Excise Tax Forms

Employment Tax Forms

Information Returns

Exempt Org. Forms

Business Tax Forms

FinCEN BOIR

General

Form 8809, Application for Extension of Time to File Information Returns. It is an IRS form used to request additional time to file the information returns such as Form W-2, 1097, 1098, 1099, 3921, 3922, W-2G, 1099-NEC, 1042-S, 5498, 5498-ESA, 5498-QA, 5498-SA, 8027, 1094-C,

1095-C, 1095-B, 1099-QA.

Who can file Form 8809?

Payers/filers who could not submit their information return with the IRS by the due date can file form 8809 to get an automatic 30-day extension.

Form 8809 Due Date

File Form 8809, once you know that an extension of time is required to file the information return, but not before January 1st of the year. It should be filed before the due date of the respective information return you are filing.

The due dates for filing the extension form 8809 for the below-mentioned form.

| Form | Paper Filing | Electronic Filing |

|---|---|---|

| W-2* | January 31 | - |

| W-2G | February 28 | March 31 |

| 1042-S | March 15 | March 15 |

| 1094-C | February 28 | March 31 |

| 1095 | February 28 | March 31 |

| 1097, 1098, 1099 | February 28 | March 31 |

| 1099-QA* | February 28 | - |

| 1099-NEC* | January 31 | - |

| 3921, 3922 | February 28 | March 31 |

| 5498 | May 31 | May 31 |

| 5498-QA* | May 31 | - |

| 8027 | Last day of February | March 31 |

* Request for extension of Forms 1099-NEC, 1099-QA, 5498-QA, and W-2 must be filed on paper.

Filing extension for different information return forms

When filing extensions for multiple information returns with different deadlines, prioritize the earliest deadline. For example, if you need to file extensions for both Form 1095-C and Form 5498, you must file by March 31, 2026, even though the deadline for Form 5498 is May 31, 2026.

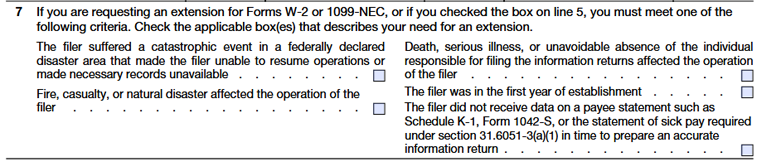

Additional Extension

An automatic 30-day deadline extension available for Forms W-2 or 1099-NEC under certain conditions. Other than these forms, if the filer needs more time, they can apply for a second 30-day extension only if they meet the criteria mentioned below and file before the expiry of the first 30-day expiration.

Criteria to apply for additional extension:

If the business faces any severe situations such as

- You were unable to resume operations or business documents due to a catastrophic event that occurred in a federal disaster region.

- Your activities were affected by a natural disaster, fire, or casualty.

- This was your company's first year of operation.

- The person responsible for filing is either sick, absent, or passed away.

- The filer did not receive data on a payee statement to file a return on time.

Filing methods supported by Form 8809

E-Filing:

The IRS recommends filing form 8809, Application for Extension of Time to File Information Returns using the electronic filing method.

Paper filing:

The Payer or Filer can file form 8809 using the paper filing method by completing the form and mailing it to the IRS using below address.

Mailing Address:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0209

TaxZerone suggests E-filing to extend information return deadline easily!

Penalty

The IRS will impose the Penalty if it applies the following:

- Fail to file before the deadline

- Fail to include necessary information or incorrect information on a return.

- File on paper when you were required to e-file

- Report an incorrect TIN or fail to report a TIN

The penalty amounts are determined by how late the filings are:

- Up to 30 days late: $60 per return to an upper limit of $683,000 per year ($239,000 for small businesses)

- 31 days late through August 1: $130 per return to the maximum limit of $2,049,000 per year ($683,000 for small businesses)

- After August 1 or not filed: $340 per return to a maximum penalty of $4,098,500 per year ($1,366,000 for small businesses)

- Intentional disregard: $680 per return with no maximum penalty

Form 8809 Instructions - How to fill it out?

Let's see line-by-line instructions on how to fill out Form 8809.

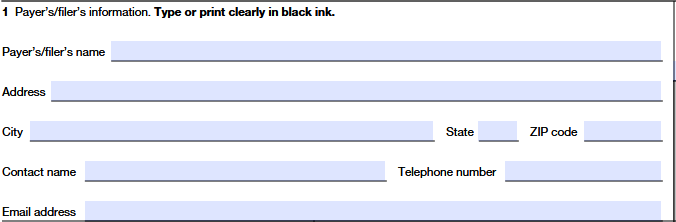

Line 1

- Payer’s/filer’s name - Enter the legal name of Payer or Filer.

- Address, City, State, ZIP Code - Enter the complete address, city, state, and Zipcode in the appropriate field.

- Contact name - Enter the contact's name of the person whom the IRS can contact if any additional information is required.

- Telephone number - Enter the phone number so that the IRS can contact you.

- Email address - Enter the email address of the filer.

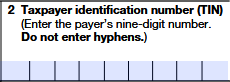

Line 2

Enter the 9-digit Taxpayer identification number (TIN) or Employer identification number (EIN)or qualified intermediary employer identification number (QI-EIN)or withholding foreign partnership employer identification number (WP-EIN) or withholding foreign trust employer identification number (WT-EIN).

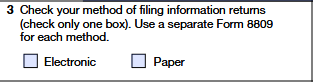

Line 3

Select the appropriate filing method for your information return:

- Check the Electronic box if you plan to file your return via e-filing.

- Check the Paper box if you plan to file your return using the paper filing method.

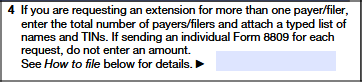

Line 4

If you are requesting an extension for many filers, enter the total count and attach a list of names and TIN.

Line 5

Check the box on Line 5, if you already requested for the automatic extension and now you are requesting a second extension.

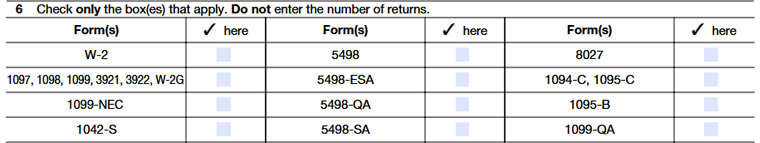

Line 6

Check the appropriate box(es) for the Form You Need an Extension. The forms include

- W-2

- 1097, 1098, 1099, 3921, 3922, W-2G

- 1099-NEC

- 1042-S

- 5498

- 5498-ESA

- 5498-QA

- 5498-SA

- 8027

- 1094-C, 1095-C

- 1095-B

- 1099-QA

Line 7

If a filer is applying for an extension of Forms W-2 or 1099-NEC, or if you selected the box on Line 5, check the appropriate box based on your extension needs.

E-file Form 8809 with TaxZerone

File your Form 8809 easily with TaxZerone at just $4.99 /return.

You will only have to enter the required information and transmit the return to the IRS.

Ready to file Form 8809 online?