Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

If you’re a corporation transferring stock to an employee through an Employee Stock Purchase Plan (ESPP), you must file IRS Form 3922. This form reports the transfer of stock acquired under an ESPP and provides important tax information for both the employee and the IRS. Filing accurately and on time ensures compliance with reporting requirements.

Table of Contents

What is Form 3922?

IRS Form 3922 is an information return used by corporations to report when an employee purchases stock through an Employee Stock Purchase Plan (ESPP) at a discounted price. This form is required by the IRS to help ensure transparency and accurate tax reporting for stock-based compensation.

It provides essential details like the date the option was granted, the purchase date, the fair market value of the stock, and the number of shares transferred. These details help employees, and the IRS track the cost basis of the stock for future tax purposes.

Who needs to file Form 3922?

If a corporation transfers stock to an employee who exercised an option under an Employee Stock Purchase Plan (ESPP), and the stock was bought at a discount or the price wasn’t fixed at the time of the offer, the corporation must file Form 3922 for each transfer made during that year.

That "first transfer" includes situations like:

- When the stock is initially transferred into the employee’s name.

- When the shares are first moved into a brokerage account, even if it happens automatically as part of a plan with a broker or financial institution.

When stock is transferred after an employee exercises an option, the shares must be clearly identifiable to ensure accurate reporting to the IRS.

When Is Form 3922 Due?

The filing deadline for Form 3922 is as follows:

| Form 3922 | Deadlines |

|---|---|

| Sending copy to Employee | February 2, 2026 |

| Paper filing | March 2, 2026 |

| IRS e-filing | March 31, 2026 |

Form 3922 instructions-how to fill out?

Let see the step-by-step instructions to fill out Form 3922

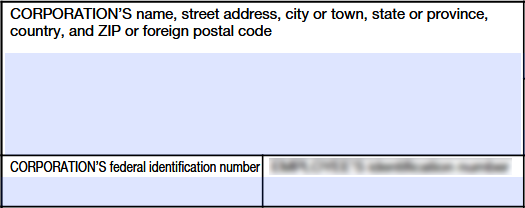

Step 1: Enter the Corporation’s details

Enter the corporation's name, address and Taxpayer Identification Number (TIN) of the entity responsible for issuing the stock through ESPP.

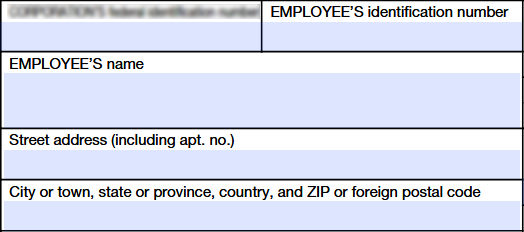

Step 2: Enter the Employee’s details

Enter the name, address and Taxpayer Identification Number (TIN) or Social Security Number (SSN) of the employee who received the stock after exercising their option under the Employee Stock Purchase Plan (ESPP).

Step 3: Stock Option & Transfer details

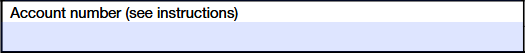

Account Number

If you're filing more than one Form 3922 for the same person, you must include an account number to identify each form. Even if not required, the IRS recommends using an account number on all Forms 3922 to help with accurate tracking and recordkeeping.

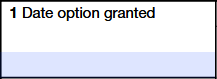

Box 1. Date Option Granted

Enter the date on which the corporation granted the employee the option to purchase stock under an Employee Stock Purchase Plan (ESPP).

Box 2. Date Option Exercised

Enter the date the employee exercised their option to purchase stock through the ESPP.

Box 3. Fair Market Value Per Share on Grant Date

Enter the fair market value (FMV) of each share on the date the option to purchase the stock was granted.

Box 4. Fair Market value per share on exercise date

Enter the fair market value per share of the stock on the date the employee exercised their option to purchase it.

Box 5. Exercise Price Paid Per Share

Enter the price in which the employee paid for each share when they purchased the stock through the option.

Box 6. Number of Shares Transferred

Enter the total number of shares for which legal ownership was transferred to the employee.

Box 7. Date Legal Title Transferred

Enter the date when the employee first gained legal ownership of the shares.

Box 8. Exercise Price Per Share Determined as if the Option Was Exercised on the Date Shown in Box 1

If the exercise price per share was not set or determinable on the option grant date (Box 1), enter the price as if the option were exercised on the grant date. If the exercise price is fixed or determinable on the grant date, leave Box 8 blank.

Ready to file Form 3922?

Ensure timely and accurate reporting of your ESPP stock transfers.