Form 940 Schedule A

Excise Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

If you, as an employer, pay unemployment taxes in multiple states or operate in a state subject to a credit reduction, you are required to file Form 940 Schedule A.

When to Use Schedule A (Form 940)

- Multiple States: If you paid state unemployment tax in more than one state.

- Credit Reduction State: If you paid wages in any state that is subject to credit reduction.

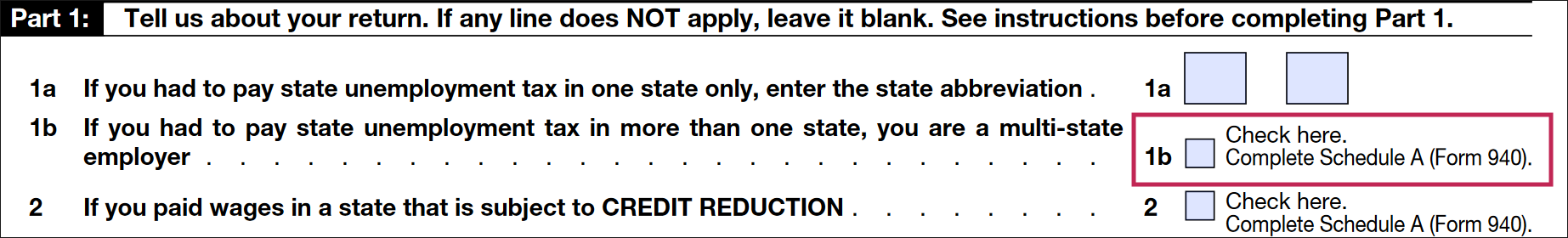

Multi-state Employers

Multi-state employers are those who pay unemployment taxes in multiple states because they hire employees from various locations. You should mark the checkbox indicating that your business is a multi-state employer on Line 1b of Form 940.

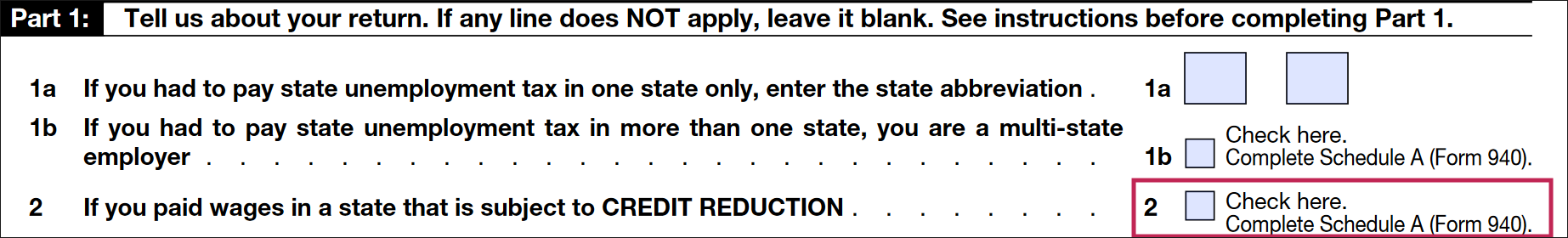

Form 940 Credit Reduction

A state that has not repaid funds borrowed from the federal government to cover unemployment benefits is known as a credit reduction state. The U.S. Department of Labor designates these states. If an employer pays wages in a credit reduction state, they must pay additional federal unemployment tax when filing Form 940 due to the state’s unemployment tax laws.

Credit Reduction Rates

Below are the credit reduction rates for 2025:

| State | 2025 Credit Reduction Rate |

|---|---|

| California | 0.012 (1.2%) |

| U.S. Virgin Islands | 0.045 (4.5% ) |

Attaching Schedule A Details to IRS Form 940

- Multi-state Employers: Check the box on line 1b of Form 940. Fill out Schedule A and attach it to your Form 940.

- Credit Reduction States: Check the box on Line 2, complete Schedule A, and attach it to your Form 940 submission.

Step-by-Step Guide to Filling Out Schedule A

Step 1: Employer Information

- Employer Identification Number (EIN)

- Name (as shown on Form 940)

Step 2: Mark States

- Mark an "X" next to each state (including D.C., Puerto Rico, and the U.S. Virgin Islands) where you paid state unemployment taxes this year, even if the credit reduction rate is zero.

- Ensure you have a state reporting number for each state. If not, contact the state unemployment agency.

Step 3: Credit Reduction

- Identify states with a credit reduction rate above zero (e.g., California 1.2%, U.S. Virgin Islands 4.5%).

- Enter the total FUTA taxable wages paid in these states in the "FUTA Taxable Wages" box, excluding wages not subject to state unemployment tax.

- Multiply the FUTA taxable wages by the state's credit reduction rate.

- Enter the result in the "Credit Reduction" box.

Step 4: Total Credit Reduction

- Add up all amounts in the "Credit Reduction" boxes.

- Enter the total in the "Total Credit Reduction" box and on Form 940, line 11.

TaxZerone will automatically calculate the taxes when you e-file through the platform.

State Abbreviations

The following table provides the two-letter postal abbreviations used on Schedule A:

| State | Abbreviation |

|---|---|

| Alabama | AL |

| Alaska | Ak |

| Arizona | AZ |

| Arkansas | AR |

| California | CA |

| Colorado | CO |

| Connecticut | CT |

| Delaware | DE |

| District of Columbia | DC |

| Florida | FL |

| Georgia | GA |

| Hawaii | HI |

| Idaho | ID |

| Illinois | IL |

| Indiana | IN |

| Iowa | IA |

| Kansas | KS |

| Kentucky | KY |

| Louisiana | LA |

| Maine | ME |

| Maryland | MD |

| Massachusetts | MA |

| Michigan | MI |

| Minnesota | MN |

| Mississippi | MS |

| Missouri | MO |

| Montana | MT |

| Nebraska | NE |

| Nevada | NV |

| New Hampshire | NH |

| New Jersey | NJ |

| New Mexico | NM |

| New York | NY |

| North Carolina | NC |

| North Dakota | ND |

| Ohio | OH |

| Oklahoma | OK |

| Oregon | OR |

| Pennsylvania | PA |

| Rhode Island | RI |

| South Carolina | SC |

| South Dakota | SD |

| Tennessee | TN |

| Texas | TX |

| Utah | UT |

| Vermont | VT |

| Virginia | VA |

| Washington | WA |

| West Virginia | WV |

| Wisconsin | WI |

| Wyoming | WY |

| Puerto Rico | PR |

| U.S. Virgin Islands | VI |

Conclusion

Ensure you follow these steps to correctly complete Form 940 Schedule A. Proper compliance helps avoid penalties and ensures accurate tax reporting.