Excise Tax Forms

Employment Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

FinCEN BOIR

General

If you operate a partnership or a multi-member LLC, Form 1065 is the IRS return that reports your business’s annual financial activity. While partnerships generally do not pay federal income tax at the entity level, they are still required to file this return to disclose income, deductions, credits, and—most importantly—how those items are allocated among partners.

Every amount reported on Form 1065 ultimately flows to partners through Schedule K-1, which they use to complete their individual or business tax returns. This makes accuracy critical: an error on Form 1065 almost always becomes an error on every partner’s return.

This instruction guide is designed to walk you through Form 1065 step by step, explaining what each section means, why the IRS requires it, and how the information flows across schedules.

Table of Contents

What Is Form 1065 and Why It Matters

Form 1065, U.S. Return of Partnership Income, is the annual federal tax return filed with the Internal Revenue Service by partnerships and entities taxed as partnerships.

Form 1065 is used to report:

- Total partnership income and expenses

- Ordinary business profit or loss

- Separately stated income and deduction items

- Credits and other tax attributes

- Balance sheet information

- Capital account activity for each partner

- Allocation of all items to partners via Schedule K-1

Why Form 1065 Is So Important

- Compliance

Filing Form 1065 is a legal requirement for most partnerships. Failure to file can result in penalties calculated per partner, per month. - Partner reporting accuracy

Partners rely entirely on Schedule K-1 generated from Form 1065. Any mistake directly affects partners’ personal or business tax returns. - Transparency to the IRS

The IRS uses Form 1065 to evaluate ownership structure, capital movements, foreign activity, and compliance with partnership tax rules. - Audit risk reduction

Accurate completion of Schedules B, K, L, M-1, and M-2 helps reduce the likelihood of IRS inquiries.

Who Must File Form 1065?

You must file Form 1065 if your business meets any of the following conditions during the tax year:

- It is a domestic partnership

- It is a multi-member LLC that has not elected corporate taxation

- It had two or more partners at any time during the year

- It had income, expenses, gains, losses, or credits, even if net income is zero

Entities Commonly Required to File

- General partnerships

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

- Multi-member LLCs taxed as partnerships

Entities That Generally Do NOT File Form 1065

- Sole proprietorships

- Single-member LLCs (unless electing partnership treatment)

- C Corporations (Form 1120)

- S Corporations (Form 1120-S)

Filing Deadlines, Extensions, and Penalties

Standard Filing Deadline

- Calendar-year partnerships: March 16, 2026 (for the 2025 tax year)

- Fiscal-year partnerships: The 15th day of the 3rd month after the tax year ends

If the due date falls on a weekend or federal holiday, the deadline shifts to the next business day.

Filing an Extension (Form 7004)

Partnerships can request an automatic 6-month extension by filing Form 7004.

- No explanation is required

- The extension moves the deadline to September 15, 2026

- The extension applies to filing only, not to paying any required taxes

Penalties for Late or Incorrect Filing

| Situation | Penalty | How It Applies |

|---|---|---|

| Late filing | $245 per partner, per month | Up to 12 months |

| Missing Schedule K-1s | Additional penalties | Per partner |

| Incomplete or inconsistent return | IRS notices & audits | Common trigger |

| Failure to furnish K-1s to partners | Separate penalties | Even if 1065 is filed |

Example: A partnership with 4 partners that files 3 months late could face penalties exceeding $2,800, even if no tax is owed.

Key Documents You Need Before Filing Form 1065

Before starting Form 1065, gather and organize the following records. Having these ready prevents errors and saves time during filing.

Financial Records

- Profit & Loss statement for the tax year

- Balance sheet (beginning and end of year)

- Cost of goods sold details (if applicable)

- Depreciation and amortization schedules

Partner Information

- Partner names and addresses

- Ownership percentages

- Profit, loss, and capital allocation agreements

- Capital contributions and withdrawals

- Guaranteed payment amounts

Prior-Year Information

- Last year’s Form 1065

- Prior-year Schedule K-1s

- Carryforward amounts (losses, credits, depreciation)

Comparison: Form 1065 vs Form 1120 vs Form 1120-S

This comparison is provided for context, not marketing, and helps filers confirm they are using the correct form.

| Form | Who Files | Core Difference |

|---|---|---|

| 1065 | Partnerships & multi-member LLCs | Pass-through taxation; partner-level reporting |

| 1120 | C Corporations | Corporation pays tax at entity level |

| 1120-S | S Corporations | Pass-through, but corporate ownership structure |

Form 1065 Line-by-Line Instructions

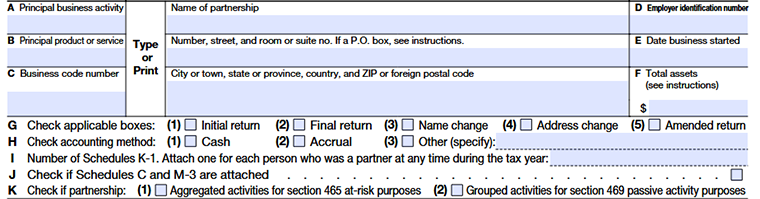

Basic Information Section (Lines A–K) + Income Section (Lines 1a–8)

This section establishes the identity, structure, and filing context of the partnership. Errors here commonly cause IRS notices or return rejections.

Name of Partnership

Enter the legal name of the partnership exactly as shown on IRS EIN records.

Enter:

- Legal partnership or LLC name

Do NOT enter:

- DBA or trade name unless it matches IRS records

Why this matters:

The IRS matches this field against the EIN database. Any mismatch may delay processing.

Address (Street, City, State, ZIP / Country)

Provide the partnership’s current mailing address.

- P.O. Box is allowed only if mail is not delivered to a street address

- Foreign partnerships must include country and postal code

Common mistake:

Using an old address without checking the “Address change” box (Line G).

Line A — Principal Business Activity

Describe the main activity that generates income.

Examples:

- “Management consulting services”

- “Residential real estate rental”

- “Software development”

Do NOT:

- Use vague terms like “business” or “services”

Why IRS asks this:

To classify business operations and compare them against industry norms.

Line B — Principal Product or Service

Explain what the partnership actually sells or provides.

Examples:

- “Web application development”

- “Commercial property leasing”

- “Tax preparation services”

Difference from Line A:

- Line A = type of activity

- Line B = specific output

Line C — Business Code Number (NAICS)

Enter the 6-digit NAICS code that best matches your activity.

Examples:

- 541511 – Custom Computer Programming Services

Why this matters:

Incorrect codes may affect IRS risk scoring and industry comparisons.

Line D — Employer Identification Number (EIN)

Enter the 9-digit EIN assigned to the partnership.

Line E — Date Business Started

Enter the date the partnership began operations, not the EIN issuance date.

Examples:

- Partnership agreement signed: May 10, 2023

- Business activity began: June 1, 2023 → Enter June 1, 2023

Line F — Total Assets (End of Year)

Enter the total book value of assets at the end of the tax year.

Includes:

- Cash

- Receivables

- Equipment

- Property

- Investments

Do NOT:

- Use market value

- Leave blank if assets exist

Flow impact:

This number must match Schedule L, End of Year – Total Assets.

Line G — Type of Return (Check All That Apply)

Check applicable boxes:

- Initial return – First year filing

- Final return – Partnership closed

- Name change – Legal name changed

- Address change – Mailing address changed

- Amended return – Correcting a previously filed return

Example:

If the partnership closed in 2025 → Check Final return

Line H — Accounting Method

Choose one:

- Cash – Income reported when received

- Accrual – Income reported when earned

- Other Specify (e.g., hybrid method)

Important:

Method must match prior-year filings unless IRS approval was obtained.

Line I — Number of Schedules K-1

Enter the total number of partners at any time during the year.

Include:

- Partners who joined or left mid-year

Why IRS asks this:

To confirm all partners receive a Schedule K-1.

Line J — Schedules C and M-3 Attached

Check if either is attached.

- Schedule M-3 is typically required for large partnerships

Line K — Activity Grouping Elections

Check applicable boxes if:

- Activities are aggregated for at-risk rules (Section 465)

- Activities are grouped for passive activity rules (Section 469)

Why IRS asks this:

Affects how losses are limited and reported to partners.

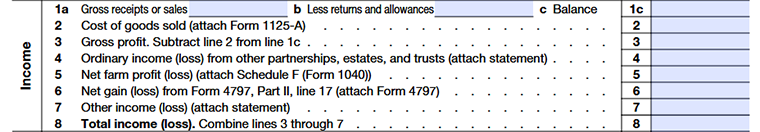

Income Section (Lines 1a–8)

This section reports the partnership’s gross income and operating results before expenses.

⚠️ Only trade or business income belongs here. Investment income is usually reported separately on Schedule K.

Line 1a — Gross Receipts or Sales

Enter total sales or service income before any deductions.

Example:

- Client billings during year: $750,000

Line 1b — Returns and Allowances

Enter refunds, discounts, or returned goods.

Example:

- Client refunds issued: $20,000

Line 1c — Balance (Net Sales)

Automatically calculated

Line 1c = Line 1a – Line 1b

Example:

$750,000 – $20,000 = $730,000

Line 2 — Cost of Goods Sold (COGS)

Enter the cost of producing or acquiring goods sold.

Attach:

Includes:

- Inventory costs

- Direct labor

- Materials

Do NOT include:

- Operating expenses (rent, admin salaries)

Line 3 — Gross Profit

Calculated as:

Line 3 = Line 1c – Line 2

Example:

$730,000 – $280,000 = $450,000

Line 4 — Ordinary Income (Loss) from Other Partnerships, Estates, and Trusts

Report pass-through income from:

- Other partnerships

- Estates or trusts

Attach statement listing each source.

Line 5 — Net Farm Profit (Loss)

Enter farm income or loss.

Attach:

Most non-farm partnerships leave this blank.

Line 6 — Net Gain (Loss) from Form 4797

Report gains or losses from sales of:

- Equipment

- Vehicles

- Business property

Attach:

Line 7 — Other Income (Loss)

Report income not listed elsewhere, such as:

- Cancellation of debt income

- Refunds

- Miscellaneous business income

Attach statement explaining each item.

Line 8 — Total Income (Loss)

Add Lines 3 through 7.

Report income not listed elsewhere, such as:

- Gross profit (Line 3): $450,000

- Other partnership income (Line 4): $15,000

- Asset gain (Line 6): $10,000

Total Income (Line 8): $475,000

How These Numbers Flow Next

- Line 8 feeds into the Deductions Section

- Final result becomes Ordinary Business Income (Line 23)

- Line 23 flows to:

- Schedule K, Line 1

- Each partner’s Schedule K-1

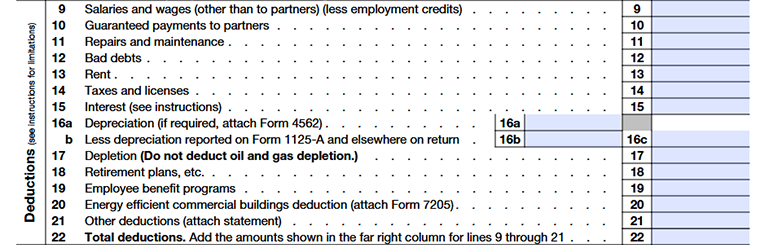

Deductions Section (Lines 9–23) & Tax and Payments (Lines 24–32)

Deductions Section (Lines 9–23)

This section reports ordinary and necessary business expenses incurred by the partnership. These deductions reduce the partnership’s taxable income, which directly impacts each partner’s Schedule K-1.

Line 9 — Salaries and Wages (Other Than to Partners)

Report wages paid to non-partner employees only.

Include:

- Employee salaries and hourly wages

- Bonuses paid to employees

- Taxable fringe benefits

- Employer-paid payroll taxes (after credits)

Do NOT include:

- Payments to partners

- Guaranteed payments (those go on Line 10)

Example:

- Office staff wages: $180,000

- Payroll tax credits used: $10,000

- Amount entered: $170,000

Why IRS separates this:

Partners cannot be treated as W-2 employees for federal tax purposes.

Line 10 — Guaranteed Payments to Partners

Guaranteed payments are amounts paid to partners without regard to partnership income.

Common guaranteed payments include:

- Compensation for services

- Payments for use of capital

Example:

- Partner A receives $60,000 annually for managing operations → Guaranteed payment

Important tax treatment:

- Deductible by the partnership

- Taxable to the partner

- Subject to self-employment tax

K-1 impact:

Reported separately on Schedule K and each partner’s Schedule K-1.

Line 11 — Repairs and Maintenance

Costs to keep property in normal operating condition.

Include:

- Equipment repairs

- Routine maintenance

- Painting, servicing, fixing

Do NOT include:

- Improvements that increase value or extend life (capitalize instead)

Example:

- Equipment servicing: $7,500

Line 12 — Bad Debts

Deduct debts that:

- Were previously included in income, and

- Are now uncollectible

Important:

Most partnerships use the specific charge-off method, not estimates.

Example:

- Client invoice of $4,000 written off as uncollectible

Line 13 — Rent

Report rent paid for:

- Office space

- Equipment

- Vehicles

Do NOT include:

- Rent paid to a partner (may require special disclosure)

Example:

- Office lease: $30,000 annually

Line 14 — Taxes and Licenses

Include:

- State and local business taxes

- Payroll taxes

- Business licenses and permits

Exclude:

- Federal income taxes

- Penalties and fines

Example:

- State franchise tax: $9,000

Line 15 — Interest

Interest paid on:

- Business loans

- Mortgages

- Lines of credit

Do NOT include:

- Personal interest of partners

Special rule:

Business interest may be limited under Section 163(j) in some cases.

Line 16 — Depreciation

Line 16a — Depreciation

Enter total depreciation expense.

Line 16b — Depreciation reported elsewhere

Subtract depreciation already included in COGS or other lines.

Line 16c — Net Depreciation

Automatically calculated.

Attach:

Example:

- Equipment depreciation: $18,000

Line 17 — Depletion

Used by businesses extracting natural resources.

Do NOT deduct oil & gas depletion here (reported elsewhere).

Line 18 — Retirement Plans, etc.

Include employer contributions to:

- SEP IRAs

- SIMPLE plans

- Qualified retirement plans

Example:

- SEP contributions: $14,000

Line 19 — Employee Benefit Programs

Include:

- Health insurance

- Life insurance

- Disability insurance

Exclude:

- Retirement benefits (Line 18)

Line 20 — Energy Efficient Commercial Buildings Deduction

Deduct qualifying energy-efficient building improvements.

Attach:

Line 21 — Other Deductions

Report expenses not listed elsewhere.

Examples:

- Legal and accounting fees

- Advertising

- Office supplies

- Utilities

- Software subscriptions

Attach a statement itemizing each category.

Line 22 — Total Deductions

Add Lines 9 through 21.

Line 23 — Ordinary Business Income (Loss)

Subtract total deductions from total income:

Line 23 = Line 8 – Line 22

Example:

- Total income (Line 8): $475,000

- Total deductions (Line 22): $430,000

- Ordinary income: $45,000

Flow impact:

- Reported on Schedule K, Line 1

- Allocated to partners on Schedule K-1

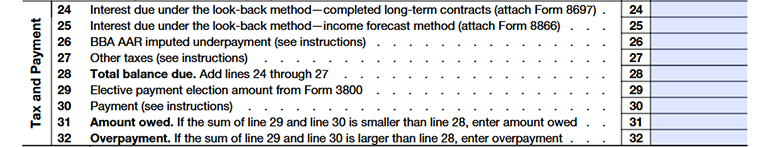

Tax and Payments Section (Lines 24–32)

Most partnerships do not pay federal income tax, but these lines apply in special situations.

Line 24 — Interest Due (Look-Back Method – Long-Term Contracts)

Used only if the partnership applies the look-back method.

Attach:

Line 25 — Interest Due (Income Forecast Method)

Applies to income forecast property.

Attach:

Line 26 — BBA AAR Imputed Underpayment

Used when partnership audit adjustments result in entity-level tax.

Important:

This applies under the centralized partnership audit regime.

Line 27 — Other Taxes

Includes:

- Excise taxes

- Recapture taxes

- Other partnership-level taxes

Line 28 — Total Balance Due

Add Lines 24 through 27.

Line 29 — Elective Payment Election Amount

Credits elected for direct payment (from Form 3800, if applicable).

Line 30 — Payment

Enter any tax payments made with:

- Extensions

- Estimated payments

Line 31 — Amount Owed

If payments are less than balance due, enter the difference.

Line 32 — Overpayment

If payments exceed balance due, enter the excess.

How Phase 3 Connects to the Rest of the Return

- Line 23 feeds Schedule K

- Guaranteed payments flow separately to partners

- Deductions affect partner basis

- Incorrect classification here often causes K-1 errors

Schedule B (Form 1065) — Other Information

Question-by-Question Instructions & IRS Logic

Schedule B is not a financial schedule — it is a compliance, disclosure, and risk-assessment schedule.

The Internal Revenue Service uses Schedule B to determine:

- Ownership concentration

- Foreign exposure

- Audit regime applicability

- Disclosure compliance

- Whether additional forms are required

Question 1 — Type of Entity Filing the Return

You must identify the legal structure of the partnership.

Options include:

- Domestic general partnership

- Domestic limited partnership

- Domestic limited liability company (LLC)

- Domestic limited liability partnership (LLP)

- Foreign partnership

Why IRS asks this:

Different partnership structures are subject to different liability, reporting, and audit rules.

Common mistake:

Checking “LLC” without confirming the entity is taxed as a partnership.

Question 2 — Ownership of 50% or More

2(a) — Entity Ownership (Corporations, Trusts, Governments)

Answer Yes if any entity directly or indirectly owned 50% or more of profits, losses, or capital.

- Includes constructive ownership

- Includes indirect chains

If “Yes”:

- You must attach Schedule B-1

2(b) — Individual or Estate Ownership

Answer Yes if any individual or estate owned 50% or more.

Why this matters:

High ownership concentration increases IRS scrutiny of:

- Allocation accuracy

- Disguised compensation

- Basis manipulation

Question 3 — Ownership of Other Entities

3(a) — Ownership of Corporations

Answer Yes if the partnership owned:

- 20% or more directly, OR

- 50% or more directly or indirectly

You must report:

- Corporation name

- EIN

- Country

- Ownership percentage

3(b) — Ownership of Other Partnerships or Trusts

Answer Yes if the partnership owned:

- 20% or more of profits/losses/capital, OR

- 50% or more directly or indirectly

Why IRS tracks this:

To identify tiered partnership structures, which are high-risk for income shifting.

Question 4 — Small Partnership Exception

Answer Yes only if all four conditions are met:

- Gross receipts < $250,000

- Total assets < $1 million

- All K-1s filed on time

- Not required to file Schedule M-3

If “Yes”:

- You may skip:

- Schedule L

- Schedule M-1

- Schedule M-2

- Item F (Total Assets)

Common error:

Claiming this exception while still having foreign activity or complex allocations.

Question 5 — Publicly Traded Partnership (PTP)

Answer Yes if interests are traded on:

- Public markets, OR

- Secondary markets

PTPs are subject to special passive activity rules.

Question 6 — Canceled or Modified Debt

Answer Yes if any partnership debt:

- Was forgiven

- Was canceled

- Had principal reduced

If “Yes”:

- Cancellation of Debt (COD) income may apply

- Additional reporting may be required

Question 7 — Reportable Transactions (Form 8918)

Answer Yes if the partnership participated in a reportable transaction.

These are transactions the IRS considers potential tax avoidance.

If “Yes”:

- Form 8918 must be filed

Question 8 — Foreign Financial Accounts (FBAR)

Answer Yes if the partnership had:

- Foreign bank accounts

- Foreign securities accounts

- Signing authority over foreign accounts

If “Yes”:

- FBAR (FinCEN Form 114) may be required

- Country name must be listed

Common misconception:

This is not reported on the tax return itself — but failure to disclose here is penalized.

Question 9 — Foreign Trust Transactions

Answer Yes if the partnership:

- Received distributions from a foreign trust

- Transferred assets to a foreign trust

If “Yes”:

- Form 3520 may be required

Question 10 — Section 754 & Basis Adjustments

10(a) — Section 754 Election

Answer Yes if the partnership has an active Section 754 election.

Why this matters:

This election allows basis adjustments when:

- Partners enter or exit

- Interests are transferred

- Assets are distributed

Once made, the election generally cannot be revoked without IRS consent.

10(b) — Section 743(b) Adjustments

Answer Yes if basis was adjusted for partner-level transfers.

You must report:

- Net positive adjustments

- Net negative adjustments

10(c) — Section 734(b) Adjustments

Applies to property distributions.

Used when distributions trigger basis adjustments at the partnership level.

10(d) — Mandatory Basis Adjustments

Answer Yes if adjustments were required due to:

- Substantial built-in loss

- Substantial basis reduction

Failure to comply here is a high-risk audit issue.

Questions 11–12 — Property Distributions

Question 11 — Like-Kind Exchange Property

Answer Yes if property from a like-kind exchange was:

- Distributed, OR

- Contributed to another entity

Question 12 — Tenancy-in-Common Interests

Answer Yes if undivided property interests were distributed.

These transactions require careful capital and basis tracking.

Questions 13–18 — Foreign Reporting Forms

Includes:

- Form 8858 (Foreign branches)

- Form 8805 (Foreign partner withholding)

- Form 8865 (Foreign partnerships)

- Form 5471 (Foreign corporations)

If “Yes”:

- You must enter the number of forms attached

Question 19 — Forms 1042 / 1042-S (Withholding)

Answer Yes if the partnership made payments to foreign persons subject to withholding.

Question 20 — Form 8938 (FATCA)

Answer Yes if the partnership is required to disclose specified foreign financial assets.

Questions 21–24 — Interest Limitation & Tax Shelter Rules

Covers:

- Section 721(c) partnerships

- Disallowed interest deductions

- Section 163(j) elections

- Form 8990 requirements

These questions identify earnings-stripping and interest abuse.

Questions 25–26 — Opportunity Zones & Foreign Transfers

Includes:

- Qualified Opportunity Fund certification (Form 8996)

- Transfers triggering Section 864(c)(8)

Questions 27–29 — Advanced Compliance Areas

Covers:

- Related-party transfers

- Inversion transactions

- Excise tax on stock repurchases (Form 7208)

Question 30 — Digital Asset Transactions

Answer Yes if the partnership:

- Received digital assets as payment, OR

- Sold or exchanged digital assets

This includes cryptocurrencies and certain tokens.

Question 32 — Election Out of Subchapter K

Rare election allowing partnerships to opt out of standard partnership tax rules.

Question 33 — Centralized Partnership Audit Regime

If “Yes”:

- You must complete Schedule B-2

- Partnership elects out of centralized audits

If “No”:

- You must designate a Partnership Representative (PR)

Designation of Partnership Representative (PR)

The PR:

- Has sole authority to deal with IRS audits

- Does not need to be a partner

- Can bind the partnership legally

Important:

This role replaces the old “tax matters partner.”

Why Schedule B Errors Are Dangerous

- Triggers IRS notices

- Forces amended returns

- Causes K-1 corrections

- Increases audit probability

Schedules K, K-1, L, M-1, and M-2

Detailed Line-by-Line Partnership Reporting Guide

These schedules explain how partnership results are summarized, allocated, reconciled, and tracked. Errors here almost always lead to partner notices, amended K-1s, or audits by the Internal Revenue Service.

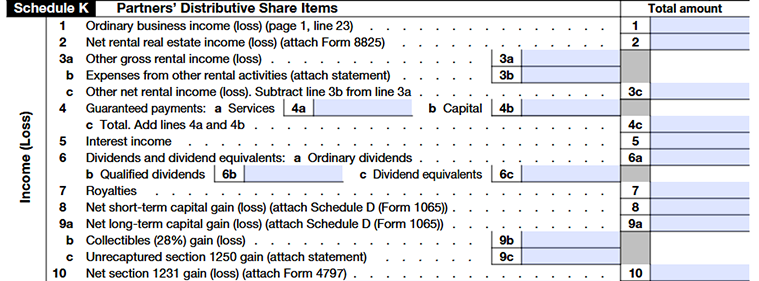

Schedule K — Partners’ Distributive Share Items (Summary Level)

Schedule K reports the total partnership amounts for each category of income, deduction, credit, and other tax item.

Nothing here is partner-specific — allocations happen later on Schedule K-1.

Schedule K — Income (Loss)

Line 1 — Ordinary Business Income (Loss)

This comes directly from Page 1, Line 23.

What it represents:

Net operating profit or loss from the partnership’s core business.

Example:

- Ordinary business income: $120,000

This amount is later split among partners based on the partnership agreement.

Line 2 — Net Rental Real Estate Income (Loss)

Income or loss from rental real estate activities.

Attach:

Why IRS separates this:

Rental real estate is subject to passive activity rules.

Line 3 — Other Rental Income (Loss)

For rental activities not involving real estate, such as equipment leasing.

- 3a: Gross rental income

- 3b: Expenses

- 3c: Net rental income (loss)

Line 4 — Guaranteed Payments

Total guaranteed payments made to partners.

- 4a: For services

- 4b: For capital

- 4c: Total

Important:

Guaranteed payments are not allocated like profits — they are reported separately.

Line 5 — Interest Income

Interest earned on:

- Bank accounts

- Notes receivable

- Investments

Line 6 — Dividends

Interest earned on:

- 6a: Ordinary dividends

- 6b: Qualified dividends

- 6c: Dividend equivalents

Qualified dividends may receive preferential tax rates at the partner level.

Line 7 — Royalties

Income from intellectual property, mineral rights, or licensing agreements.

Lines 8–10 — Capital Gains and Section 1231 Items

Includes:

- Short-term capital gains

- Long-term capital gains

- Collectibles gains

- Unrecaptured Section 1250 gains

- Section 1231 gains/losses

Attach:

- Schedule D (Form 1065)

- Form 4797 (when applicable)

Line 11 — Other Income (Loss)

Income not classified elsewhere.

Examples:

- Cancellation of debt income

- Litigation settlements

- Insurance proceeds

Attach statements specifying each item.

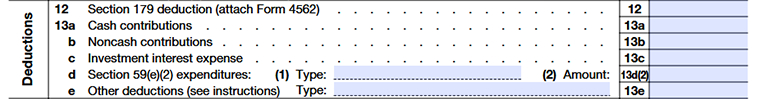

Schedule K — Deductions

Line 12 — Section 179 Deduction

Immediate expensing of qualifying assets.

Attach:

- Form 4562

Line 13 — Charitable Contributions & Investment Interest

Includes:

- Cash charitable contributions

- Noncash contributions

- Investment interest expense

- Section 59(e) expenditures

- Other deductions

Each item may have partner-level limitations.

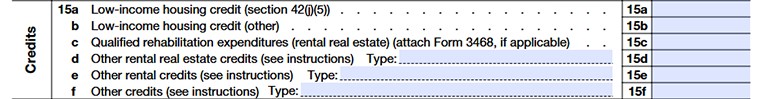

Schedule K — Self-Employment, Credits & International

Line 14 — Self-Employment Income

Reports amounts subject to self-employment tax for partners.

Line 15 — Credits

Includes:

- Low-income housing credits

- Rehabilitation credits

- Other business credits

Credits may be limited by partner basis or at-risk rules.

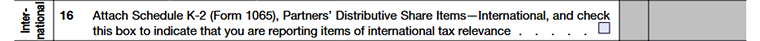

Line 16 — International Tax Items

Requires Schedule K-2 and impacts partner Schedule K-3.

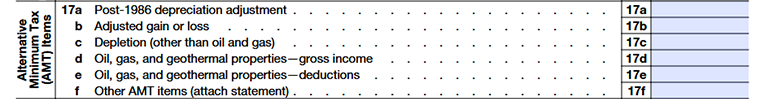

Line 17 — AMT Items

Alternative Minimum Tax adjustments, such as:

- Depreciation differences

- Depletion

- Oil and gas income

Lines 18–21 — Other Information

Includes:

- Tax-exempt income

- Nondeductible expenses

- Distributions

- Investment income/expenses

- Foreign taxes paid

Schedule K-1 — Partner-Level Allocation

Each Schedule K-1 shows a partner’s share of every Schedule K item.

What Determines Allocation

Allocations are based on:

- Ownership percentage

- Profit-sharing ratios

- Special allocations in the partnership agreement

Example Allocation

Partnership facts:

- Ordinary income (Schedule K, Line 1): $120,000

- Two partners:

- Partner A: 60%

- Partner B: 40%

K-1 reporting:

- Partner A: $72,000

- Partner B: $48,000

Why K-1 Accuracy Is Critical

- K-1 errors require amended partner returns

- Late K-1s trigger per-partner penalties

- IRS compares K-1 totals directly to Schedule K

Schedule L — Balance Sheets per Books

Schedule L shows the partnership’s financial position, not tax values.

It must be completed unless the partnership qualifies for the small partnership exception.

Assets Section (Beginning & End of Year)

Includes:

- Cash

- Accounts receivable (net of bad debts)

- Inventory

- Investments

- Loans to partners

- Depreciable assets (net of depreciation)

- Intangible assets

- Other assets (itemized)

Liabilities & Capital

Includes:

- Accounts payable

- Short-term and long-term debt

- Loans from partners

- Other liabilities

- Partners’ capital accounts

Rule: Total assets must equal total liabilities plus capital.

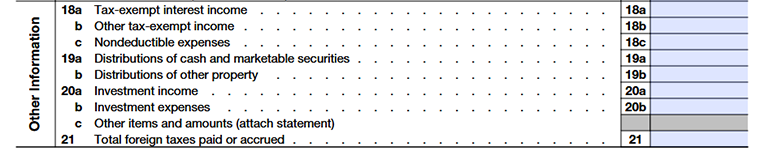

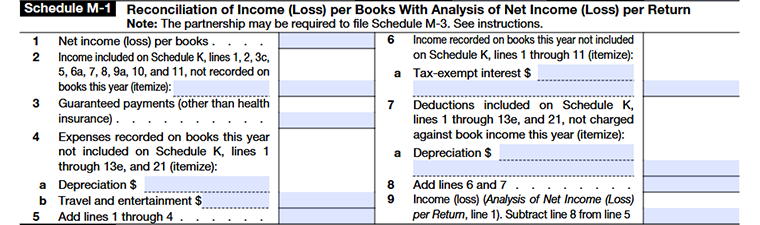

Schedule M-1 — Book vs Tax Reconciliation

Schedule M-1 explains why book income ≠ taxable income.

Key M-1 Differences

Common reconciling items:

- Depreciation differences

- Nondeductible expenses

- Tax-exempt income

- Guaranteed payments

Example

- Book income: $150,000

- Tax depreciation exceeds book depreciation: $20,000

- Nondeductible expenses: $5,000

Taxable income:

$150,000 – $20,000 + $5,000 = $135,000

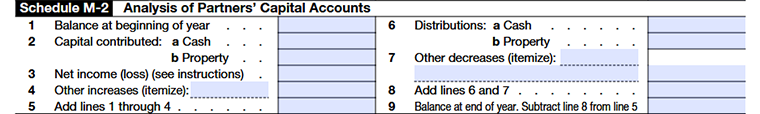

Schedule M-2 — Analysis of Partners’ Capital Accounts

Schedule M-2 tracks how partner capital changes during the year.

This is far more important for partnerships than AAA is for S Corps.

Capital Account Components

- Beginning capital

- Capital contributions

- Net income or loss

- Distributions

- Other increases or decreases

Example (Single Partner)

- Beginning capital: $80,000

- Net income: $45,000

- Distribution: $25,000

Ending capital:

$80,000 + $45,000 – $25,000 = $100,000

Why Schedule M-2 Matters

- Determines partner basis

- Affects deductibility of losses

- Impacts taxation of distributions

- Closely reviewed in IRS audits

How All Schedules Connect

| Schedule | Purpose |

|---|---|

| Page 1 | Calculates partnership income |

| Schedule K | Summarizes tax items |

| Schedule K-1 | Allocates items to partners |

| Schedule L | Shows financial position |

| Schedule M-1 | Explains book vs tax differences |

| Schedule M-2 | Tracks partner capital |

A mistake in any one of these schedules often cascades into all others.

Common Form 1065 Filing Mistakes (and How to Avoid Them)

These are real-world errors that frequently trigger IRS notices, rejected e-files, or amended Schedule K-1s.

1. Treating Partners Like Employees

Mistake: Paying partners wages and reporting them on Line 9.

Correct treatment:

- Partner compensation must be reported as Guaranteed Payments (Line 10)

- Partners are not W-2 employees for federal tax purposes

Why IRS cares:

Misclassification affects self-employment tax and income allocation.

2. Incorrect Partner Ownership Percentages

Mistake: Using year-end ownership instead of weighted ownership when partners join or leave mid-year.

Correct approach:

- Allocate income based on the partnership agreement

- Reflect partial-year ownership correctly on Schedule K-1

Impact:

Incorrect allocations lead to amended K-1s and partner tax corrections.

3. Schedule K Does Not Match Total of K-1s

Mistake: Schedule K totals do not reconcile with all issued K-1s.

IRS cross-check:

The IRS system automatically validates:

- Schedule K totals

- Aggregate K-1 totals

Any mismatch = notice.

4. Ignoring Schedule B Disclosures

Mistake: Answering “No” to foreign, ownership, or audit questions without review.

High-risk areas:

- Foreign bank accounts (FBAR-related)

- Section 754 elections

- Partnership Representative designation

- Digital asset transactions

Result:

Schedule B errors are among the top audit triggers for partnerships.

5. Capital Accounts Not Reconciled (Schedule M-2)

Mistake: Ending capital balances do not match:

- Schedule L

- Prior-year ending balances

- Partner records

Why this matters:

Capital account accuracy affects:

- Partner basis

- Loss deductibility

- Distribution taxation

6. Missing or Late Schedule K-1s

Mistake: Filing Form 1065 but delaying K-1 distribution.

Penalty exposure:

- Penalties apply per partner, even if the 1065 itself is timely

Best practice:

Prepare K-1s before e-filing Form 1065.

Lesser-Known Forms Commonly Required With Form 1065

Many partnerships file Form 1065 correctly — but miss required attachments, leading to IRS follow-ups.

| Form | When Required |

|---|---|

| Form 1125-A | Form 1125-A If reporting Cost of Goods Sold |

| Form 4562 | Depreciation or Section 179 deduction |

| Form 4797 | Sale of business property |

| Form 8825 | Rental real estate activities |

| Form 8697 / 8866 | Look-back interest |

| Schedule K-2 / K-3 | International tax items |

| Form 8990 | Business interest limitation |

| Form 8996 | Qualified Opportunity Fund |

| Form 3520 | Foreign trust transactions |

| FinCEN Form 114 | Foreign bank accounts (FBAR) |

Filing Checklist Before Submitting Form 1065

Use this checklist to reduce errors and rejections:

- Partnership name & EIN match IRS records

- Accounting method consistent with prior year

- Schedule K totals match all K-1s

- Capital accounts reconcile (M-2 ↔ L)

- Schedule B answered completely and accurately

- Required attachments included

- K-1s prepared for all partners

- Extension filed (Form 7004) if needed

Frequently Asked Questions (Instruction-Specific,

Non-Overlapping)

1. Does a partnership with no income still need to file Form 1065?

Yes. Many partnerships are required to file even with zero income, especially if they have expenses, partners, or ongoing legal existence.

2. Can a partnership report a loss on Form 1065?

Yes. Losses pass through to partners and may be deductible, subject to:

- Basis rules

- At-risk rules

- Passive activity limitations

3. What is the difference between Guaranteed Payments and Profit Allocation?

- Guaranteed Payments: Fixed, paid regardless of profits; subject to self-employment tax

- Profit Allocation: Based on ownership or agreement; depends on partnership results

They are reported separately and taxed differently.

4. Is Schedule M-2 required every year?

Not always. It is generally required when:

- Assets or receipts exceed IRS thresholds, or

- The partnership has significant capital activity

However, maintaining capital accuracy is always recommended.

5. Who should be the Partnership Representative?

The PR should be someone who:

- Understands partnership tax rules

- Can respond to IRS inquiries

- Has authority to bind the partnership

The PR does not have to be a partner.

6. Can partners file their tax returns before receiving Schedule K-1?

No. Partners must wait for Schedule K-1, as it contains essential income and deduction details.

7. What happens if a Schedule K-1 is wrong?

The partnership must issue:

- Corrected K-1s, and

- Potentially file an amended Form 1065

A smarter way to file your partnership tax return

From income reporting to partner allocations, TaxZerone supports every step of Form 1065 filing.

- IRS-authorized partnership e-filing

- Real-time error checks to avoid rejections

- Automatic Schedule K-1 generation for all partners

- Secure cloud storage (ZeroneVault)

- Affordable pricing for partnerships of all sizes