Form 1099-DA Instructions

E-file your IRS Form 1099-DA for the 2025 tax year with TaxZerone!

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 1099-DA, Digital Asset Proceeds From Broker Transactions, is a new IRS information return introduced to report sales and exchanges of digital assets such as cryptocurrencies, stablecoins, tokenized securities, and certain NFTs. Brokers and digital asset middlemen must file this form with the IRS and furnish copies to customers when they facilitate digital asset transactions.

Starting with the 2025 tax year, brokers must report gross proceeds from sales. Beginning in 2026, basis reporting for covered securities will also be required.

At TaxZerone, we make IRS Form 1099-DA e-filing simple, secure, and IRS-compliant.

Who must file Form 1099-DA?

Form 1099-DA must be filed by U.S. digital asset brokers who handle the sale, exchange, or disposition of digital assets on behalf of their customers. If you’re in the business of facilitating digital asset transactions, the IRS requires you to report them.

- Exchanges and trading platforms that execute sales of digital assets such as cryptocurrency, stablecoins, or NFTs.

- Businesses that redeem digital assets they issued or created.

- Intermediaries such as kiosks, payment processors for digital assets, and real estate reporting persons who accept digital assets.

- Custodians or trustees selling digital assets on behalf of clients.

- U.S. branches and U.S. persons acting as brokers (foreign branches are generally excluded).

Form 1099-DA Filing Deadlines (Tax Year 2025, Filed in 2026)

Brokers and intermediaries dealing with digital assets must meet strict filing deadlines for

1099-DA Form:

| Filing Requirement | Deadline |

|---|---|

| Furnish Copy B to Recipients | February 17, 2026 |

| File with IRS (Paper Filing) | March 2, 2026 |

| File with IRS (Electronic) | March 31, 2026 |

IRS Requirement: If you are filing 10 or more information returns (combined across all 1099s, W-2s, etc.), you are required to e-file.

Penalties for Late or Incorrect Filing

- If a form is filed within 30 days late, the penalty is $60 per form.

- If a form is filed more than 30 days late but by August 1, the penalty is $130 per form.

- If a form is filed after August 1 or not filed at all, the penalty is $340 per form.

- If a form is filed with intentional disregard, the penalty is $680 per form, with no upper limit.

The maximum penalties are different for small and large firms, as well as for government agencies. There is no limit for willful disrespect.

How to Fill Out Form 1099-DA Instructions

Before we get into the step-by-step filing steps, you should know that Form 1099-DA comes with up to four copies, each with a different use:

- Copy A: Sent to the Internal Revenue Service (IRS).

- Copy 1: Submitted to the state tax department (if required).

- Copy B: Given to the payment recipient for their records and tax filing.

- Copy 2: Attached to the recipient’s state income tax return (if applicable).

Let's go over the most important filing instructions for each part of the form with that in mind:

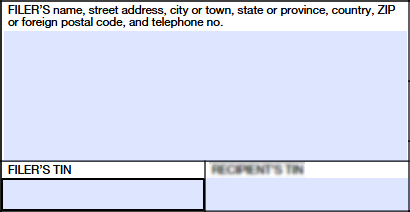

Filer’s Details

- Enter the filer’s name, address, and TIN (EIN if a business; SSN/ITIN if an individual broker)

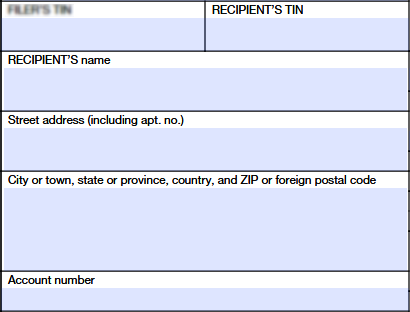

Recipient’s Details

- Enter the recipient’s TIN, legal name, and complete mailing address (street, city, state, ZIP, or foreign postal code).

- Add the account number if the recipient has multiple accounts with you.

CUSIP Number

- For brokers reporting a tokenized security under Regulations §1.6045-1(c)(8)(i)(D)(1), enter the CUSIP or other applicable identifying number of the digital asset.

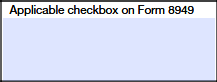

Applicable Checkbox on Form 8949:

- Use this box to enter a one-letter code to help the recipient report the transaction on Form 8949 and/or Schedule D (Form 1040):

- Code G. This code indicates a short-term transaction for which the cost or other basis is being reported to the IRS.

- Code H. This code indicates a short-term transaction for which the cost or other basis is not being reported to the IRS.

- Code J. This code indicates a long-term transaction for which the cost or other basis is being reported to the IRS.

- Code K. This code indicates a long-term transaction for which the cost or other basis is not being reported to the IRS.

- Code Y. Use this code to report a transaction if you cannot determine whether the recipient should check box H or box K on Form 8949 because the holding period is unknown.

Box 1a – Code for Digital Asset

- Enter the nine-character alphanumeric digital token identifier assigned by the Digital Token Identifier Foundation (DTIF). You can look up your assets in the DTIF Registry. If the asset is not registered with DTIF, enter “999999999.”

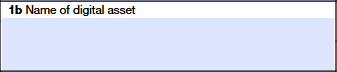

Box 1b – Name of Digital Asset

- Enter the full name of the digital asset being reported. If a DTIF identifier was entered in Box 1a, provide the name matching the DTIF registration. For qualifying stablecoins, enter the stablecoin’s name. For specified NFTs, enter “Specified NFTs.” s

Box 1c – Number of Units

- Enter the number of digital asset units sold, exchanged, or otherwise disposed of, up to 18 decimal places. For qualifying stablecoins, enter the total stablecoin units. For specified NFTs, enter the total number of NFT units.

Box 1d – Date Acquired

- Enter the date you acquired the digital asset in MM/DD/YYYY format (e.g., 05/24/2025).

- Leave blank if the assets were acquired on multiple dates, if Box 9 is checked and the acquisition date is unknown, or when reporting qualifying stablecoins or specified NFTs using an optional reporting method.

Box 1e – Date Sold or disposed

- Enter the sale date of the digital asset in MM/DD/YYYY format.

Box 1f – Proceeds

- Report gross proceeds from the sale (cash, property, services, or other digital assets), reduced by transaction fees.

Box 1g – Cost or Other Basis

- Enter the adjusted basis of the digital asset sold. If the asset is not a covered security and you check Box 9 without reporting basis, leave Box 1g blank. Enter “0” only if the asset’s basis is zero.

Box 1h – Accrued Market Discount

- Enter the accrued market discount amount for digital assets that are both covered securities and debt instruments for federal income tax purposes.

Box 1i – Wash Sale Loss Disallowed

- Enter disallowed losses under wash sale rules (applies mainly to tokenized securities).

Box 2 – Check if Basis Reported to IRS

- Check this box if you are either not checking Box 9 or are checking Box 9 but still reporting basis in Box 1g. Do not check this box for sales of qualifying stablecoins or specified NFTs under an optional reporting method.

Box 3a – Reported to IRS:

- Indicate whether proceeds are gross or net of premiums/fees.

Box 3b – Check if Proceeds Are Form a Qualified Opportunity Fund (QOF)

- Check this box if the sale involves a disposition of an interest in a Qualified Opportunity Fund.

Box 4 – Federal Income Tax Withheld

- Report any backup withholding.

Box 5 – Check if Loss Is Not Allowed based on amount in 1f

- Check this box if the loss reported in Box 1f is not allowed.

Box 6 – Gain or Loss

- Report the profit or loss from digital assets that were sold, exchanged, or otherwise disposed of. Indicate if it was short-term or long-term and if any part was ordinary income.

Box 7 – Check if Only Cash Proceeds Were Paid in the Transaction

- Check this box if only cash (U.S. dollars or any convertible foreign currency issued by a government or central bank) was paid in the transaction. Check this box even if you combined the reporting of the underlying transaction with the report of the transaction used to pay broker fees.

Box 8 – Check if broker reflied on customer-provided

- Check if you received customer-provided acquisition info to identify digital assets sold, exchanged, or disposed of, even if not used for the lot reported. Skip if all such assets were already disposed of.

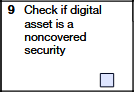

Box 9 – Check id digital asset is a Noncovered Security

- Check this box if reporting a sale of a noncovered security. Do not check for covered securities or qualifying stablecoins/NFTs using the optional reporting method. If checked, you did not have to complete boxes 1d, 1g, 1h, 1i, and 6, or check box 2. Completing them voluntarily does not incur penalties under sections 6721 and 6722.

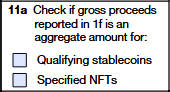

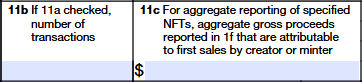

Box 11a–11c – Reason Digital Asset Was Eligible for an Optional Reporting Method

- If you reported sales of a digital asset eligible for an optional reporting method, check the applicable box to indicate the type of digital asset.

- If you checked “Qualifying stablecoins,” you must complete box 11b.

- If you checked “Specified NFTs,” you must complete box 11b and, if applicable, box 11c.

- If neither box was checked, you did not have to completeboxes 11b or 11c.

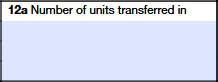

Box 12a – Number of Units Transferred In

- Report the number of digital asset units that were transferred into a custodial account. Enter the amount to 18 decimal places. If you reported sales of qualifying stablecoins orspecified NFTs using an optional reporting method, leave this box (12a) blank.

Box 12b – Transfer-In Date

- Enter the date the digital assets were transferred into a custodial account, using the MM/DD/YYYY format.

Boxes 14–16 – State Information

- Enter the state boxes only if the amounts are required to be reported to the states:

- Box 14: Enter the abbreviated name of the state.

- Box 15: Enter the filer’s state identification number assigned by the state.

- Box 16: Enter the amount of state income tax withheld, if any.

These boxes are for your convenience and are not required for IRS filing. If reporting for more than one state, use the dash line to separate the information. If a state requires a paper copy, provide Copy 1 to the state and give Copy 2 to the payee for their state income tax return.

How to E-File Form 1099-DA with TaxZerone

E-filing Form 1099 DA with TaxZerone is simple, fast, and secure. Before you start, make sure you have all the required information ready to avoid mistakes and save time.

What You Need to eFile 1099-DA Form

- Filer information: Name, address, and TIN (EIN for businesses or SSN/ITIN for individuals).

- Recipient information: Name, address, TIN, and account number (if applicable).

- Transaction details: Digital asset information, proceeds, cost/basis, gain/loss, and Form 8949 code (G, H, or J).

Step 1: Fill Out Form 1099-DA

Enter all required details, including your information and the recipient’s details, the digital asset transaction amounts, and the applicable Form 8949 code.

Step 2: Review and Submit

Carefully check all entries. TaxZerone automatically validates your form to catch errors or missing information. Once verified, e-file the form directly with the IRS.

Step 3: Provide the Recipient Copy

After submission, share a copy with the recipient for their tax records. You can send it securely via email or provide access through the ZeroneVault portal, where recipients can view their forms anytime.

Benefits of E-Filing Form 1099-DA with TaxZerone

E-file Form 1099-DA using TaxZerone and enjoy multiple benefits. Here are some of the key advantages:

- Built-in IRS Checks: Lowers the possibility of rejections or fines by automatically verifying your Form 1099-DA entries to identify any missing or inaccurate information.

- Share Recipient Copies Easily: Use ZeroneVault to send recipient copies digitally or opt for postal delivery—no manual mailing is necessary.

- Quick Bulk Filing: To expedite the reporting process, upload hundreds or even thousands of 1099-DA documents at once.

- Affordable Pricing: Time and money can be saved without sacrificing accuracy with competitive pricing based on file volume.

- Step-by-Step Filing Interface: No technical knowledge or tax experience is required; an intuitive tool walks you through each step.