Form 4868 Instructions

E-file your IRS Form 4868 for individuals to request an automatic extension for your 2025 tax return.

Excise Tax Forms

Employment Tax Forms

Information Returns

Exempt Org. Forms

Business Tax Forms

FinCEN BOIR

General

IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows individual taxpayers to request additional time to file their income tax return. This extension applies to U.S. citizens and residents who need more time to complete their Form 1040, 1040-SR, 1040-NR, or 1040-SS. Filing Form 4868 grants a 6-month extension for filing tax returns.

For U.S. citizens or residents who are out of the country on the regular due date, the IRS allows an additional 2 months to file their return and pay any amount due without requesting an extension, making the new deadline June 16, 2026. However, if more time is needed, filing Form 4868 can provide an extra four months, giving taxpayers until October 15, 2026, to file.

Who Can File Form 4868?

Any U.S. citizen or resident unable to file their income tax return by the deadline can submit Form 4868 to request an extension.

This extension applies to the following federal income tax returns:

- Form 1040 – U.S. Individual Tax Return

- Form 1040-SR – U.S. Tax Return for Seniors

- Form 1040-NR – U.S. Nonresident Alien Income Tax Return

- Form 1040-SS – U.S. Self-Employment Tax Return

When is Form 4868 Due?

For the 2025 tax year, the deadline for filing Form 4868 is April 15, 2026.

Individual taxpayers who want an extension must file 4868 Form on or before the due date for the actual tax return to be filed. However, if the due date falls on weekends or federal holidays, then the filing deadline will be the next business day.

Filing Form 4868 for the 2025 tax year will extend the filing deadline to October 15, 2026.

Taxpayers who are out of the country on the original due date get an automatic 2-month extension until June 15, 2026. They can file Form 4868 to receive an additional 4-month extension.

Extend Your Income Tax Deadline in Minutes!

File Form 4868 electronically with TaxZerone and get extra time to finalize your tax return. Just 3 simple steps, done in minutes.

Form 4868 penalty

If taxpayers fail to file their income taxes on time or fail to pay taxes, they may face penalties from the IRS:

| Late Filing Penalty | Late payment Penalty |

|---|---|

| The penalty is 5% of the unpaid tax per month. | The penalty is 0.5% of the unpaid tax per month. |

| The maximum penalty is 25%. | The maximum penalty is 25%. |

| If the return is over 60 days late, the minimum penalty is $510 (adjusted for inflation) or the balance of the tax due, whichever is smaller. |

Filing an extension with Form 4868 gives you extra time to file your return, but not extra time to pay. Ensure timely payments to avoid penalties and interest.

Form 4868 Instructions - How to fill out?

To fill out the extension request accurately, follow the Form 4868 instructions below

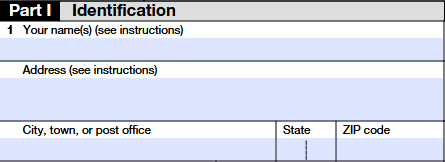

Part I: Identification

Line 1 – Name and Address

- Name(s): Enter your full legal name (and spouse’s name for joint filers).

- Address: Provide your current mailing address.

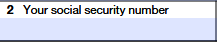

Line 2 - Social Security Number (SSN) or Employer Identification Number (EIN):

- Enter your social security number (SSN).

- Estates or trusts filing Form 1040-NR should enter their EIN and write "estate" or "trust" in the left margin.

- Nonresidents without an SSN must apply for an ITIN using Form W-7.

Line 3 – Spouse’s SSN (If Filing Jointly) spouse’s SSN.

- Enter your spouse’s SSN as it will appear on your joint tax return.

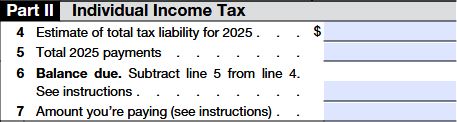

Part II: Individual Income Tax

Line 4—Estimate of Total Tax Liability for 2025

- Enter the total tax liability expected for 2025, based on:

- Form 1040, 1040-SR, or 1040-NR: Line 24; or

- Form 1040-SS: Part I, Line 7

(If the expected tax liability is zero, enter 0.)

Line 5—Estimate of Total Payments for 2025

- Enter the total tax liability you made for 2025, based on:

- Form 1040, 1040-SR, or 1040-NR: Line 33 (excluding Schedule 3, Line 10); or

- Form 1040-SS: Part I, Line 12 (excluding Line 11b)

( Do not include the amount you are paying with Form 4868)

Line 6—Balance Due

- Enter the Subtract Line 5 from Line 4. If Line 5 is greater than or equal to Line 4, enter 0.

Line 7—Amount You're Paying

- Enter the amount you are willing to pay in this line. In case you couldn’t pay the amount displayed on line 6, you can still get an extension. But you should pay as much as you can to limit the amount of interest you’ll owe. Also, you may be charged the late payment penalty on the unpaid tax from the regular due date of your return.

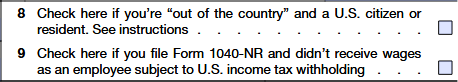

Line 8—Out of the Country

- Check this box if you were out of the U.S. on the original tax deadline.

- If eligible, this may allow additional time beyond the standard extension.

Line 9—Form 1040-NR Filers

- Check the box in this line if you filed Form 1040-NR and didn’t receive wages as an employee subject to U.S. income tax withholding.

How to file Form 4868?

Form 4868 can be filed with the IRS either electronically or by paper filing.

Individual taxpayers who want an extension must file Form 4868 on or before the due date for the actual tax return to be filed. However, if the due date falls on weekends or federal holidays, then the filing deadline will be the next business day.

Filing Form 4868 for the 2025 tax year will extend the filing deadline to October 15, 2026.

Electronic filing or E-filing

E-filing extension Form 4868 provides you with a lot of benefits. Even the IRS recommends electronic filing as the process is quick and you will get the instant status of your return. To file Form 4868 electronically, you can opt to use an e-file service provider.

TaxZerone is an IRS-authorized e-file service provider that supports the electronic filing of extension Form 4868. You can simply enter the required information, calculate the balance due, and transmit the return to the IRS.

Paper filing

You can also file Form 4868 with the IRS by manually filling out the form and sending it via postal email. If you are paper filing your extension form, make sure you are sending the return earlier before the deadline, as it may take some time for the return to reach the IRS

Although there are two filing options available for taxpayers to file an extension, the IRS recommends the e-filing of Form 4868 as it is simple, easy, and takes less time and cost compared to paper filing.

Choose E-filing. Choose TaxZerone.

Save your time, money, and effort by filing extension Form 4868 online with TaxZerone, an IRS-authorized e-file service provider.

Where to send Form 4868 - Mailing address

After filling out Form 4868, you are required to manually send the return to the IRS by postal mail. The address to which you need to send the returns will vary based on where you reside

Check out the mailing address for Form 4868 based on your location.

| IF you reside in | A your payment to Internal Revenue Service | AND you’re not making a payment, send Form 4868 to Department of the Treasury, Internal Revenue Service Center: | OR simply e-file Form 4868 using |

|---|---|---|---|

| Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas | P.O. Box 1302, Charlotte, NC 28201-1302 | Austin, TX 73301-0045 | TaxZerone At just $11.99/return |

| Arizona, Arkansas, New Mexico, Oklahoma | P.O. Box 931300, Louisville, KY 40293-1300 | Austin, TX 73301-0045 | E-file Form 4868 with TaxZerone in 3 simple steps |

| Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | P.O. Box 931300, Louisville, KY 40293-1300 | Kansas City, MO 64999-0045 | Complete your 4868 e-filing process with TaxZerone in less than 5 minutes |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, Wyoming | P.O. Box 931300, Louisville, KY 40293-1300 | Ogden, UT 84201-0045 | E-file 4868 extension with TaxZerone An IRS-authorized provider |

| A foreign country, American Samoa, or Puerto Rico, or are excluding income under Internal Revenue Code section 933, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien, or are a nonpermanent resident of Guam or the U.S. Virgin Islands | P.O. Box 1303, Charlotte, NC 28201-1303 | Austin, TX 73301-0215 USA | TaxZerone supports e-filing of Form 4868 with the IRS |

| All foreign estate and trust Form 1040-NR filers | P.O. Box 1303, Charlotte, NC 28201-1303 USA | Kansas City, MO 64999-0045 USA | File extension forms with TaxZerone and stay tax compliant |

| All other Form 1040-NR and 1040-SS filers | P.O. Box 1303, Charlotte, NC 28201-1303 USA | Austin, TX 73301-0215 USA | File extension forms with TaxZerone and get instant return updates |

How to e-file Form 4868?

E-filing extension Form 4868 can be completed in 3 simple steps. Before you start with the e-file process, keep the information below ready.

Information required to file Form 4868 online

- Your basic information such as name, SSN, and address. If filing a joint return, your spouse's name and SSN.

- Tax year

- Estimate of total tax liability for the tax year

- Total tax repayment amount

When you have all the information, you can then follow the steps below to e-file Form 4868 using TaxZerone.

Step 1: Select the tax year and enter the required information listed above.

Step 2: Calculate the balance due by providing estimated total tax liability for the tax year

Step 3: Transmit the return to the IRS.

Do you have all the required information to file your 4868 extension IRS?

Quickly e-file Form 4868 with TaxZerone and get up to a 6-month extension.

How to pay the balance due while filing Form 4868 online?

While completing step 2, if you have a balance due, you can opt to pay the due amount using the electronic funds withdrawal (EFW) option. You will need to provide your bank account information, such as account number, account type, and routing number.

Once the IRS processes your return, your balance due will be automatically debited from your account. Make sure to maintain a sufficient balance in your account.

E-file Form 4868 with TaxZerone

File 4868 extension form easily with TaxZerone at just $11.99/return. You will only have to enter the required information, calculate your balance due, and transmit the return to the IRS.

You will also get email updates on your return status as soon as the IRS processes it.

Ready to file Form 4868 online?

Takes 3 simple steps and less than 5 minutes