IRS Form 5227 Instructions

E-file your IRS Form 5227 for the 2025 tax year to report split-interest trust financials and charitable distributions accurately.

Excise Tax Forms

Employment Tax Forms

Information Returns

Extension Forms

Business Tax Forms

FinCEN BOIR

General

IRS Form 5227, Split-Interest Trust Information Return, is used to report the financial activities of split-interest trusts. These trusts typically combine charitable and non-charitable beneficiaries. Filing this form ensures compliance with IRS requirements and provides transparency in how trust income, deductions, and distributions are handled.

Trustees are responsible for preparing and filing Form 5227 annually with the IRS.

Table of Contents

Who Must File

Form 5227 must be filed by trustees of any trust organized as one of the following:

- Charitable remainder annuity trusts (CRATs)

- Charitable remainder unitrusts (CRUTs)

- Charitable lead trusts (CLTs)

- Pooled income funds

These split-interest trusts are required to submit Form 5227 annually, providing a detailed report of their financial activities, distributions, and charitable deductions.

Trustees of CRATs, CRUTs, CLTs, or pooled income funds—Form 5227 filing is mandatory.

With TaxZerone, e-file quickly and ensure every detail of trust income, distributions, and charitable deductions is reported correctly.

Exception to Filing Requirement

A split-interest trust is not required to file Form 5227 if all these conditions apply:

- The trust was created before May 27, 1969, and

- All corpus transfers to the trust occurred before May 27, 1969, or

- For every transfer of corpus made after May 26, 1969, no deduction was allowed under any of the sections listed in IRC section 4947(a)(2).

However, if a split-interest trust formed before May 27, 1969, receives a contribution to corpus after that date for which a deduction is allowed, it loses this exception status. In that case, the trust must file Form 5227 starting with the tax year when the contribution occurs and for every subsequent year thereafter—just like any split-interest trust created on or after May 27, 1969.

When is Form 5227 Due?

- For Calendar-Year Trusts: The filing deadline for Form 5227 reporting the 2025 tax year is April 15, 2026.

- For Fiscal-Year Trusts: Form 5227 must be filed by the 15th day of the fourth month after the end of the trust’s fiscal year in 2026. For example, if the fiscal year ends on June 30, 2026, the form is due by October 15, 2026.

- Extension of time to file: Trustees may request a six-month extension to file Form 5227 by submitting Form 8868 (Application for Extension of Time to File an Exempt Organization Return) on or before the original filing deadline (April 15, 2026, for calendar-year trusts). If granted, the extended deadline will generally be October 15, 2026, for calendar-year trusts.

Penalties for Noncompliance

- Failure to File Timely, Complete, or Correct Return: The penalty is $25 per day (up to $12,500 per return). If the trust has gross income over $318,500, the penalty is $125 per day (up to $63,500 per return).

- Failure to Comply with IRS Written Demand: If the IRS sends a written demand, the penalty is $10 per day up to $6,000 if not complied with by the specified date.

- Trustee Penalty: If the trustee knowingly fails to file, the same penalty applies to both the trust and the trustee.

- Additional Penalties: Penalties may apply for filing false or fraudulent returns or if key information is missing. Incomplete or incorrect returns can jeopardize compliance and charitable deductions.

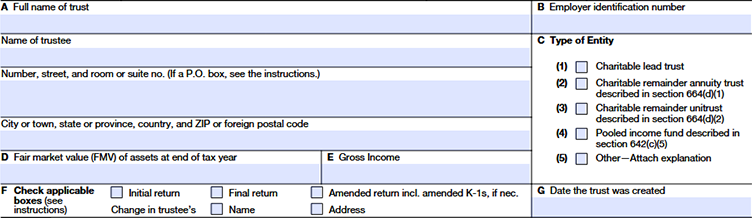

Trust Identification Information

In this section of Form 5227, trustees provide the basic identifying details of the trust, including its legal name, trustee information, address, type of entity, financial values, and filing status. These details allow the IRS to recognize the trust, confirm its structure, and track compliance.

- Full Name of Trust – Enter the legal name of the trust as stated in the trust agreement.

- Name of Trustee – Provide the trustee’s full name. If multiple trustees exist, list the primary contact.

- Address – Include the number, street, and room or suite number. If using a P.O. Box, follow IRS guidelines. Also provide the city, state, ZIP code, and country (if foreign).

- Employer Identification Number (EIN) – Report the trust’s EIN, not the trustee’s personal SSN.

- Type of Entity – Indicate whether the trust is a:

- Charitable lead trust

- Charitable remainder annuity trust (CRAT)

- Charitable remainder unitrust (CRUT)

- Pooled income fund

- Other (with explanation attached)

- Fair Market Value of Assets – State the total fair market value of all trust assets at the end of the tax year.

- Gross Income – Report the trust’s total gross income before any deductions or expenses.

- Return Type/Status – Check the appropriate box if this is an initial return, final return, amended return (with amended K-1s if necessary), or if trustee information has changed.

- Date the Trust Was Created – Enter the original date the trust was established

Part I: Income and Deductions - Sections A to E

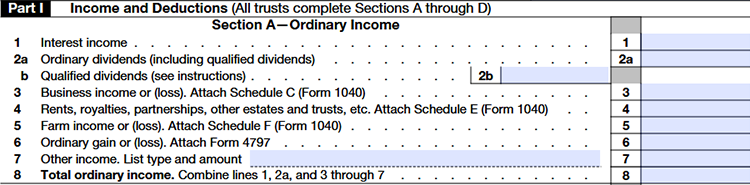

Section A: Ordinary Income

- Interest Income

List the total taxable and tax-exempt interest (excluding municipal bond interest, which will be later in Section C). This includes interest from bank accounts, corporate bonds, notes receivable, etc.

2a. Ordinary Dividends

Report the gross amount of dividends received from stocks, mutual funds, and similar investments before any expenses.

2b. Qualified Dividends

Of the dividends received, identify and enter qualified dividends (generally, those held long enough to qualify for special tax treatment; check instructions for criteria).

- Business Income or (Loss)

Enter business income or loss for the trust. If the trust operates or holds interests in a trade or business, attach IRS Schedule C (Form 1040). - Rents, Royalties, Partnerships, Other Estates and Trusts

Enter net income or loss from rental real estate, royalties, and income from partnerships or other entities. Attach IRS Schedule E (Form 1040). - Farm Income or (Loss)

List net farm income or loss. Attach IRS Schedule F (Form 1040) if the trust is engaged in farming activities. - Ordinary Gain or (Loss)

Report gains or losses on the sale of property used in a trade or business (not the typical capital assets). Attach Form 4797. - Other Income

Specify any other ordinary income sources not previously reported. Provide both the type and the dollar amounts in an attached statement if there are multiple other income types. - Total Ordinary Income

Add together lines 1, 2a, and 3 through 7, and enter the total on line 8.

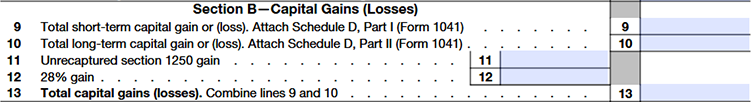

Section B: Capital Gains (Losses)

- Short-Term Capital Gain or (Loss)

Enter all net short-term capital gains and losses. Attach IRS Schedule D, Part I (Form 1041), detailing capital transactions of assets held one year or less. - Long-Term Capital Gain or (Loss)

Report the net total of long-term capital gains and losses (assets held more than one year). Use Schedule D, Part II (Form 1041). - Unrecaptured Section 1250 Gain

If the trust sold depreciated real estate, report any recapture income relating to this special category. - 28% Rate Gain

Report gains that are subject to the 28% maximum tax rate (e.g., gains on collectibles and certain small business stock). - Total Capital Gains (Losses)

Combine amounts from lines 9 and 10 for a net capital gain or loss.

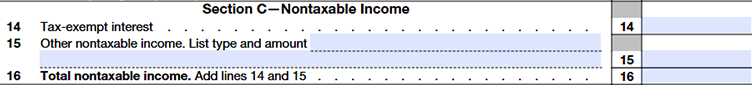

Section C: Nontaxable Income

- Tax-Exempt Interest

Report interest on municipal or other tax-exempt bonds. - Other Nontaxable Income

Specify other types of nontaxable income (e.g., life insurance proceeds, gifts). Provide both type and amount. - Total Nontaxable Income

Add lines 14 and 15.

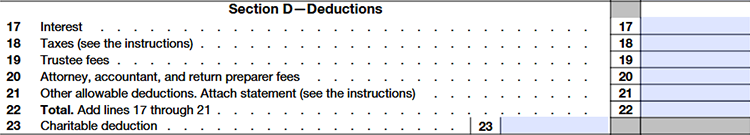

Section D: Deductions

- Interest

Total interest expense paid by the trust (e.g., on loans, mortgages). - Taxes

Taxes paid by the trust that are deductible (property taxes, state income taxes, etc.). Federal income taxes cannot be deducted. - Trustee Fees

Enter total fees paid to trustees. - Attorney, Accountant, and Return Preparer Fees

Sum all professional fees paid in connection with trust administration. - Other Allowable Deductions

List other deductions permitted under the tax code (insurance, safe deposit box rental, etc.). Attach a detailed itemization if necessary. - Total Deductions

Add the amounts from lines 17 to 21. - Charitable Deduction

Report the total amount distributed or set aside for charitable purposes that’s eligible for a charitable deduction.

Section E: Deductions Allocable to Income Categories (Section 664 Trusts Only)

24a. Allocable Ordinary Income Deductions

Enter the portion of total deductions from line 22 that is attributable to ordinary income.

b. Ordinary Income Less Allocable Deductions

Subtract 24a from 8, and enter the result.

25a. Allocable Capital Gain Deductions

List the portion of deductions that pertain to capital gain.

b. Capital Gain Less Allocable Deductions

Subtract 25a from 13, and enter the result.

26a. Allocable Nontaxable Income Deductions

Report the part of deductions related to nontaxable income.

b. Nontaxable Income Less Allocable Deductions

Subtract 26a from 16, and enter the remaining nontaxable income.

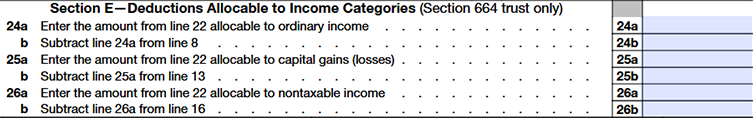

Part II: Schedule of Distributable Income (Section 664 Trusts Only)

This section tracks the amounts of income the trust has available for distribution, categorized by ordinary income, capital gains, and nontaxable income. It also accounts for the special Net Investment Income (NII) classifications relevant post-2012.

- Lines 1-3:

- Line 1: Enter any undistributed income carried forward from prior tax years, divided into ordinary income (a), capital gains/losses (b), and nontaxable income (c).

- Line 2: Report current tax year net income before distributions, sourcing amounts from Part I (lines 24b, 25b, and 26b) for each category.

- Line 3: Sum undistributed income (line 1) and current year income (line 2) for total distributable income.

- NII Classification Columns:

- Distinguish between "Excluded Income" and "Accumulated NII post 2012" within each income category for tax and reporting accuracy.

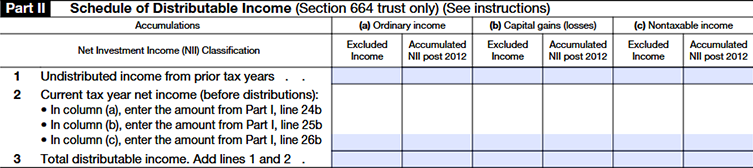

Part III: Distributions of Principal for Charitable Purposes

This section accounts for the use of trust principal to fulfill charitable purposes.

- Section A (Lines 1-4):

- Line 1: Enter total principal amounts distributed for charitable purposes in prior tax years.

- Line 2: Report principal distributed in the current tax year for charitable purposes.

For each distribution, provide: - (A) Payee's full name and address.

- (B) Date of distribution.

- (C) Charitable purpose and a description of any non-cash assets distributed.

- Line 3: Total all amounts reported on attachments for distributions beyond the main form space.

- Line 4: Add lines 1 through 3 for total principal charitable distributions.

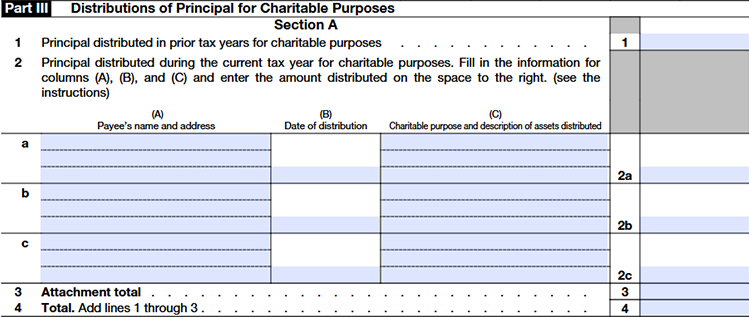

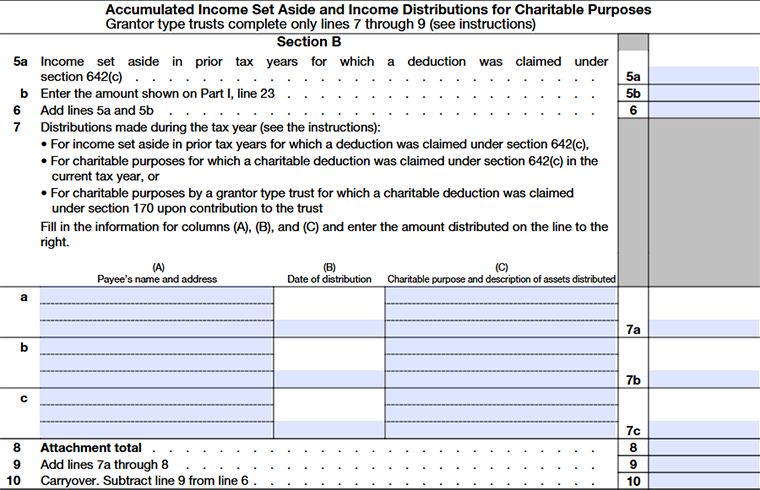

- Section B(Lines 5-10): Accumulated Income Set Aside and Income Distributions

- Lines 5a & 5b: Report income set aside in prior years for which a charitable deduction was taken (per IRC Section 642(c)) and the current year's charitable deduction from Part I, line 23.

- Line 6: Sum of lines 5a and 5b.

- Lines 7a-7c: Report distributions made during the year against amounts set aside in prior and current years, with full payee, date, and purpose details.

- Line 8: Total current year distributions attached.

- Line 9: Sum of distributions (lines 7 + 8).

- Line 10: Carryover amount, calculated by subtracting line 9 from line 6, indicating income set aside but not yet distributed.

- Grantor Trusts: Only complete lines 7-9 in Section B.

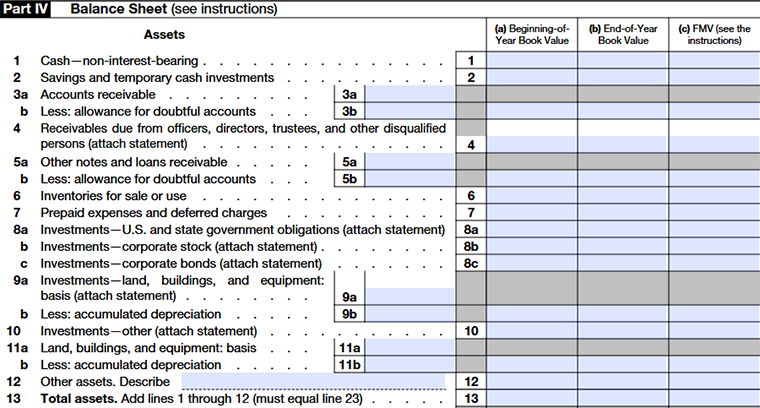

Part IV: Balance Sheet

Report the trust's financial position as of the start and end of the tax year.

- Lines 1-13: Assets

- Include all categories such as cash (interest-bearing and non-interest), receivables (with allowance for doubtful accounts), notes/loans, inventories, prepaid expenses, investments (government, corporate stocks/bonds, real estate, equipment), and other assets with descriptions.

- Provide beginning and ending book values and the fair market value (FMV) for each asset category.

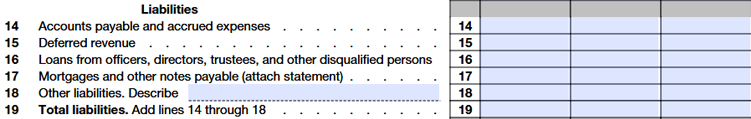

- Lines 14-19: Liabilities

- Accounts payable, accrued expenses, deferred revenue, loans from disqualified persons, mortgages, and other liabilities.

- Attach supporting statements for complex liabilities.

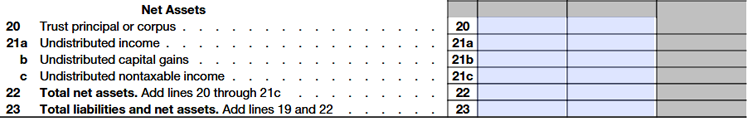

- Lines 20-23: Net Assets

- Principal or corpus, undistributed income (ordinary, capital gains, and nontaxable).

- Line 22: Sum of total net assets.

- Line 23: Total liabilities plus net assets (should balance with total assets).

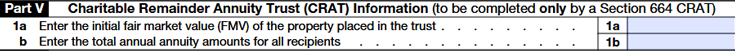

Part V: Charitable Remainder Annuity Trust (CRAT) Information

For CRATs governed under Section 664(d)(1) only.

- Line 1a: Enter the initial fair market value of property placed into the trust.

- Line 1b: Enter the total annual annuity amounts paid to all recipients.

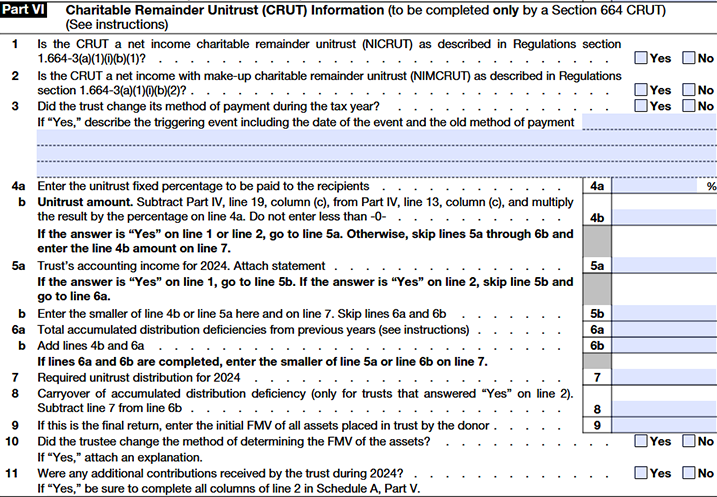

Part VI: Charitable Remainder Unitrust (CRUT) Information

For CRUTs governed under Section 664(d)(2).

- Line 1: Indicate if the CRUT is a Net Income Charitable Remainder Unitrust (NICRUT).

- Line 2: Indicate if it is a Net Income with Make-up CRUT (NIMCRUT).

- Line 3: State whether the trust changed its payment method during the year; if yes, provide a detailed explanation.

- Line 4a: Enter the fixed percentage unitrust payout.

- Line 4b: Calculate and enter the unitrust amount by subtracting liabilities from assets FMV, multiplied by the percentage.

- Line 5-8: These lines address trust accounting income, accumulated distributions, and final required distributions for the year, as well as any carryover of distribution deficiencies for NIMCRUTs.

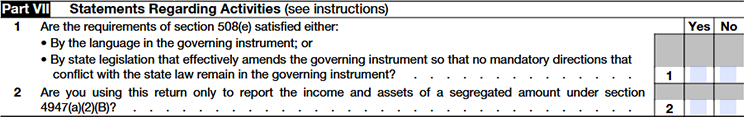

Part VII: Statements Regarding Activities

- Line 1: Confirm whether IRC section 508(e) requirements are met (governing instrument amendments or state law compliance).

- Line 2: Indicate if the return only reports income/assets of segregated amounts under Section 4947(a)(2)(B).

Part VIII: Statements on Activities Requiring Form 4720

If any of these activities apply, Form 4720 must be filed unless an exception applies.

- Self-Dealing (Section 4941): Activities with disqualified persons related to sales, loans, reimbursements, compensation, or transfers.

- Excess Business Holdings (Section 4943): Trust ownership in businesses beyond allowed thresholds.

- Jeopardizing Investments (Section 4944): Investments threatening the charitable purpose.

- Taxable and Political Expenditures (Sections 4945 & 4955): Involvement in lobbying, political campaigns, grants outside charitable purposes, or disallowed expenditures.

- Personal Benefit Contracts (Section 170(f)(10)): Contracts involving personal benefit premiums.

Trustees must answer these questions truthfully, provide explanations, and file Form 4720 if required.

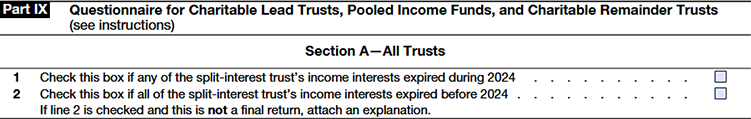

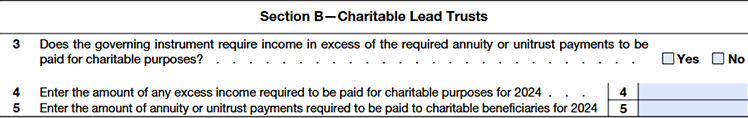

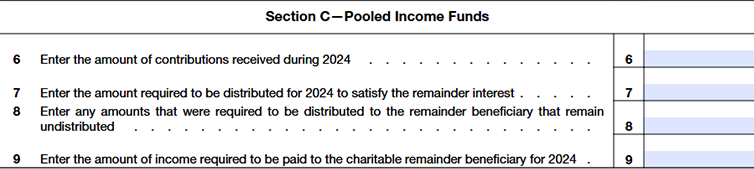

Part IX: Questionnaire for Charitable Lead Trusts, Pooled Income Funds, and Charitable Remainder Trusts

- Section A: Indicate if any income interests expired during the year or prior years.

- Section B (Charitable Lead Trusts): Report excess income requirements and required payments to charitable beneficiaries.

- Section C (Pooled Income Funds): Provide details of contributions received, required distributions to remainder beneficiaries, and any undistributed remainder amounts.

- Section D (Charitable Remainder Trusts): Declare if the trust involves cemeteries or veterans’ posts, elections related to income timing, trust instrument amendments, final distributions, foreign account interests (FinCEN Form 114 requirements), etc.

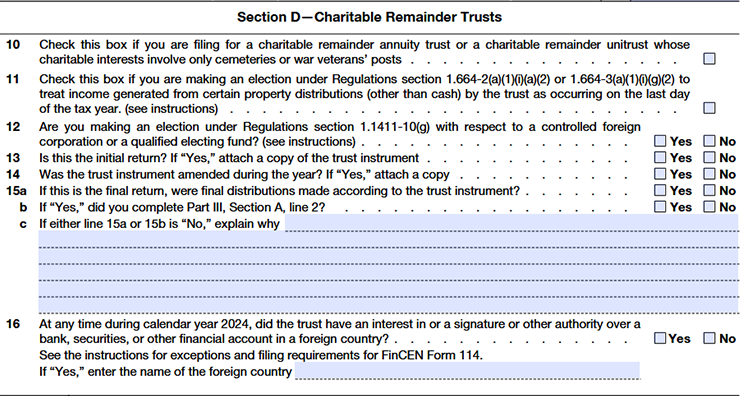

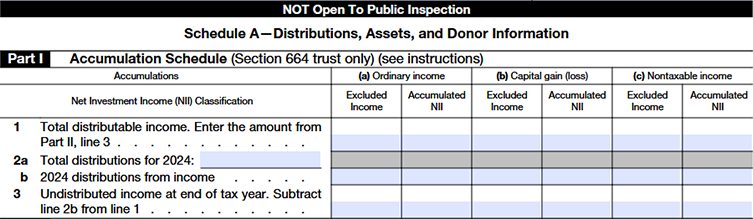

Schedule A (Not Open to Public Inspection)

Overview of Schedule A

Schedule A of Form 5227 is a confidential attachment used by Section 664 charitable remainder trusts (CRTs) and charitable lead trusts to report detailed accumulations of income, distributions, asset donations, and donor information. Unlike the main Form 5227, Schedule A is not open to public inspection to protect sensitive donor and distribution data.

Part I: Accumulation Schedule (Section 664 Trusts Only)

This schedule tracks trust income accumulations by type and their classification under Net Investment Income (NII) rules.

- Line 1: Total Distributable Income

Enter the total distributable income amount from Part II, line 3 of the main Form 5227. Break it down into: - (a) Ordinary income

- (b) Capital gain (loss)

- (c) Nontaxable income

Additionally, classify each as "Excluded Income" or "Accumulated NII post 2012" within their respective columns, following applicable IRS NII rules. - Line 2a: Total Distributions for 2025

Enter total amounts distributed during the tax year across all income categories. - Line 2b: 2025 Distributions from Income

Specify the portion of those 2025 distributions attributable solely to income (versus principal/corpus). - Line 3: Undistributed Income at End of Tax Year

Calculate the remaining undistributed income by subtracting line 2b from line 1 for each income type and classification.

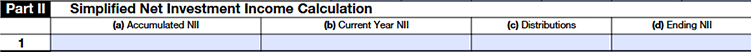

Part II: Simplified Net Investment Income (NII) Calculation

Track the NII components consistently during the year:

- Column (a) Accumulated NII: Enter prior years’ accumulated NII amounts.

- Column (b) Current Year NII: Enter current year NII amounts.

- Column (c) Distributions: Report distributions reducing NII.

- Column (d) Ending NII: Calculate ending NII balance after distributions.

This simplified schedule helps ensure proper tracking of NII for taxation and reporting purposes.

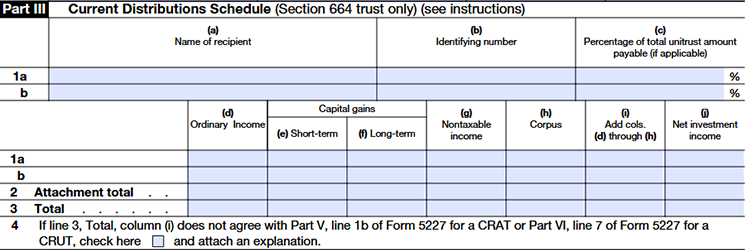

Part III: Current Distributions Schedule (Section 664 Trusts Only)

Report current year distributions with detailed recipient information.

- Columns to fill:

- (a) Recipient’s full name and address

- (b) Recipient’s identifying number (e.g., social security or EIN) — only here as Schedule A is confidential

- (c) Percentage of total unitrust payable if applicable

- (d) Ordinary income distributed

- (e) Short-term capital gains distributed

- (f) Long-term capital gains distributed

- (g) Nontaxable income distributed

- (h) Corpus or principal distributed

- (i) Total distribution amount (sum of columns d through h)

- (j) Net investment income distributed

- Line 2: For more recipients than fit on the form, attach a schedule continuing the same details, then summarize attachment totals on line 2.

- Line 3: Total distributions to all recipients; the sum of amounts shown in column (i) including attachments.

- Line 4: If the total on line 3 column (i) does not match the corresponding amounts reported elsewhere on the main Form 5227 (Part V line 1b for CRATs or Part VI line 7 for CRUTs), check this box and attach a detailed explanation.

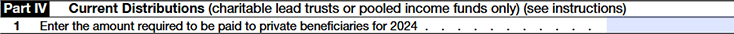

Part IV: Current Distributions for Charitable Lead Trusts or Pooled Income Funds Only

- Line 1: Enter the total amount required to be paid to private beneficiaries (non-charitable recipients) in the current tax year.

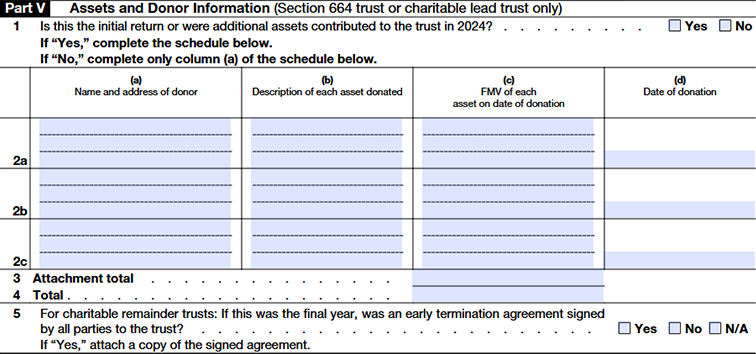

Part V: Assets and Donor Information (Section 664 Trusts or Charitable Lead Trusts Only)

- Line 1: Initial Return or Additional Contributions for 2025

If this is the trust’s first return or if new assets were contributed during 2025, answer "Yes." Otherwise, answer "No." - Schedule below Line 1 if “Yes”:

Provide: - (a) Donor name and address

- (b) Description of each donated asset

- (c) Fair Market Value (FMV) of each asset on the donation date

- (d) Date of donation

- Lines 2a to 4:

Complete as applicable, summarizing donations made, with total FMV reported on Line 4. - Line 5: Final Year Termination Agreement

For charitable remainder trusts, if this was the final filing year, indicate whether an early termination agreement was signed by all parties. If yes, attach a copy of the signed agreement.

Key Points and Best Practices

- Schedule A is confidential, ensure this form is handled securely and separately from public filings.

- Attach supplemental schedules for additional recipients or donations if space is insufficient.

- Reconciliation between Schedule A distributions and the main Form 5227 is crucial to avoid IRS inquiries.

- Keep thorough documentation supporting FMV calculations, donor identity, asset descriptions, and distribution purposes.

- Filing Schedule A accurately reflects compliance with section 664 trust rules and ensures trust tax reporting integrity.

FAQs

1. What information must be reported on Form 5227?

Details include trust identification, income and deduction breakdowns, distributable income schedules, distributions to beneficiaries, asset and liability balances, and specific information for CRATs and CRUTs.

2. Is Schedule A part of Form 5227 public?

No, Schedule A contains sensitive distributions and donor information and is exempt from public inspection to protect privacy.

3. What are the penalties for not filing or filing late?

Penalties for not filing or filing late can include a fine of $25 per day, up to $12,500 per return, or $125 per day, up to $63,500 for larger trusts. Failure to file or filing inaccurately may also jeopardize the trust’s tax-exempt status.

4. Do I need to file Form 1041 in addition to Form 5227?

Typically, no. Split-interest trusts use Form 5227 instead of Form 1041 for reporting. However, certain situations may require both forms; consult a tax advisor.

5. Can I request an extension to file Form 5227?

Yes, trustees can file Form 8868 to request an automatic 6-month extension before the original due date. This extends the filing deadline but not the deadline to pay any tax owed.

6. How long is the extension for Form 5227?

You can request a 6-month extension to file Form 5227 by submitting IRS Form 8868 before the original deadline. For calendar-year trusts, this typically extends the filing deadline from April 15 to October 15 of the filing year. Note that the extension only applies to filing, not to payment.

Ready to E-file your Form 5227?

Ensure your split-interest trust stays compliant with the IRS.

TaxZerone makes it simple, accurate, and secure to e-file your Form 5227 online.