Form 1099-Q Instructions

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

What is IRS Form 1099-Q?

IRS Form 1099-Q is used to report distributions from qualified education programs, such as 529 plans and Coverdell ESAs, to both the IRS and the recipient. These distributions cover educational expenses for designated beneficiaries.

Who can file Form 1099-Q?

Any financial institution, educational institution, or entity that administers a qualified education program and makes distributions of $10 or more during the tax year must file Form 1099-Q. This form ensures that both the IRS and the recipient are informed about the taxable distributions.

When is the Form 1099-Q due date?

There are two key deadlines related to Form 1099-Q that trustees/payers must be aware of:

Filing deadline with IRS

The deadline for trustees/payers to file Form 1099-Q with the IRS depends on the filing method:

- E-filing deadline: March 31st, 2026

If you're e-filing the Form 1099-Q to the IRS, the deadline is March 31st of the year following the tax year for which the form is being issued - Paper filing deadline: February 28th, 2026*

If you're filing Form 1099-Q with the IRS using traditional paper filing methods, the deadline is earlier — February 28th of the year following the tax year for which the form is being issued.

Avoid the last-minute 1099-Q deadline stress

E-file with TaxZerone now for easy IRS compliance and peace of mind.

Recipient copies deadline: January 31st, 2026*

Trustees/payers are required to provide copies of Form 1099-Q to the recipients (individuals or entities that received interest payments) by January 31st of the year following the tax year for which the form is being issued. This ensures that recipients have the necessary information to accurately report their interest income when filing their tax returns.

It is crucial for payers to meet these deadlines to avoid potential penalties from the IRS for failure to file Form 1099-Q accurately and on time. Penalties may be imposed for late filing, failure to provide recipient copies, or reporting incorrect information on the form.

Form 1099-Q penalty

If you miss filing Form 1099-Q within the deadline, the IRS will impose a penalty for each missed return. Below is the breakdown of Form 1099-Q penalties:

| Days late | Penalty per return |

|---|---|

| Up to 30 days | $60 |

| 31 days late through August 1 | $130 |

| After August 1 or not filed | $340 |

| Intentional disregard | $680 |

Why risk penalties?

Choose TaxZerone to e-file your 1099-Q forms ahead of the deadline.

Form 1099-Q Instructions - How to fill out?

Let's see line-by-line instructions on how to fill out Form 1099-Q.

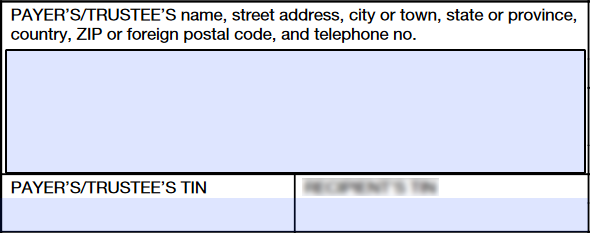

Trustee/Payer details

Enter the payer/trustee’s name, complete address, and TIN (SSN if you're an individual; EIN if you're a business).

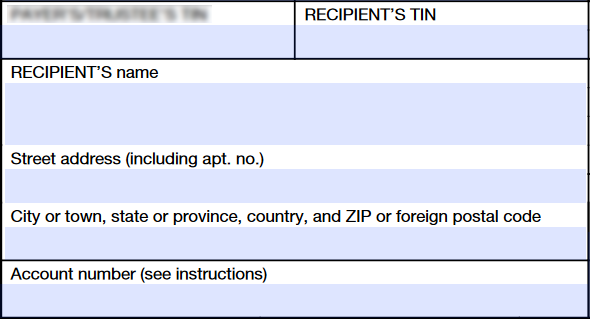

Recipient details

Enter the recipient’s name, complete address, and TIN (SSN for an individual; EIN for a business).

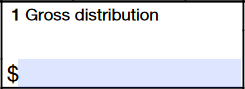

Box 1: Gross Distribution

For Qualified Tuition Programs (QTPs):

- Includes cash or in-kind distributions for:

- Tuition credits or certificates

- Payment vouchers

- Tuition waivers

- Similar items

- Also includes refunds to account owner, designated beneficiary, and beneficiary (in case of death or disability)

For Coverdell Education Savings Accounts (ESAs):

- Includes refunds, payments upon death or disability, and withdrawals of excess contributions plus earnings

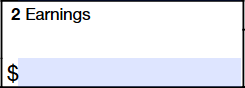

Box 2: Earnings

Enter earnings in Box 2. If there's a loss:

- Enter zero if it's not the final distribution year or if there are no earnings.

- Only report the loss if it's the final distribution year.

Earnings are not subject to backup withholding.

If you are reporting a distribution from a Coverdell ESA that includes a returned contribution plus earnings, file two separate Forms:

- One for the returned contribution plus earnings

- One for the distribution of the other part of the account

Box 3: Basis

For Qualified Tuition Programs (QTPs) and Coverdell Education Savings Accounts (ESAs):

Enter the basis amount in Box 3

Calculation:

- Box 3 amount = Box 1 (Gross Distribution) - Box 2 (Earnings)

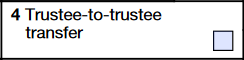

Box 4: Type of Transfer

Box 4a: Trustee-to-Trustee Transfer

Check this box for direct transfers:

For Qualified Tuition Programs (QTPs):

- From one QTP to another QTP

- From a QTP to an ABLE account

For Coverdell Education Savings Accounts (ESAs):

- From one Coverdell ESA to another Coverdell ESA

- From a Coverdell ESA to a QTP

Important for transfers between qualified education programs:

- The distributing program must provide you a statement showing the earnings portion of the distribution

- This statement is due within 30 days of the distribution or by January 10, whichever is earlier

- Use this information to properly calculate the earnings (or loss) reported in Box 2 and the basis reported in Box 3

Box 4b: QTP to Roth IRA Transfer

Check this box if the distribution was made directly (trustee-to-trustee transfer) from a QTP to a Roth IRA maintained for the benefit of the QTP beneficiary.

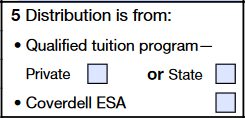

Box 5a-5c: Distribution Is From

Box 5a: Private QTP

Check this box if the distribution is from a Qualified Tuition Program (QTP) established by one or more private eligible educational institutions.

Box 5b: State QTP

Check this box if the distribution is from a QTP established by a state.

Box 5c: Coverdell ESA

Check this box if the distribution is from a Coverdell Education Savings Account (ESA).

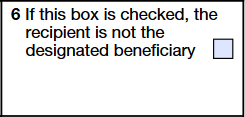

Box 6: Designated Beneficiary Checkbox

Check the box if the recipient is not the designated beneficiary under a QTP or a Coverdell ESA.

How to file Form 1099-Q?

Form 1099-Q can be filed electronically or by postal mail.

Form 1099-Q electronic filing (E-filing)

The IRS recommends e-filing Form 1099-Q as the process is efficient and straightforward. E-filing offers the advantage of receiving notifications promptly after the IRS processes your submission.

With TaxZerone, the e-filing process is streamlined and can be completed within minutes. You simply need to fill out the form, review the information, transmit it to the IRS electronically, and provide the recipient's copy.

Paper filing

If you prefer to file Form 1099-Q via traditional paper methods, here are the steps to follow:

- Download and print Form 1099-Q from the IRS website (www.irs.gov).

- Complete the required fields, including the recipient's name, address, TIN, and distribution amount. Also, provide your business name, address, and TIN.

- Mail the completed paper form to the IRS at the address specified in the 1099 instructions. Refer to the "Where to Send Form 1099-Q - Mailing Address" section to find the correct address for your state.

- Send a copy of the 1099-Q to the recipient by January 31st for their tax reporting purposes.

Important considerations for paper filing:

- Mail the forms several weeks before the deadline to ensure timely arrival at the IRS.

- You are required to provide a copy of the 1099-Q to the recipient for accurate tax reporting on their part.

- Paper filing involves printing, mailing, and tracking forms. As an alternative, you can choose to file 1099-Q forms electronically for faster processing and delivery.

Where to send Form 1099-Q - Mailing address

If you prefer paper filing, the mailing address for Form 1099-Q varies depending on your business location. Below is a table summarizing the mailing address for Form 1099-Q:

| If your business operates in or your legal residence is… | Mail Form 1099-Q to… |

|---|---|

| Alabama, Arizona, Arkansas, Delaware, Florida, Georgia, Kentucky, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Texas, Vermont, Virginia | Internal Revenue Service Austin Submission Processing Center P.O. Box 149213 Austin, TX 78714 |

| Alaska, Colorado, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming | Department of the Treasury IRS Submission Processing Center P.O. Box 219256 Kansas City, MO 64121-9256 |

| California, Connecticut, District of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia | Department of the Treasury IRS Submission Processing Center 1973 North Rulon White Blvd. Ogden, UT 84201 |

| Outside the United States | Internal Revenue Service, Austin Submission Processing Center, P.O. Box 149213, Austin, TX 78714 |

How to e-file Form 1099-Q with TaxZerone

Before initiating the e-filing process for Form 1099-Q, it's essential to have all the necessary information ready to ensure a smooth and efficient filing experience. Here's what you'll need:

Required information for filing Form 1099-Q:

- Payer/Trustee details.

- Recipient details.

- Payment details: Gross Distribution, Earnings and Basis

Once you have gathered all the required information, you can proceed with the e-filing process using TaxZerone in three simple steps:

Step 1: Complete Form 1099-Q

Fill out the form with the necessary details, including payer and recipient information, gross distribution, and distribution code.

Step 2: Review and transmit the return

Carefully review the information entered to ensure accuracy, and then transmit the completed Form 1099-Q to the IRS electronically.

Step 3: Provide the recipient copy

After transmitting the form to the IRS, send a copy of the completed Form 1099-Q to the recipient for their tax reporting purposes.

Benefits of e-filing Form 1099-Q with TaxZerone

When you choose to e-file Form 1099-Q with TaxZerone, you can enjoy the following advantages:

- IRS form validations: Ensure accuracy by checking your returns for potential errors or missing information.

- Email recipient copies: Conveniently send recipient copies via email.

- Secure portal access (ZeroneVault): Provide recipients with secure access to their return copies anytime, anywhere, through the ZeroneVault portal.

- Competitive pricing: Enjoy industry-leading pricing, with rates as low as $0.59 per form.

By leveraging TaxZerone's e-filing solution, you can streamline the Form 1099-Q filing process, ensuring accuracy, efficiency, and compliance with IRS requirements.