Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

IRS Form 1098-F, is used to report fines, penalties, or other amounts paid by individuals, businesses, or other entities as a result of violating laws, regulations, or environmental rules. This form is intended to help ensure that these payments are reported accurately to the Internal Revenue Service (IRS).

Government agencies or entities (including nongovernmental entities treated as governmental) that assess or collect these fines or penalties are responsible for filing this form. Additionally, a copy of Form 1098-F must be sent to the recipient, the individual or entity that incurred the fine or penalty.

Table of Contents

Who required to file form 1098-F?

The government or governmental entity (including nongovernmental entities treated as governmental entities,) must file Form 1098-F to report any fines, penalties, or other amounts. These payments generally arise from violations of laws, regulations, or environmental rules imposed by federal, state, or local authorities.

If you are filing Form 1098-F, you must provide a statement to the payer. Filers of Form 1098-F may truncate a payer's Taxpayer Identification Number (TIN) on statements furnished to the payer, but not on IRS filings. A filer's own TIN cannot be truncated.

Important deadline to file for form 1098-F:

The form 1098-f deadline are given below for the tax year:

To IRS:

- E-Filing: The IRS recommends electronic filing for Form 1098-F and requires it for entities submitting 10 or more information returns.

Deadline for the Tax year 2025 : March 31, 2026

- Paper filing: Entities can use the paper filing method if they are submitting fewer than 10 forms.

Deadline for the Tax year 2025 : March 2, 2026

To the Payer:

The appropriate entity must provide a copy of Form 1098-F to the recipient (the person or entity that incurred the fine or penalty) by January 31 of the following year.

Form 1098-F instructions-how to fill out?

Step-by-step instructions to file form 1098-F

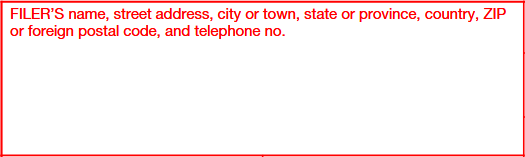

Step 1: Enter the Filer’s details

Enter the filer’s name, address and telephone number along with Filer’s Taxpayer Identification Number. Use the same name and address on Form 1096.

Step 2: Enter the Payer’s details

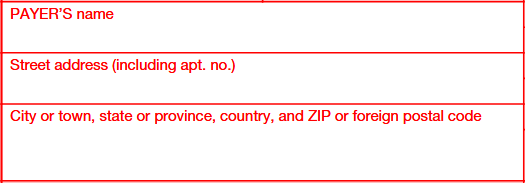

Enter the Payer’s Taxpayer Identification Number (TIN).

Enter the Payer’s name, and address including apartment number, city, state, country, and ZIP code.

Step 3: Fines, Penalties and other amounts details

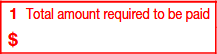

Box 1: Total Amount to be paid Pursuant to the Suit, Order, or Agreement

Enter the total amount due to suit, order or agreement which the amount equals or exceeds $50,000.

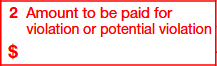

Box 2: Amount To Be Paid for Violation or Potential Violation

Enter the amount required to be paid for a violation, investigation, or inquiry into a potential legal violation. If some or all of the amounts paid to investigation and potential legal violation of law is not identified. Leave Blank on Box 2 and write Code E in Box 9.

Box 3. Restitution/Remediation Amount

Enter the amount required to be paid for restitution/ remediation under the suit, order or agreement. If the some or all of the amounts paid for restitution/ remediation is not identified. Leave Blank on Box 3 and write code E in Box 9.

Box 4. Compliance Amount

Enter the amount required to be paid as result of suit, order or agreement, for the purpose of compliance with a law. If some or all of the amounts paid is not identified. Leave the blank in Box 4 and write the code E in Box 9.

Box 5. Date of Order/Agreement

Enter the date when the court issued the order or when the agreement was fully executed.

Box 6. Court or Entity

Enter the name of the court or relevant entity that issued the order or approved the agreement.

Box 7. Case Number

Enter the case number which is in court order or agreement.

Box 8. Case Name or Names of Parties to Suit, Order, or Agreement

Enter the case name or name of the parties to suit, order or agreement.

Box 9: Code

Enter one or more of the following codes. read the code description carefully and choose the correct ones:

Code A: Multiple Payments

Use Code A if the payer has made (or) is required to make multiple payments to fulfill the total amount specified in the suit, order, or agreement.

Code B: Multiple Payers

Use Code B if multiple payers are making multiple payments under the suit, order, or agreement.

Code C: Multiple payees

Use code C if there are multiple payees under the suit, order, or agreement.

Code D: Provision of services or provision of property

Use Code D if the suit, order, or agreement requires the payer to provide services or transfer property.

Code E: Payment amount not identified

Use Code E if the suit, order, or agreement does not specify some or all of the amount required for the violation, investigation, or inquiry, or if it identifies a payment for restitution, remediation, or compliance but leaves the total amount or payment for property/services unspecified.

Effortlessly file Form 1098-F with TaxZerone!

Ensure accuracy, stay compliant, and get instant IRS notifications