Difference Calculation

Subtract line 6 from line 5 and enter the result on line 7.

Line 8: Special Allowance Amount Calculation

- This calculation follows the IRS rules for the special allowance on Line 8.

- You multiply Line 7 by 50% (0.50) and enter the result, but the maximum you can enter is $25,000.

Special case for Married Filing Separately:

- If you lived apart from your spouse for the entire year, the maximum is $12,500.

Line 9: Allowed rental loss now

No prior-year unallowed CRD: Enter the smaller of Line 4 or Line 8

With prior-year unallowed CRD (from Line 3):

- First, calculate the $25,000 special allowance for current-year rental losses (Lines 4–8), ignoring prior-year CRD.

- If there’s a current-year loss (Line 1d) and a prior-year CRD loss (Line 3), use the IRS Worksheet to determine how much of the remaining allowance can apply to the prior-year CRD.

- Enter the Worksheet result on Line 9.

Worksheet Steps (all numbers as positive amounts):

- Start with $25,000 (or $12,500 if married filing separately and lived apart) and subtract the smaller of Line 4 or Line 8.

- Enter your prior-year CRD loss from Part I, Line 3.

- Subtract the smaller of Line 4 or Line 8 from Line B.

- Enter the smallest of:

- Prior unallowed CRD

- Line A

- Line C

Finally, add Line D to the smaller Line 4 or Line 8, and enter that total on Line 9. Write “CRD” and the CRD amount on the dotted line.

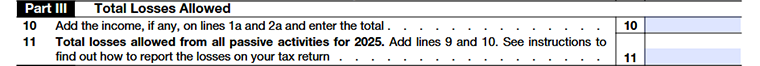

Part III: Total Losses Allowed

Line 10: Total Income

Add the amounts from Line 1a and Line 2a and enter the sum on Line 10.

Line 11: Total Passive Losses Allowed

- Add Line 9 and Line 10 to get the total losses allowed from all passive activities for 2025.

- The allowed loss to report on your tax return.

- Any unallowed loss that can be carried forward to future years.

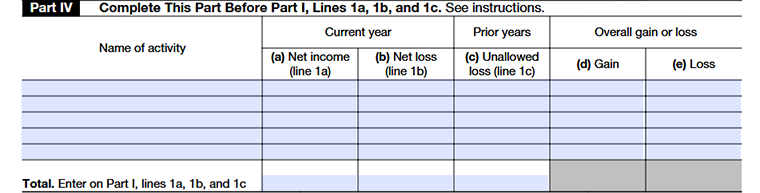

Part IV: Complete This Part Before Part I, Lines 1a, 1b, and 1c

Include income or losses from rental real estate activities if you actively participated when calculating Part I, lines 1a–1c, of Form 8582.

Prior year unallowed losses: Only enter them in Part IV, column (c) if you actively participated in both the year the loss aroseand the current year. Otherwise, report them in Part V.

Column (a): Current-Year Income

- Enter the net income for each activity in column (a).

- Add all amounts in column (a) and enter the total on Part I, line 1a, of Form 8582.

Example:

If a Schedule E rental activity earns $5,000 and a Form 4797 gain is $2,000, enter $7,000 in column (a).

Column (b): Current Year Loss

- Enter the net loss for each activity here. Do not include prior year unallowed losses.

- Add the amounts in column (b) and enter the total on Part I, line 1b of Form 8582.

- If an activity has both income and loss on different forms,report income in column (a) and loss in column (b).

Example:

Schedule E shows $1,000 income, Form 4797 shows $4,500 loss → enter $1,000 in column (a) and $4,500 in column (b).

Column (c): Prior Year Losses

- Enter any losses from prior years that were not allowed for each activity.

- You can find these amounts on your 2024 Form 8582, Part VII, column (c).

- Total column (c) and enter the result on Part I, line 1c, of your 2025 Form 8582.

Columns (d) and (e): Overall Gain or Loss

Combine the amounts in columns (a) through (c) for each activity. Enter the overall gain in column (d) or the overall loss in column (e).

Do not carry these amounts to Parts I, II, or III of Form 8582. They are used later in the form to determine the loss allowed for the current year.

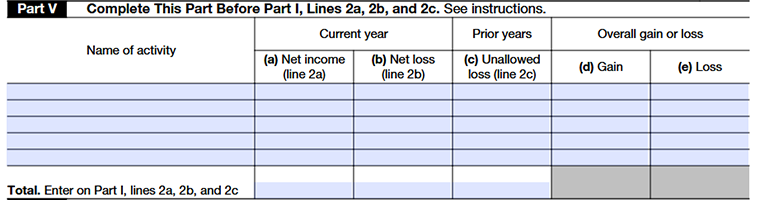

Part V: Complete This Part Before Part I, Lines 2a, 2b, and 2c

Use Part V to determine the amounts to report on Part I, lines 2a–2c,for:

- Passive trade or business activities,

- Passive rental real estate activities that don’t qualify for the special allowance,

- Rental activities that are not rental in real estate.

If you have prior-year unallowed CRD from passive activities other than rental real estate, include it in Part V and write “CRD” next to the activity name.

Column (a): Current Year Income

- Enter the net income for each activity in column (a).

- Add all amounts in this column and report the total on Part I, line 2a, of Form 8582.

Column (b): Current Year Loss

- Enter the net income for each activity in column (b).

- Add the amounts and report the total on Part I, line 2b, of Form 8582.

Column (c): Prior Year Unallowed Losses

- Enter any losses from prior years that were not allowed for each activity.

- These amounts come from Part VII, column (c), of your 2024 Form 8582.

- Total column (c) and enter the result on Part I, line 2c, of your 2025 Form 8582.

Columns (d) and (e): Overall Gain or Loss

- Combine the amounts in columns (a) through (c) for each activity.

- Enter the overall gain in column (d) or the overall loss in column (e).

- Do not carry these amounts to Parts I, II, or III of Form 8582.

- They are used later to determine the loss allowed for the current year.

Parts IV and V: Gains and Losses

- Columns (d) and (e) show overall gains or losses for each activity.

- Overall gain: Report all amounts from columns (a) - (c) on your tax forms, including Form 8582.

- Overall loss: Allocate your allowed loss from Part III, Line 11 using Parts VI-IX.

- Complete Part VI only if Part II, Line 9, has an amount; otherwise, use Part VII for losses and any prior year unallowed CRD.

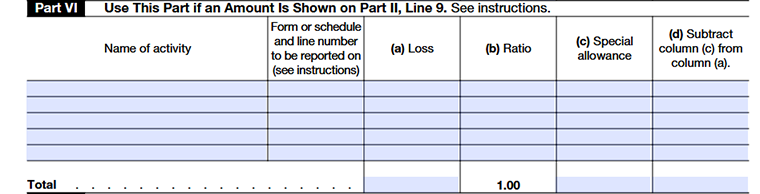

Part VI: Use This Part if an Amount Is Shown on Part II, Line 9

Use Part VI to allocate the special allowance from Part II, line 9, across your rental real estate activities.

- Complete a separate Part VI if any allowance is applied to prior-year unallowed CRD.

- List each activity name in the first column and the form, schedule, and line number where the loss is reported in the second column (list multiple locations if applicable or attach a statement).

If line 9 includes no prior-year CRD, list all activities with an overall loss from Part IV, column (e).

If prior-year unallowed CRD is included, complete an additional Part IV for those CRD activities and enter the prior-year CRD in column (a), then complete columns (b) and (c) as instructed.

Column (a): Loss

Enter the overall loss for each activity from Part IV, column (e).

Column (b): Ratio

- Divide each activity’s loss by the total loss for all activities to find its share. Enter this percentage in column (b).

- All percentages in column (b) must add up to 1.00.

Column (c): Allocate Special Allowance

No prior year CRD:

Multiply each ratio in column (b) by Part II, line 9 of Form 8582 and enter the result. The total of column (c) must equal line 9.

With prior-year CRD:

- For current-year rental activities with active participation, multiply each ratio by the lesser of line 4 or line 8.

- For prior year unallowed CRD, multiply each ratio by the amount from line D of the Worksheet.

Totals:

- Column (c) for active rental activities = the lesser of line 4 or line 8.

- Column (c) for prior-year CRD = amount from line D of the Worksheet.

Total: Full Allowance Check

- If the total of column (c) equals the total of column (a),the losses in Part IV (or, for prior-year CRD, the amount in Part I, line 3) are fully allowed anddo not carry over to Part VII.

- Report all amounts from columns (a), (b), and (c) of Part IVon the appropriate forms and schedules.

Total: Partial Allowance

- If the total amount of column (c) is less than column (a), the losses are only partially allowed.

- Complete column (d) to calculate the remaining amounts.

Column (d): Loss after Special Allowance

- Subtract column (c) from column (a) and enter the result in column (d).

- Then carry this amount to Part VII, column (a).

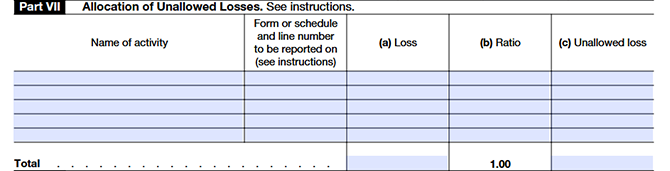

Part VII: Allocation of Unallowed Losses

Complete Part VII if any activity shows an overall loss in Part V, column (e) or a loss in Part VI, column (d) (or Part IV and prior-year CRD in Part I, line 3, if Part VI was not needed).

List each activity’s name and the form, schedule, and line number where the loss is reported.

If the loss includes prior year unallowed CRD (from non-rental or rental real estate activities), add “CRD” after the activity name.

Column (a): Loss Amounts

Enter the losses from:

- Column (d) of Part VI (which includes column (e) of Part IV and any prior year unallowed CRD from Part I, line 3, if Part VI wasn’t needed), and

- Column (e) of Part V, if any.

Column (b): Loss Allocation Ratio

For each activity, divide its loss in column (a) by the total of all losses in column (a). Enter this ratio in column (b).

The sum of all ratios must equal 1.00.

Column (c): Compute Remaining Loss

- Enter Part I, line 3 of Form 8582 as a positive amount (Line A).

- Enter Part II, line 9 of Form 8582 (Line B).

- Subtract Line B from Line A (Line C).

- Multiply each ratio in column (b) by Line C and enter the result in column (c).

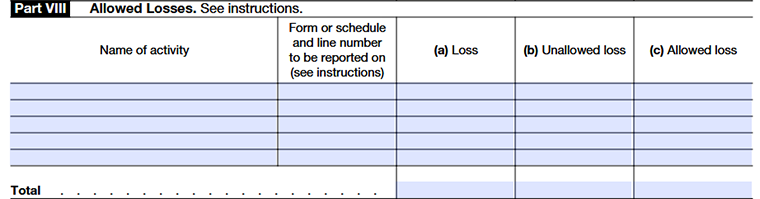

Part VIII: Allowed Losses

Use Part VIII for any activity listed in Part VII if all the loss is reported on a single form or schedule and no separate transactions need to be identified.

- Enter the name of each activity and the form, schedule, and line number where the loss is reported.

- If the activity includes prior-year unallowed CRD, list it on a separate line and add “CRD” after the activity name.

- Even if part of the loss is current-year and part is prior-year, use Part VIII to determine the allowed loss

Column (a): Total Loss

- Enter the net loss plus any prior year unallowed loss for each activity.

- Add losses from columns (b) and (c) of Parts IV and V and any prior-year CRD from Part I, line 3.

Column (b): Unallowed Loss

- Enter the amount from Part VII, column (c) for each activity.

- These are your 2025 unallowed losses. Keep a record for next year’s PAL calculation.

Column (c): Allowed Loss

- Subtract column (b) from column (a).

- This is the 2025 allowed loss.

- Report these amounts on the appropriate forms and schedules, following any additional limitations.

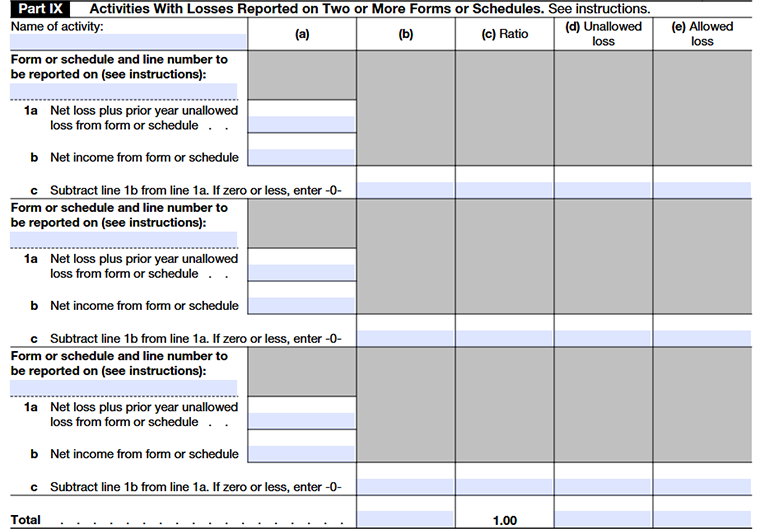

Part IX: Activities With Losses Reported on Two or More Forms or Schedules

Use Part IX for any activity listed in Part VII if its losses are reported on more than one form or schedule or must be separately identified on the same form (for example, 28%-rate and non-28%-rate capital losses on Form 8949).

Part IX divides the allowed and unallowed losses for the activity and assigns the allowed loss to the correct forms or schedules. Only losses that affect tax liability differently are separated, including those reported on:

- Schedules C, E, and F, and

- Form 8949, Parts I and II (28%-rate and non-28%-rate losses).

Line 1a

Column (a): Net loss plus prior year unallowed loss

- Enter the total loss for the activity, including any prior-year unallowed loss, if it is reported on the same form - or, for Form 4797 or Form 8949, the same part of the form.

- If you have both 28% rate andnon-28% rate losses on Form 8949, review the Form 8949 example before completing Part IX.

Line 1b

Column (a): Net income from form or schedule

- Enter any net income from the activity that is reported on the same form or schedule - or the same part of the same form - as the loss entered on line 1a, column (a).

Example:

- If you report a prior-year unallowed loss from Form 4797, Part I on line 1a and the activity has a current-year gain on the same form and part, enter that gain on line 1b, column (a).

- If there is no gain, enter 0 on line 1b, column (a).

Line 1c

On line 1c, subtract the income on line 1b from the total loss shown on line 1a. If the result is zero or a negative number, enter 0. This line shows how much loss remains after offsetting any income from the activity

Column (b): Net income from form or schedule

- Subtract line 1b, column (a) from line 1a, column (a) and enter the result in column (b).

- If line 1b, column (a) is greater than line 1a, column (a), enter 0 in column (b).

Column (c): Ratio

- Divide each loss in column (b) by the total of column (b)and enter the result as a ratio.

- All ratios in this column must add up to 1.00.

Column (d): Unallowed loss

- Multiply the unallowed loss from Part VII, column (c) by each ratio in column (c) of Part IX.

- If column (b) shows 0, enter 0 in column (d) for that form or schedule.

Column (e): Allowed loss

Subtract column (d) from the loss shown on line 1a, column (a). The result is the loss allowed for 2025 under the passive loss rules.

Report this allowed loss on the appropriate forms or schedules, following any other applicable limitations. The forms must reflect both:

- The allowed loss from column (e), and

- Any related income for the activity from Part IV or Part V, column (a).

Parts VIII and IX: Allowed vs. Unallowed Losses

Parts VIII and IX are used to determine the allowed and unallowed losses for each activity.

- Use Part VIII when all losses from an activity are reported on one form or schedule, and no separate transactions need to be identified.

- Use Part IX if an activity’s losses are reported on more than one form or schedule, or if the activity includes multiple transactions that must be reported separately (such as certain capital losses taxed at different rates).

Ready to complete your Form 5227 e-filing?

Ensure compliance with IRS passive activity loss regulations. TaxZerone provides a secure

and efficient way to attach IRS Form 8582 and electronically file Form 5227 with accuracy and confidence.