Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 3921 is an IRS information return used to report stock transfers resulting from the exercise of an Incentive Stock Option (ISO). It helps taxpayers track potential tax implications related to ISOs, making it a crucial stock option to return for both corporations and employees.

Table of Contents

Who needs to file Form 3921?

Corporations are required to file Form 3921 if they transfer shares of stock to any person during the calendar year as a result of that person exercising an Incentive Stock Option (ISO), which is in Section 422(b) of the Internal Revenue Code.

Key requirements for filing Form 3921

Form 3921 can be filed either online through e-filing or by sending paper forms directly to the IRS. Before filing, you must know the information needed to file.

Employee information for those who exercised the Incentive Stock Option, including their name, address, and TIN.

- Date the incentive stock option was granted

- Date the option was exercised

- Exercise price per share

- Fair market value of each share on the date the option was exercised.

- Number of shares transferred

Important deadline for Form 3921

If your company transfers stock to an employee through an incentive stock option (ISO) plan, you're required to file Form 3921 with the IRS and furnish a copy to the employee.

For the 2025 tax year, the Form 3921 deadline is as follows:

| Filing Type | Deadlines |

|---|---|

| Sending employee copy | February 2, 2026 |

| Paper filing | March 2, 2026 |

| IRS e-filing | March 31, 2026 |

Form 3921 instructions on how to fill out form 3921 online ?

Let’s see the step-by-step process of fill out Form 3921

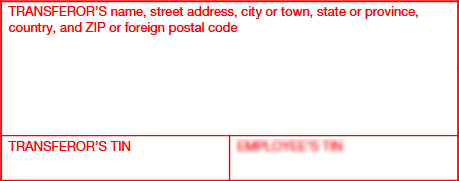

Step 1: Enter the Transferor’s details

Enter the name, address (street, city, state, ZIP), and the Taxpayer Identification Number (TIN) of the entity transferring the stock.

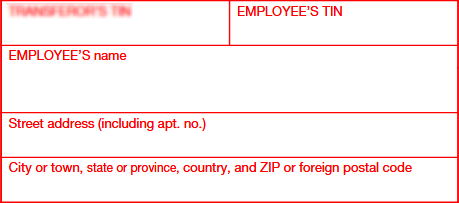

Step 2: Enter the Employee’s details

Enter the employee’s name, address, and Taxpayer Identification Number (TIN) to whom the shares were transferred as a result of exercising the option.

Step 3: Stock Options & Exercise Details

Account Number

The account number is required to identify and track multiple Form 3921 filings for the same person. If an individual has more than one account or transaction related to the exercise of an incentive stock option (ISO), the account number allows the IRS and the filer to distinguish between those separate filings.

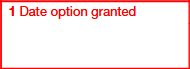

Box 1: Date Option Granted

Enter the precise date on which the corporation formally granted the Incentive Stock Option (ISO) to the employee.

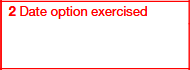

Box 2: Date Option Exercised

Enter the date on which the employee exercised the stock option.

Box 3: Exercise Price Per Share

The corporation is required to enter the exercise price for each share of stock.

Box 4: Fair Market Value per share on exercise date

Enter the fair market value (FMV) per share of the company’s stock on the date the employee exercised the option.

Box 5: Number of Shares Transferred

Enter the total number of shares that were transferred to the employee when the stock option was exercised.

Box 6: If Other Than TRANSFEROR, Name, Address, and TIN of Corporation Whose Stock Is Being Transferred

Enter the name, address, and TIN of the corporation transferring the stock as part of the option to exercise. Only provide this information if it is different from the corporation listed in the TRANSFEROR section at the top left corner of this Form.