Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes are used by charitable organizations to report donations of qualifying vehicles to the IRS. This form is essential for both donors and the IRS, as it allows donors to claim tax deductions while ensuring compliance with tax laws.

If the organization sells the vehicle, the deduction is generally limited to the sale proceeds. Organizations must provide the donor with a copy of the form within 30 days of the donation or sale and submit it to the IRS by the appropriate deadline.

Who needs to file form 1098-C?

A donee organization that receives a qualified vehicle with a claimed value exceeding $500 must file a separate Form 1098-C with the IRS for each contribution.

Important deadline for filing form 1098-C:

If you're reporting a donated motor vehicle, boat, or airplane, it's crucial to stay aware of the Form 1098-C deadline to avoid penalties and ensure donors receive their tax deduction in time.

For the 2025 tax year, the key deadlines are:

To IRS:

- E-Filing: The IRS encourages charity organizations to file Form 1098-C using electronic filing. Electronic filing is mandatory to file the form if the organization is submitting 10 or more forms in information returns.

Deadline for the Tax year 2025 : March 31, 2026

- Paper filing: Charity Organization can using the paper filing method if they file less than 10 forms

Deadline for the Tax year 2025 : March 2, 2026

To the Donor:

The donee organization must provide a copy of Form 1098-C to the donor within 30 days of the donation or the sale of the vehicle.

Form 1098-C instructions-how to fill out?

Step-by-step instructions to fill out 1098-C form

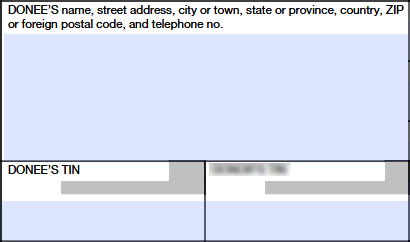

Step 1: Enter the Donee’s details

Enter the Donee’s name, address and telephone number along with the donee’s Taxpayer Identification Number (TIN).

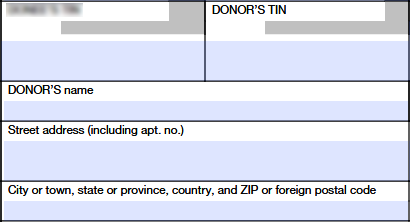

Step 2: Enter the Donor’s details

Enter the donor's Taxpayer Identification Number (TIN), full name, and complete address, including apartment number, city, state, country, and ZIP code.

Step 3: Contributed property details

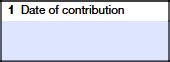

Box 1: Date of Contribution

Enter the date the motor vehicle, boat, or airplane was received from the donor.

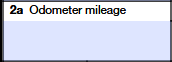

Boxes 2a- 2d: Odometer Mileage, Year, Make, and Model of Vehicle

Enter the odometer mileage reading (for motor vehicles only), along with the make, model, and year of the donated vehicle.

Box 3: Vehicle or Other Identification Number

Enter the Vehicle Identification Number (VIN) for a motor vehicle, the Hull Identification Number for a boat, or the Aircraft Identification Number for an airplane.

Box 4a: Vehicle sold in arm's length transaction to unrelated party

The charity must check this box to certify that the donated vehicle was sold for more than $500 in an arm’s length transaction to an unrelated party and fill out boxes 4b and 4c.

Skip this box if the vehicle’s claimed value is $500 or less.

Box 4b: Date of Sale

If you checked box 4a, enter the date the vehicle was sold in the arm's length transaction. Skip this box if the vehicle's claimed value is $500 or less.

Box 4c: Gross proceeds

Enter the gross proceeds the charity received from the sale of the donated vehicle.

If box 4a is checked, you can generally claim a deduction equal to the smaller amount in box 4c or the vehicle's fair market value (FMV) on the date of the donation.

Skip this box if the vehicle’s claimed value is $500 or less.

Box 5a: Vehicle will not be transferred before completion of material improvements or significant intervening use

The charity must check this box to certify that the donated vehicle will not be sold before significant use or improvement. If checked, you can generally deduct the vehicle’s fair market value (FMV) on the contribution date.

Skip this box if the qualified vehicle has a claimed value of $500 or less.

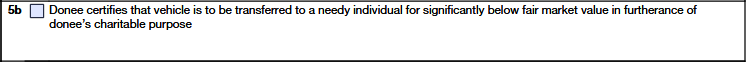

Box 5b: Vehicle to be transferred to a needy individual for significantly below FMV

The charity must check this box to certify that the donated vehicle will be transferred to a needy individual as part of its charitable mission to assist the poor and underprivileged in need of transportation.

Skip this box if the vehicle has a claimed value of $500 or less.

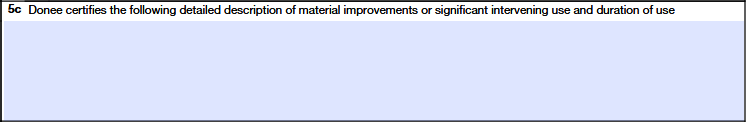

Box 5c: Description of material improvements or significant intervening use and duration of use

Give a detailed description of the planned material improvements or significant intervening use of the vehicle, including the duration of use.

Skip this box if the vehicle's claimed value is $500 or less.

Box 6a: Checkbox for whether donee provided goods and services in exchange for the vehicle described.

Check the box to confirm if any goods or services were provided to the donor in exchange for the vehicle listed in boxes 2a, 2b, 2c, 2d, and 3.

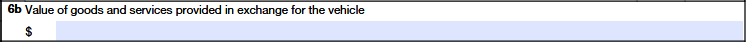

Box 6b: Value of goods and services provided in exchange for the vehicle described

If you checked "Yes" in box 6a, complete box 6b by providing a good faith estimate of the value of goods and services given, including intangible religious benefits. Include the value of any goods and services provided in a different year than the vehicle donation. Refer to Pub. 561 for guidance on valuation.

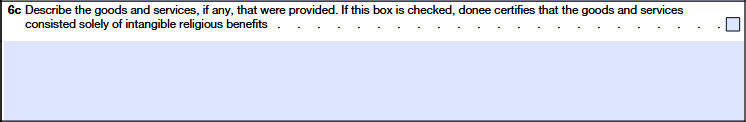

Box 6c: Description of the goods and services

If you checked "Yes" in box 6a, provide a detailed description of the goods and services given to the donor, including any intangible religious benefits. If only intangible religious benefits were received, check the box. These benefits are provided by religious organizations and are not typically sold in commercial transactions.

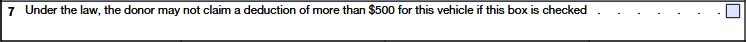

Box 7: Checkbox for a vehicle with a claimed value of $500 or less

Check box 7 if the vehicle's claimed value is $500 or less or if the donor did not provide a TIN. If this box is checked, do not file Copy A with the IRS or provide Copy B to the donor.

File form 1098-C with TaxZerone

Say goodbye to paperwork! TaxZerone helps you file your submissions on time to avoid penalties!