AutoMagic2290 - Simplify Your Form 2290 Filing Process

File your HVUT Form the smart way with AutoMagic2290, just upload your IRS-stamped Schedule 1 from last year.

Employment Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Looking to make your Form 2290 filing easier and faster? This resource page is your go-to guide for everything related to AutoMagic2290 - TaxZerone’s powerful tool that helps you to populate the data from your previous filing with just one upload. Let’s discuss it in detail!

Table of Contents

What is AutoMagic2290?

AutoMagic2290 is a smart feature offered by TaxZerone that simplifies your IRS Form 2290

e-filing process. It automatically imports data from previous year’s Schedule 1, which will save you from entering vehicle and business details manually.

Who can use AutoMagic2290?

Form 2290 filers who have their IRS-stamped Schedule 1 PDF from the previous year can use 'AutoMagic2290 ' to easily pre-fill their data. This feature will be useful for reporting multiple vehicles to the IRS, helping you avoid repetitive data entry and ensuring an error-free process.

Simplify your HVUT filing with AutoMagic2290 — fast, easy, and error-free.

Try it now and get your IRS-stamped Schedule 1 in minutes!

Why use AutoMagic2290?

- No Manual Data Entry: By uploading last year's schedule 1 to AutoMagic2290, the tool will automatically fill in your business and vehicle information, eliminating the need to enter everything manually.

- Save Time: File your form using AutoMagic2290 and it will take less than a minute. Just review the information and submit your application to the IRS.

- Reduces Errors: By automatically transferring the details, the filing will be accurate and minimize mistakes.

- Perfect for multi-vehicle filing: It will be more useful when filing multiple vehicles, as it avoids repetitive data and ensures accurate filings.

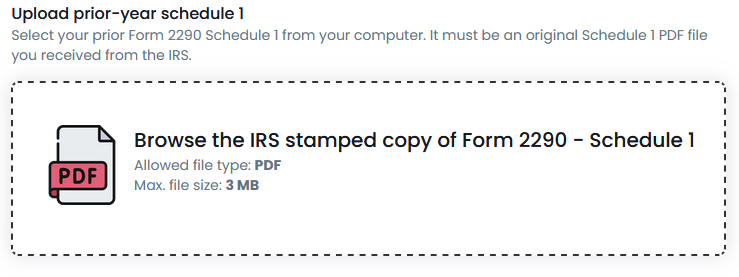

What File Formats will be accepted?

AutoMagic2290 accepts only PDF files for importing data from prior‑year Schedule 1 forms (the official PDF issued by the IRS). If you try uploading any other file type, the system won’t recognize it.

How to Add New Vehicles?

After importing the data, click on "Add Taxable Vehicles" to include any new vehicle information, such as the VIN and the taxable gross weight of the vehicle in the form.

How to file HVUT form with TaxZerone using AutoMagic2290?

Step 1:

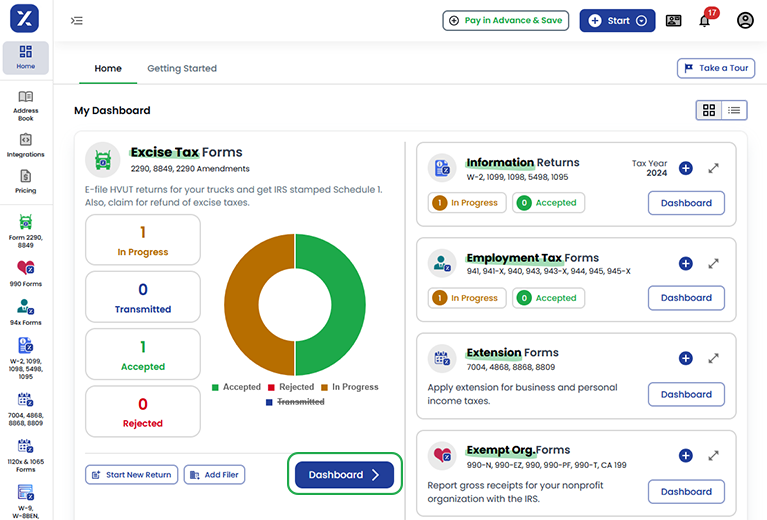

Log in to your TaxZerone account and navigate to the Excise Tax Forms dashboard. Then, click on the “Dashboard” button and select the “Start New Return” to begin your HVUT filing.

Step 2:

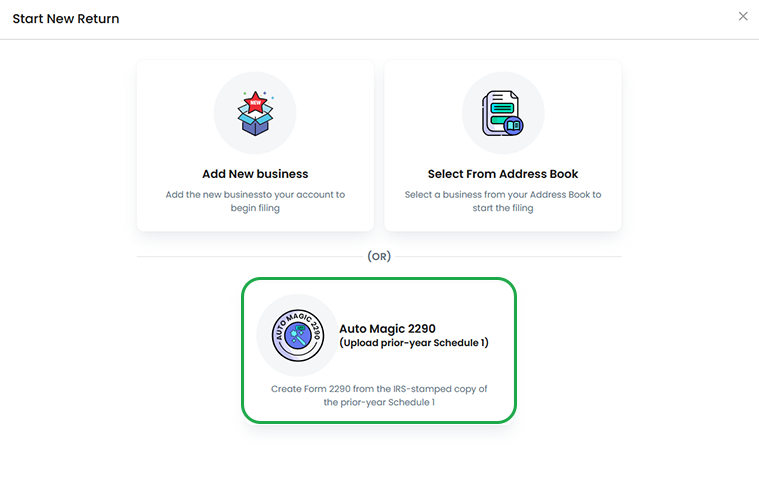

Select “Auto Magic 2290”for a faster and smarter filing experience.

Step 3:

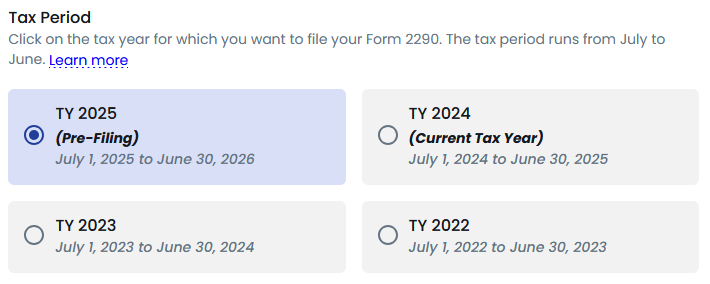

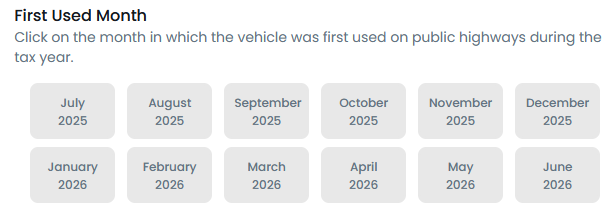

Step 4:

Select your preferred payment method to pay the IRS tax.

Electronic Funds Withdrawal (EFW): It allows the IRS to directly debit from your bank account on the date that mentioned.

Electronic Federal Tax Payment System (EFTPS): you can schedule your payment separately on the IRS website.

Credit or Debit card: You can pay using a credit or debit card through an approved payment processor.

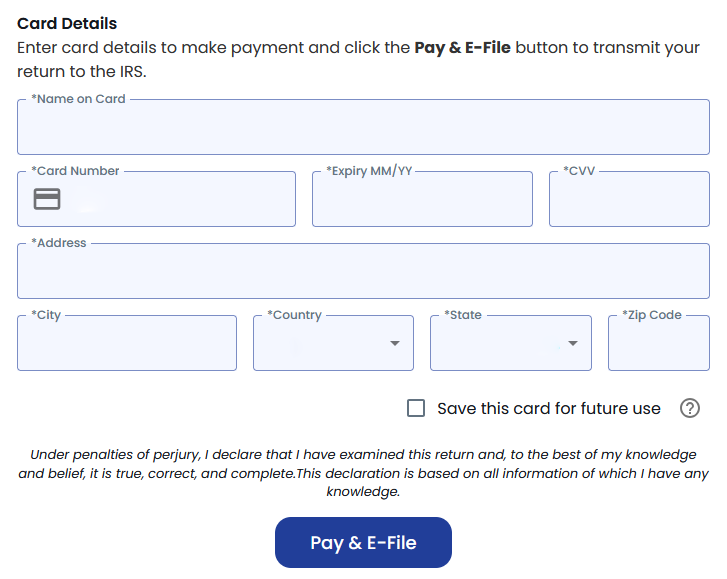

Step 5:

Select any additional services you may need, then enter your card details, and transmit the return securely to the IRS.

💡 Need a quick tour?

Check out our easy step-by-step video on YouTube to see how AutoMagic2290 simplifies your Form 2290 filing

What Happens After Filing?

Once you e-file using AutoMagic2290:

- You will receive your IRS-stamped Schedule 1 instantly.

- You can download, print, or email the document directly from your TaxZerone account.

Ready to File with AutoMagic2290?

Skip the manual entry and speed up your Form 2290 filing with AutoMagic2290.

Upload your prior Schedule 1 and get your IRS-stamped Schedule 1 within minutes.