Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 1098-Q, Qualifying Longevity Annuity Contract (QLAC) Information, is an IRS information return used to report details about QLACs purchased from qualified retirement accounts, such as IRAs and 401(k) plans.

Annuity providers and insurance companies must file this form with the IRS and furnish a copy to the contract holder to ensure compliance with retirement distribution rules. This form helps the IRS track QLAC purchases and verify that the invested amount is correctly excluded from Required Minimum Distributions (RMDs) until annuity payments begin, typically at age 85.

These instructions provide guidance on who must file, what information must be reported, deadlines, and compliance requirements for Form 1098-Q.

Table of Contents

Who needs to file form 1098-Q?

A contract issuer must file Form 1098-Q if they issue a Qualifying Longevity Annuity Contract (QLAC). Form 1098-Q is used to report details about QLACs purchased from qualified retirement accounts, such as IRAs and 401(k) plans.

The form provides important information related to QLACs, such as premium payments and annuity terms.

Filing Requirements for a QLAC

- A QLAC must meet certain requirements, including:

- Premiums within dollar limits

- Annuity payments starting no later than the first day of the month after the employee’s 85th birthday

- Specific distribution and death benefit rules

Limitation on Premiums—Plans and IRAs

2025 Premium Limit: For QLACs, premiums paid in 2025 must not exceed $200,000 (adjusted for inflation thereafter). This limitation applies to premiums paid for QLACs in both employer-sponsored plans and IRAs.

Exchange of Insurance Contracts for QLAC

If an insurance contract is exchanged for a QLAC, the fair market value of the exchanged contract counts towards the premium limit.

Consequences of Excess Premiums

If premiums exceed the limit, the contract may lose its status as a QLAC unless corrected in a specified manner. The excess must be returned to the non-QLAC portion of the employee’s account.

Death of Employee and Beneficiaries

Upon the employee’s death, the surviving spouse or designated beneficiary may receive benefits under the QLAC, subject to specific rules regarding annuity payments and survivor benefits.

Return of Premiums

In the case of death, the return of premium payments to beneficiaries is allowed. However, the return of premium is subject to RMD rules and must be paid within the required timeframes.

Special Circumstances

- Form 1098-Q must be filed each year, starting from when premiums are first paid, until the contract holder turns 85 or passes away.

- If the contract holder dies and the spouse is the sole beneficiary, payments to the spouse don’t start until the holder's scheduled benefit age.

- Continue filing Form 1098-Q annually for the spouse until payments begin, or the spouse passes.

Important deadline to file Form 1098-Q

The important due dates for filing, including the deadline Form 1098-Q, are given below.

To IRS:

- E-Filing: The IRS encourages the Issuers (annuity providers and insurance companies) to file Form 1098-Q electronically. Electronic filing is mandatory if the issuer is submitting 10 or more forms in information returns.

Deadline for the Tax year 2025 : March 2, 2026

- Paper filing: Issuer (Annuity providers and insurance companies) can use the paper filing method for Form 1098-Q if they file fewer than 10 forms..

Deadline for the Tax year 2025 : March 2, 2026

To the Participant:

The issuer (annuity provider or insurance company) must send copies to the contract holder (participant) by February 2, 2026, for the 2025 tax year.

Key information reported on Form 1098-Q:

Form 1098-Q reports information including:

- Contract's holder information

- Issuer's information

- Account number

- Annuity start date

- Annuity invested in QLAC

- QLAC Certification

Form 1098-Q instructions-how to fill out?

Step-by-step instructions to fill out Form 1098-Q

Step 1: Enter the Issuer’s Details

Enter the Issuer’s name, address and telephone number along with the Issuer’s Taxpayer identification Number.

Step 2: Enter the Participant’s Details

Enter the Participant's Tax Identification Number (TIN).

Enter the Participant’s name and address including apartment number, city, state, country, and ZIP code.

Step 3: Qualifying Longevity Annuity Contract Details

Account Number

An account number is required if you are filing multiple Forms 1098-Q for the same recipient. The IRS also recommends assigning an account number to all Forms 1098-Q in your file.

Plan Number, Name of Plan, and Employer Identification Number

If the contract is purchased under the plan, enter the plan number, name of plan, and EIN of the plan sponsor in the appropriate field.

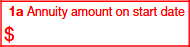

Box 1a. Annuity Amount on Start Date

The annuity amount is the scheduled payment that will be made to the participant once the annuity begins.

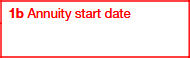

Box 1b. Annuity Start Date

Enter the date when the participant’s annuity payments will begin with their Qualified Longevity Annuity Contract (QLAC).

The date reported is shown in the format of month, day, and year, mm/dd/yyyy.

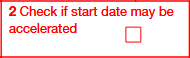

Box 2. Check if Start Date May Be Accelerated

Check this box if annuity payments have not yet started, and the start date can be moved earlier than originally scheduled.

Box 3. Total Premiums

Enter the total amount of money that has been paid to the Qualifying Longevity Annuity Contract (QLAC) up until the end of the calendar year.

The total amount paid to all QLACs should not exceed $200,000. If exceeds more than that, you should contact the contract issuer.

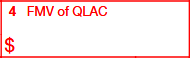

Box 4. FMV of QLAC

Enter the Fair Market Value (FMV) of the Qualified Longevity Annuity Contract (QLAC) as of the end of the calendar year.

Boxes 5a Through 5l

Enter the premium amount paid for the contract along with the date of each payment.

Simplify your Form 1098-Q filing with TaxZerone

TaxZerone ensures fast, accurate and secure filing, and helps you stay compliant with the IRS.