Schedule E (Form 1040) for Form 5227

File Schedule E with Form 5227 quickly and stay IRS-compliant!

Excise Tax Forms

Employment Tax Forms

Information Returns

Extension Forms

Business Tax Forms

FinCEN BOIR

General

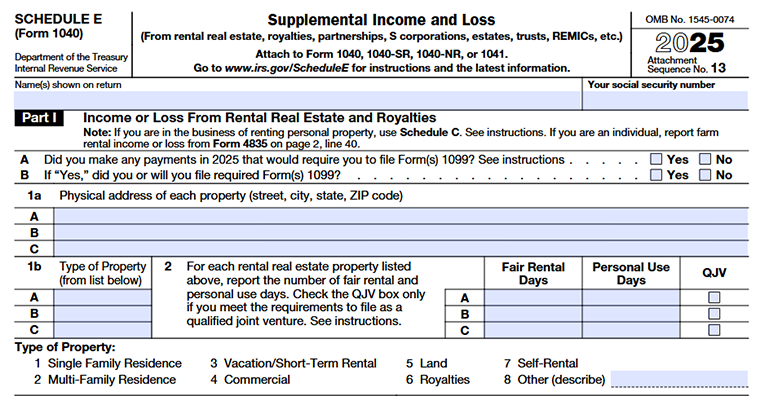

Schedule E (Form 1040) is used to report income that doesn’t come from regular wages—such as rental properties, royalties, partnerships, S corporations, estates, and trusts.

When a trust is e-filing Form 5227, Schedule E is only required if the trust earns certain types of income that need to be reported separately. This helps the IRS clearly understand exactly where the trust’s additional income came from.

In Part I of Form 5227, this information is entered on the fourth line, where the trust includes its Schedule E details to accurately report this supplemental income.

You can easily prepare and e-file Schedule E together with Form 5227 on TaxZerone, making the entire process simple, accurate, and stress-free.

Table of Contents

Why Trusts Filing Form 5227 Need Schedule E (1040)

Even though Schedule E (Form 1040) is commonly associated with individual returns, the IRS also requires Form 5227 filers to use Schedule E when a trust receives certain types of supplemental income, such as:

- Rental real estate income

- Royalties

- Partnership income

- S corporation income

- Unrelated business taxable income (UBTI)

Including Schedule E gives the IRS a clear view of how the trust earned its supplemental income and helps determine how that income should be taxed or applied to other sections of the return.

Who Needs to File Schedule E: The Trust or the Beneficiary?

A trust is responsible for filing Form 5227, and it must also attach Schedule E whenever it earns any type of supplemental income, such as rental income, royalties, or partnership and S corporation income. Beneficiaries, however, do not attach Schedule E to the 5227 form.

Beneficiaries instead file Form 1040, not Form 5227. They are required to include Schedule E with their Form 1040 only when they receive income reported on a Schedule K-1 from a trust, estate, partnership, or S corporation.

What happens when a trust filing Form 5227 forgets to add Schedule E?

If a trust filing Form 5227 fails to attach Schedule E even though it earned income that must be reported on that schedule, the IRS treats the return as incomplete. Penalties may apply if the missing information results in inaccurate reporting or affects any tax calculations, including unrelated business taxable income.

What penalties apply for filing an incomplete or incorrect Form 5227, including missing Schedule E (1040)?

The IRS imposes daily penalties when a trust submits a Form 5227 that is not complete and accurate, which includes leaving out schedules such as Schedule E. The penalty structure is as follows:

- $25 per day, up to a maximum of $13,000,

for trusts with gross income below the IRS threshold. - $125 per day, up to a maximum of $65,000,

for trusts with gross income over $327,000 (current IRS threshold).

The higher penalty level applies only when the trust’s gross income exceeds $327,000, according to the most recent IRS instructions.

How to File Schedule E (1040) with TaxZerone

Part I: Income or Loss from Rental Real Estate and Royalties

This section is where the trust reports rental or royalty income that must also be carried into IRS Form 5227.

Line A:

If the trust paid anyone $600+ for rental-related services, it must answer whether Form 1099 is required.

- “Yes”: if the trust made those kinds of payments.

- “No”: if it didn’t.

Line B:

If the trust was required to file Form 1099, this asks whether those 1099 forms were already filed or will be filed.

- “Yes”: if the trust has filed or will file the 1099 forms.

- “No”: only if it failed to file them

Line 1a:

Write the full physical address of each rental property.

- Add the street address, city, state, and ZIP code.

- If it’s outside the U.S., list the city, province/state, country, and postal code instead.

Line 1b:

Here you’ll enter a single code that tells the IRS what kind of property you’re renting:

- 5 – Land rental

Use this if you’re renting out land only with no buildings on it. - 7 – Self-rental

Use this when you rent the property to a business you actively participate in. - 8 – Other

Use this if your property doesn’t match any of the other categories.

Line 2:

- Fair Rental Days – Days the property was rented at a normal, fair market price.

- Personal Use Days – Days you, a co-owner, family members, or anyone paying less than fair rent used the property.

- Qualified Joint Venture (QJV) - For IRS 5227 filers, leave this box unchecked.

Any personal-use days don’t count as rental days, so be sure to split the expenses based on how the property was actually used.

Not personal use: Days spent working full-time on repairs or days it was your main home before or after renting (as long as you tried to rent it for 12 months).

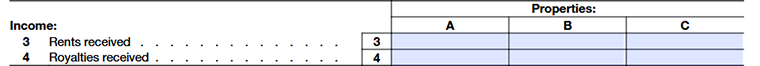

Income:

Line 3:

Enter the total rent the trust received for each property in Columns A, B, or C. This includes:

- Normal rent payments

- Rent for a room/space inside a property

- Non-cash rent (services or property) — report the fair market value

Line 4:

Use this line only if the trust received royalties, such as:

- Oil, gas, or mineral royalties

- Copyright or patent royalties

- Name, image, and likeness (NIL) royalties

- Licensing or merchandising payments

Report royalties separately for each property (A, B, or C).

If the trust received $10 or more, a Form 1099-MISC should be issued.

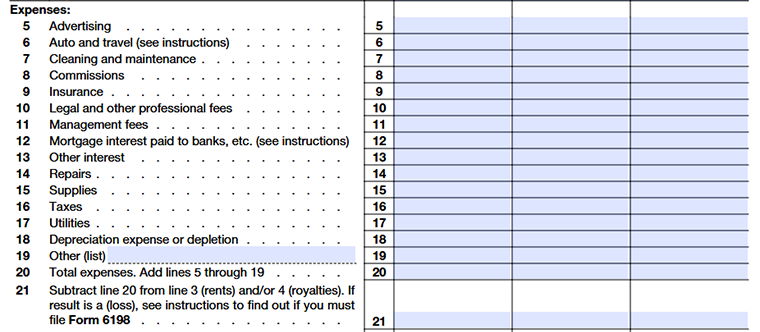

Expenses:

Line 5 - Advertising

Enter any costs the trust paid to advertise the rental property— online listings, flyers, signs, platform fees, etc.

Other Expense Rules

You can deduct ordinary and necessary rental expenses for each property (taxes, repairs, insurance, management fees, commissions, depreciation, etc.).

Do NOT deduct:

- The value of your own labor

- Costs for major improvements (these must be capitalized)

If only part of a home is rented, deduct only the portion that applies to the rental space.

Accessibility Costs:

The trust may be able to claim:

- A tax credit (Form 8826) for accessibility improvements,

- A deduction of up to $15,000 for removing barriers for disabled or elderly individuals.

But not for the same cost.

Line 6 - Auto and Travel

You can deduct the ordinary and necessary vehicle and travel costs connected to your rental activity. This includes 50% of meals while traveling away from home.

Important: If you use the standard mileage rate, you cannot deduct:

- Actual vehicle expenses

- Lease/rental payments

- Depreciation

You have two ways to deduct auto expenses:

1. Standard Mileage Rate (70¢ per mile for 2025)

- You owned the vehicle and used the standard mileage rate the first year it was placed in service,

- You leased the vehicle and used the mileage rate for the entire lease period.

If you use standard mileage:

- Multiply your rental-related miles × 70¢

- Add parking fees & tolls

- Enter the total on Line 6

2. Actual Expenses Method

- Include the rental-use portion of gas, oil, repairs, insurance, tires, tags, etc. on Line 6

- Put lease or rental payments on Line 19

- Put depreciation on Line 18

Line 7 - Cleaning and Maintenance

Costs for cleaning services, landscaping, pest control, snow removal, or general upkeep.

Line 8 - Commissions

Real estate agent commissions paid for finding tenants or managing rentals.

Line 9 - Insurance

Premiums for property insurance, liability insurance, flood insurance, etc.

Line 10 - Legal and Professional Fees

- Tax advice related to its rental property or royalty income

- Preparation of tax forms connected to that rental or royalty activity

Do NOT deduct on Line 10:

- Defending or protecting ownership/title

- Recovering the property

- Improving or developing the property

These costs must be capitalized (added to the property’s basis), not deducted as expenses.

Line 11 - Management Fees

Payments to property management companies or rental platforms that charge management fees.

Line 12 - Mortgage Interest (Paid to Banks/Lenders)

Report the interest the trust paid on a rental-property mortgage to a bank or financial institution.

This amount usually appears on Form 1098 if you pay $600 or more.

Important rules:

- Only deduct interest for the portion of the loan actually used for the rental activity.

- Prepaid interest (points) must be spread over the life of the loan—not deducted at once.

- If the 1098 doesn’t match the trust’s actual interest paid, you can use the correct amount but attach a statement explaining why.

Line 13 - Other Interest

- The lender was not a financial institution (no Form 1098),

- Someone else received the Form 1098 but the trust paid part of the interest (report the trust’s share here with an attached statement).

How to Allocate Interest

The IRS requires “tracing.”

This means you deduct interest based on how the loan money was actually used. (Example: if 70% of the loan is funded by the rental activity, then 70% of the interest is deductible.)

Business Interest Limitation

This applies only if the trust of rental activity rises to the level of a trade or business (rare Form 5227 filers).

If it does, you may need Form 8990 to compute allowed interest.

If not, simply report eligible interest on Lines 12 and 13.

Line 14 - Repairs

Use this line to deduct the trust’s repair and maintenance costs—the expenses that keep the rental property in good working condition.

Repairs (Deductible)

These do not improve or upgrade the property; they simply keep things running.

Examples:

- Fixing a broken lock

- Patching drywall

- Painting a room

- Minor plumbing fixes

These can be deducted in full on Line 14.

Improvements (NOT deductible here)

If the trust upgrades, restores, or changes how the property is used, that is an improvement, not a repair.

Examples:

- Replacing an entire HVAC system

- Adding new insulation

- Installing new windows

- Remodeling a room

These must be capitalized and depreciated over time (reported on Line 18).

Line 15 - Supplies

Small items used for rental operations—light bulbs, cleaning supplies, small tools, etc.

Line 16 - Taxes

Property taxes, local occupancy taxes, or other government charges on the property.

Line 17 - Utilities

Use this line to deduct utility costs the trust paid for the rental property—such as electricity, water, gas, trash service, or internet if it relates to the rental.

You can also deduct rental-related phone calls, like calling a tenant or service provider.

But NOT deductible:

The base cost of the first phone line in a residence (this is always considered personal, even if sometimes used for rental calls).

Line 18 - Depreciation

Depreciation lets the trust recover the cost of a rental building over time. Since buildings wear out, part of their cost is deducted each year—but land is never depreciated.

Separating cost of land and buildings

- Depreciation starts when the rental property is ready to be rented.

- It continues until the trust has fully deducted its cost or stopped using the property for rental income.

- If the property was purchased with land included, the trust must separate the cost between:

- Land (not depreciable)

- Building (depreciable)

Usually based on fair market value or property tax assessments.

When 5227 filers must attach Form 4562:

Attach Form 4562 only if the trust is claiming:

- Depreciation for property first placed in service in 2025, or

- Depreciation for listed property (like a vehicle), or

- A Section 179 deduction or amortization that began in 2025

Line 19 - Other Expenses

- List any rental or royalty expenses that don’t fit on Lines 5–18 (like bank fees, supplies, software, HOA fees, etc.).

- If applicable, you can also include certain energy-efficient building deductions under section 179D (Form 7205).

Line 20 - Total Expenses

Add all the above expenses (lines 5–19) to get your total deductions.

Line 21 - Your Profit or Loss

Line 21 basically shows whether you made money or lost money from your rental or royalty activity.

Line 21 = Income – Expenses

If Line 21 shows a loss

Sometimes you’re not allowed to deduct the full loss right away.

In that case, the IRS makes you check your loss using Form 6198 (At-Risk Rules).

- Write “Form 6198” next to Line 21

- Attach the form

- Only enter the part of the loss that’s allowed

Line 22 - Rental Real Estate Loss You Can Actually Deduct

(Only for rental real estate - not for royalty income)

If Line 21 has a rental loss, the IRS may limit it under the passive activity loss rules.

If your rental is passive

- You may need Form 8582.

- That form tells you how much of the loss you’re allowed to claim this year.

- Enter that allowed amount on Line 22.

If your rental is NOT passive

- you qualify for a rental real estate exception

- Then no Form 8582 is needed

- Just bring the loss from Line 21 straight down to Line 22.

If you had losses from a prior year

- If you have rental losses from a previous year and Form 8582 now allows you to use them, just add those losses to Line 22 as well.

Lines 23a-23e: Totals

- 23a: Add up all rental income amounts from Line 3 (for every rental property) and enter the total here.

- 23b: Add up all royalty income amounts from Line 4 and enter the total.

- 23c: Add up all mortgage interest reported on Line 12 for all properties.

- 23d: Add up all depreciation/depletion amounts from Line 18.

- 23e: Add up all total expenses from Line 20 for all properties.

This section simply pulls together all your column totals in one place for the trust’s final rental/royalty summary.

Line 24 - Income

Add up all positive amounts from Line 21 (rental and royalty income).

Don’t include any losses here — only the income.

Line 25 - Losses

Add together:

- Any royalty losses from Line 21, and

- Any rental real estate losses from Line 22.

Enter the total loss on Line 25.

Line 26 - Total Rental & Royalty Income (or Loss)

Combine:

- Line 24 (income)

- Line 25 (losses)

This gives the trust’s overall net rental/royalty result.

For Form 5227 filers, this amount flows into the trust income section on later pages (not to Form 1040 — that part of the IRS text applies to individual filers, not trusts).

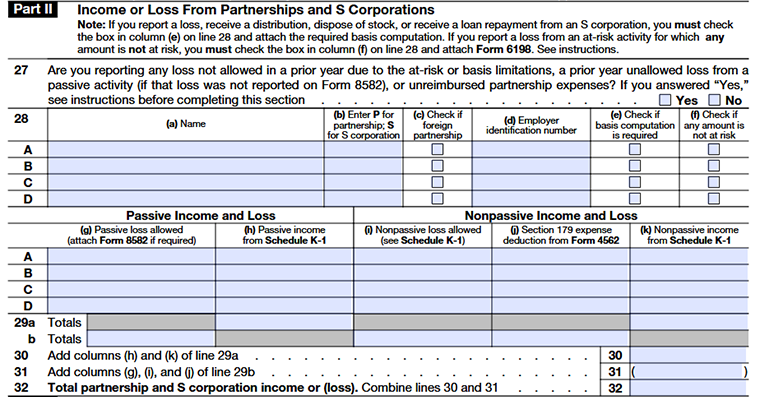

Part II: Income or Loss from Partnerships and S Corporations

Line 27

“Yes” on Line 27, the IRS wants to make sure the amounts you report match your Schedule K-1.

"No" they may send you a notice. Below are the situations you may need to report separately on Line 28.

Prior-Year Losses Allowed This Year (Basis / At-Risk Rules)

If you had losses from past years that were not allowed because of basis or at-risk limits, and they are now deductible:

- Report them on a separate line in column (i) of Line 28.

- Do not mix these losses with current-year amounts.

- Write “PYA” in column (a). (PYA = Prior Year Adjustment)

Prior-Year Passive Losses Not Reported on Form 8582

If you had passive activity losses from earlier years that are now deductible (for example, because you had overall passive income or fully disposed of the activity):

- Report them on a separate line in column (g) of Line 28.

- Do not combine with current-year items.

- Enter “PYA” in column (a).

Unreimbursed Partnership Expenses (UPE)

These are expenses you paid out of pocket for the partnership, and you were required to pay them under the partnership agreement.

Rules:

- UPE from nonpassive activities → report in column (i) on a separate line.

- UPE from passive activities

- If you must file Form 8582 → do NOT report separately.

- If you do not need Form 8582 → report in column (g) on a separate line.

- Write “UPE” in column (a).

Gambling Income & Losses from Partnerships

- If the partnership is in the gambling business:

- Report gambling winnings on Schedule E, column (k).

- Report gambling losses on Schedule E, column (i).

- You can only deduct gambling losses up to your total gambling winnings from all sources on your tax return (Schedules 1, C, and E).

Line 28

Use Line 28 to list your current-year income or loss from partnerships or S corporations. Put each amount in the right column (passive or nonpassive). If your K-1 shows extra items, list each one on a separate line and label it in column (a).

If You Used a Loan to Invest

Interest from a loan used to buy or invest must be reported based on how it’s used:

- Business interest: Schedule E

- Passive interest: Form 8582, then Schedule E

- Investment interest: Form 4952

- Personal interest: Not deductible

(a) Name: Enter the name of the partnership or S corporation shown on your K-1.

(b) P or S: Mark P for a partnership or S for an S corporation.

(c) Foreign Partnership: Check this only if the partnership is foreign (formed outside the U.S.).

(d) EIN: Enter the entity’s Employer Identification Number from the K-1.

(e) Basis Computation Required: Check out this box if you’re an S corporation owner and must attach a basis worksheet (for losses, distributions, stock sales, or loan repayments).

(f) Any Amount Not at Risk: Check this if part of your investment is not fully at risk, meaning some losses may not be deductible.

Passive Columns for 5227 Filers

(g) Passive Loss Allowed: Enter the passive losses you’re allowed to deduct this year. Use Form 8582 first if required.

(h) Passive Income: Enter passive income on the K-1 reports to you.

Nonpassive Columns for 5227 Filers

(i) Nonpassive Loss: Enter nonpassive losses you can deduct (usually when you actively participate).

(j) Section 179 Deduction: Enter any Section 179 expenses passed through to you.

(k) Nonpassive Income: Enter nonpassive income you received (from activities you materially participated in).

Line 29a - Totals (Passive Income Columns)

Add up all the amounts in column (h) (passive income) and column (k) (nonpassive income) for the partnerships or S corporations listed above. These totals flow into Line 30.

Line 30 - Total Passive & Nonpassive Income

On Line 30, you enter the combined income from columns (h) + (k) of Line 29a. This is the total income from partnerships and S corporations.

Line 31 - Total Losses

On Line 31, you add the amounts from columns (g) + (i) + (j) of Line 29b. This represents your total losses and deductions from these entities.

Line 32 - Total Partnership & S Corporation Income (or Loss)

Finally, combine Line 30 (income) and Line 31 (losses).

The result is your overall net income or loss from all partnerships and S corporations for the year.

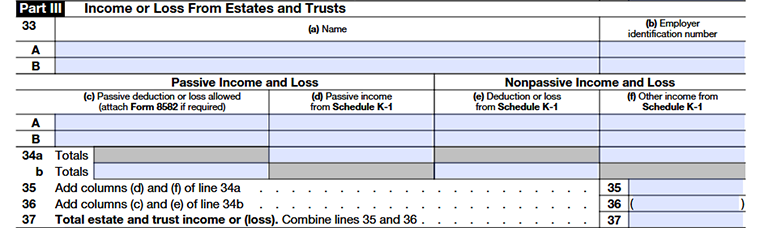

Part III: Income or Loss from Estates and Trusts

Line 33

Column (a) – Name

Write the name of the estate or trust that issued the Schedule K-1 to your trust.

Column (b) – Employer Identification Number

Enter the EIN of that estate or trust. This helps the IRS match the income reported.

Passive Income and Loss Columns

Column (c) – Passive deduction or loss allowed

Enter passive losses or deductions your trust is allowed to claim from the Schedule K-1. (If you have passive activity limits → Form 8582 may be required)

Column (d) – Passive income from Schedule K-1

Enter any passive income the trust received from the estate or trust—things like rental income or income from activities where the trust does not materially participate.

Nonpassive Income and Loss Columns

Column (e) – Deduction or loss from Schedule K-1

Enter nonpassive losses or deductions (e.g., business losses where the trust materially participates).

Column (f) – Other income from Schedule K-1

Enter all nonpassive income, such as interest, dividends, business income, royalties, or any income the estate/trust reported as “other” on the K-1.

Line 34a / 34b – Totals

Add the amounts in each row (A & B) for passive and nonpassive sections.

Line 35

Add passive income minus passive losses

(Columns (d) + (f) totals).

Line 36

Add passive + nonpassive losses/deductions

(Columns (c) + (e) totals).

Line 37 – Total estate and trust income (or loss)

Combine lines 35 and 36.

This is the final income or loss your 5227 reports from estates and trusts.

Part IV - Income or Loss from Real Estate Mortgage Investment Conduits (REMICs) - Residual Holder

- Part IV is only used if your trust owns a residual interest in a REMIC (Real Estate Mortgage Investment Conduit).

If so, the REMIC sends you a Schedule Q (Form 1066) every quarter, showing your trust’s share of income or loss. - You use those numbers to fill in this section.

Do NOT attach Schedule Q to the return - keep it in your files. - If you report REMIC items differently from how the REMIC reported them, you may need to file Form 8082.

- If your trust owns more than one REMIC, you can add another sheet using the same format and then combine the totals.

Line 38 - REMIC Residual Income

Line 38 is where you total the amounts you entered in columns (d) and (e) from Part IV. These amounts represent your share of the REMIC’s quarterly income or loss from all residual interests you hold.

This line only includes the regular REMIC income items, not the minimum taxable income from column (c).

Line 39 - Total REMIC Income or Loss

On Line 39, you report the combined total from:

- Column (d) (taxable income/loss), and

- Column (e) (other REMIC income)

This is the amount that carries over to:

- Schedule E, line 39 (for individuals), or

- The corresponding line on Form 1041 (for estates & trusts)

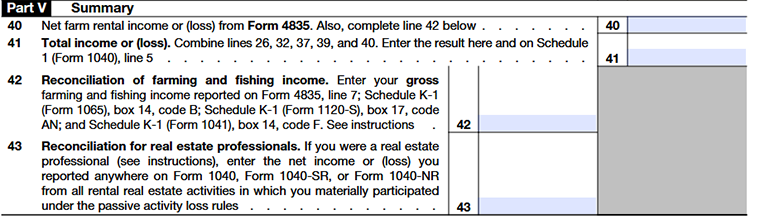

Part V: Summary

Line 40 – Net Farm Rental Income or Loss (from Form 4835)

This line asks for your net income or loss from farm rentals.

If the trust rented farmland and received income, or had expenses/losses, you will enter the final amount from Form 4835 here.

- You must also complete Line 42 (related to farming/fishing income).

Line 41 – Total Income or Loss

This line gives you the big picture of all income or losses the trust reported across Schedule E.

- Add the totals from Lines 26, 32, 37, 39, and 40

- Enter the combined amount on Line 41

- Also report this amount on Schedule 1 (Form 1040), line 5,if applicable

This number shows the trust’s total net activity from partnerships, S corporations, rentals, estates, trusts, REMICs, and farm rentals.

Line 42 (For 5227 Filers) — Farming & Fishing Income Check

Line 42 is used to report gross farming or fishing income that flows to the trust. This helps determine if the trust qualifies special estimated tax relief available to farming and fishing activities.

Special Rule for Farming & Fishing Trusts

A trust with significant farming or fishing income may avoid estimated-tax penalties if:

- At least two-thirds of its total income is from farming or fishing, and

- The trust’s 2025 return is filed and paid by March 2, 2026.

Paperwork Reduction Act (Simplified for 5227 Users)

- The IRS requires information on Form 5227 to properly administer tax laws.

- You only need to provide information on forms that display a valid OMB control number.

- Keep all records related to the trust if they may be needed for tax purposes.

- Completion time varies by trust and activity level. If you have suggestions for simplifying Form 5227, the IRS invites comments through the main return instructions.

Line 43 – Reconciliation for Real Estate Professionals

This line is only for people who qualify as real estate professionals.

If you meet those rules (material participation + real estate - related work hours)

- Enter the net income or loss from all rental real estate activities

- This includes amounts reported anywhere on Form 1040, 1040-SR, or 1040-NR

Need to e-file Form 5227 with Schedule E (Form 1040)?

Keep your split-interest trust fully compliant with IRS requirements.

TaxZerone helps you accurately report rental, royalty, and other passive income on Schedule E and seamlessly file Form 5227—quickly, securely, and with confidence.