Form 941 Bulk Upload

TaxZerone’s Bulk Upload feature helps you to file multiple returns at once in just

a few easy steps — it’s fast, simple, and saves you time!

Filing returns for multiple clients or businesses is easier and more efficient when you have the right tools in place. Bulk upload is a time-saving option for tax professionals handling Form 941 filings for multiple businesses.

With TaxZerone’s Bulk Upload Feature, you can quickly import all your Form 941 data at

once — no repetitive data entry, just fast and accurate e-filing.

Table of Contents

What is Bulk upload?

Bulk upload is a feature offered by TaxZerone which helps you submit multiple Form 941 returns at once using a single excel file. Instead of entering each employer’s information, you can fill out an excel template with all the required data and upload it in one go.

Tired of entering Form 941 data one by one?

Use our Bulk Upload feature and file your return in minutes.

Who can use bulk upload?

Bulk upload can be used by tax professionals, payroll service providers, and businesses that need to file Form 941 for multiple clients or entities. If you are managing filings for many employers, bulk upload helps for faster processing, saving time, and reducing errors.

What file formats will be accepted?

TaxZerone accepts Excel (.xlsx) format only. We already provided a preformatted

Excel template for Form 941 bulk uploads. You fill in the excel sheet, upload it, and you are ready to go.

Steps to Bulk Upload Form 941 with TaxZerone

Follow these steps to bulk upload your Form 941 with TaxZerone.

Step 1:

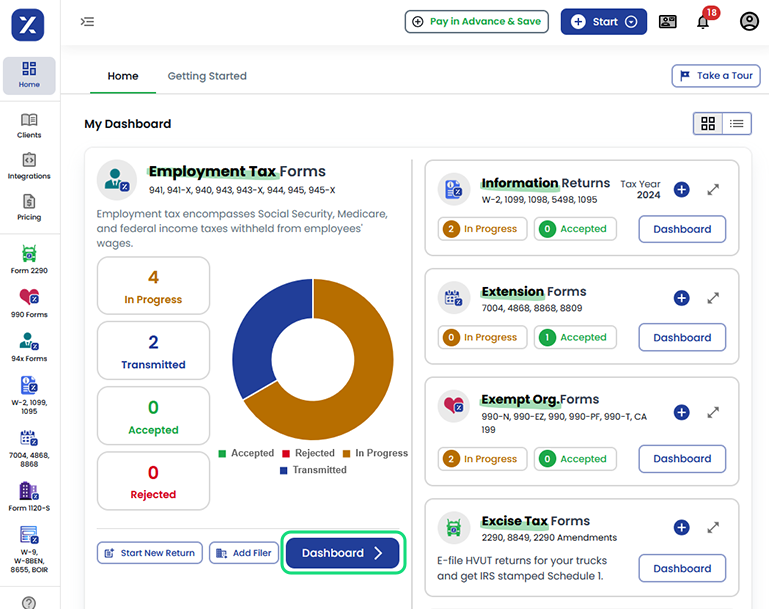

- Sign In to TaxZerone account using your credentials and move to the “Employment Tax Dashboard”.

- Then click on the “Dashboard” button to begin your Employment Tax filing.

Step 2:

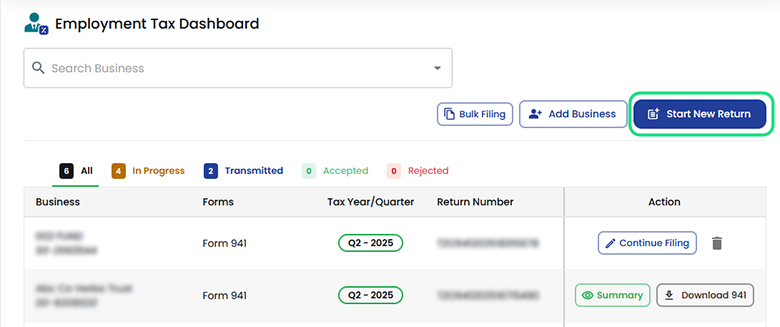

Select the “Start New Return” button

Step 3:

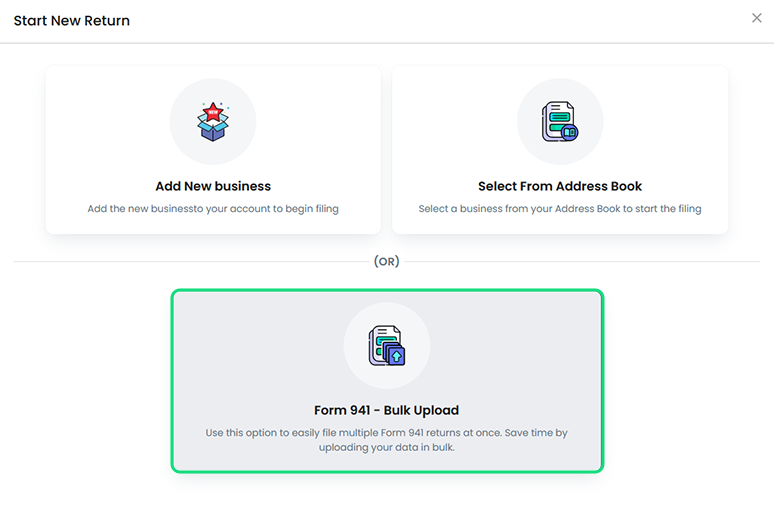

Choose the “Form 941- Bulk Upload” option to file multiple employment tax forms together.

Step 4:

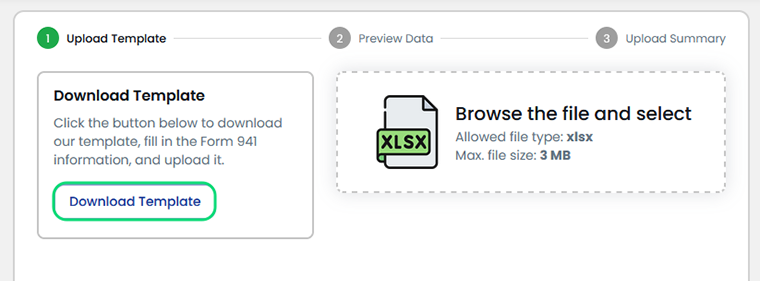

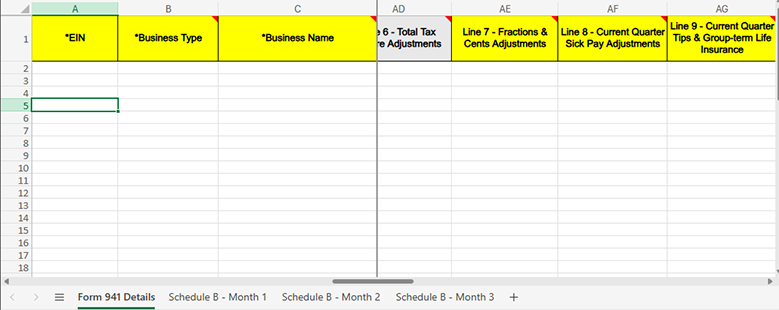

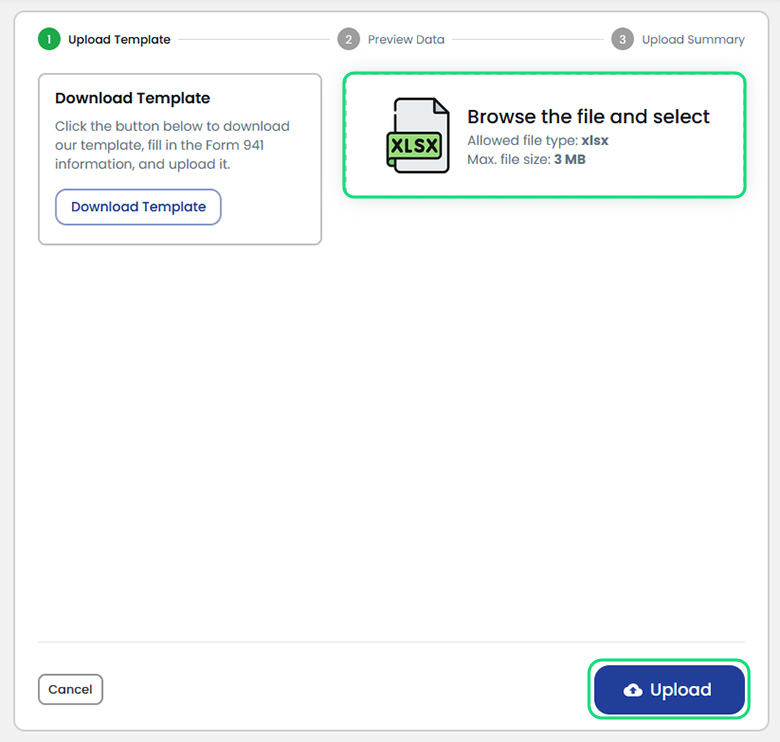

1.Upload Template

- Download the bulk upload template (Excel format), fill in the Form 941 details, and upload it.

- Enter the employer information, tax details, Schedule B (Month 1, Month 2, Month 3) accurately for each EIN/business in the template and upload it.

- The grey colored fields in the template are automatically calculated, so you can leave them blank.

(or)

- Upload your Excel file that includes all the necessary Form 941 details for each employer.

- Make sure the information is completed and formatted correctly to ensure a smooth and accurate bulk filing process.

- Click on ‘Upload’ to move on to the next step.

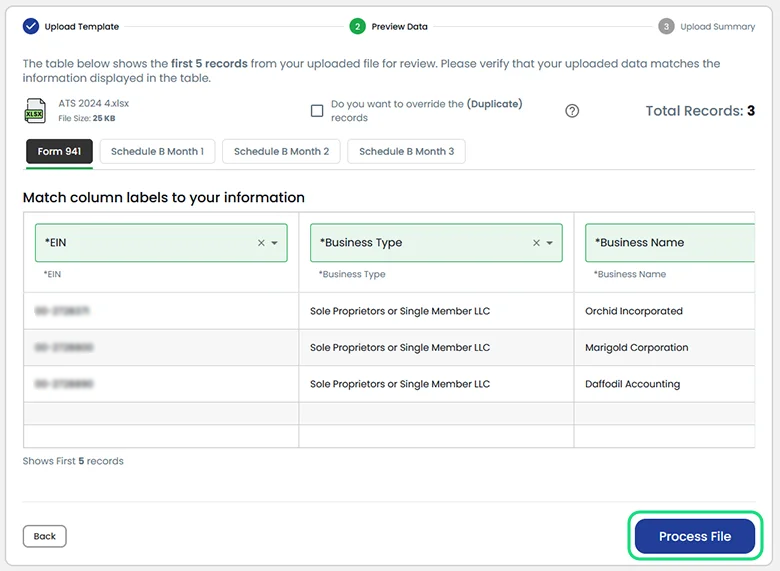

2. Preview Data

- Preview your uploaded data and make sure that all the information has been accurately mapped to the correct fields on Form 941.

- If you notice any errors or mismatches, make the necessary corrections before proceeding.

- Then, click on “Process File” to process the data.

3. Upload summary

Check the status of your Form 941 submission.

- If any errors are detected, go to the Error Records tab to view detailed information about the issues. From there, you can make corrections in your file and re-upload the updated version to continue with your submission.

- If there are no corrections, click on the “Go to Review” button.

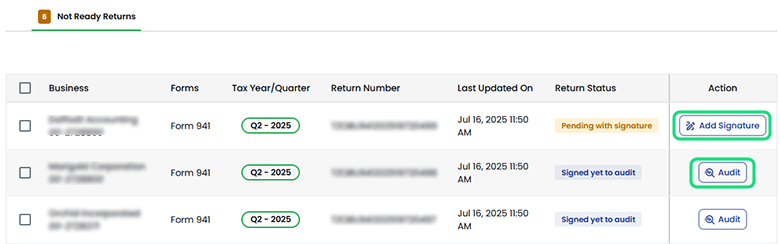

Step 5:

- If the Action column shows “Add Signature”, Click the button to attach an IRS-authorized electronic signature ( 94x Online Signature PIN or Form 8453-EMP) to the return.

- or

- If the Action column shows only “Audit”, Click on the button.

Step 6:

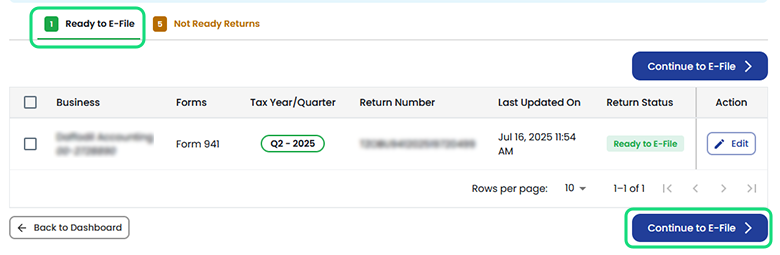

Now all your returns are organized into two sections.

1. Ready to E-File

This list contains all the returns that are complete and ready for submission. You can select multiple returns from this section and e-file them in bulk.

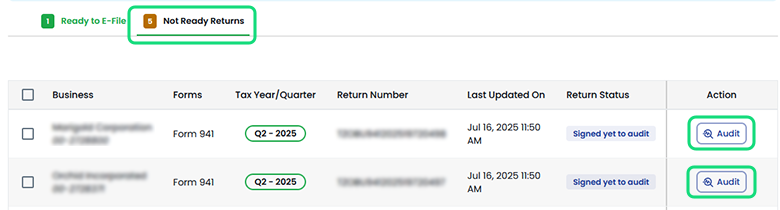

2. Not Ready Returns

These are returns that still require validation. Click on“Audit” and the return will move to the Ready to E-File section.

Step 7:

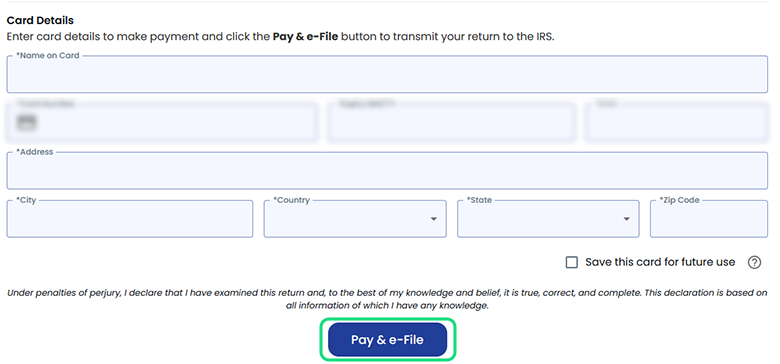

Enter your card details and click “Pay & e-File” to complete your payment and securely submit your return to the IRS.

Benefits of Bulk Upload with TaxZerone

- Save Time and Effort: Upload and file multiple returns at once, no need to enter data manually for each form.

- Easy Excel Integration: Simply upload a pre-filled Excel sheet and let our system map your data to the correct fields automatically.

- Error Detection Made Easy: Instantly identify and fix errors with detailed feedback through the "Error Records" tab before submission.

- Faster E-Filing in Bulk: Select all validated returns and e-file them in just a few clicks—no repetitive steps.

Ready to E-File with TaxZerone?

E-file all your Form 941 returns in one simple upload —fast,

easy, and efficient with TaxZerone.