Form 1097-BTC Instructions

Read the instructions and report the bond tax credit accurately with TaxZerone

Excise Tax Forms

Employment Tax Forms

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

If your organization issues or transfers bond tax credits, you’re required to report them using IRS Form 1097-BTC. This form is used to report the allocation of tax credit bonds, such as Build America Bonds or Qualified Energy Conservation Bonds. Filing accurately and on time ensures proper credit tracking and IRS compliance.

Table of Contents

Form 1097-BTC

Form 1097-BTC, is an information form used to report bond tax credits to the IRS annually and to bond holders or investors on a quarterly basis. This form provides information including CUSIP number, type of bond the bond holder has invested in, the total credits and monthly credits. The bond holder can use these credits while filing federal taxes.

Who must file Form 1097-BTC?

Bond Issuers or agents such as brokers, nominees, mutual funds, or partnerships must file copy A of this form with the IRS to report the tax credits distributed. The issuers of bonds will send a copy B to the bond holder if they receive a tax credit of at least $10 directly or indirectly from a tax credit bond or a stripped credit coupon during the tax year.

Types of tax credit bonds

Credit distributed from the following tax credit bonds must be reported on this form.

- New clean renewable energy bonds

- Qualified energy conservation bonds

- Qualified zone academy bonds

- Qualified school construction bonds

- Clean renewable energy bonds

- Build America bonds (Tax Credit).

Important dates for filing

The Form 1097-BTC deadline varies depending on the filing method:

- Paper filing: February 28

- Electronic filing: March 31

Recipient copies must be furnished quarterly before the 15th day of the 2nd month.

| Quarter | Reporting period | Recipient deadline |

|---|---|---|

| 1st Quarter | January to March | May 15 |

| 2nd Quarter | April to June | August 15 |

| 3rd Quarter | July to September | November 15 |

| Annual/4th Quarter | October to December | February 15 |

File with Taxzerone for a quick and easy way to submit

your IRS forms online.

Instructions to file Form 1097-BTC

Follow the instructions and file your forms accurately with Taxzerone.

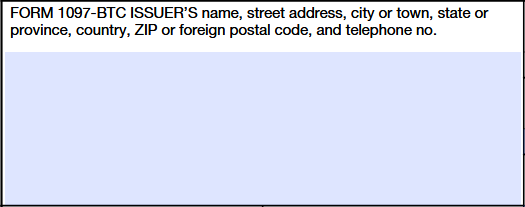

Enter the issuer’s full legal name, complete address including City, State, country, ZIP code and telephone number.

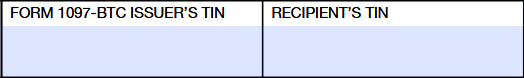

Enter the Issuer’s and Recipient’s TIN (Taxpayer Identification Number) in the appropriate field.

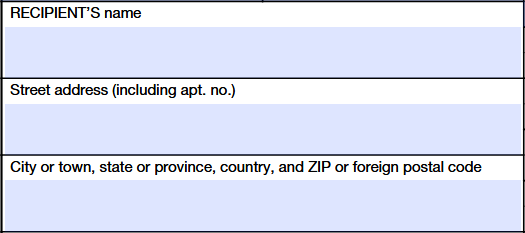

Enter the Recipient's legal name, address including apartment number, city, state, country, ZIP code.

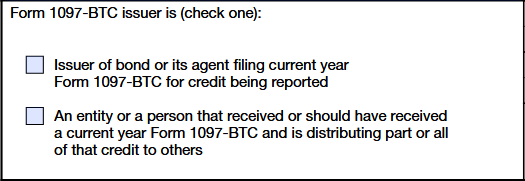

Select only one box that describes the issuer:

- Check the first box if you are the issuer of the bond or an agent filing the current year’s Form 1097-BTC to report the credit.

- Check the second box if you are an entity or individual who has received (or should have received) a current year Form 1097-BTC and you are now distributing part or all of that credit to others.

Enter the calendar year to report when the bond tax credits were issued.

Box 1

Enter the total amount of credits distributed to the recipient for the calendar year, as reported in boxes 5a through 5l. This field should be completed only when filing to the IRS (Copy A) and providing the annual statement to the recipient (Copy B).

Box 2a

Enter the unique identification number code:

- Enter “C” for a CUSIP number,

- Enter “A” for an account number

- Enter “O” for self-provided identification number

If you checked the first box under Form 1097-BTC issuer and you don’t have a CUSIP number in bond, use the account number or any other unique identifying number.

Box 2b

Enter the Unique identification number which is assigned by the issuer and the limit is up to 39 alphanumeric characters. It can be CUSIP number, account number, or any other unique identification number that is used to track bond transactions.

Box 3

For clean renewable energy bonds, enter code "101" and for all other bond types, enter code "199."

Box 4

Reserved for future use.

Boxes 5a-5l

Report the monthly bond tax credits allowed to the recipient for each month of the calendar year. Here’s how to calculate the credit:

STEP 1:

For Qualified tax credit bond, Clean renewable energy bond, or Qualified zone academy bond (issued before October 4, 2008)

calculate the credit by multiplying the outstanding face amount of the bond by the applicable credit rate.

Outstanding face amount = Original face value – Principal amount that has been repaid

Qualified Zone Academy Bonds (Issued Before July 1, 1999):

Calculate the Credit rate by multiplying 110% (or 1.10) by the long-term Applicable Federal Rate (AFR). AFR is published monthly by the IRS in the Internal Revenue Bulletin.

Build America Bond

Calculate the Credit rate by multiplying 35% (or 0.35) by the interest payable on the interest payment date. Enter the amount in boxes 5a–5l for the month in which the interest payment occurred.

Example:

If the bond pays interest on June 30 and December 31, the credit amounts should be entered in box 5f (June) and box 5l (December).

STEP 2:

Qualified Energy Conservation Bond (Issued on March 15, 2017)

| Credit Allowance Date | Send Recipient Copy | Box on Form | Credit Amount |

|---|---|---|---|

| March 15, 2025 | May 15, 2025 | Box 5c | 25% (0.25 × STEP 1 amount) |

| June 15, 2025 | August 15, 2025 | Box 5f | 25% (0.25 × STEP 1 amount) |

| September 15, 2025 | November 17, 2025 | Box 5i | 25% (0.25 × STEP 1 amount) |

| December 15, 2025 | February 16, 2026 | Box 5l | 25% (0.25 × STEP 1 amount) |

Clean renewable energy bond or Qualified tax credit bond

If the clean renewable energy bond or qualified tax credit bond is issued, redeemed, or matured in the middle of 3-month period, instead of getting the full 25% credit for that quarter, credit will be prorated based on how many days the bond was active during those 3 months.

Example 2

A qualified zone academy bond that issued matures on March 23, 2025. The bond is not outstanding for the entire 3-month period ending June 15, 2025, then you must prorate the 25% by dividing the number of days the bond was active by total number of days.

Proration Calculation = 8 days (number of days from March 16 through March 23) / 92 days

(number of days from March 16 through June 15)

= 0.087 x 0.25 = 2% (0.02)

For the Second Quarter, the credit allowance date is June 15, 2025. Enter the amount in box 5f by multiplying 2% (0.02) with STEP 1 amount. For annual reporting, enter in box 1 "27%" (0.27) of the amount determined in STEP 1.

Box 6

Enter any additional information.

Ready to file Form 1097-BTC?

Report bond tax credits accurately and stay compliant with the IRS