Form 15397 Instructions

File Form 15397 with TaxZerone and get a 30-day extension to send your recipient statements.

Excise Tax Forms

Employment Tax Forms

Information Returns

Exempt Org. Forms

Business Tax Forms

FinCEN BOIR

General

IRS Form 15397 allows businesses to request additional time to issue recipient copies of certain information returns. If you need more time to distribute recipient copies of Forms such as W-2, W-2G, 1042-S, 1095, 1097, 1098, 1099, 3921, 3922, and 5498, the Form 15397 helps you avoid penalties by requesting an extension.

This resource will help you understand who should file, when to file, and how to complete Form 15397 accurately.

Table of Contents

What is Form 15397

Form 15397 is used to request a one-time extension of up to 30 days to furnish recipient statements for certain information returns to recipients for the current tax year. This extension applies only to the recipient copies, not to the IRS filing deadline.

Need more time to furnish recipient copies?

File Form 15397 through TaxZerone and get your 30-day extension today.

Who should file Form 15397?

Issuer/Transmitter should file Form 15397 if:

- Need more time to send recipient copies of information returns (like Forms W-2, 1099s, or 5498s).

- Circumstances such as missing information or unexpected business issues prevent you from furnishing forms on time.

When to File Form 15397?

Form 15397 should be filed on or before the original due date but not before January 1 to furnish the recipient copies. The forms and their due dates are:

| Form | Recipient’s Due Date* |

|---|---|

| 1042-S | March 15 |

| 1095-B, 1095-C | February 28 |

| 1098, 1099, 3921, 3922, W-2G | January 31 |

| 1097 | Q1: May 15 Q2: August 15 Q3 November 15 Q4: February 15 |

| 1099-NEC | January 31 |

| 1099-QA | January 31 |

| W-2 | January 31 |

| 5498 | For FMV/RMD/ SIMPLE IRA contributions: January 31 For all other contributions: May 31 |

| 5498-ESA | April 30 |

| 5498-QA | March 15 |

| 5498-SA | May 31 |

*If the deadline falls on a weekend or legal holiday, the next business day will be considered.

The IRS grants a 30-day extension if the form is filed correctly, and the reason for filing an extension is valid.

What information do you need to file IRS Form 15397?

To complete Form 15397, the following details are required:

- Issuer’s/ Transmitter’s legal name

- Taxpayer Identification Number (TIN)

- Address and contact details

- Types of forms for which you’re requesting an extension

- Reason for requesting an extension

Step-by-Step instructions on how to complete Form 15397:

The instructions below will guide you on filing Form 15397 accurately with the IRS.

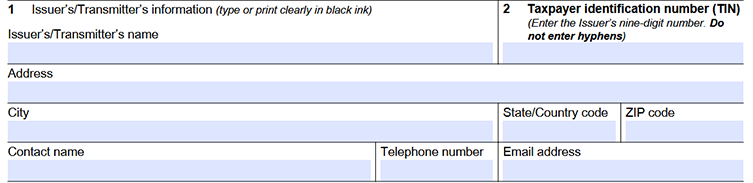

Line 1:

Enter the Issuer’s/Transmitter’s name, complete address such as City, State, and ZIP code. Also, enter the Contact name, Telephone number, and Email address of the person the IRS may contact regarding this form

Line 2:

- Enter the issuer’s nine-digit Employer Identification Number (EIN), Qualified Intermediary EIN (QI-EIN), Withholding Foreign Partnership EIN (WP-EIN), or Withholding Foreign Trust EIN (WT-EIN).

- If you don’t have an EIN or QI-EIN, enter your Social Security Number (SSN).

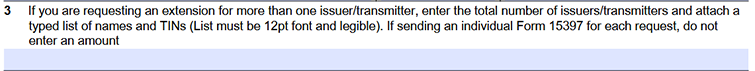

Line 3:

- If you are using a single Form 15397 to request an extension for many issuers or transmitters, include a typed list of each name and TIN along with the total number of issuers or transmitters.

- This field should be left empty if you are filing a different form 15397 for each issuer or transmitter.

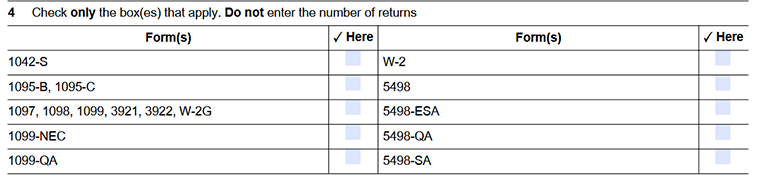

Line 4:

Check the boxes of the information return types for which you need more time to furnish recipient copies, such as:

- 1042-S

- 1095-B, 1095-C

- 1097, 1098, 1099, 3921, 3922, W-2G

- 1099-NEC

- 1099-QA

- W-2

- 5498

- 5498-ESA

- 5498-QA

- 5498-SA

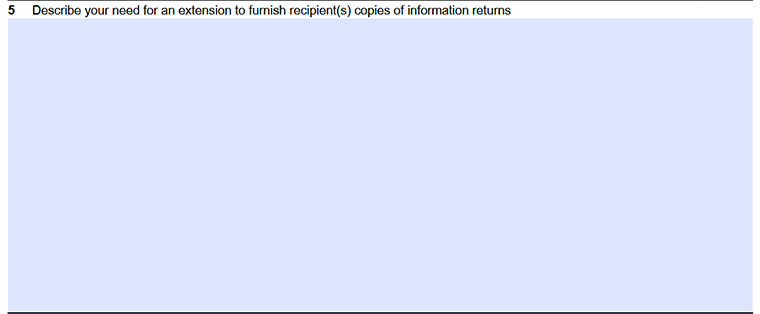

Line 5:

If you checked any boxes on Line 4, explain why you need more time to send the recipient copies of the information returns.

To confirm that the given details are true, enter the signature and title of the issuer along with the date.

How to Submit Form 15397 by Fax?

If you prefer to submit your Form 15397 by fax,

- Send your completed and signed form to the IRS using the official fax numbers below:

- Fax to:

Internal Revenue Service Technical Services Operation

Attn: Extension of Time Coordinator 877-477-0572

(International: 304-579-4105)

What happens after you file IRS 15397 Form?

- If Form 15397 is approved by the IRS, you receive a 30-day extension to furnish recipient copies.

- If the IRS denies your request, you must furnish the copies by the original due date to avoid penalties.

File Form 15397 with TaxZerone

- IRS Error Checks: TaxZerone checks your form 15397 for mistakes that could cause your extensions to be denied.

- Email Delivery: Send copies to the recipient by email, so you don't have to mail them manually.

- ZeroneVault Access: Share your filed forms securely anytime, anywhere through our encrypted portal.

- Affordable & Transparent: Get competitive prices with no extra fees.

Ready to extend your recipient deadline?

File Form 15397 with TaxZerone in minutes and stay in compliance with the IRS regulations.