Form 8849 Schedule 6 Instructions: Other Claims

Claim a Refund for Your Heavy Vehicle with TaxZerone!

Form 8849 Schedule 6 is used to request refunds of excise taxes that don't fall under the more specific categories found on other schedules. This schedule is commonly referred to when filing other claims that don’t have a dedicated form or schedule within Form 8849, especially after Form 2290 has already been filed.

Whether your vehicle was sold, destroyed, or stolen, Schedule 6 helps you reclaim the tax you already paid.

Table of Contents

What is Form 8849 Schedule 6?

Schedule 6 also referred as "Other Claims" is submitted with Form 8849 to request refunds for:

- Overpaid or mistakenly paid federal excise taxes.

- HVUT paid for vehicles that were sold, destroyed, or stolen.

- Vehicles that were used less than 5,000 miles (or 7,500 miles for agricultural vehicles) during the tax year.

Unlike other schedules of Form 8849 that target specific taxes (like fuel or retail taxes), Schedule 6 is designed for miscellaneous or general refund situations.

Ready to claim your excise tax refund?

With TaxZerone , filing Form 8849 with Schedule 6 is fast, simple, and stay IRS compliant. s

When to Use Schedule 6?

You should file Form 8849 with Schedule 6 if:

| Scenario | Refund Eligibility |

|---|---|

| Truck was sold, destroyed, or stolen | Refund for unused portion of HVUT |

| Truck used less than 5,000 miles (or 7,500 for agriculture) | Full HVUT refund |

| You overpaid HVUT on Form 2290 | Refund of excess tax paid |

Required Information and Documentation to claim a Refund on Heavy Vehicles

Before you start filling out Form 8849, make sure you have all the necessary information and documents ready. Here’s what you’ll need:

- Your name and Address (individuals, businesses)

- Employer Identification Number (EIN)

- Vehicle Identification Number (VIN)

- Taxable gross weight category

- Date of Sale, Destroyed, or stolen

- Refund amount

- Name and Address of the purchaser of sold vehicle

Filing Deadline

Refund claims must be submitted:

- Within 3 years from the date you filed the original Form 2290, or

- Within 2 years from the date, you paid the tax — whichever is later.

Filing within this period ensures the IRS processes your refund without rejection.

Types of Claims Allowed on Schedule 6

Use Schedule 6 of Form 8849 to claim a refund of Heavy Vehicle Use Tax (HVUT) if a vehicle was sold, destroyed, stolen, Low Mileage Vehicles or if you overpaid.

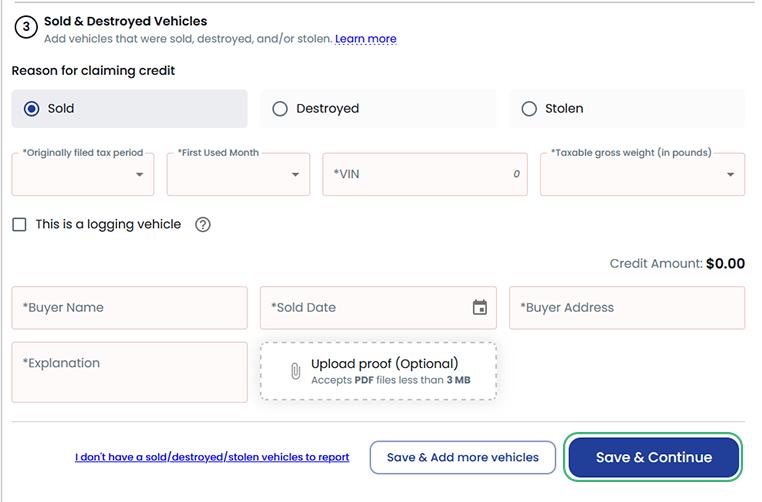

1. Sold:

- If you sold your truck during the tax year and already paid HVUT, you can get a refund for the remaining months.

- You’ll need the date of sale, VIN, and just mention when you sold the vehicle. Uploading Bill of sale is optional.

2. Destroyed:

- If your vehicle was permanently damaged (e.g., fire or accident), you may qualify for a partial refund.

- Submit the Tax period, FUM, VIN, Taxable gross weight, destruction date, and describe what happened and when it was destroyed. Proof like an insurance report is optional.

3. Stolen:

- If your vehicle was stolen and not recovered, you can claim a prorated refund.

- Enter the date it was stolen and explain the situation. Uploading the theft document is optional.

4. Low Mileage Vehicles:

- If your vehicle was driven 5,000 miles or less (7,500 miles for agricultural vehicles) during the tax year, you may qualify for a refund of the HVUT paid

5. Overpaid:

- Overpaid HVUT? This usually happens with duplicate payments or incorrect vehicle weight.

- Submit proof of both payments and an explanation.

Step-by-Step Instructions to Fill Out Form 8849 Schedule 6 in TaxZerone

Here are the step-by –step instructions Form 8849 to fill out a refund claim for excise tax

Step 1: Sign In or Create an Account

- If you’re new to TaxZerone, click Sign Up to create your account.

- Already have an account? Just click Sign In to log in and get started.

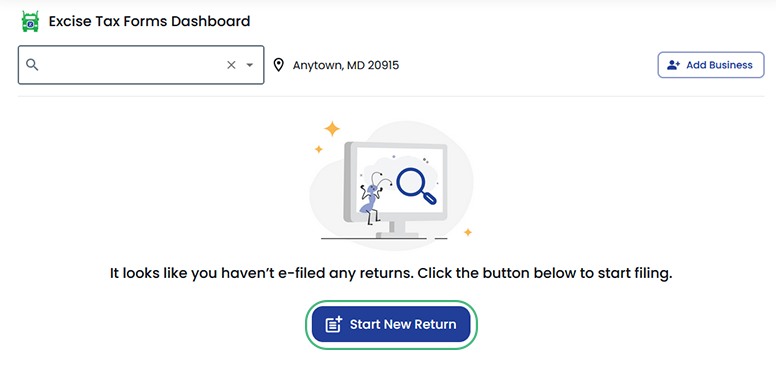

Step 2: Start a New 8849 Filing

From the Excise Tax Forms Dashboard, click on "Start New Return"

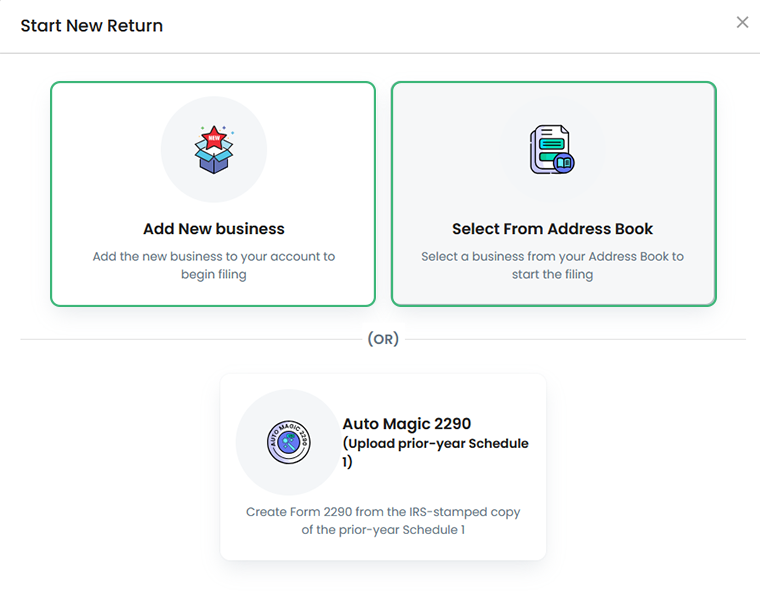

Step 3: Add or Select a Business

- New users? Click "Add New Business" to enter your business details.

- Returning users? Click "Select from Address Book" to use an existing business profile.

You'll need to enter:

- Business Name

- Employer Identification Number (EIN)

- Business Address

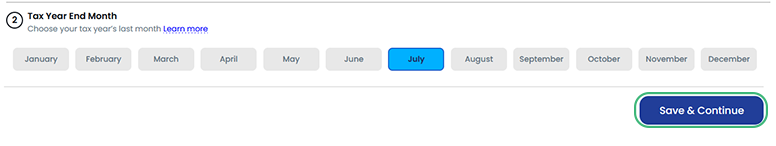

Step 4: Select Tax Year End Month

- Choose the tax year’s last month you're filing for.

- Click "Save & Continue"

Step 5: Provide Refund Reason and Upload Documents

- Indicate the reason for the claim (e.g., vehicle was sold, destroyed, or stolen) and, if available, upload supporting documents.

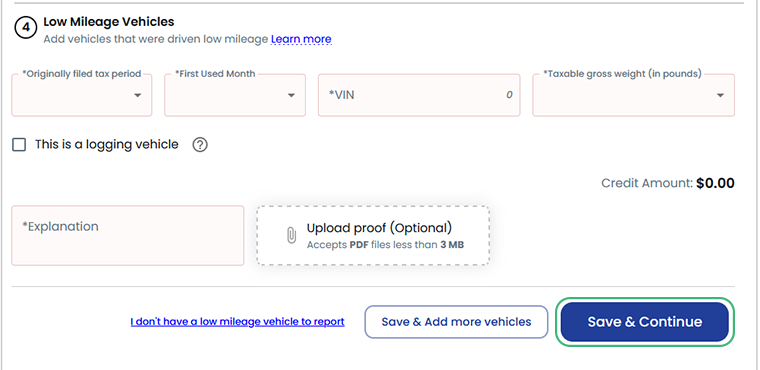

Step 6: Add Low Mileage Vehicles (If Applicable)

- If you're claiming a refund for low mileage vehicles, enter the details and Click "Save & Continue" or have no low mileage vehicles to report, click "I don’t have low mileage vehicles to report".

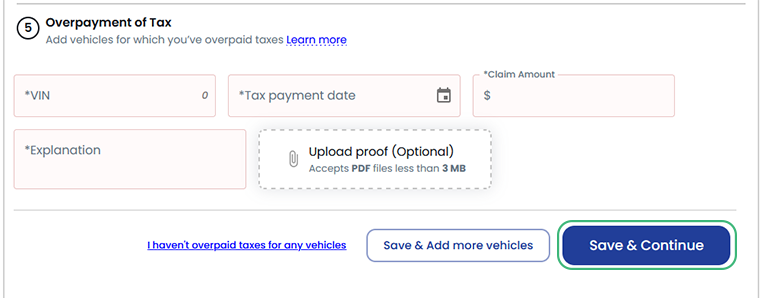

Step 7: Report Overpayment of Tax (If Any)

- If you’ve overpaid tax for any vehicle, enter the relevant details and Click "Save & Continue"

- If not, simply click "I don’t have overpaid tax to report".

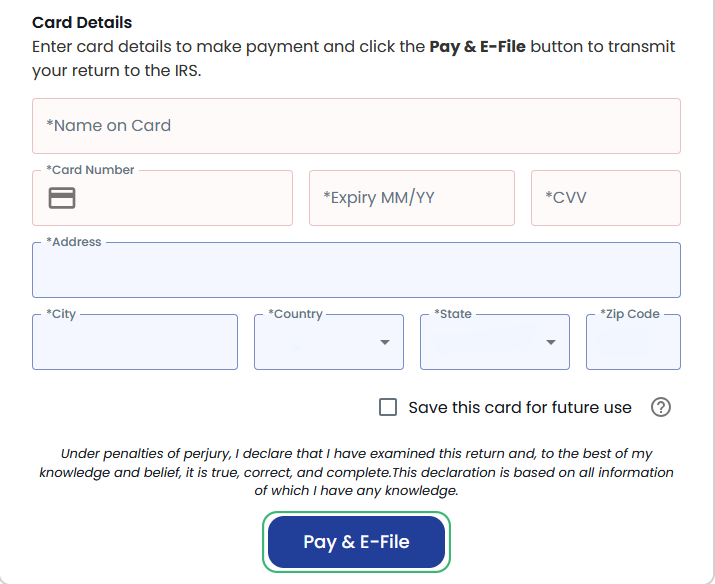

Step 8: Submit Your Filing

Enter card details to make payment and click the Pay & E-File button to transmit your return to the IRS.

Mailing Address:

Department of the Treasury

Internal Revenue Service

Cincinnati, OH 45999-0002

Need a quick guide?

Watch our easy step-by-step video on YouTube to learn how to file Form 8849 and claim a refund on Heavy Vehicle Use Tax (HVUT) for overpaid or exempt vehicles

🎥 Watch here [Watch Tutorial Videos]

Don’t Wait to Get Your HVUT Refund!

Make sure you’ve got your documents ready, choose Schedule 6 for your refund claim,

and double-check your details before filing.