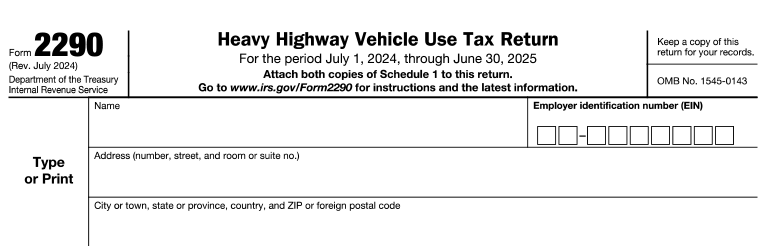

Form 2290 Instructions

E-file your IRS Form 2290 for the 2025-2026 tax year with these easy instructions.

Employment Tax Forms

Information Returns

Exempt Org. Forms

Extension Forms

Business Tax Forms

FinCEN BOIR

General

What is IRS Form 2290?

IRS Form 2290, Heavy Highway Vehicle Use Tax Return, is used to figure and pay road taxes for heavy highway motor vehicles with a taxable gross weight of 55,000 pounds or more that operate on public highways. This return must also be filed when the acquisition of used vehicles is made for the current tax period.

However, vehicles that run less than 5,000 miles (7,500 miles for agricultural vehicles) are considered tax-suspended vehicles. If you own such a vehicle, you are not required to pay the heavy vehicle tax for it but should file the irs 2290 form.

Get Your IRS-Stamped Schedule 1 for the 2025–2026 Tax Year

E-file your 2290 for the 2025-2026 tax year and receive your stamped Schedule 1 in minutes.

Save 10% — Use Code EFILE2290 at Checkout!

Who must file Form 2290?

A trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 irs to figure out and pay HVUT with the IRS every tax year.

When is the Form 2290 due date?

The due date to file Form 2290 with the IRS will be the last day of the month following the vehicle's First Used Month (FUM). The current tax period for heavy highway vehicles begins on July 1, 2025, and ends on June 30, 2026.

The annual Heavy Vehicle Use Tax Form 2290 filing deadline for this tax year is September 2.

IRS Due Date Chart for Tax Year 2025:

| If, in this period, the vehicle is first used during | Then, file IRS Form 2290 and make your payment by* |

|---|---|

| July 2025 | September 02, 2025 |

| August 2025 | September 30, 2025 |

| September 2025 | October 31, 2025 |

| October 2025 | December 01, 2025 |

| November 2025 | December 31, 2025 |

| December 2025 | February 02, 2026 |

| January 2026 | March 02, 2026 |

| February 2026 | March 31, 2026 |

| March 2026 | April 30, 2026 |

| April 2026 | June 01, 2026 |

| May 2026 | June 30, 2026 |

| June 2026 | July 31, 2026 |

*File by this date regardless of when the state registration for the vehicle is due. If any due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Form 2290 penalty

The IRS imposes penalties for failing to file Form 2290 or pay taxes on or before the due date. There are also penalties for filing false or fraudulent returns.

Below are the penalty rates:

| Failure to file the Heavy Vehicle Used Tax (HVUT) return by the deadline. | Failure to file both the 2290 return and heavy vehicle taxes |

|---|---|

| 4.5% of the total tax amount due and the penalty will increase monthly for up to five months. | 0.5% of your total tax amount. You will also face an additional interest charge of 0.54% per month. |

To avoid penalties, you can show a reasonable cause for failing to file Form 2290 or pay taxes on time and can request penalty relief by sending a letter to the IRS explaining the reason.

Form 2290 Instructions - How to fill out?

Here are the step-by-step irs form 2290 instructions to fill out HVUT(Form 2290)

- Name - Enter the name of the filer. The name entered should match the name on the IRS database.

- EIN - Enter the Employer Identification Number

- Address - Enter your organization's address. If the address is outside the United States, in the space for “city or town, state, and ZIP code,” enter the information in the following order: city, province or state, and country.

Check the below lines if applicable,

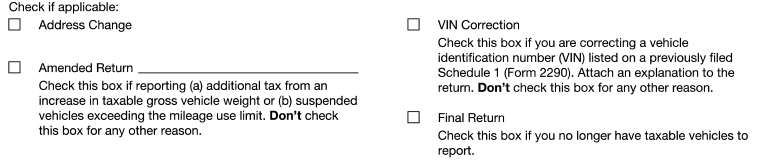

- Address Change - If your address has changed, check the Address Change box.

- VIN Correction - Check the VIN Correction box if you are correcting a VIN listed on a previously filed Schedule 1. List the corrected VIN or VINs on Schedule 1. Also, be sure to use Form 2290 for the tax period you're correcting. Attach a statement with an explanation for the VIN correction.

- Amended Return - Check the Amended Return box only if you're reporting an additional tax from an increase in taxable gross vehicle weight, or suspended vehicles exceeding the mileage use limit.

- Final Return - If you no longer have vehicles to report, check the Final Return box, sign the return, and mail it to the IRS. This will be considered your final 2290 return.

E-file 2290 for suspended vehicles using TaxZerone.

If your vehicles meet the low-mileage suspension criteria, filing Form 2290 (Suspended) with the IRS is mandatory.

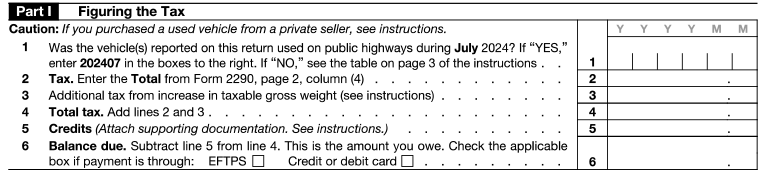

Part I - Figuring the Tax

Line 1: Enter the date for the month of first vehicle use during the tax period.

Line 2: To figure the tax amount on line 2, complete the Tax Computation table on page 2. Enter that total in line 2.

Line 3: Report the additional tax from an increase in taxable gross weight. Complete this line only if the taxable gross weight of a vehicle increases during the period and the vehicle falls into a new category.

Line 4: Add lines 2 and 3 and enter the total tax amount.

Line 5: Complete line 5 only if you are claiming a credit for tax paid on a vehicle that was:

- Sold before June 1 and not used during the remainder of the period,

- Destroyed (so damaged by an accident or other casualty it isn't economical to rebuild it) or stolen before June 1 and not used during the remainder of the period, or

- Used during the prior period 5,000 miles or less (7,500 miles or less for agricultural vehicles)

Line 6: Subtract line 5 from line 4 and enter the amount in line 6. This is the tax amount you owe. Check the respective box on how you're going to make the payment; either via EFTPS or Credit/Debit card.

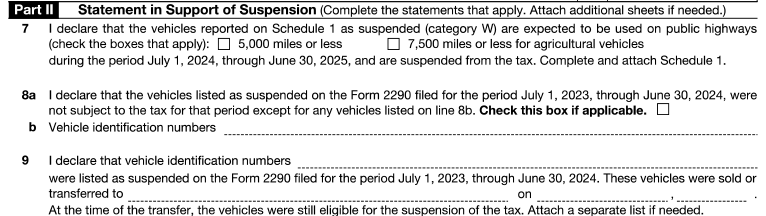

Part II. Statement in Support of Suspension

Line 7: Complete this line to suspend the tax on vehicles expected to be used less than the mileage use limit during a period.

In addition to that, you must also

- List the vehicles on which the tax is suspended on Schedule 1 and

- Count the number of tax-suspended vehicles (designated by category W) listed on Schedule 1, Part I, and enter the number on Schedule 1, Part II, line b.

Line 8a: Verify in this line that vehicles listed as suspended on Form 2290 for the prior tax period and used 5,000 miles or less (7,500 miles or less for agricultural vehicles) were not subject to the tax for that period.

Line 8b: If you checked box 8a, you must list here the VINs of the vehicles listed as suspended in the prior period and then used for 5,000 miles or more during the period (7,500 miles or more for agricultural vehicles).

Line 9: Complete this line under the following context - If in the prior period, line 7, was completed and the tax-suspended vehicles were sold or otherwise transferred.

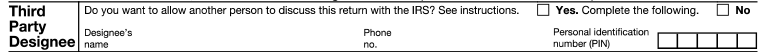

Third Party Designee: If you want to allow an employee of your business, a return preparer, or other third parties to discuss your Form 2290 with the IRS, check the Yes box in the Third Party Designee section of Form 2290.

Also, enter the designee's name, phone number, and any five digits that the person chooses as their personal identification number (PIN). The authorization applies only to the tax return on which it appears.

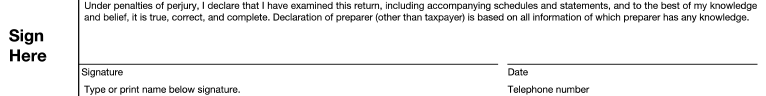

Signature: After you verify all the information in the return, sign it along with the date and telephone number. Returns filed without a signature will be sent back to you for signing.

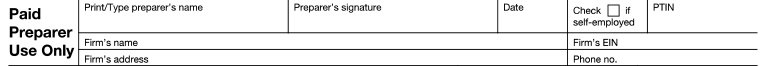

Paid Preparer Use Only: This section must be completed by your Paid Preparer only. The preparer must give you a copy of the form in addition to the copy to be transmitted to the IRS.

If you are a paid preparer, enter your preparer tax identification number (PTIN) in the space provided. Include your complete address. If you work for a firm, you must also enter the firm's name and the EIN of the firm.

How to File Form 2290?

HVUT 2290 form irs can be filed with the IRS electronically or by paper filing.

Electronic filing or E-filing

E-filing your form 2290 heavy use tax with the IRS is the best approach as the process is quick and faster. The IRS also recommends that taxpayers e-file their 2290 returns because they are processed faster and the stamped Schedule 1 will be provided in a matter of minutes.

You can e-file HVUT Form directly with the IRS or can opt to use an e-file service provider.

TaxZerone is an IRS-authorized e-file service provider that supports the electronic filing of Form 2290. You can enter the required information, calculate and pay the balance tax due, transmit the return to the IRS, and get your stamped schedule 1 2290 tax form in minutes!

Paper filing

Another method to file Form 2290 is paper filing. You can manually fill out the form and send it via postal email.

If you are paper filing your HVUT 2290 form, make sure to send the return earlier before the deadline, as it may take some time for the return to reach the IRS.

Although two filing options are available for heavy vehicle users, the IRS recommends e-filing as it is simple, easy, and takes less time and cost compared to paper filing.

E-file HVUT Form 2290 with TaxZerone.

Save your time, money, and effort by e-filing IRS Form 2290 with TaxZerone, an IRS-authorized e-file service provider.

Where to send Form 2290 - Mailing address

After filling out all the required information, you are required to manually send the return to the IRS by postal mail.

Send a paper copy of Form 2290 to the mailing address mentioned below:

| If you are filing a paper return | Mailing Address |

|---|---|

| With full payment and that payment is not drawn from an international financial institution. | Internal Revenue Service P.O. Box 932500 Louisville, KY 40293-2500 |

| Without payment due or if payment is made through EFTPS or by credit/debit card. | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0031 |

| With a check or money order drawn from an international financial institution. | Internal Revenue Service International Accounts 1973 Rulon White Blvd. Ogden, UT 84201-0038 |

How to e-file Form 2290?

E-filing IRS Form 2290 can be done in 3 simple steps. Before you start with the e-file process, keep the information below ready.

Information required:

- Business Name & Address.

- EIN (Employer Identification Number).

- VIN (Vehicle Identification Number).

- Taxable Gross Weight of Vehicle.

- First Used Month (FUM) of Vehicle.

Once you have all the information above, you can follow the steps below to e-file Form 2290 using TaxZerone.

Step 1: Enter the required information, such as your business name, EIN, VIN, taxable gross weight, and first used month (FUM).

Step 2: Review the information you provided in the form and pay the balance tax due using the EFW or EFTPS or Credit/Debit card option.

Step 3: Transmit the return to the IRS and get your stamped Schedule 1 as soon as you complete the filing process.

E-file Form 2290 with TaxZerone

Quickly e-file HVUT Form 2290 with TaxZerone and get your Stamped Schedule 1 in minutes!

How to pay the balance tax due while filing 2290 tax form online?

While completing step 2, if you have any balance tax due, you can choose to pay the balance due amount using any one of the following methods.

- Electronic Funds Withdrawal (EFW)

- Credit/Debit card

File IRS Form 2290 for multiple vehicles easily with TaxZerone's bulk upload feature

Save time & Try it today!